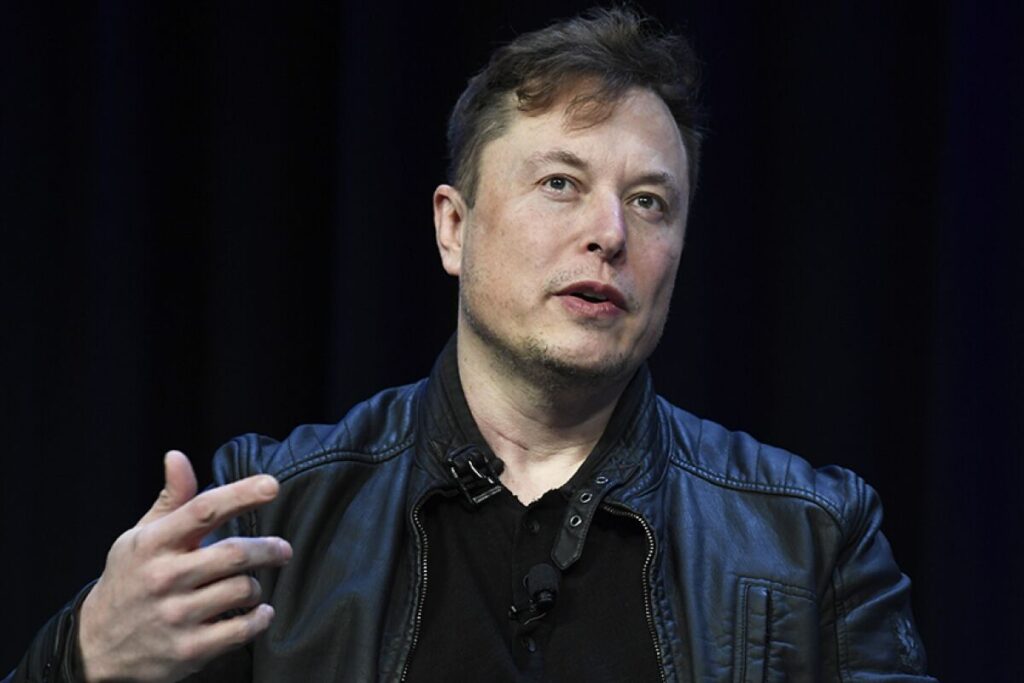

Tesla and SpaceX founder and Chief Executive Elon Musk officially acquired Twitter on Thursday following a series of court battles, memes, and terminations.

The $44 billion USD deal comes as Musk bought out the social media giant for $54.2 per share, following his successful bid on 11 April this year.

Musk also took the company private and delisted it from the New York Stock Exchange to remove it from public shareholders, the first time since it was listed in 2013.

To be super clear, we have not yet made any changes to Twitter’s content moderation policies https://t.co/k4guTsXOIu

— Elon Musk (@elonmusk) October 29, 2022

The NYSE mentioned Twitter will no longer be a public company and that the exchange would freeze its shares on 28 October, along with several trading platforms.

Public listing provides regulatory scrutiny, a key advantage following numerous rows the billionaire has faced with the Securities and Exchange Commission (SEC) in recent years over Twitter posts.

Conversely, Twitter as a private firm will allow it to avoid public oversight as it no longer needs to disclose quarterly reports.

Musk also ordered Twitter employees to print up to 60 pages of code from the platform for further evaluation, following his requests in recent months.

Why Musk Is Taking Twitter

The news comes as Musk, 51, aims to drastically restructure the social media platform by slashing key positions and hiring executives to lead the company’s new direction.

Speculators also believe the measures will allow for more free speech and less censorship under the new board’s leadership, which may entice a fresh user base to join the platform.

According to the New York Times, the company has struggled to grow its advertising operations and attract new users, triggering sweeping measures after he purchased the firm. Musk has dismissed several executives from the San Francisco-based firm, including CEO Parag Agrawal, general counsel Sean Edgett, chief financial officer Ned Segal, and legal and policy executive Vijaya Gadde.

The Twitter executives who were fired on Thursday include Parag Agrawal, the chief executive; Ned Segal, the chief financial officer; Vijaya Gadde, the top legal and policy executive; and Sean Edgett, the general counsel, said two people with knowledge of the matter. At least one of the executives who was fired was escorted out of Twitter’s office, they said.