Sunday, February 11th, marks the annual Super Bowl LVIII in the United States, and there’s intrigue within the crypto community regarding rumours of no crypto ads appearing this year, akin to 2023.

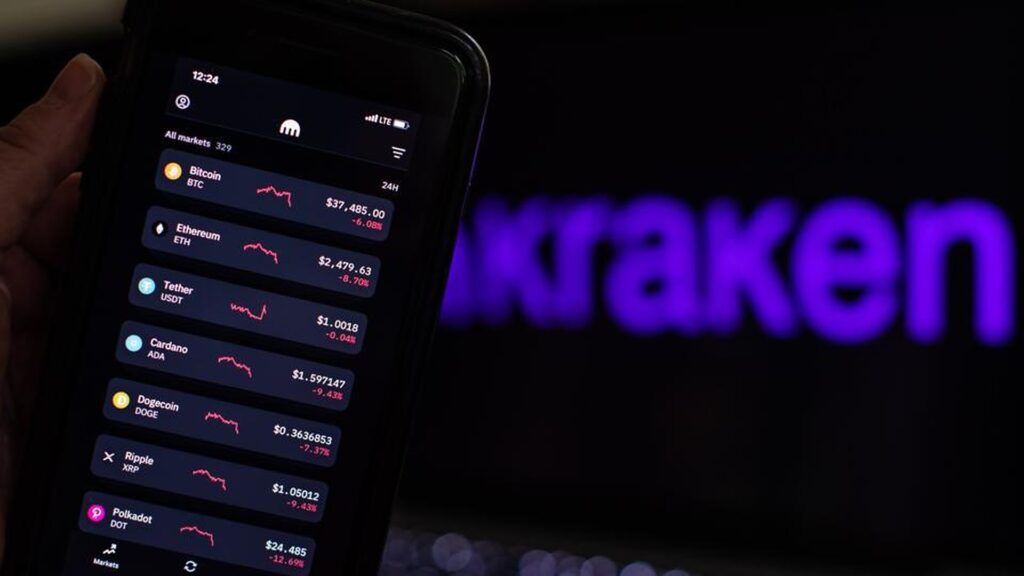

However, an executive of crypto exchange Kraken suggests that the event’s American-centric focus clashes with its global plans.

The now-defunct crypto exchange FTX stood out as a major advertiser during the 2022 Super Bowl, featuring comedian Larry David, just nine months before its collapse.

On February 1st, Cointelegraph reported that David regretted taking part in the FTX promotion, in which he encouraged viewers “not to miss out on the next big thing.”

“So, like an idiot, I did it,” David declared.

In a recent Fox Business report, Kraken’s chief marketing officer, Mayur Gupta, emphasised a transition in crypto advertising, moving away from generating hype toward educating the public about the potential of crypto for the future.

“If the last wave of crypto marketing was all about hype and FOMO [fear of missing out], this current wave has to be rooted in education and awareness for the substance and true value proposition of crypto as a movement that will bring financial freedom and inclusion.”

Furthermore, Gupta pointed out that the Super Bowl mainly caters to an American audience.

He anticipates that the next major wave of crypto users will come from locations worldwide, suggesting the exchange’s preference for events with a more global appeal.

“The Super Bowl is a very US-centric event, and the next wave of crypto users will come from all around the world, not just the United States,” he stated.

Meanwhile, Reuters recently reported that the US federal government is working to increase the global viewership of the Super Bowl this year.

READ MORE: Boosting Your Cryptocurrency’s Brand Before the 2024 Halving

The game will reportedly be broadcast in 190 countries, and the US State Department will help organise watch parties in 30 locations abroad.

According to data from Nielsen, the Super Bowl has reached over 100 million viewers every year since 2010.

There was speculation that with the United States Securities and Exchange Commission (SEC) approving 11 spot Bitcoin exchange-traded funds (ETFs) on January 10th, some asset management firms would consider advertising to the Super Bowl audience.

However, the world’s largest asset manager, BlackRock, reportedly has not secured any advertisement slots for its spot Bitcoin ETF product.

Another recently approved applicant, asset management firm VanEck, recently shared on X that seeing no crypto ads in this year’s Super Bowl will be a positive.

Cointelegraph recently reported that during Super Bowl LVII in 2023, the first game following bankruptcy filings from several crypto firms and a market downturn, crypto advertisements were absent.

According to Paul Hardart, a clinical professor of marketing for New York University’s Stern School of Business, “fun, humour and entertainment” will likely be the theme of ads for Super Bowl LVIII, in a “notable shift away” from artificial intelligence and crypto firms.