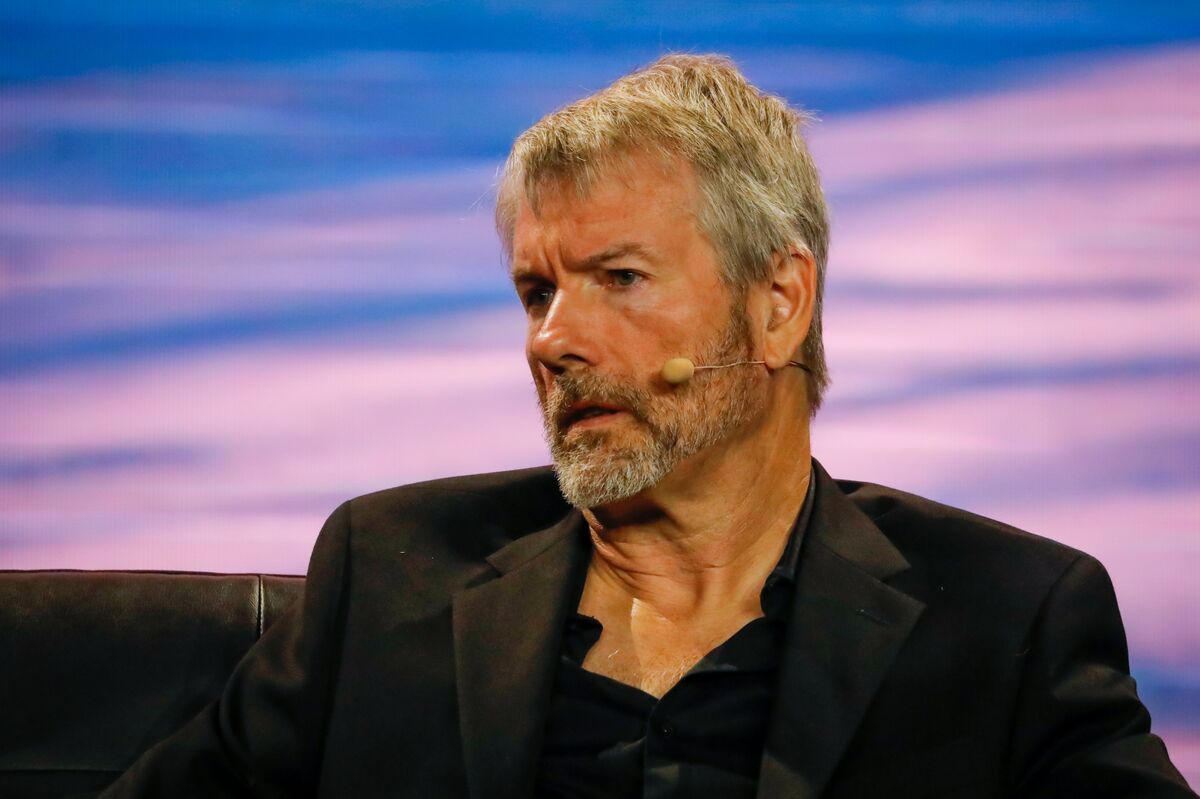

During a recent podcast discussion, Michael Saylor of MicroStrategy conveyed his belief that the involvement of major corporations in purchasing and holding Bitcoin should not be viewed as a worrisome development.

Speaking on the Coin Stories podcast with Natalie Brunell, released on August 7, Saylor highlighted the inevitable expansion of third-party and corporate engagement within the Bitcoin domain.

While acknowledging the aspiration of Bitcoin enthusiasts for complete self-control or sovereignty over their holdings, Saylor proposed that this might not be the exclusive solution, given the diverse applications of Bitcoin.

He expressed the idea that as Bitcoin further intertwines with society, its utility will diversify, negating a one-size-fits-all approach.

Saylor enumerated three primary factors substantiating the need for custodial services: technical, political, and natural considerations.

On a political basis, he argued that certain circumstances necessitate reliance on third-party custodians.

He pointed out that unless fundamental changes occur, political factors tied to regions such as New York City, California, or Iceland will demand custodial solutions.

From a technical perspective, Saylor highlighted the inevitability of trusting layer-3 third parties for transactions, particularly those involving mobile devices.

READ MORE: Former FTX CEO Sam Bankman-Fried’s Bail Revoked Over Witness Intimidation Allegations

He painted a vision of Bitcoin as a foundational layer, accompanied by layer-2 systems like the Lightning Network for speed, and layer-3 services provided by entities like Bank of America and Apple to enhance functionality.

Saylor also introduced the concept of natural reasons for custodial reliance.

He postulated that certain individuals, like an elderly person dealing with Alzheimer’s or someone wanting to secure assets for a future grandchild, might find it safer to entrust their holdings to others.

Drawing an analogy to childhood experiences, he cited that the absence of car keys didn’t necessarily invoke complaints, suggesting a comparable situation with Bitcoin custody.

Emphasizing adaptability, Saylor underlined that the market will ultimately dictate the optimal blend of Bitcoin integration methods.

He asserted that a diverse array of ways to incorporate, wrap, embed, or transact with Bitcoin should not evoke fear, as the right combination of integrations will naturally emerge through market dynamics.

In conclusion, Michael Saylor, during a recent podcast exchange, expressed his viewpoint that the involvement of large corporations in Bitcoin custody shouldn’t raise alarm.

He highlighted the inevitability of Bitcoin’s expansion across various sectors and delineated reasons for custodial arrangements based on technical, political, and natural factors.

Saylor stressed the importance of embracing multiple integration approaches, with the market determining the most suitable amalgamation of Bitcoin functionalities.

Other Stories:

Hacker’s Tether Address Blacklisted with Police and Cyber Support, Stolen Crypto Recovery Progresses

Curve Finance Vows Reimbursement After $62 Million Hack