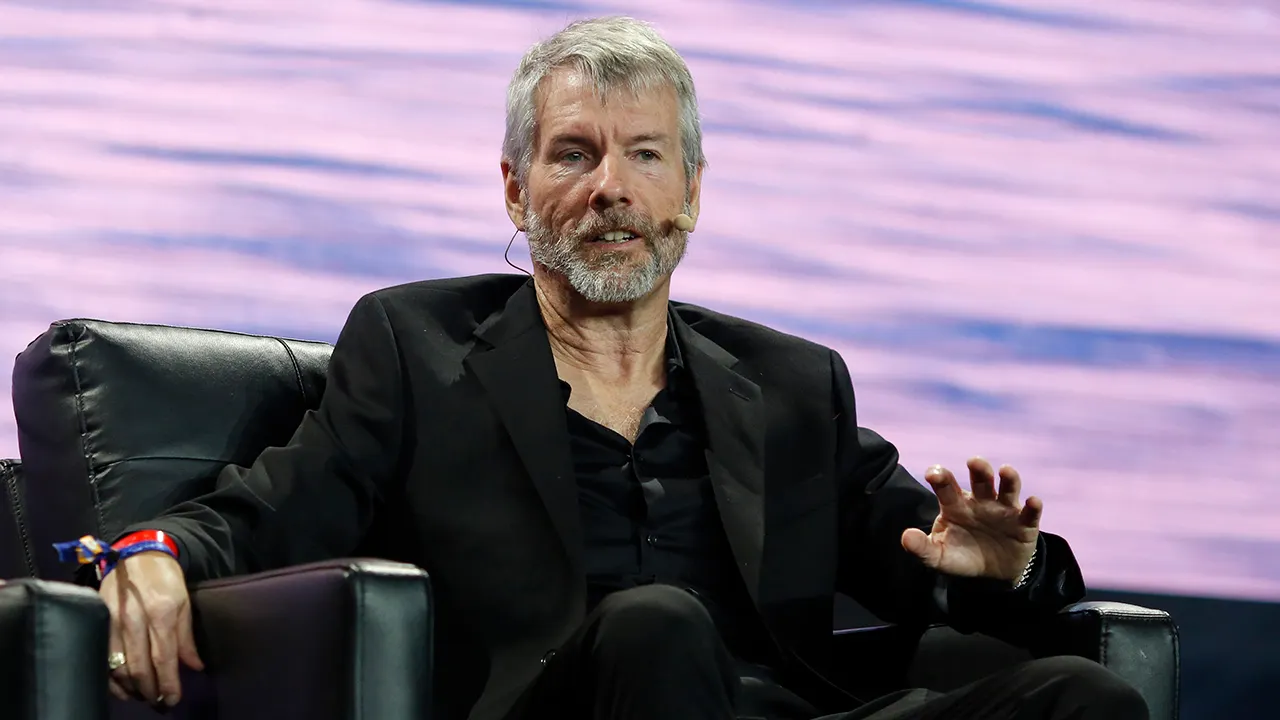

Bitcoin bull Michael Saylor believes that the potential approval of a spot Bitcoin exchange-traded fund (ETF) could mark the most significant development on Wall Street since the early 1990s.

In an interview with Bloomberg on December 19, Saylor expressed his enthusiasm for the prospect of a spot Bitcoin ETF, emphasizing its potential impact on the financial world.

Saylor stated, “It’s not unreasonable to suggest that this may be the biggest development on Wall Street in 30 years.

“The last thing that was this consequential was the creation of the S&P index and the ability to invest in all 500 S&P companies via one trade at the same time.”

According to Saylor, a spot Bitcoin ETF would serve as a gateway for both retail and institutional investors who have previously struggled to access a reliable channel for Bitcoin investments.

He anticipates that this ETF could trigger a significant surge in demand, followed by a “supply shock” in April when the Bitcoin halving event occurs.

“I don’t think we’ve ever seen a 2 to 10x increase in demand combined with a halving in supply in a scarce, desirable asset that people want to hold for a long period of time,” Saylor explained. As a result, he predicts that 2024 will witness a major bull run for the cryptocurrency market.

Saylor also confirmed that his company, MicroStrategy, would continue its Bitcoin investment strategy.

READ MORE: FTX Bankruptcy Drains $53,000 per Hour on Legal Fees and Advisors, Totaling $350 Million

He emphasized their commitment to finding ways to acquire more Bitcoin per share for shareholders, whether through debt, equity, or cash flows from the business.

MicroStrategy has been a pioneer in providing traditional investors with exposure to Bitcoin’s price since it began acquiring Bitcoin in 2020.

They offer leverage without charging fees, making it an attractive option for long-term Bitcoin investors.

At the time of publication, MicroStrategy owns 174,530 BTC with an average purchase price of $30,252, which is now valued at approximately $7.3 billion. This represents a $2.1 billion gain on their Bitcoin investment.

Saylor’s journey with Bitcoin has evolved significantly. A decade ago, he famously predicted the downfall of Bitcoin, a prediction that has not aged well.

However, his change of heart around 2020 led to MicroStrategy’s substantial Bitcoin investments, earning him recognition as one of the cryptocurrency’s most vocal proponents.

Bitcoin analyst Dylan LeClair praised Saylor for his ability to adapt, stating, “The measure of intelligence is the ability to change.”

In retrospect, Bitcoin’s price was just $677 on December 19, 2013, when Saylor made his initial prediction.

By the time MicroStrategy entered the market in August 2020, Bitcoin had surged to around $11,650, marking an 18-fold increase from his earlier prediction.

In conclusion, Michael Saylor’s endorsement of a potential spot Bitcoin ETF highlights the growing mainstream acceptance of cryptocurrencies and their significance in the financial world, showcasing the dynamic nature of the digital asset space.

Discover the Crypto Intelligence Blockchain Council