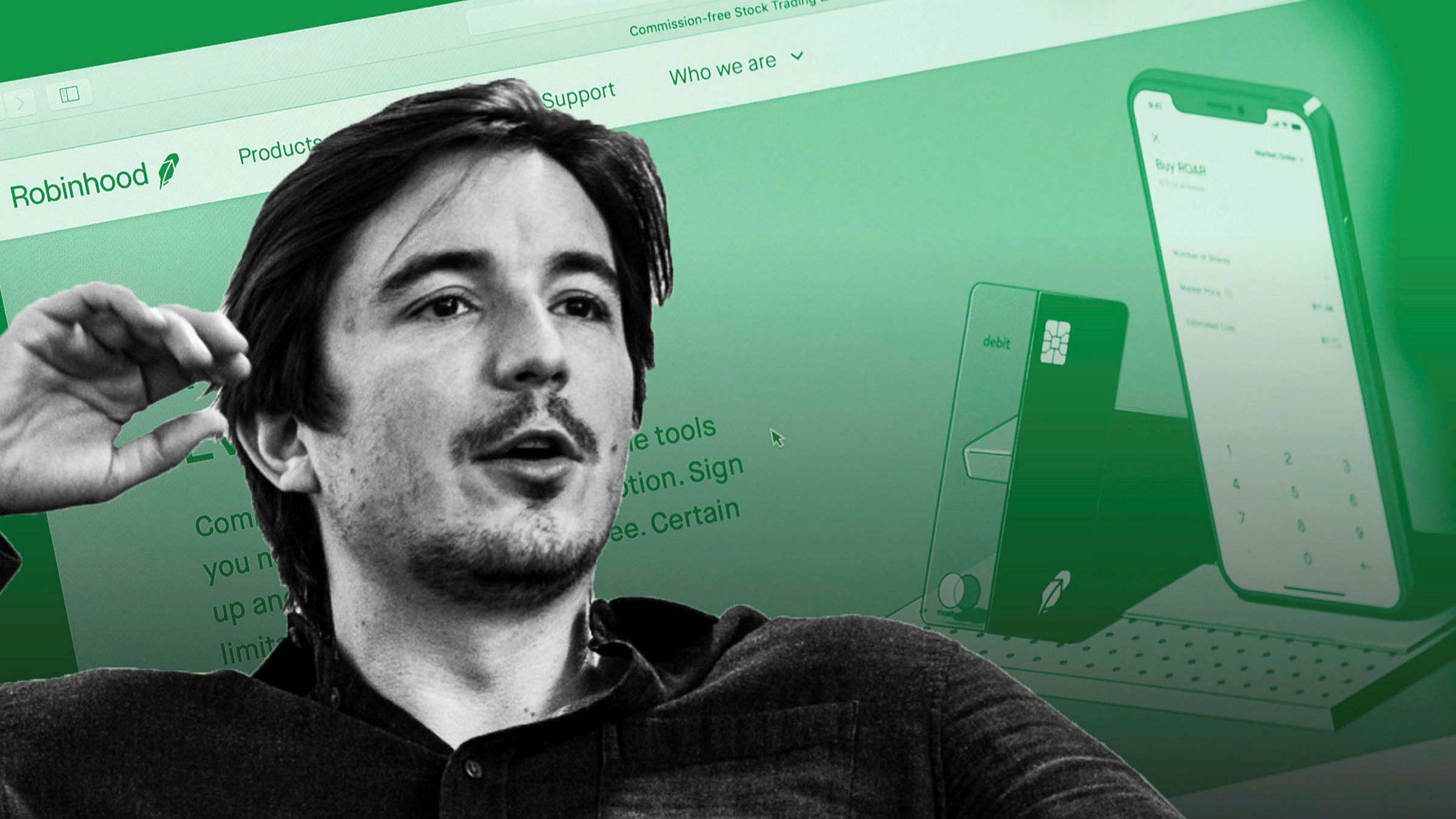

The CEO of Robinhood, Vlad Tenev, has highlighted the growing influence of tokenization in private stock markets, emphasizing the potential of blockchain technology to revolutionize traditional finance.

The Impact of Tokenization on Private Markets

Speaking at a recent financial event, Tenev pointed out that tokenizing assets, particularly private stocks, can enhance liquidity, reduce settlement times, and create more accessible investment opportunities. He noted that blockchain-based solutions could streamline processes that are traditionally complex and inefficient in private equity markets.

“Tokenization has the potential to reshape financial markets by making investments more liquid and accessible to a broader range of investors,” Tenev stated.

Growing Institutional Interest in Blockchain-Based Securities

In recent months, major financial institutions have been exploring the integration of tokenized securities into their investment portfolios. Companies such as BlackRock and Fidelity have begun testing blockchain technology for asset management, recognizing its potential to enhance transparency and efficiency in financial markets.

Tenev emphasized that Robinhood is actively monitoring this trend and sees significant growth opportunities in the tokenization of private stocks and other financial instruments. He expressed confidence that regulatory clarity in the coming years will further support innovation in this space.

The Future of Tokenized Finance

With increasing interest from both institutional and retail investors, the tokenization of assets is expected to gain traction in the financial industry. Experts believe that as blockchain technology matures, it will play a crucial role in redefining traditional financial markets.

Tenev concluded by stating that Robinhood is committed to exploring new opportunities in the blockchain space, ensuring that its platform remains at the forefront of financial innovation.

Summary

- Robinhood CEO Vlad Tenev sees tokenization of private stocks as a game-changer for financial markets.

- Blockchain technology can enhance liquidity, improve transparency, and shorten settlement times in private equity markets.

- Major financial institutions like BlackRock and Fidelity are actively exploring tokenization for asset management.

- Tenev stated, “Tokenization has the potential to reshape financial markets by making investments more liquid and accessible.”

- Regulatory uncertainty remains a key challenge, but the industry expects more clarity in the coming years.

- Robinhood is closely monitoring blockchain advancements and exploring opportunities in tokenized finance.

- As blockchain technology matures, experts predict a major shift in traditional financial markets through asset tokenization.

- Tenev reaffirmed Robinhood’s commitment to staying at the forefront of innovation in financial technology.