The United States Department of Justice (DoJ) has revealed plans to strengthen its efforts in combating crypto-related crimes by significantly increasing the resources of its crypto crime team.

The move comes as a response to the growing threat of cybercriminals utilizing cryptocurrencies for illicit activities.

In an announcement made on July 20, Principal Deputy Assistant Attorney General Nicole Argentieri unveiled the consolidation of two key DoJ teams: the Computer Crime and Intellectual Property Section (CCIPS) and the National Cryptocurrency Enforcement Team (NCET).

The NCET, described as an “enormously successful startup,” will be integrated into the CCIPS, providing it with access to additional resources and support.

The merger will lead to a substantial expansion of the team’s capacity to investigate and prosecute criminal offenses involving the abuse of cryptocurrencies.

The number of criminal division attorneys available to work on crypto-related cases is expected to more than double, as any CCIPS attorney may be assigned to handle NCET cases.

Explore the Crypto Intelligence Blockchain Council

This infusion of talent and expertise will bolster the unit’s efforts to tackle cybercrimes.

As part of the restructuring, the NCET will also welcome a new acting director. Claudia Quiroz, a former assistant attorney from the U.S.

Attorney’s Office for the Northern District of California and a deputy director of NCET since its inception, has been named as the new head of the team.

Quiroz’s experience and knowledge in the field make her a valuable asset in leading the charge against crypto-related criminal activities.

One of the primary areas of focus for the revamped team will be combating ransomware crimes.

Ransomware attacks have become a pervasive threat, and tracking criminals through their crypto payments will be a key strategy to prevent them from escaping justice.

By freezing or seizing illicit funds before they are sent to ransomware hotspots like Russia, the DoJ aims to disrupt the financial incentives that drive these criminal operations.

The NCET’s establishment in 2021 was part of the broader Cryptocurrency Enforcement Framework initiative by the DoJ.

Under the leadership of the former Director Eun Young Choi, the team concentrated on addressing thefts and hacks involving decentralized finance, with a particular emphasis on “chain bridges.”

With the expansion and consolidation of the crypto crime team, the DoJ seeks to send a clear message to cybercriminals that their illicit activities involving cryptocurrencies will not go unchecked.

By equipping the team with more resources, personnel, and a strong leader, the DoJ is taking significant steps to safeguard the integrity of the financial system and protect individuals and businesses from the threat of crypto-related crimes.

Other Stories:

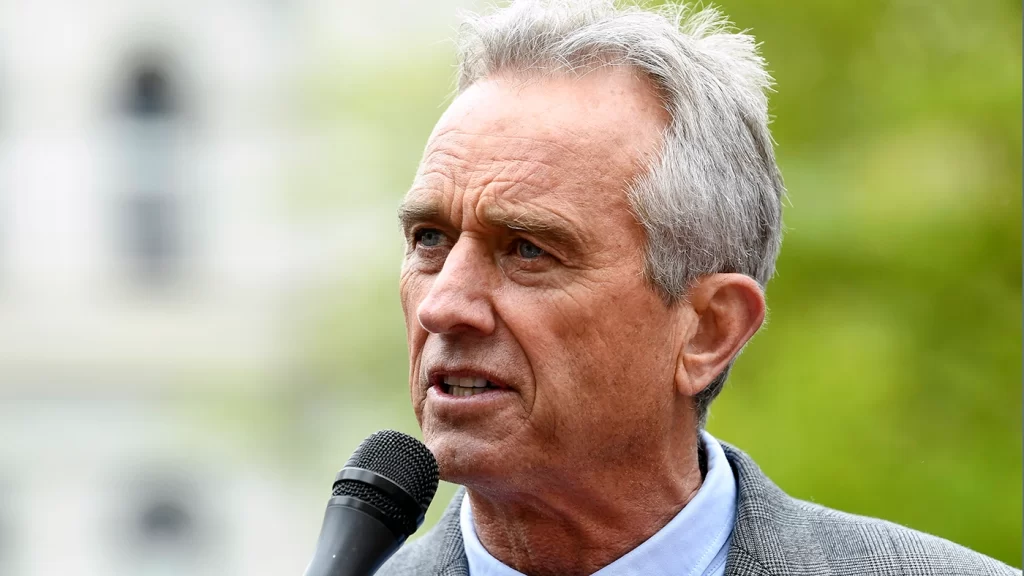

Robert F. Kennedy Jr. Pledges to Back US Dollar with Bitcoin if Elected President

Bitcoin Mining Companies Employ Derisking Strategies, Offload BTC to Exchanges