In a recent announcement, Robinhood, the popular app for trading cryptocurrencies and stocks, revealed that it will discontinue support for Cardano, Polygon, and Solana. This action comes in the wake of the United States Securities and Exchange Commission’s (SEC) recent lawsuits against crypto exchanges Binance and Coinbase for allegedly offering unregistered securities, including these three tokens.

In a June 9 update, Robinhood stated that it will cease support for these tokens from June 27 onwards, following an internal review. The decision was primarily influenced by the SEC’s lawsuits against Coinbase and Binance, which according to Robinhood, created an “uncertainty cloud” around the tokens.

The company expressed its belief in the future of crypto and pledged to continue advocating for clearer regulations in the U.S. crypto market, so as to foster confidence among participants.

On June 5, the SEC accused Binance of dealing in unregistered securities. Soon after, Coinbase was subjected to similar charges, with the SEC identifying 13 tokens, including Cardano, Polygon, and Solana, as unregistered securities.

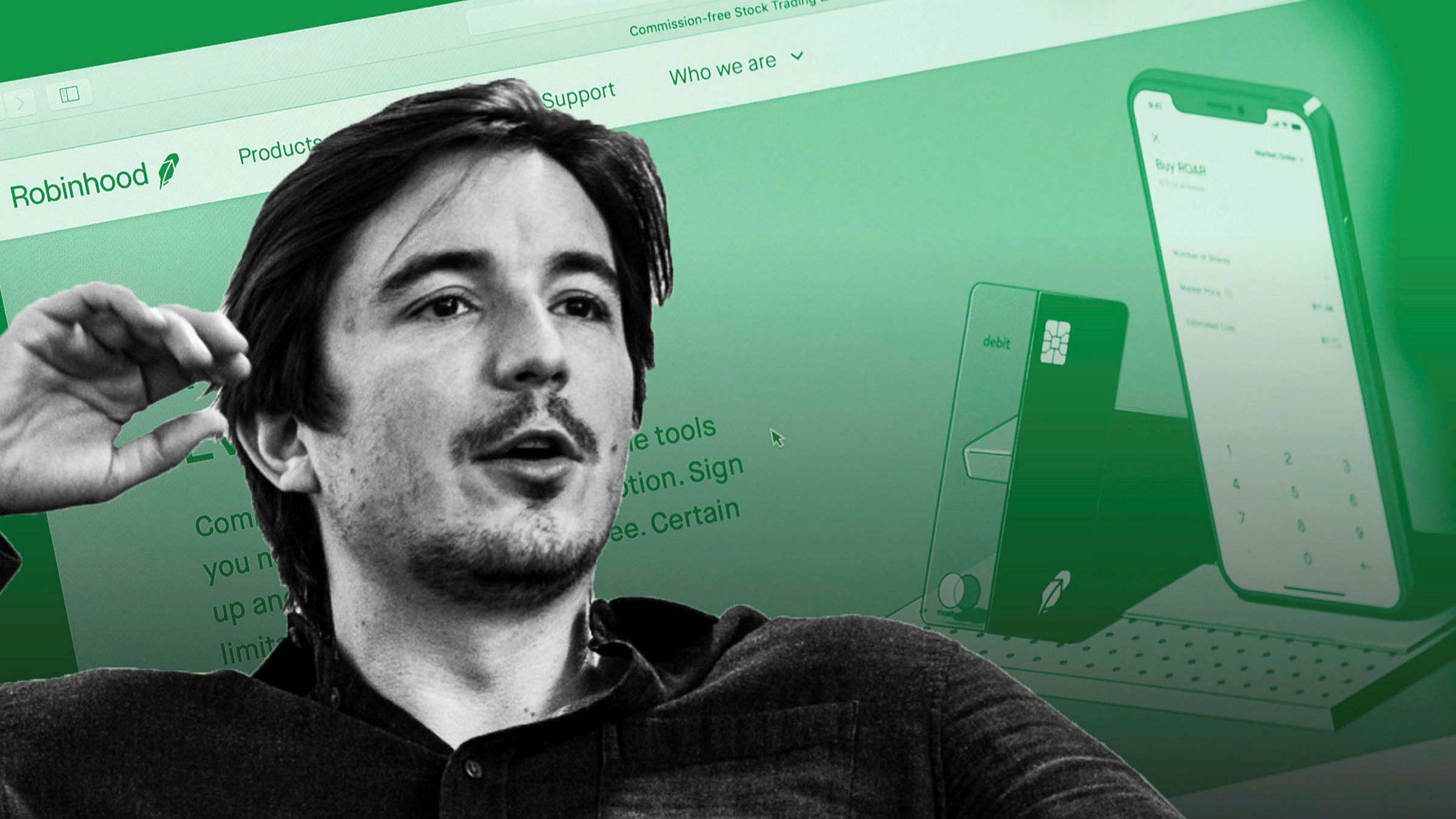

Robinhood’s chief legal compliance and corporate affairs officer, Dan Gallagher, a former SEC commissioner, testified in a congressional hearing on June 6, saying that functioning as a registered broker-dealer in the U.S. was akin to taking the difficult route in crypto. Even though Robinhood attempted to follow the SEC’s guidelines, Gallagher highlighted the complexity of the journey.

The SEC’s actions have caused a stir in the crypto community, leading to debates on the regulator’s approach towards digital asset companies. The case against Coinbase claimed that the exchange had been operating as an unregistered security broker since 2019, despite the firm going public in April 2021.

Changpeng Zhao, CEO of Binance and Binance.US, was mentioned in the SEC lawsuits for their purported involvement in unregistered token offers and sales, including BNB. In response to what it called the SEC’s “extremely aggressive and intimidating tactics”, Binance.US announced the suspension of U.S. dollar deposits on June 8.

Other Articles:

Review: The 3 best crypto exchanges in the UK

Binance.US forced to suspend USD deposits

Bored Ape Yacht Club (BAYC) utility – Why are investors spending millions on these NFTs?