In a recent turn of events, the Decentralized Finance (DeFi) platform Unizen has suffered a significant security breach, leading to a loss of approximately $2.1 million in user funds.

The compromise was initially detected on March 9 by PeckShield, a blockchain analytics company, which identified an “approve issue” resulting in the drain of over $2 million.

PeckShield’s discovery prompted them to advise users to revoke their platform approvals immediately to prevent further losses. Additionally, SlowMist, another security firm, confirmed the total losses to be around $2.1 million, revealing that the attacker had exchanged the stolen Tether for Dai, a stablecoin.

In response to the incident, Unizen communicated directly with the hacker via an on-chain message on March 10, proposing a 20% bounty for the return of the pilfered assets.

The platform also disclosed that they were collaborating with law enforcement and forensic experts to unmask the hacker’s identity.

Despite the ongoing negotiations for the return of the stolen funds, Unizen made a prompt decision to reimburse the affected users.

By March 11, the protocol announced its intention to compensate 99% of the victims as swiftly as possible.

READ MORE: Sam Altman Reinstated to OpenAI Board Amid Legal Battle with Elon Musk

The statement detailed plans for individualized distribution processes, emphasizing a cautious and thorough approach to ensure accuracy.

Unizen’s commitment to rectifying the situation was further underscored by an announcement that founder and CEO Sean Noga had provided personal funds to facilitate the reimbursements.

Starting March 11, users who incurred losses of up to $750,000 were assured of receiving their refunds, either in USDT or USD Coin. For those who faced greater losses, Unizen promised tailored resolutions.

Moreover, Unizen released an instructional video to guide users on reviewing and revoking platform approvals, aiming to forestall any additional vulnerabilities.

Martin Granström, Unizen’s chief technology officer, affirmed on X that sufficient evidence had been gathered for a comprehensive analysis of the breach.

Granström announced the forthcoming release of a detailed incident report and pledged an investment in enhanced security measures to prevent future exploits.

To submit a crypto press release (PR), send an email to sales@cryptointelligence.co.uk.

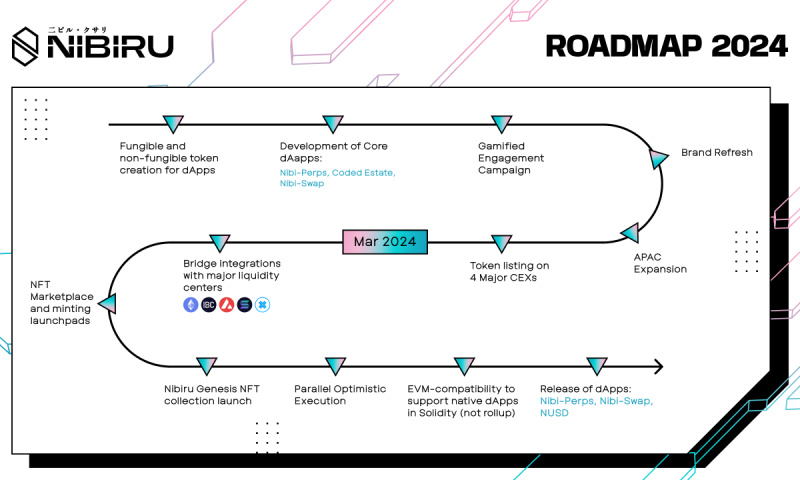

At launch, Nibiru Chain offers a wide range of functionalities to its community and prospective builders. Users can engage in staking with NIBI validators and participate in decentralized governance. Nibiru Chain will also introduce competitive Web3 gaming through

At launch, Nibiru Chain offers a wide range of functionalities to its community and prospective builders. Users can engage in staking with NIBI validators and participate in decentralized governance. Nibiru Chain will also introduce competitive Web3 gaming through