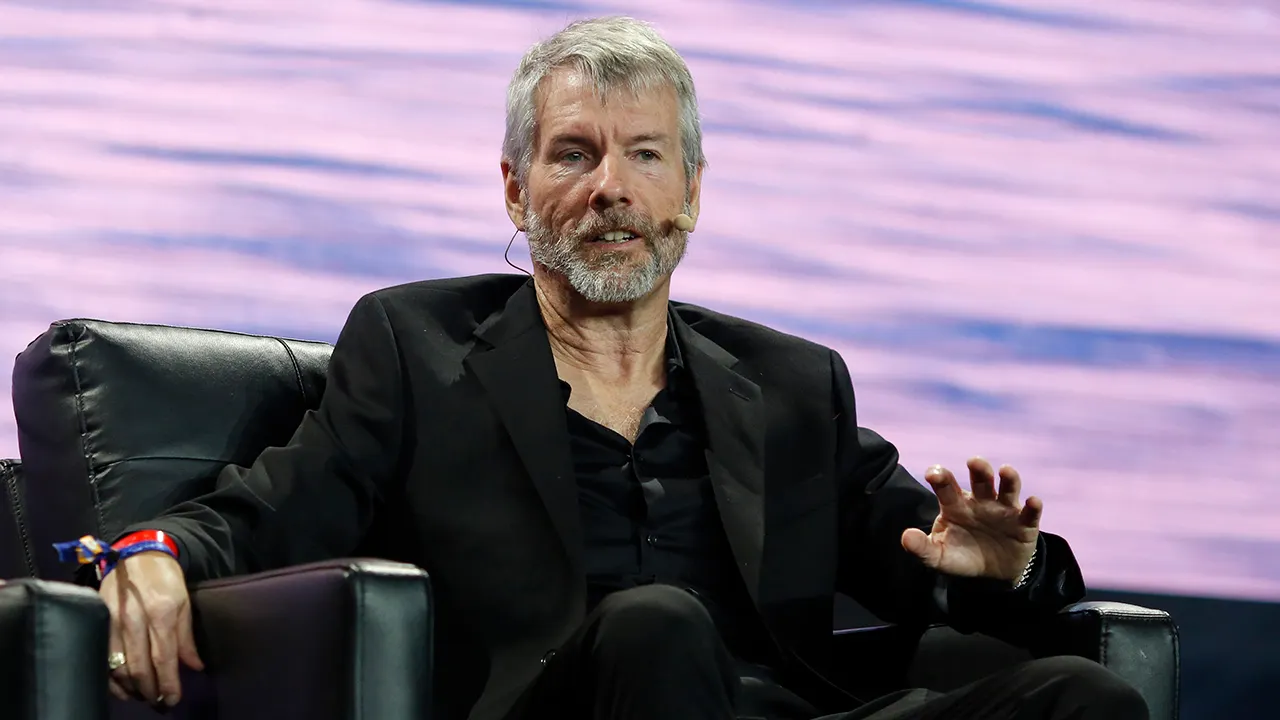

MicroStrategy’s Executive Chairman, Michael Saylor, has initiated a four-month process to sell $216 million worth of his shares in the company, with a portion earmarked for increasing his Bitcoin holdings.

This move was disclosed in a filing with the United States Securities and Exchange Commission (SEC) on January 2nd, where Saylor revealed that he had commenced the sale of his 315,000 stock options awards, originally granted to him in April 2014.

These stock options are set to expire on April 30, 2024.

As per the filing, Saylor began the sell-off on January 2nd, liquidating his first tranche of 5,000 shares.

This sale aligns with his announcement during MicroStrategy’s third-quarter earnings call on November 2nd, where he outlined his intention to sell 5,000 MSTR shares daily for the next four months.

The proceeds from these sales are intended to address “personal obligations” and bolster Saylor’s personal Bitcoin holdings.

Saylor expressed his rationale for the sale during the earnings call, stating that exercising this option would enable him to fulfill personal obligations and acquire more Bitcoin for his personal account.

READ MORE: Bitcoin Price Prediction: AI Suggests Potential $100,000 Milestone by 2024

He emphasized that his stake in the company’s equity remains “significant” despite these personal sales.

It’s worth noting that according to a November 1st Q-10 filing with the SEC, Saylor has the capacity to sell a maximum of 400,000 shares of his vested options between January 2nd and April 26th of the current year.

While Bitcoin experienced a remarkable 170% rally over the preceding year, MicroStrategy’s performance has eclipsed that of the cryptocurrency, boasting a staggering 411% gain during the same period, based on TradingView data.

In a significant move, on December 27th, MicroStrategy made a substantial purchase of 14,620 Bitcoins for $615 million, further expanding its already substantial Bitcoin holdings.

This acquisition brought MicroStrategy’s total Bitcoin stash to an impressive 189,150 Bitcoins, valued at approximately $8.5 billion at prevailing market prices.

Saylor’s ongoing share sales, coupled with MicroStrategy’s unwavering Bitcoin accumulation, underscore the company’s commitment to cryptocurrency as a core part of its corporate strategy.

Discover the Crypto Intelligence Blockchain Council