Banks that accept deposits from cryptocurrency companies should be aware of increased liquidity risks, particularly if firms are highly interconnected with other digital asset businesses, said Michael Barr, the Federal Reserve’s vice chair of supervision, in a speech on Wednesday.

Barr said the Fed is working with the Office of the Comptroller of the Currency and the Federal Deposit Insurance Corp to highlight the risks to banks of concentrating their deposits in the crypto industry, warning that banks could experience deposit fluctuations linked to price swings in the broader crypto market.

“The recent volatility in crypto markets has demonstrated the extent of centralization and interconnectedness among crypto-asset companies, which contributes to amplified stress,” he said.

“While banks were not directly exposed to losses from these events, these episodes have highlighted potential risks for banking organizations.”

Speaking at DC Fintech Week, Barr said the banking regulators’ engagement with financial institutions on the risks of accepting deposits from crypto firms is “not intended to discourage banks from providing access” to banking services for crypto companies, but instead on making sure that any risks are appropriately mitigated.

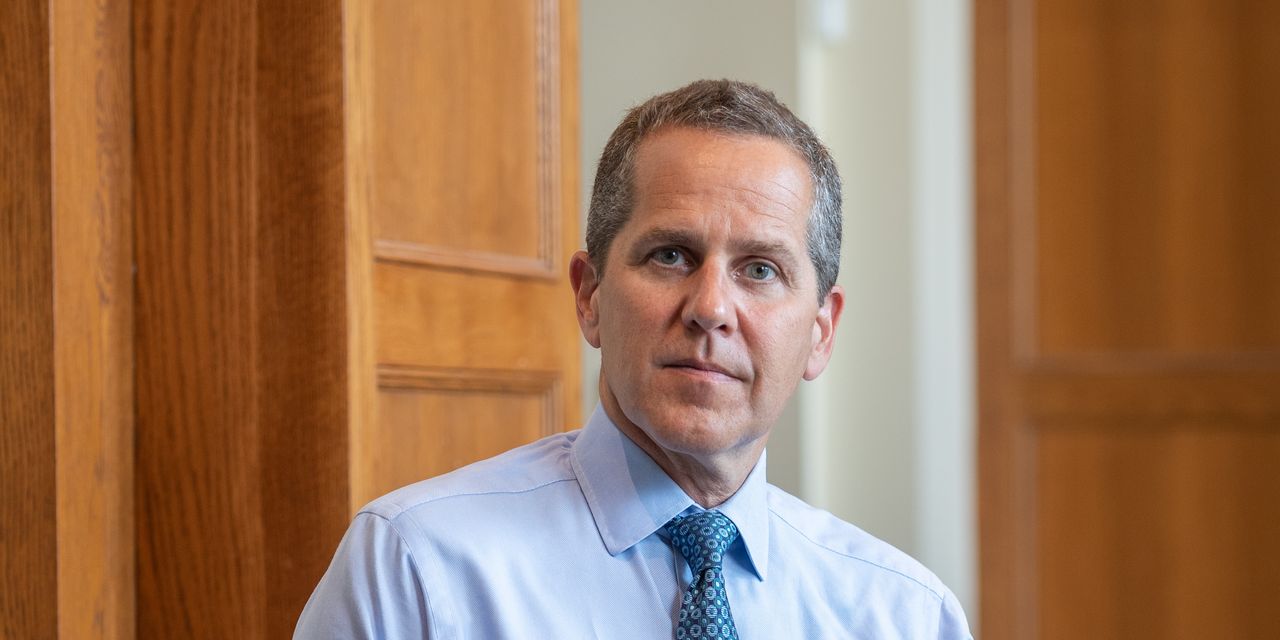

Barr’s comments mark his first full remarks on cryptocurrency and fintech since taking the top regulatory post at the Fed in July. In the speech, Barr said regulators need to balance supporting innovation while providing guardrails that protect consumers and guard against systemic risks.

Barr also warned that crypto companies making misrepresentations about deposit insurance can confuse customers, and may lead to increased withdrawals at crypto-aligned banks that provide such services during periods of heightened stress.

Those comments follow action the FDIC took in August in which it ordered crypto exchange FTX, along with several other crypto firms, to halt what it called “false and misleading” claims an FTX official had made about whether funds at the company are insured by the government.