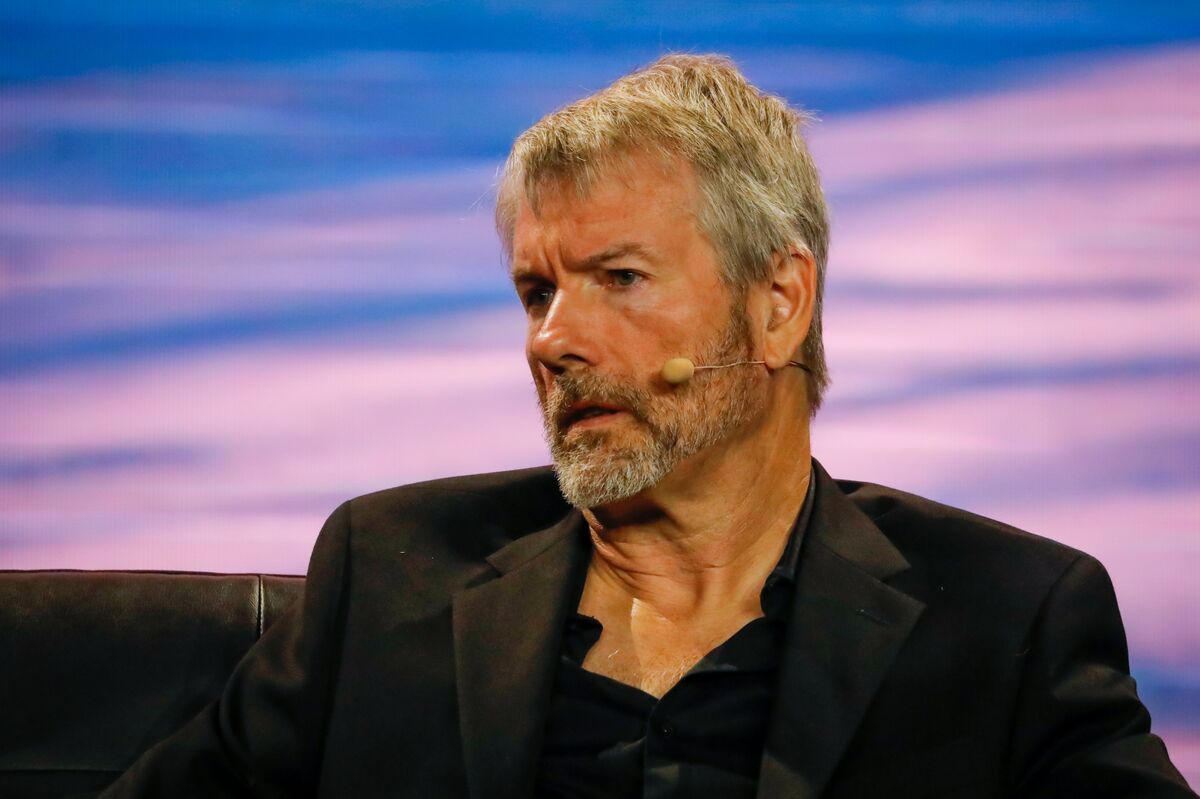

On Jan. 19, MicroStrategy co-founder Michael Saylor posted a Bitcoin chart signaling another BTC purchase, marking the 11th consecutive week of such updates.

“Things will be different tomorrow,” Saylor wrote on social media, likely referencing the inauguration of President-elect Donald Trump on Jan. 20.

The company recently acquired 2,530 BTC worth around $243 million on Jan. 13, bringing its total Bitcoin holdings to 450,000 BTC.

This purchase aligns with MicroStrategy’s 21/21 plan to raise $42 billion through equity and fixed-income securities for Bitcoin acquisitions.

The firm remains the largest corporate Bitcoin holder.

MicroStrategy’s Continued Bitcoin Accumulation

MicroStrategy’s December 2024 and January 2025 Bitcoin purchases were highlighted in a recent update, showing the company’s steady progress in its accumulation strategy.

Saylor’s long-term vision includes integrating Bitcoin into national economic policies.

He has previously suggested that a country issuing debt or printing money to convert fiat into Bitcoin could gain a significant edge globally.

Saylor also proposed that the United States Treasury convert its gold holdings to Bitcoin.

This move, he argued, would neutralize foreign adversaries’ gold reserves while bolstering America’s BTC reserves.

In December 2024, Saylor outlined a crypto regulatory framework designed to enhance the U.S. economy.

“A strategic digital asset policy can strengthen the US dollar, neutralize the national debt, and position America as the global leader in the 21st-century digital economy,” Saylor stated.

His plan aims to elevate digital asset markets to a $10 trillion valuation and grow digital asset capital markets to $280 trillion.

Support for a Bitcoin Strategic Reserve

Asset manager Anthony Pompliano echoed similar sentiments in November 2024, urging the U.S. to adopt a Bitcoin strategic reserve.

Pompliano suggested that federal, state, and local governments should prioritize acquiring Bitcoin to prevent being outpaced by other nations.

Both Saylor and Pompliano stress the urgency of embracing Bitcoin as a strategic asset.