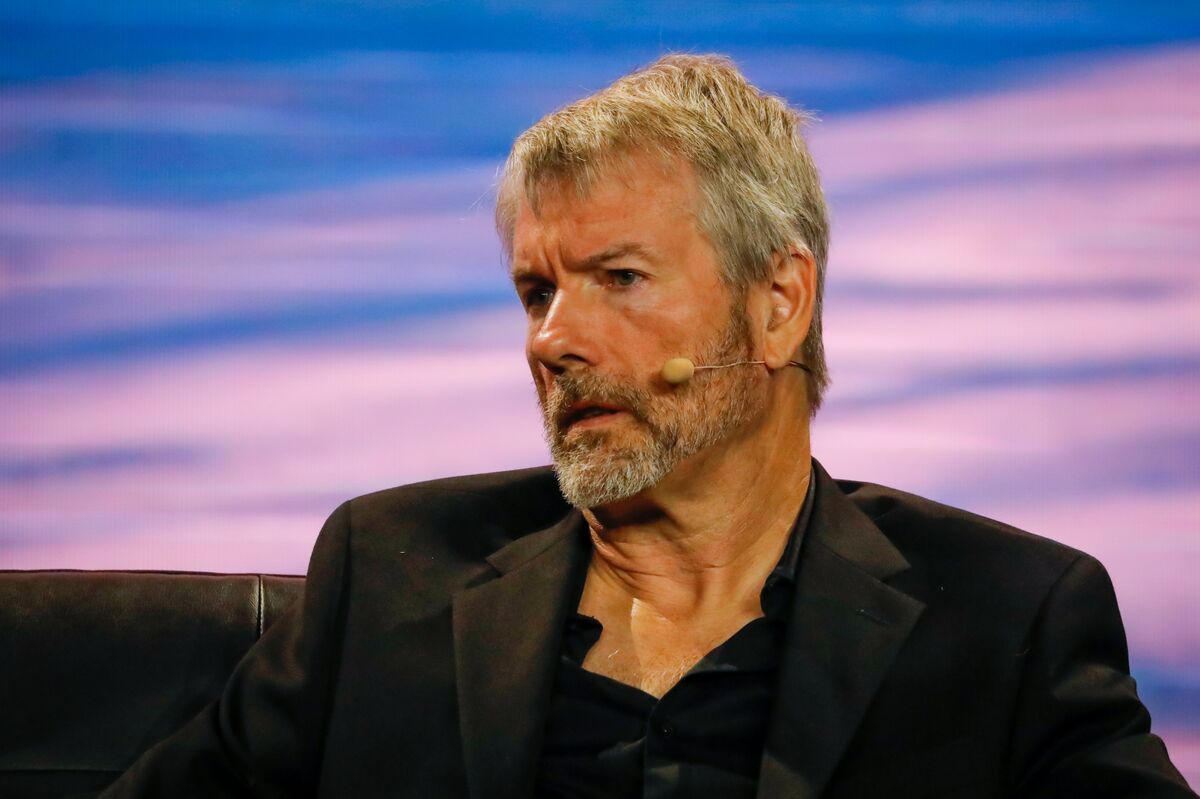

MicroStrategy’s executive chairman, Michael Saylor, faced backlash over recent comments suggesting that Bitcoin custodianship is better handled by “too big to fail” financial institutions rather than through self-custody, a practice he previously endorsed.

In an Oct. 21 interview with financial reporter Madison Reidy, Saylor controversially argued that Bitcoin holders “have nothing to lose” by transferring their assets to institutions.

This view seemed to contradict Saylor’s earlier advocacy for self-custody, making it a contentious point within the crypto community.

When asked about the possibility of the U.S. government stripping Bitcoin holders of self-custody rights, similar to how private gold ownership was made illegal in 1933, Saylor dismissed the concern, labeling those who fear state-sanctioned seizure as “paranoid crypto-anarchists.”

He added, “It’s a myth and a trope that goes on over and over again,” and emphasized that “there’s just a lot of fear that’s unnecessary.”

Saylor suggested that instead of using hardware wallets, Bitcoin holders should rely on major banks that are “engineered to be custodians of financial assets.”

His stance sparked criticism from Bitcoin advocates.

“Saylor is on a mission to relegate Bitcoin into an investment pet rock and halt its usage as a currency,” said “Sina,” founder of Bitcoin custody firm 21st Capital.

Simon Dixon, author of “Bank to the Future,” speculated that Saylor’s shift in position could be tied to MicroStrategy’s long-term plan to become a Bitcoin bank offering collateralized loans.

“Bitcoin anarchists: keep helping people gain freedom from banks, governments & central banks,” Dixon urged.

John Carvalho, CEO of Bitcoin payments firm Synonym, also criticized Saylor’s change in tone, pointing out that Saylor used to claim “Bitcoin is hope” for everyone.

He questioned what Saylor meant by that statement if he now dismissed “paranoid crypto-anarchists” as having ulterior motives.

Following the FTX collapse in November 2022, Saylor had advocated for Bitcoin self-custody, arguing that it prevented powerful custodians from corrupting the network: “In systems where there is no self-custody, the custodians accumulate too much power and then they can abuse that power.”

He even encouraged people to remember their 12-word seed phrase and to “tell people to ‘f*** themselves’ if they come for you.”