American business intelligence and cloud-based services firm MicroStrategy is mulling investing in Ethereum, sources told Crypto Intelligence News on Wednesday.

New Ethereum holdings would be in addition to MicroStrategy’s impressive Bitcoin holdings, and will not in any way impact their continued accumulation of BTC, a person familiar with the matter emphasised.

Crypto Intelligence News has approached MicroStrategy for comment, but has not received a response at the time of publishing this article.

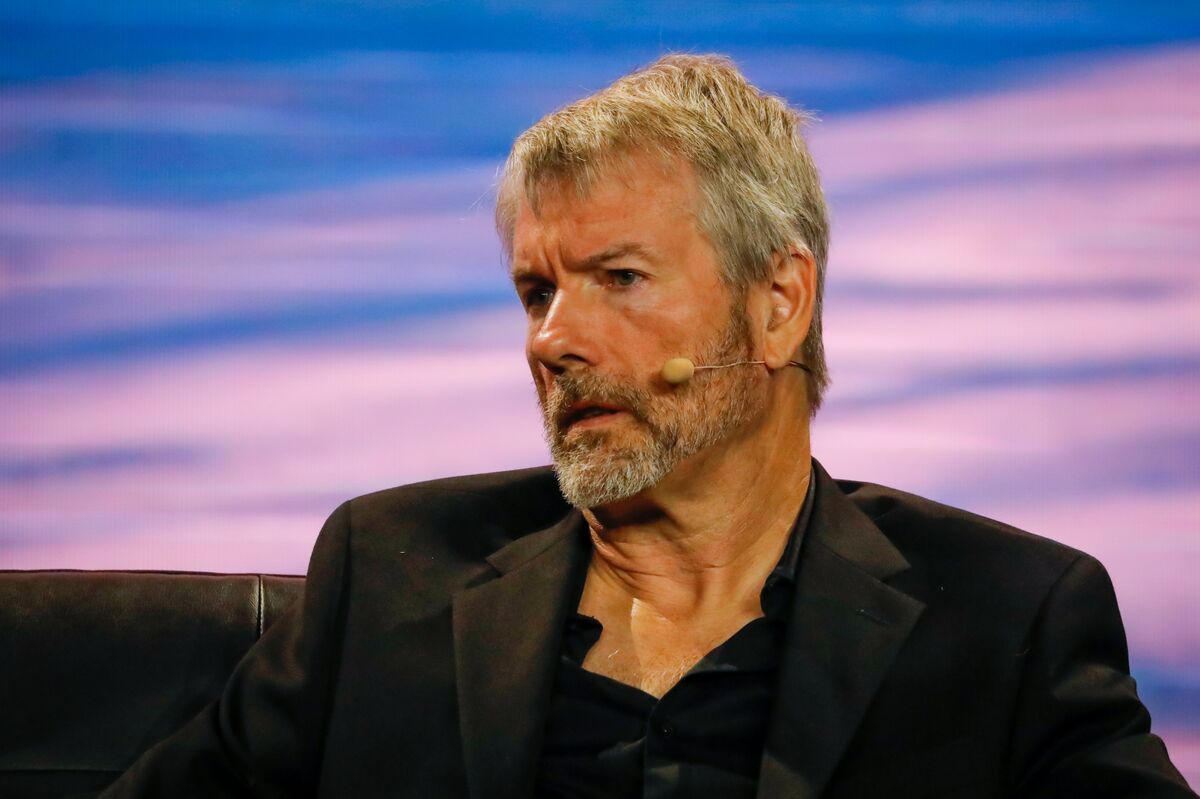

These reports come after MicroStrategy, led by Michael Saylor, its founder and current Executive Chairman, announced on Tuesday that it intends to raise $600 million through the sale of convertible debt in a private offering.

The purpose behind this significant financial move is to further increase the company’s bitcoin holdings. Since the middle of 2020, MicroStrategy has aggressively been buying bitcoin, now holding approximately 193,000 tokens valued at over $13 billion, based on the current bitcoin price of $67,500.

The decision to issue convertible debt comes at a time when MicroStrategy’s stock has seen substantial growth, with its value almost doubling in 2024. This includes a notable 24% rise in just one day’s trading session. However, in early trading on Tuesday, the company’s shares experienced a 6% drop.

This strategy reflects MicroStrategy’s ongoing commitment to bitcoin as a central component of its investment approach, leveraging the recent strong performance of its stock to finance further acquisitions of the cryptocurrency.

Discover the Crypto Intelligence Blockchain Council