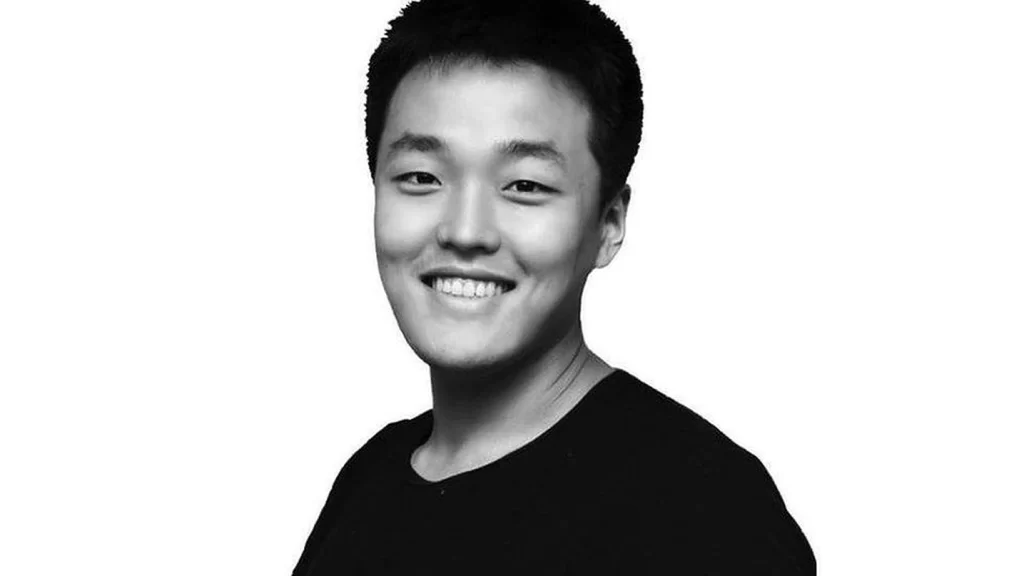

Montenegro’s authorities are set to release Terraform Labs co-founder Do Kwon from prison while his extradition to the United States or South Korea remains undecided.

Kwon, detained for approximately one year, will be released on March 23 but must relinquish his travel documents to ensure he does not leave the country, as reported by Montenegrin news outlet Vijesti on March 22.

This decision by the Council of the Supreme Court precedes a review that may either approve or reject his extradition to South Korea, his homeland.

Kwon’s arrest in Montenegro in March 2023 alongside Han Chang-joon, Terraform Labs’ ex-chief financial officer, was due to the use of counterfeit travel documents.

This arrest was complicated by extradition requests from both the U.S. and South Korea, where Kwon faces charges of fraud, although a final ruling on his extradition has yet to be made.

In the U.S., Kwon would confront eight felony charges filed by prosecutors in March 2023.

READ MORE: Vitalik Buterin Doubles Grant for ENS, Fueling Growth and Innovation in Web3 Addresses

Alternatively, South Korea might indict him for fraud and breaches of capital markets law. The destination of his potential extradition remains uncertain.

The plan involves confiscating Kwon’s South Korean passport, which was set to be revoked in 2022 following Terra’s downfall.

Despite this, Kwon used a falsified Costa Rican passport in Montenegro, claiming it to be genuine, which led to his arrest in 2023.

Additionally, Terraform Labs co-founder Shin Hyun-Seong, also known as Daniel Shin, and others linked to the platform are facing criminal charges for investor fraud.

Following Terra’s collapse in May 2022, Shin remained in South Korea.

The collapse brought significant regulatory attention to the platform and played a part in a broader downturn in the cryptocurrency market.

To submit a crypto press release (PR), send an email to sales@cryptointelligence.co.uk.