Robinhood, the crypto-friendly trading platform, has experienced a significant surge in digital asset trading volume in November, reporting a staggering 75% month-on-month increase.

This exciting development was disclosed in a Form 8-K filing submitted to the United States Securities and Exchange Commission (SEC) on December 4th, where Robinhood explicitly stated, “November Crypto Notional Trading Volumes were roughly 75% above October 2023 levels.”

While the crypto sector witnessed this remarkable upswing, it did not have a corresponding impact on equity and options contract trading volumes, which remained relatively flat compared to the previous month.

This impressive performance in November marks a noteworthy turnaround for Robinhood, which had reported a substantial 55% decline in cryptocurrency notional volumes over the course of the year in its Q3 results filing. Consequently, its Q3 revenue fell below analyst estimates, standing at $467 million.

Transaction-based revenues also experienced an 11% year-on-year decrease to $185 million, largely attributed to the decline in crypto volumes throughout 2022.

READ MORE: Space Force Member Calls for Bitcoin’s Role in National Cybersecurity

However, with the recent crypto market rally that has seen the total capitalization surge by 40% to reach $1.6 trillion in just two months, Robinhood appears poised for a more profitable fourth quarter.

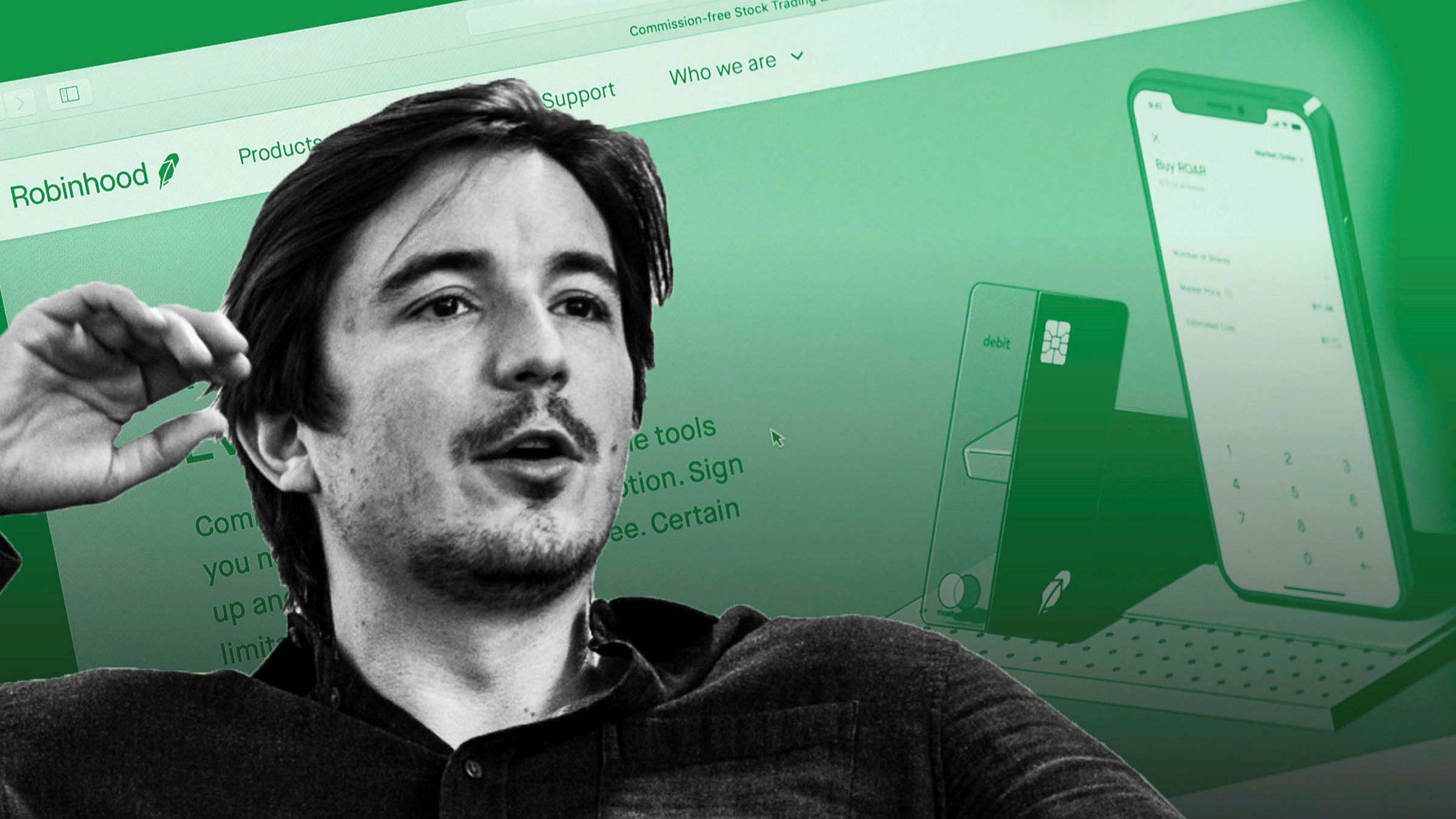

CEO Vlad Tenev had previously hinted at the platform’s potential, suggesting that it could eventually generate “nine figures” in annual revenue during an earnings call in November.

Tenev noted that retail investors were showing renewed interest in crypto, explaining, “You’re starting to see retail investors wake up to certain segments of the rally, and in crypto activity, you’re seeing a groundswell.”

Despite a fluctuating stock performance, Robinhood’s stock prices have risen by 18% since the start of 2023. However, the company’s stock had been on a downward trend since mid-July after reaching its 2023 peak at just over $13.

As of the time of writing, Robinhood’s stock was trading at $9.95 in after-hours trading, following a 2.5% daily gain.

Furthermore, Robinhood has ambitious plans for expansion, including launching equities in the United Kingdom markets and venturing into futures trading in 2024, contingent upon regulatory approval.

Notably, in August, it was reported that Robinhood had accumulated 118,000 BTC, valued at approximately $3 billion at that time.

Discover the Crypto Intelligence Blockchain Council