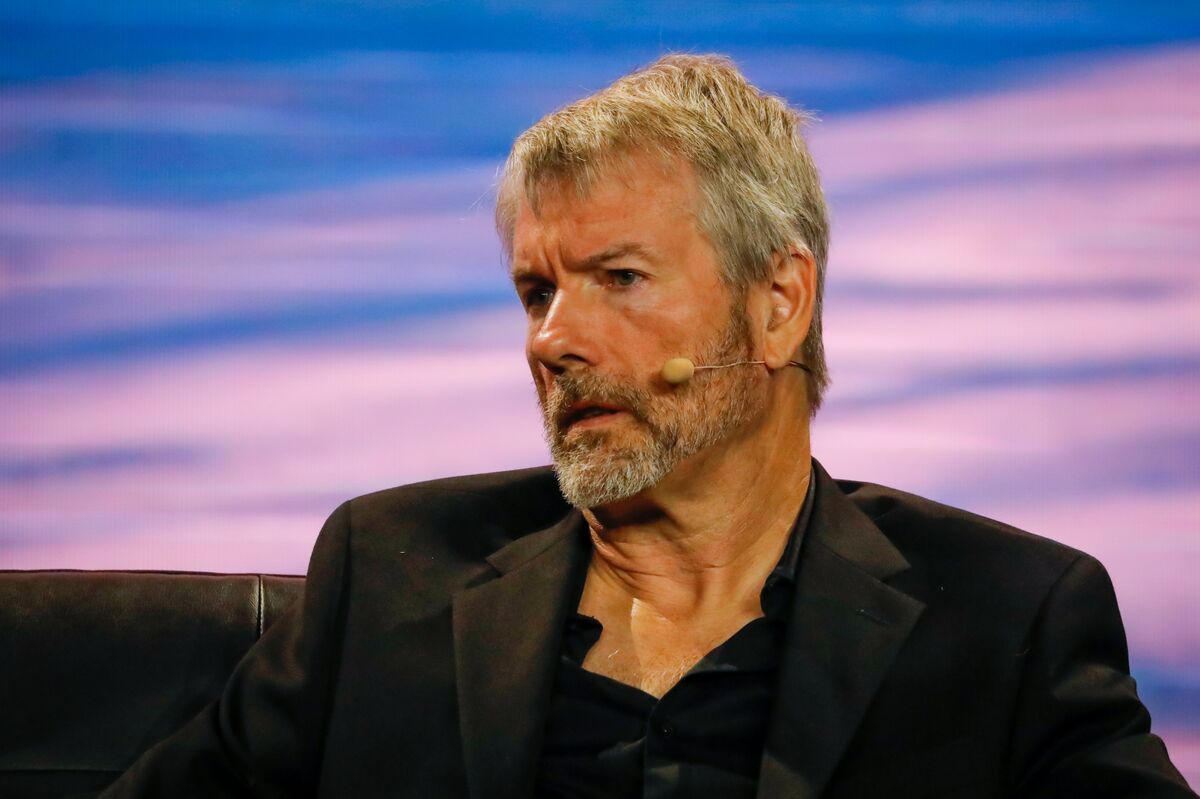

MicroStrategy, the business intelligence software company, continues to display unwavering confidence in Bitcoin as it posts a return to profitability in the first quarter of 2023. The firm’s CEO, Michael Saylor, shared the positive financial results while emphasizing the company’s ongoing dedication to the leading cryptocurrency.

The enterprise software provider has turned a corner from previous financial difficulties, reporting a profit in Q1 2023. This turnaround can be partially attributed to MicroStrategy’s substantial investments in Bitcoin, which have paid off significantly.

In a recent interview, Saylor emphasized that the company’s conviction in Bitcoin is stronger than ever, with no plans to relinquish its position as a primary institutional investor in the digital asset. The CEO also highlighted Bitcoin’s potential as a store of value, stating that it surpasses traditional assets like gold.

Since its initial investment in August 2020, MicroStrategy has consistently increased its Bitcoin holdings, currently owning over 124,946 BTC. This unwavering support has positioned the company as one of the most significant institutional investors in the cryptocurrency space.

MicroStrategy’s commitment to Bitcoin has also influenced other major companies to consider the digital asset as part of their investment strategy. Saylor’s advocacy for Bitcoin’s adoption has encouraged businesses to reevaluate their approach to the evolving world of digital currencies.

In summary, MicroStrategy’s return to profitability in Q1 2023 is a testament to the company’s steadfast belief in Bitcoin’s potential. As one of the foremost institutional investors in the cryptocurrency, the firm’s success serves as a prime example for other businesses considering digital asset investment.