StaFi, one of the leading staking infrastructure providers, announced support for EigenLayer’s Liquid Restaking Token (LRT), allowing users to participate in the restaking ecosystem. Users on StaFi can now rehypothecate their staked tokens to provide security to decentralized applications (DApps) that are required to build their trust and security – or their own actively validated services (AVS).

Eigenlayer LRT is already supported on the LSaaS Stack App, while support for Karak and BounceBit LRT will be maintained. There are also plans to roll out support for BTC LRT in the future.

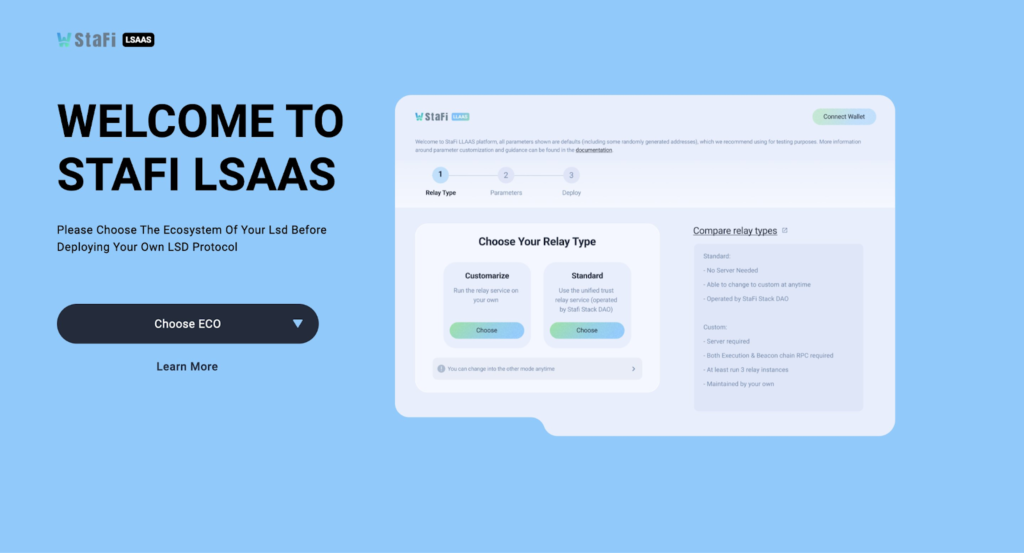

The latest integration follows the launch of StaFi’s liquid staking as a service (LSaaS )testnet – launched last month – and the publication of the StaFi 2.0 roadmap. The roadmap included plans to add the LRT stack to power new re-staking applications. EigenLayer also launched on mainnet in February this year allowing developers to leverage pooled security via restaking by extending the security of Ethereum to AVSs.

The integration of the LRT stack will enable project teams and DApp developers to seamlessly deploy LRT on LSaaS, significantly enhancing the efficiency of LRT development and overall accessibility of restaking.

Terming the latest addition to LSaaS as a “major breakthrough for developers”, Liam Young, the founder of StaFi stated:

“The integration of LRT into StaFi’s Liquid Staking as a Service is a major breakthrough for developers, who are now free to create restaking products that harness shared security across multiple chains. Up until now, building with LRT has been a complex task that entails significant lead time. StaFi’s LRT Stack will slash time to market while empowering builders to create novel solutions that draw upon the crypto economic guarantees that liquid staking permits.”

EigenLayer is a protocol built on Ethereum that permits restaking to enhance overall security across the blockchain ecosystem. The platform introduces novel ideas such as staking and free market governance that create an optimized system of pooled security whereby the staked $ETH is repurposed to provide validation services to AVSs.

Simply, EigenLayer repurposes currently staked ETH (or another token) to provide validation services to AVSs via restaking. The staked ETH is repurposed to validate transactions to platforms built on Ethereum but cannot utilize the settlement layer of the blockchain. Crucially, stakers retain their staking rewards on Ethereum.

The integrated LRT stack will support several functionalities such as restaking, unrestaking, and withdrawing tokens. Additionally, users will be able to mint and burn LRTs, join restaking pools and delegate and undelegate staking operators.

To facilitate the LRT/ETH pair construction, AVS restaking rewards will be swapped for ETH in the market via swap. This will follow the launch of EigenLayer’s planned upgrade which will allow developers and LRT operators to construct their LRT with the aforementioned functionalities swiftly.