Several crypto-related public companies have recently released their quarterly earnings reports, demonstrating significant revenue growth and profit increases.

This article highlights the earnings of some of the major players in the crypto industry.

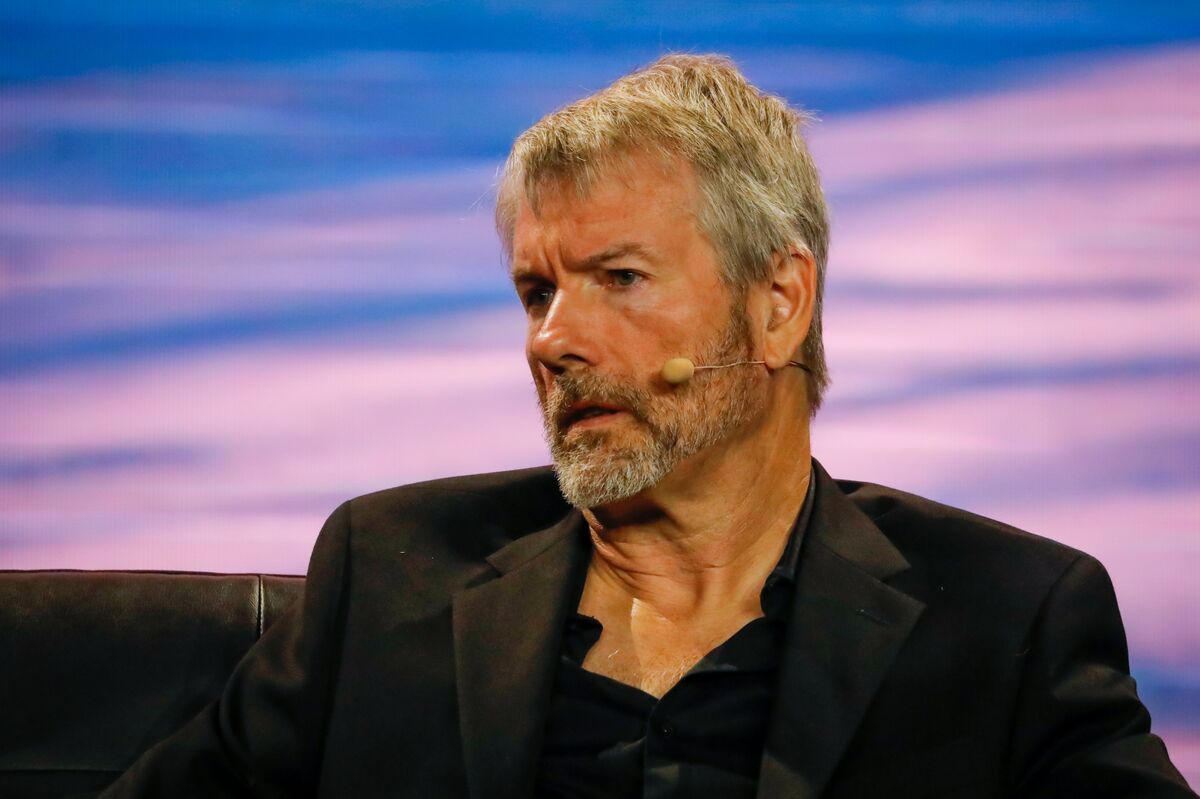

MicroStrategy, a Bitcoin-focused institutional giant, experienced a turnaround in Q2, with the surge in Bitcoin price contributing to its profitability.

As of July 31, the company holds 152,800 BTC, making it one of the largest corporate Bitcoin holders in the U.S. In the earnings report filed on Aug. 1, MicroStrategy reported a net income of $22.2 million, a substantial swing from a net loss of $1.1 billion in Q2 of 2022, with revenue steady at $120.4 million.

Block, led by Jack Dorsey, exceeded expectations with a 34% year-on-year increase in Bitcoin revenue.

Block’s Q2 earnings report revealed $2.4 billion in Bitcoin sales and a gross profit of $44 million, marking a 7% increase over the same period in 2022. The company’s revenue grew by 25.6% from $4.4 billion to $5.53 billion year on year.

Coinbase, the first American crypto exchange to go public, posted quarterly earnings of $663 million in net revenue, surpassing early estimates.

For the first time, non-trading revenue exceeded trading revenue, with $335.4 million coming from subscriptions and services.

Despite a 10% decline in revenue compared to Q2 2022, the firm outperformed estimates due to its growing U.S. market dominance and reduced losses to under $100 million.

READ MORE: U.S. Senators Call for Crackdown on North Korea’s Cryptocurrency Funding of Nuclear Program

CoinShares, a European digital asset manager, reported a 33% year-on-year revenue surge, though it saw a 25% decline in asset management fees.

Profits for the quarter were 5.3 million pounds ($6.76 million), in contrast to a net loss of 0.6 million pounds ($0.77 million) in Q2 2022.

Robinhood, the fintech trading platform, became profitable for the first time since going public, according to its quarterly earnings report.

It recorded a net income of $25 million, or earnings per share of $0.03, a significant turnaround from a net loss of $511 million in the previous quarter.

In summary, the recent quarterly reports reveal a thriving crypto industry, benefiting from price rises in the crypto market and a decline in bearish momentum.

While some firms experienced fluctuations in certain areas, the overall trend indicates growth and profitability within the crypto-centric public companies.

Other Stories:

U.S. Senators Call for Crackdown on North Korea’s Cryptocurrency Funding of Nuclear Program

Latvia Sees Decline in Crypto Asset Purchases Amidst Concerns Over Fraud and Money Laundering