The cryptocurrency community is abuzz with discussions about the upcoming Bitcoin halving in 2024, but there’s another significant event on the horizon this year. Mt. Gox, the hacked Bitcoin exchange, is set to repay its creditors by the end of October 2023, according to the trustee overseeing the process.

This repayment has the potential to significantly impact the cryptocurrency market in various ways.

Mt. Gox, founded in 2010, was once the largest Bitcoin exchange, handling around 70% of all BTC transactions before its collapse.

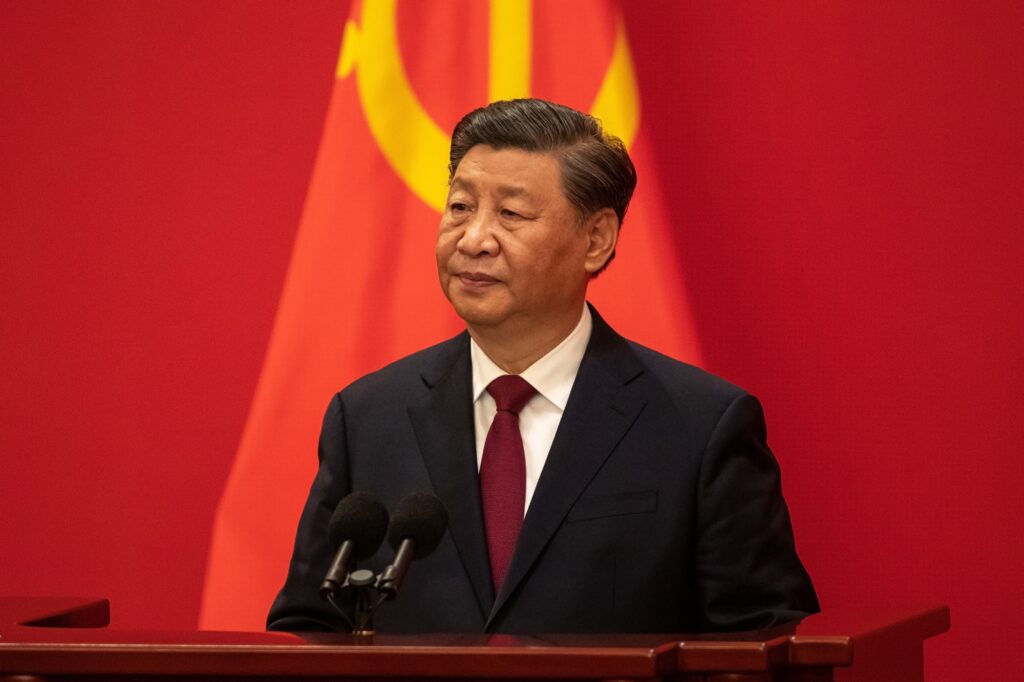

READ MORE: Chinese Government Tightens Regulations on AI Development

In 2014, the exchange suffered a security breach, resulting in the loss of 850,000 BTC, equivalent to 4% of all Bitcoin to be issued.

This made Mt. Gox one of the largest cryptocurrency bankruptcies ever, and creditors have been waiting for repayment for nearly a decade.

Industry observers believe that the repayment of Mt. Gox will have a notable impact on the market. Jacob King, the founder and CEO of WhaleWire, anticipates that most creditors, who lost their Bitcoin nearly ten years ago, will sell at least a portion of their BTC upon receiving it.

This influx of sell orders could create downward pressure on prices and potentially lead to a market downturn.

The prolonged delays in the repayment process have already caused disillusionment among investors, eroding their confidence in the market.

While some creditors expect to continue holding their Bitcoin, there are concerns that the news of the coins being released will lead other non-claimant holders to sell due to fears of price decline.

Mt. Gox aims to repay over 10,000 crypto creditors worldwide, totaling 142,000 BTC ($4.3 billion) and 143,000 Bitcoin Cash (BCH) worth around $40 million, along with 69 billion Japanese yen ($510 million) in fiat currency.

Payments will be made individually, using a combination of fiat and cryptocurrencies.

The repayment of Mt. Gox funds is anticipated to be a significant event, but its impact on the market will depend on factors such as the manner of fund release and media coverage.

Whale Alert co-founder Frank Weert believes that while some may cash out, it is unlikely to cause a massive sell-off.

This event, on such a large scale, is unprecedented in the crypto industry.

Although skeptics downplay the potential effects, comparing the amount of Bitcoin to be repaid to the holdings of Bitcoin advocate Michael Saylor, the market can absorb this repayment within a relatively short timeframe.

On-chain and exchange volumes are substantial, making the event manageable.

Furthermore, the distribution of Mt. Gox’s Bitcoin to numerous individuals could have a positive impact on the network as a mass-distribution event, reactivating long-term holders and strengthening self-custody practices.

Overall, the long-awaited repayment of Mt. Gox’s creditors is expected to have a significant impact on the cryptocurrency market.

While some foresee a potential market downturn due to sell-offs, others believe it will be absorbed quickly.

Regardless, the event marks the end of an era plagued by Mt. Gox-related uncertainty and is seen as a positive step forward for the industry.