MicroStrategy’s Bitcoin holdings have surged in value to over $20 billion as Bitcoin’s price climbed above $80,000.

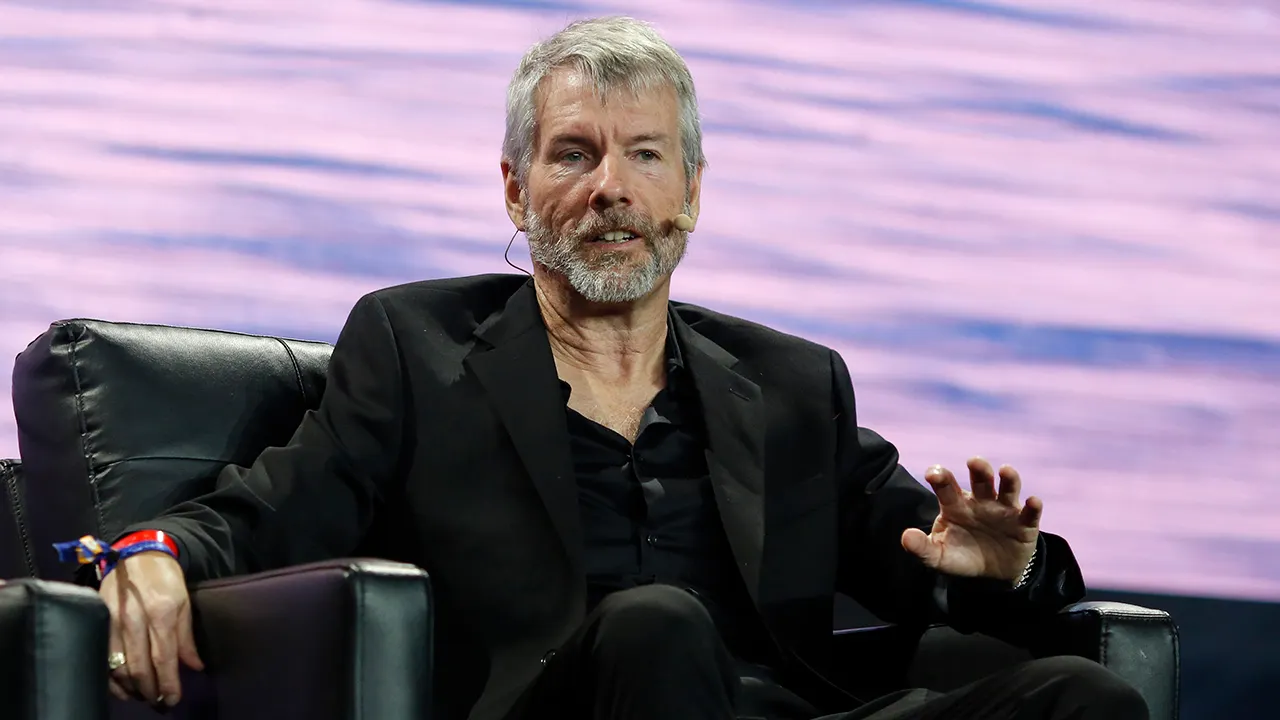

The company now holds 252,200 Bitcoin, valued at $20.5 billion, which represents a 104% gain on its total Bitcoin investment, according to the “Saylor Tracker,” named after MicroStrategy’s executive chairman, Michael Saylor.

Data from BitcoinTreasuries shows that MicroStrategy has acquired Bitcoin through 42 purchases, averaging a cost of $39,292 per Bitcoin.

MicroStrategy remains the largest corporate Bitcoin holder, followed by Bitcoin miners Marathon Digital and Riot Platforms, whose Bitcoin holdings are worth $2.1 billion and $840 million, respectively.

The firm has ambitious plans to raise $42 billion over the next three years under its “21/21” initiative, intending to secure $21 billion through equity and another $21 billion in fixed-income securities to purchase more Bitcoin.

Currently, Bitcoin is priced at $81,617, an all-time high, according to CoinGecko.

Other large Bitcoin holders are also benefitting from the recent price surge.

Bhutan’s Bitcoin reserves have grown to over $1 billion, as reported by blockchain analytics firm Arkham Intelligence.

The Himalayan country has been building a major Bitcoin mining infrastructure and appears to be leveraging Bitcoin as part of its national reserves.

Bhutan’s Bitcoin holdings are now equivalent to 32% of its $3.15 billion GDP, according to IMF data from October 2024.

El Salvador is another nation reaping gains from Bitcoin’s rally.

The country’s Bitcoin holdings, totaling 5,930 BTC, are now worth over $482 million, with unrealized profits nearing $214 million, according to Drop Stab data.

Despite initial criticism when Bitcoin’s market dropped in 2022, El Salvador continues its dollar-cost-averaging approach, buying 1 Bitcoin per day under President Nayib Bukele’s direction.