Decentralized Finance, commonly referred to as DeFi, is an overarching term representing a variety of financial applications that are built on blockchain networks, most notably Ethereum.

DeFi is reshaping the world of finance by displacing traditional intermediaries, such as banks and brokerages, with peer-to-peer networks that allow market participants to interact directly with each other. This transformation opens the door to a more open and inclusive financial ecosystem.

What falls under DeFi?

DeFi platforms can encompass everything from lending and borrowing platforms, to decentralized exchanges (DEXs), to asset tokenization, to yield farming, and much more. These platforms operate via smart contracts – self-executing contracts with the terms of the agreement directly written into code, without any intermediaries involved.

The basis of the DeFi revolution lies in the democratic ideals that are intrinsic to its design. Traditional financial systems have barriers that prevent many from accessing basic financial services. DeFi aims to remove these barriers and offer financial services to all, regardless of location, wealth, or status.

In traditional finance, central authorities like banks, governments, or corporations control the financial systems and their rules. In DeFi, control is decentralized and rests in the hands of the people who use, build, and invest in the system. This is achieved through the use of blockchain technology and cryptography.

One of the main attractions of DeFi is its permissionless nature. This means that anyone, anywhere, can access financial services without needing to meet any prerequisites or go through a vetting process. DeFi applications are typically open-source, which means their code is public and can be audited by anyone. This transparency allows users to directly verify the functionality and security of applications.

Lending and borrowing are central aspects of any financial system, and DeFi is no exception. Through DeFi platforms, users can lend their assets and earn interest from borrowers. For borrowers, DeFi offers over-collateralized and under-collateralized loans. Unlike traditional systems, these loans are decentralized and do not require a credit check, only collateral. Interest rates are typically determined by supply and demand dynamics, making the system more competitive than traditional lending institutions.

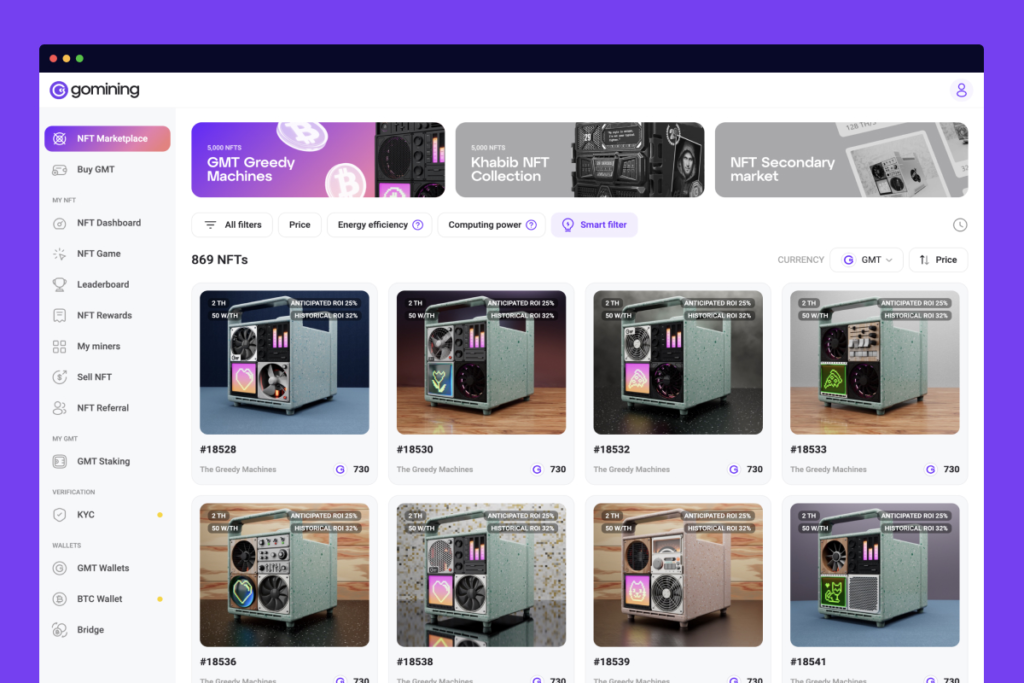

DeFi has also ushered in a new era of financial instruments and trading platforms. Decentralized exchanges, or DEXs, allow users to trade digital assets directly from their wallets, removing the need for a centralized exchange as a middleman. In addition, synthetic assets, which are blockchain-based assets that mimic the value of real-world assets, have also become popular. These allow users to gain exposure to a variety of assets without actually owning them.

Yield farming

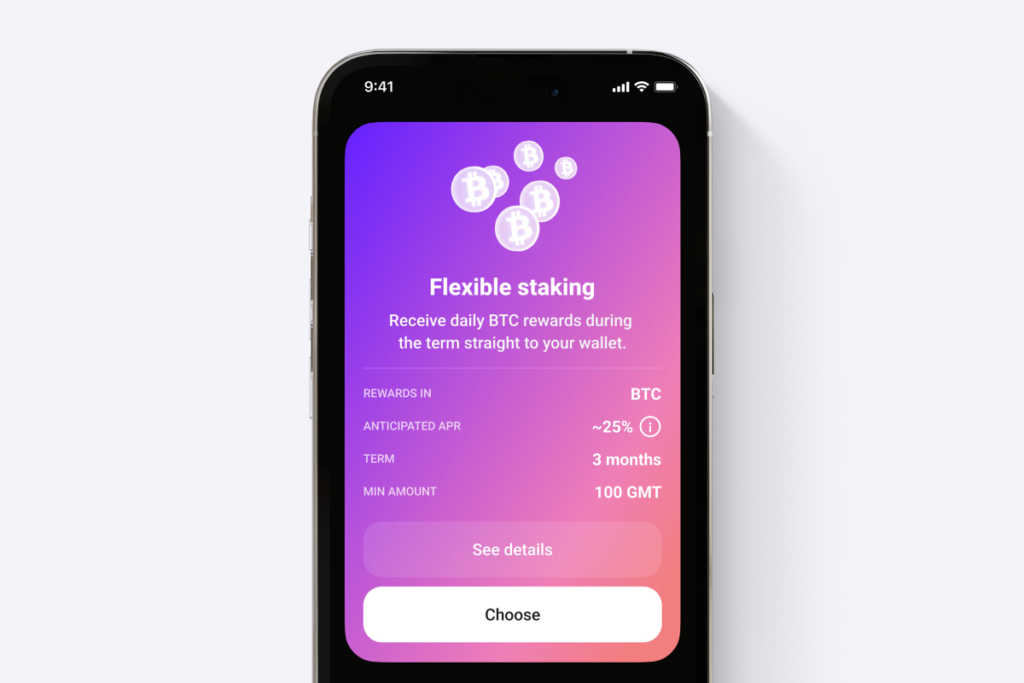

One of the most innovative and lucrative aspects of DeFi is yield farming. It is a practice that allows cryptocurrency holders to earn rewards for staking their coins in a DeFi protocol. In essence, yield farming protocols incentivize liquidity providers (LPs) to stake or lock up their crypto assets in a smart contract-based liquidity pool. These rewards can come from transaction fees, interest from lenders, or even new tokens.

However, DeFi is not without its risks. As a nascent industry, DeFi has faced several growing pains, including vulnerabilities in smart contracts leading to hacks, the potential for high volatility, and a steep learning curve that can leave less technically inclined users at a disadvantage. Despite these risks, many believe the potential benefits and revolutionary potential of DeFi make it worth exploring.

Regulation is another critical challenge for DeFi. While the lack of regulation is part of what makes DeFi attractive to many users, it also means less consumer protection. Regulatory bodies across the world are grappling with how to approach DeFi, striving to balance the need for consumer protection and fraud prevention with the desire not to stifle innovation.

Moreover, the environmental impact of DeFi, as part of the broader blockchain and crypto industry, is another concern due to the energy-intensive process of mining digital currencies and executing smart contracts.

Despite these challenges, the promise of DeFi is immense. If the sector can manage these risks effectively, DeFi has the potential to revolutionize the global financial system, making it more inclusive, efficient, and transparent. It represents a radical reimagining of financial systems that have been in place for centuries, offering the tantalizing prospect of a more equitable distribution of wealth and resources.

Examples of DeFi companies

Some examples of DeFi companies include decentralized exchanges, such as UniSwap and Pancake Swap, and other companies that operate within the decentralized finance space in any capacity.

Summary

In conclusion, DeFi is a fascinating development within the financial and technology sectors, offering a blend of opportunity, innovation, and risk.

Its potential to disrupt traditional finance is already being felt and will likely continue to cause ripple effects throughout the global financial ecosystem for years to come. It is clear that DeFi represents a significant step towards the democratization of finance, pushing us closer to a world where financial services are truly accessible to all.