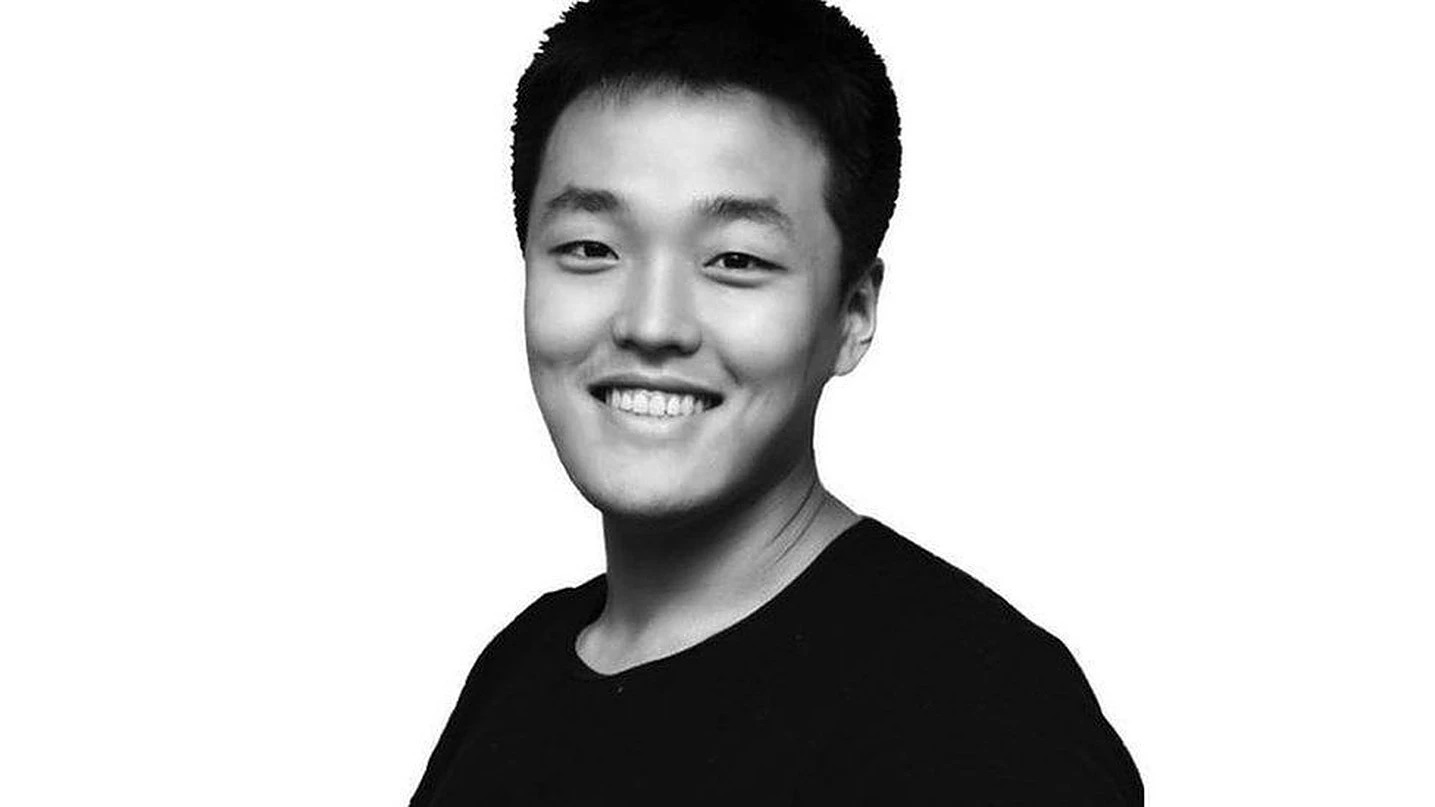

Do Kwon, the co-founder of Terraform Labs, has formally requested that a United States district judge dismiss a securities and fraud lawsuit initiated by the United States Securities and Exchange Commission (SEC), arguing that the SEC has failed to provide evidence of wrongdoing by him or his firm.

In a legal filing submitted on October 27th to the U.S. District Court for the Southern District of New York, legal representatives for both Do Kwon and Terraform presented their case, asserting that the cryptocurrencies associated with Terraform, namely Terra Classic (LUNC), TerraClassicUSD (USTC), Mirror Protocol (MIR), and the mirrored assets (mAssets), which replicate traditional stocks on the blockchain, should not be classified as securities as alleged by the SEC.

The lawyers emphasized that, despite an extensive two-year investigation, the completion of a thorough discovery process involving over 20 depositions and the exchange of more than two million documents and data, the SEC has failed to substantiate its claims of wrongdoing.

They contended that there is insufficient evidence to support many of the SEC’s allegations, suggesting that the regulator was aware that some of its claims were unfounded, particularly the allegation that Kwon and Terraform secretly transferred millions of dollars into Swiss bank accounts for personal gain.

READ MORE: Crypto Platform Expands Institutional Crypto Custody Services Amid Surging Demand

In the lawsuit filed against Kwon and Terraform in February, the SEC accused the duo of sending 10,000 Bitcoins to a Swiss financial institution and withdrawing $100 million, further alleging that they engaged in fraudulent activities by repeatedly making false and misleading statements.

Kwon’s legal team insisted that the SEC knew the falsity of this allegation when initiating the case, emphasizing that Terraform Labs had no customers and therefore, no customer funds.

The Terra ecosystem, valued at $40 billion, experienced a significant collapse in May 2022 due to the devaluation of TerraUSD (UST), its algorithmic stablecoin, which lost its peg to the U.S. dollar.

Additionally, Kwon and Terraform sought to exclude the opinions of SEC experts, including a report by Rutgers University economics professor Bruce Mizrach, which they criticized as “junk science.”

Judge Jed Rakoff, presiding over the case, had previously rejected Terraform’s attempt to have the lawsuit dismissed.

It’s worth noting that Do Kwon is currently detained in Montenegro and has previously requested that the court reject the SEC’s motion to extradite and interview him in the United States.

Discover the Crypto Intelligence Blockchain Council