Binance, the largest cryptocurrency exchange worldwide, and Binance.US have negotiated an arrangement with the U.S. Securities and Exchange Commission (SEC). The agreement is intended to ensure all assets from U.S. customers remain domestically held until a significant lawsuit filed by the SEC is concluded.

The deal, revealed in court documents submitted on Friday, awaits the approval of the presiding federal judge in the case. As part of the agreement, only Binance.US employees will have access to these U.S. customer assets to prevent them from leaving the country.

Earlier this month, the SEC sued Binance, its founder and CEO Changpeng Zhao, and the operator of Binance.US. The SEC alleges that Binance manipulated its trading volumes, misappropriated customer funds, did not adequately restrict U.S. customers on its platform, and misled investors about its market monitoring measures.

This litigation, along with another one launched against major U.S. exchange Coinbase, marks an intensification of regulatory pressure on the cryptocurrency industry in the U.S.

The current agreement does not solve the SEC lawsuit. Instead, it stipulates that Binance.US will restrict Binance Holdings officials from accessing private keys for its diverse wallets and tools such as Amazon Web Services. This move is aimed at protecting customer assets.

On Saturday, the SEC affirmed that the emergency relief order obtained for Binance.US customers would protect their assets and enable ongoing withdrawal of assets. Gurbir Grewal, the SEC’s enforcement division director, stated the prohibitions were crucial for asset protection.

In response, a Binance spokesperson emphasized that user funds would remain safe and secure on all Binance platforms. The proposed agreement also includes plans for Binance.US to create new crypto wallets inaccessible to the global exchange’s employees and accelerate the discovery schedule.

Last week, the U.S. Binance affiliate ceased dollar deposits and set a deadline for customers to withdraw their dollar funds, following an SEC court request to freeze its assets.

Other Stories:

Binance US fires employees over SEC investigation

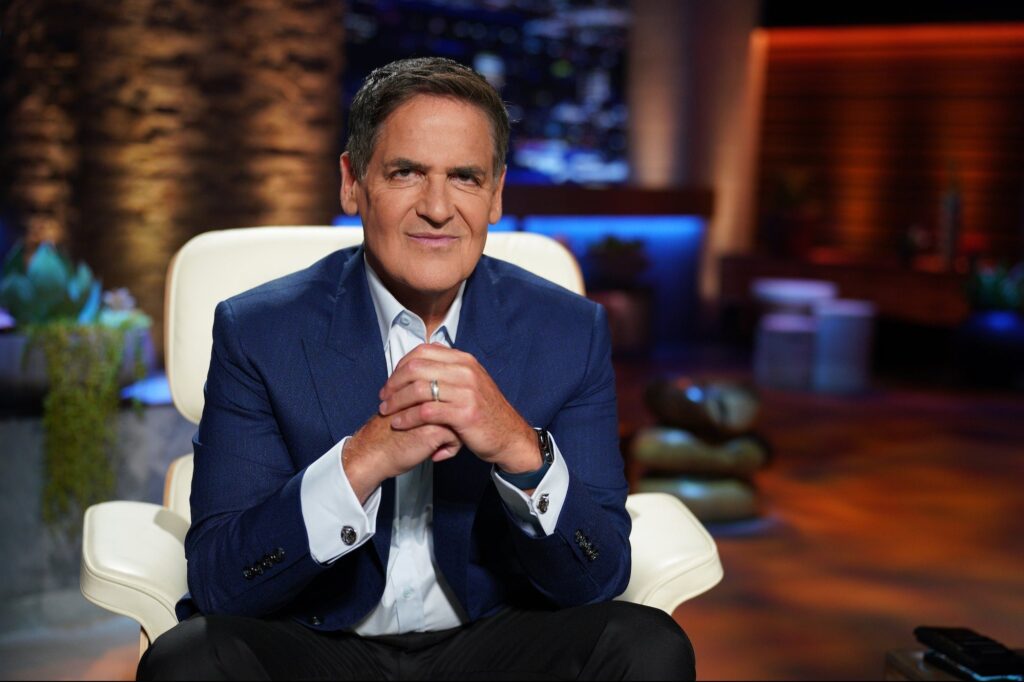

Mark Cuban clashes with the SEC over crypto regulation

Hong Kong warns banks against placing ‘undue burden’ on crypto exchanges