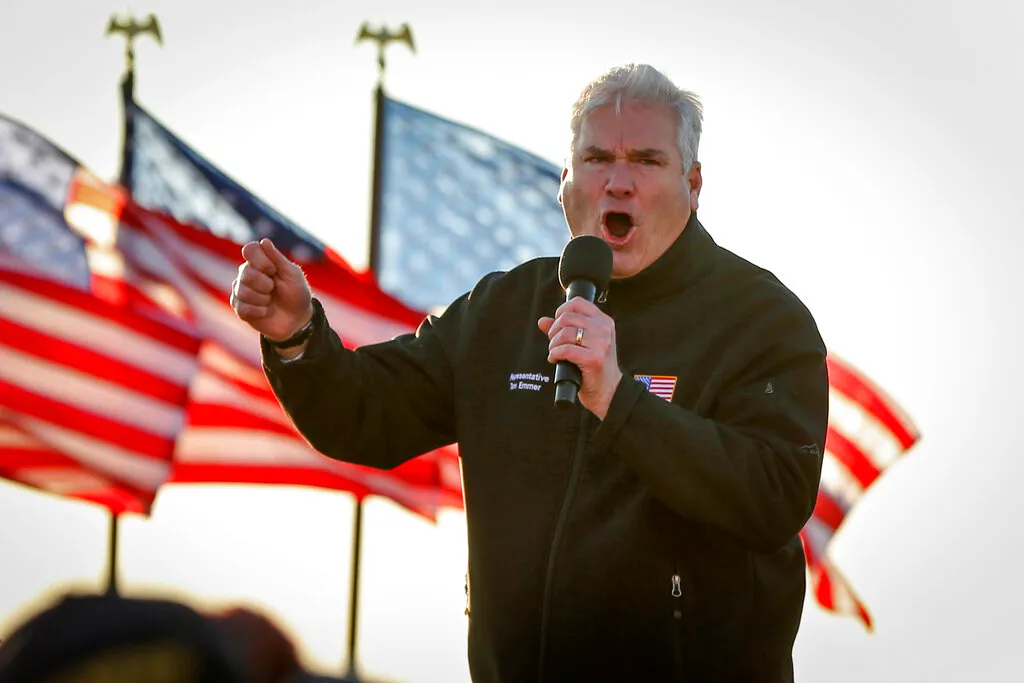

Representative Tom Emmer, along with 49 original co-sponsors, has reintroduced the “CBDC Anti-Surveillance State Act” in the United States House of Representatives, aimed at preventing what they perceive as excessive control by unelected officials in Washington over central bank digital currency (CBDC) issuance.

Their primary objective is to safeguard the financial privacy rights of American citizens.

In a statement, Emmer expressed concerns about the Biden administration’s willingness to compromise financial privacy for the sake of a surveillance-style CBDC.

He emphasized the importance of upholding American values such as privacy, individual sovereignty, and free-market competitiveness.

Emmer initially introduced this legislation in January 2022, and it was formally presented to Congress in February 2023.

The bill seeks to curtail the Federal Reserve’s authority to create a programmable digital dollar, which Emmer perceives as a tool for surveillance that could undermine American society.

The legislation has specific provisions aimed at limiting the Federal Reserve’s powers.

Firstly, it prohibits the issuance of CBDCs directly to individuals, a measure designed to prevent the central bank from transforming into a retail bank capable of collecting individuals’ personal financial data.

READ MORE: CFTC Commissioner Calls for Tech-Driven Investor Protection Reforms

Additionally, the bill bars the central bank from utilizing CBDCs as a means of implementing monetary policy.

Emmer has previously voiced concerns about the potential weaponization of money by the federal government in its quest to expand financial control.

He has been joined in these concerns by U.S. presidential candidate Robert F. Kennedy Jr., who argued that CBDCs would grant the government unprecedented power to stifle dissent by denying access to funds at the click of a button.

Several notable figures, including Senators French Hill, Warren Davidson, and Mike Flood, also support the CBDC Anti-Surveillance State Act.

Their united front reflects a growing apprehension within certain political circles regarding the potential risks associated with CBDCs and their implications for individual privacy and government control over financial transactions.

Other Stories:

Federal Reserve Vice Chairman Highlights CBDC Research and Stablecoin Oversight in Fintech Speech

SEC Pursues Appeal in Ripple Labs Lawsuit Over XRP’s Security Classification

Bitcoin Rebounds from Three-Month Lows Amid Traders’ Doubts