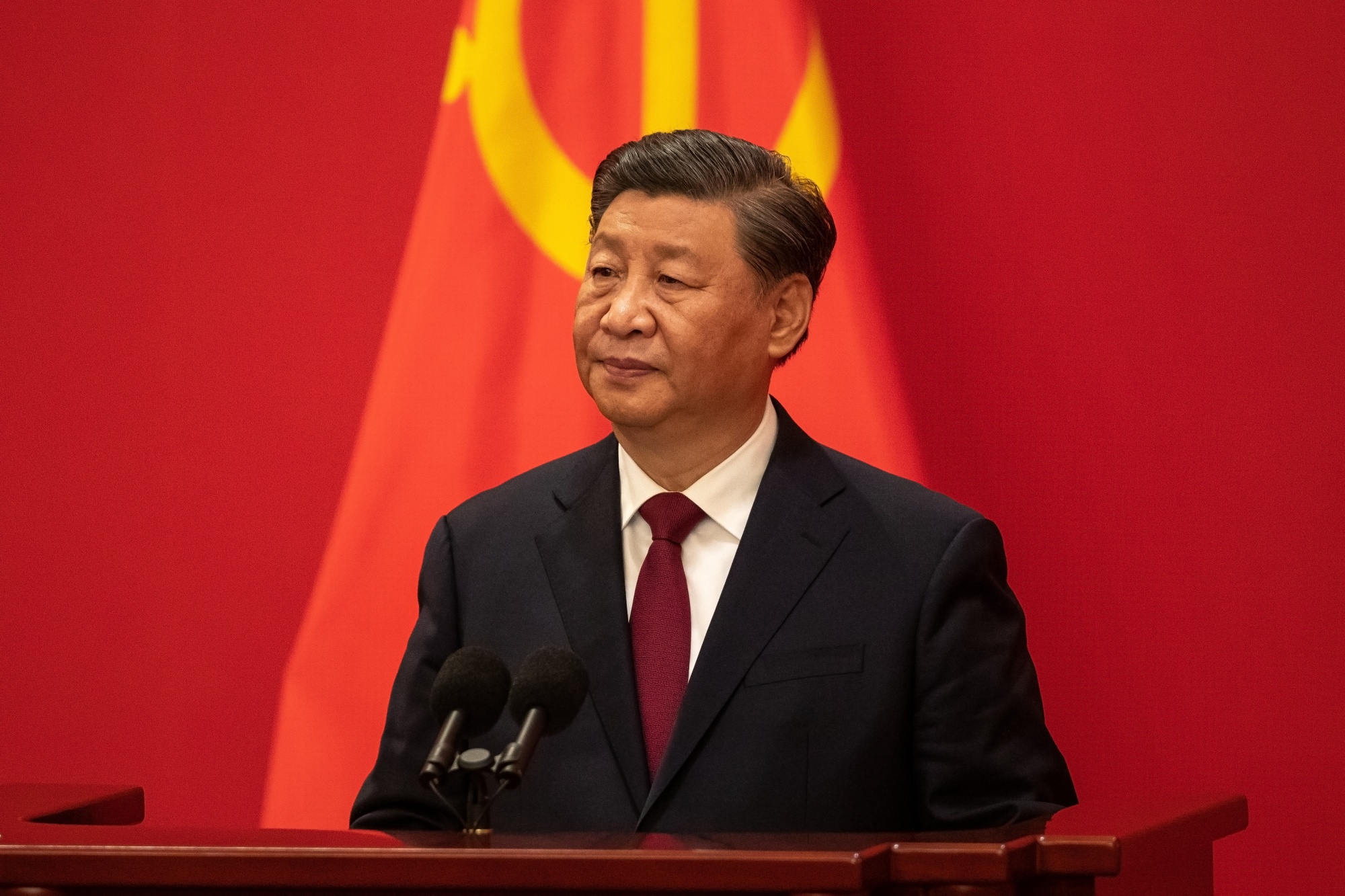

Xinhua News Agency, the state broadcaster of China, recently released a transcript of President Xi Jinping’s address at the 2023 Shanghai Cooperation Organisation (SCO) Summit.

The SCO, established by China and Russia in 2001, is a significant regional organization focused on political, economic, and security cooperation.

During his speech, President Xi expressed his appreciation for Iran becoming a full member of the organization and praised the inclusion of Belarus.

READ MORE: Crypto Firms Struggle to Attract Local Talent in Hong Kong Despite Regulatory Changes

He also emphasized the importance of central bank digital currencies (CBDCs) and proposed expanding the use of local currency settlements among SCO countries, fostering cooperation in sovereign digital currencies, and establishing SCO development banks.

The People’s Bank of China reported in January that there were 13.61 billion digital yuan CBDCs in circulation, accounting for approximately 0.13% of the monetary supply.

Since then, the use of the digital yuan has expanded to include China’s Belt and Road Initiative, consumer airdrops, and everyday transportation payments.

However, experts caution that despite promotional efforts, the currency has struggled to gain widespread adoption.

In another development, it was reported on July 10 that Chinese consumers would soon have access to a SIM card linked to the digital yuan CBDC.

With the digital wallet embedded in the SIM card, individuals can make payments for their phone bills using point-of-sale machines, even when their phones have no power.

Moving to Hong Kong, the cost of obtaining a crypto exchange license has skyrocketed to HK$100 million ($12.77 million), according to a report by Tencent News on July 5.

While some teams have relocated to Malaysia due to lower costs and favorable conditions for crypto projects in Southeast Asia, several exchanges, including Huobi, OKX, BitgetX, Hashkey Pro, and Gate.io, have applied for licensing in Hong Kong to comply with the requirement that all crypto exchanges obtain a regulatory license or cease operations by mid-2024.

Meanwhile, a concerning incident occurred on July 7 when the developers of Multichain, a Chinese cross-chain bridge protocol, announced a halt in their services.

This was followed by a security firm’s warning that over $126 million had been drained from Multichain. Circle and Tether froze significant amounts of USDC and USDT, respectively, in response.

The hack affected Multichain’s token price, which dropped by 20% and now trades at $2.62 per token. It is worth noting that Multichain had experienced a previous hack in July 2021.

The Monetary Authority of Singapore (MAS) announced new regulations requiring Digital Payment Token (DPT) providers to place clients’ assets in a statutory trust by the end of the year.

Retail investors will be prohibited from accessing crypto lending and staking services, while institutional and accredited investors will still have access to these services.

The MAS highlighted the importance of enhancing investor protection and market integrity in DPT services and is seeking public feedback on the proposed rule changes.

In Thailand, Bitkub, the country’s largest cryptocurrency exchange, raised $17.1 million by selling 9.22% of its equity to Asphere Innovations PLC.

Bitkub reported holding substantial assets and customer deposits, as well as liabilities. The exchange’s total assets experienced a significant decline from 2021 to 2022.

Finally, Line Next, a South Korean non-fungible tokens firm, signed a memorandum of understanding with Sega, a renowned Japanese video game company, to remake one of Sega’s classic games on its Web3 gaming platform, Game Dosi.

Sega, known for franchises such as Sonic the Hedgehog, is venturing into the blockchain gaming space through this partnership with Line Next, which already has several titles on its platform.

These recent developments reflect the ongoing advancements and challenges in the digital currency, crypto regulation, and blockchain gaming sectors in the Asian region.