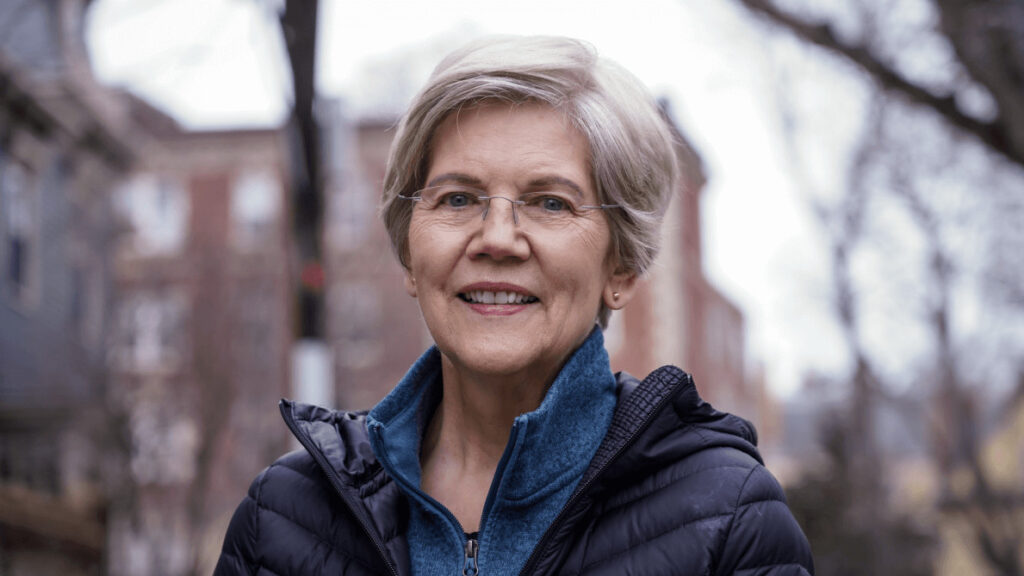

United States Senator Elizabeth Warren is known for her critical stance on the cryptocurrency industry, prompting backlash from various sectors for her actions against digital assets.

In February, the Blockchain Association, along with military and national security professionals, expressed their concerns about Warren’s proposed cryptocurrency legislation, especially her Anti-Money Laundering bill.

They argue that the bill could significantly slow down the blockchain industry’s development in the United States, potentially harming the country’s strategic position, job market, and having minimal impact on the illicit activities it aims to curb.

Kristen Smith, CEO of the Blockchain Association, shared with Cointelegraph the strong industry and congressional support following their letter to Congress, highlighting the industry’s dedication to fostering an innovative environment while addressing regulatory challenges.

Despite opposition, Warren remains steadfast in her critique of the crypto sector.

In a Bloomberg interview, she expressed a desire to work with the industry but criticized its resistance to regulatory measures aimed at curbing illegal activities, implicating the industry in facilitating transactions for drug traffickers, human traffickers, and even contributing to North Korea’s nuclear program.

The crypto community has responded critically to Warren’s regulatory approach.

Danny Lim, from MarginX, criticized the bill for its inefficiency and lack of suitability for the crypto environment, suggesting that traditional finance regulations cannot be directly applied to cryptocurrencies.

Zac Cheah of Pundi X echoed these sentiments, calling for regulations that balance innovation with effective anti-money laundering measures.

Warren’s position could be further challenged by John Deaton, a lawyer and XRP advocate, who announced his candidacy for the Senate in Massachusetts, posing a direct threat to Warren’s seat.

Deaton’s campaign has garnered support from notable figures in the cryptocurrency community, including Cardano founder Charles Hoskinson.

Deaton’s candidacy underscores the growing political influence of the crypto industry and signals a potential shift in the political landscape for those with anti-crypto platforms.

With a significant portion of Boston.com poll respondents viewing Warren as vulnerable to Deaton’s challenge, the upcoming election could mark a pivotal moment in the intersection of cryptocurrency and politics.

To submit a crypto press release (PR), send an email to sales@cryptointelligence.co.uk.

On March 14, the cryptocurrency market witnessed a significant price surge in Solana (SOL), marking its highest point since January 2022.

The currency experienced an increase of approximately 6.70%, reaching $174, outperforming the overall cryptocurrency market, which saw a slight decline of 0.25%.

This rally was primarily fueled by heightened activity on the Solana network, largely due to the enthusiasm surrounding the memecoin project Dogewhatif (WIF).

The project gained traction when its supporters gathered $700,000, vastly exceeding their initial $50,000 goal, to display the token’s logo on the Las Vegas sphere.

This event propelled WIF’s price by 25%, pushing its market cap to $3 billion.

The price of SOL began to climb after the Dogwifhat campaign was announced on March 10, resulting in a more than 24% increase.

This rally gained momentum particularly after the successful WIF crowdfunding.

The involvement of memecoin projects on Solana’s blockchain has been a bullish signal for the network, with research indicating significant activity during these periods.

READ MORE: FLOKI Cryptocurrency Eyes New Highs Amid Token Burns and Analyst Optimism

Solana’s network has also shown signs of increased activity, with the total-value-locked (TVL) reaching its highest since December 2022, at 23.07 million SOL.

This surge is reflective of the platform’s growing utility for decentralized applications (DApps) and transactions, potentially leading to greater SOL demand.

Additionally, Solana’s recent performance against Bitcoin has been notable.

The SOL/BTC pair saw a substantial rise of 32.45% after a dip earlier in the month, with a 6.60% increase on March 14 alone.

This suggests a shift in investor preference from Bitcoin, which has shown signs of being overbought, to altcoins like Solana and XRP, which present a more balanced sentiment.

Technical analysis also supports Solana’s bullish trend, with predictions targeting the $195-200 range by the end of March.

However, the recent rally has pushed Solana’s RSI into the overbought territory, hinting at a possible correction.

If a downturn occurs, SOL could face a drop towards its 0.5 Fibonacci retracement level at $135, a 20% decline from its current price.

To submit a crypto press release (PR), send an email to sales@cryptointelligence.co.uk.

The cryptocurrency market has seen significant activity recently, with Bitcoin reaching another all-time high.

Similarly, the Shiba Inu (SHIB) cryptocurrency has been making efforts to reach a new historical peak.

Part of these efforts includes the SHIB community’s continuous attempt to burn SHIB meme coins, aiming to reduce their supply and increase scarcity.

Recent data from the Shibburn tracker indicates that millions of Shiba Inu coins have been burned, showcasing a remarkable surge in the burn rate of 430%.

According to this data, there has been a 429.78% increase in the rate at which SHIB coins are being destroyed, with a total of 15,155,141 meme coins sent to “inferno” wallets across nine transactions.

The most significant transaction moved 10,196,078 SHIB to an unspendable blockchain wallet, followed by smaller transactions moving 1,882,892 and 1,580,028 SHIB to dead-end addresses.

Although this spike in the burn rate is impressive, it’s important to note that the total amount of coins burned in these instances is less than the amount burned in other daily activities within the same week.

READ MORE: Web 3.0 Gaming: Taki Games Set to Launch Genopets Match in April

For example, on March 12, a substantial 386,077,185 SHIB were burned, despite the burn rate only increasing by 29.22%.

The most notable burn event recently occurred on March 9, when the SHIB team itself undertook a massive burn of 13,610,153,841 SHIB.

This event was not limited to SHIB coins; it also included the burning of BONE and LEASH tokens, which are crucial to the Shibarium ecosystem.

These burns were facilitated by Shibarium’s layer-2 solution and the gas fees collected by the developers.

Despite the fluctuation in burn activities, SHIB’s price experienced a 7.80% increase within the last 24 hours, trading at $0.00003382 at the time of reporting.

This activity underscores the community’s dedication to influencing the coin’s value through strategic burns, aiming for a tighter supply and potentially higher prices.

To submit a crypto press release (PR), send an email to sales@cryptointelligence.co.uk.

With only about 34 days left until the Bitcoin halving event, which will slash the Bitcoin issuance rate by half, there’s a buzz in the cryptocurrency market.

Basile Maire, D8X co-founder and former UBS executive director, in an interview with Cointelegraph, emphasized the significant impact this event could have on supply and demand dynamics.

He said, “There seems to be more demand and less supply, so according to the old economic rules, prices have to move up.

“So the question now: is the [Bitcoin halving] priced in? Probably not to the full extent.”

‘This anticipated event is set against the backdrop of Bitcoin’s price surging past $71,000 for the first time on March 11, signaling robust market optimism.

This bullish sentiment is further echoed in the Bitcoin futures market, where expectations are steering towards a remarkable climb to the $100,000 mark by May.

Maire detailed, “The option data says that people expect Bitcoin price to be in the range of $80,000 to $100,000.

READ MORE: Web 3.0 Gaming: Taki Games Set to Launch Genopets Match in April

“For instance, in May, there was quite a spike in open interest for $100,000. While it’s not a big volume [spike]. I still think this means something.”

Adding to the fervor is the upcoming U.S. presidential election, seen by Maire as a potential positive catalyst for the crypto market.

He believes measures to stabilize traditional markets will inadvertently benefit cryptocurrencies, especially with the enhanced linkage through ETFs.

The surge in Bitcoin’s value has also been partly attributed to the inflows from U.S. spot Bitcoin exchange-traded funds (ETFs), as noted by Sergei Gorev, a risk manager at YouHodler.

He highlighted the significant daily purchases by these ETFs, stating, “Spot Bitcoin ETFs buy 10 times more Bitcoin daily than miners produce each day.”

With a total on-chain holding of $60.5 billion as of March 13, and based on recent trends, Bitcoin ETFs are on track to absorb a substantial portion of the BTC supply annually, per Dune data, further underscoring the growing mainstream acceptance and investment in Bitcoin ahead of the halving event.

To submit a crypto press release (PR), send an email to sales@cryptointelligence.co.uk.

Decentralized physical infrastructure network (DePIN) Dabba plans to boost internet to the unconnected in India via the launch of 100,000 Dabba Lite devices in the country.

Dabba, a blockchain-based company aiming to connect the unconnected with a visionary decentralised physical infrastructure (DePIN) network, announced the launch of its Season 2 campaign in India. The campaign aims to deploy over 100,000 Dabba Lite devices across India this year to offer cheap and accessible internet services.

This follows the Season 1 campaign trial in the most populous country, where it sold all 1,000 Dabba Lite devices within days of launch earlier this year. These campaigns aim to bring super fast and affordable internet to India via its robust decentralized physical infrastructure network (DePIN).

The company has partnered with key investors in this project, including Multicoin Capital, Y Combinator and Borderless Capital, which previously played a key role in helping Google expand its public WiFi and FSOC initiatives.

India, the world’s most populous country with over 1.43 billion people has suffered from poor internet services, and the latest initiative aims to greatly increase the availability of internet services across the country. Less than half of the population has access to internet services with only 30 million Indians enjoying access to fast WiFi services. By providing fast and affordable internet to the country, Dabba aims to unlock this massive potential the country holds in internet and digital assets, as Arul Murugan, Managing Partner at Borderless Capital explained.

“With more than 1.4 billion people and the limitation to expand the fixed broadband connectivity, India represents the largest market for decentralised wireless and WiFi networks, and Dabba is strategically positioned to become a market leader within this space,” Murugan stated.

Providing access to this underserved nation will set Dabba as an industry leader in DePIN services, he further explained. This will be made possible by Dabba building a network of Local Cable operators (LCOs) and deploying its low-cost, proprietary networking hardware to urban and rural areas within the country.

Hotspot owners on the platform are invited to purchase Dabba Lite hardware and choose an LCO, which deploys the device on their behalf. Once the hotspot owners start providing internet services around their area, they can earn token rewards, calculated according to the quantity of data consumed by hotspot users. The hotspot owners will only be paid when hotspot devices are set up in locations where customers pay for WiFi connectivity.

“Dabba’s strategic alliance with stakeholders essential for connectivity, especially Local Cable Operators (LCOs) marks a pivotal shift in India’s internet landscape,” said Shayon Sengupta of Multicoin Capital. “This innovative model not only enhances connectivity but also drives grassroots economic growth, positioning Dabba as a key player in India’s quest for universal internet access.”

With the recent upsurge in data demand, India’s supply lags way behind and Dabba could be the solution to filling up the demand. Notwithstanding, the country has also witnessed a resurgence in its appetite for cryptocurrencies and digital assets, a powerful combination which could drive Dabba’s mission towards leading the internet supply space in India.

As alluded to, the company successfully completed its first test campaign with 1,000 Dabba Lite devices deployed over the first two months of the year. These devices have, so far, seen a steady consumption of 90-100 TB of paid data per month, showing the rising demand for cheap internet in India. Powered by the Dabba token, Dabba will aggregate and leverage over 150,000 LCOs and help them efficiently scale their operations in remote and suburban areas of India.

Binance, the leading crypto exchange in terms of market share, is capitalizing on the current enthusiasm for meme coins by launching a new promotion focused on popular crypto tokens such as Shiba Inu (SHIB), Dogecoin (DOGE), and Dogwifhat (WIF).

Announced recently, this promotion offers users who borrow selected meme coins on Binance Margin—including DOGE, SHIB, WIF, PEPE, FLOKI, BONK, and MEME—a waiver on interest fees for the first hour.

This incentive is available from March 12 to March 26, targeting the seven largest meme coins by market cap.

The mechanism behind the promotion is straightforward: interest accrues hourly, but traders can avoid any charges by repaying within the first hour of borrowing.

This strategy aligns with Binance’s broader goal to leverage the surging interest in meme coins, which have been at the forefront of the current bull cycle’s narrative.

The exchange aims to attract more users to trade these tokens by utilizing their popularity.

In addition to this promotion, Binance has expanded its offerings in the meme coin sector.

It has introduced WIF for spot trading and listed MYRO, a Solana-based meme coin, for futures trading.

READ MORE: Pepe Coin Surges to New Heights, Joining Bitcoin and Ether in Crypto Rally

Additionally, a PEPE/USDC trading pair has been added, complementing the existing PEPE/USDT pair, as part of efforts to appeal to meme coin traders.

The exchange is not just focusing on meme coins but also on the Game-Fi sector, acknowledging its potential in the upcoming bull cycle.

The interest fee waiver also covers gaming tokens such as PORTAL, GALA, BNX, YGG, and PIXEL, indicating Binance’s recognition of diverse investment narratives.

The increased interest in meme coins, particularly SHIB, is evident across the crypto trading platform landscape.

NewsBTC highlighted that platforms like Robinhood and Crypto.com have significantly increased their SHIB holdings, responding to the growing demand from traders.

SHIB’s popularity is further underscored by a reported 20-fold increase in daily new addresses in March compared to February and a new all-time high in the Total Value Locked (TVL) of its layer-2 network, Shibarium.

At the moment, SHIB’s price has seen an uptick in the last 24 hours, trading at approximately $0.00003318 according to CoinMarketCap data, reflecting the broader interest in this meme coin and its ecosystem.

To submit a crypto press release (PR), send an email to sales@cryptointelligence.co.uk.

On March 14, Bitcoin hit a new all-time high, reaching $73,794 on Bitstamp, as captured by Cointelegraph Markets Pro and TradingView data.

This surge came after a strong overnight rebound, dispelling any previous signs of weakness before the latest Wall Street session.

The resurgence was highlighted by Rekt Capital, a well-known trader and analyst on X (formerly Twitter), who remarked, “Bitcoin dipped again earlier this week and once again successfully retested old All Time Highs as support.”

The excitement was partly fueled by notable supply trends, particularly the impact of the United States’ spot Bitcoin exchange-traded funds (ETFs), which recorded net inflows of $683.7 billion on March 13, as reported by the UK-based investment firm Farside.

These inflows significantly outstripped the day’s outflows from the Grayscale Bitcoin Trust (GBTC), indicating a bullish momentum.

Willy Woo, a statistician and the creator of Bitcoin data resource Woobull, commented on the institutional products’ future, sharing a sentiment similar to Cathie Wood, CEO of ETF provider ARK Invest.

Woo stated on X, “The ETFs are just getting started, institutions and wealth management platforms will take a couple of months to complete due diligence before proper allocation begins.”

This anticipation is visualized in a chart showing Bitcoin network inflows, highlighting the ETFs’ contributions.

Moreover, MicroStrategy, known for holding the largest Bitcoin treasury among public companies, announced plans to acquire more than 1% of the total BTC supply.

Currently owning 205,000 BTC, the company aims to invest an additional $500 million to surpass the 210,000 BTC mark.

Despite some concerns over Bitcoin’s ability to maintain its momentum, bullish sentiment prevailed.

Charles Edwards, founder of Capriole Investments, was among the optimists predicting a significant move for BTC/USD.

He emphasized the role of ETF inflows, stating on X, “Bitcoin’s getting ready for a big move,” and added, “a billion a day keeps the dip away.”

Previously, Edwards had declared the era of “deep value” Bitcoin dip-buying over, concluding, “That ship has sailed. You had 2 years to pick up undervalued Bitcoin.

Instead, an exciting new chapter has begun,” marking a transition to a new phase in Bitcoin’s market dynamics.

To submit a crypto press release (PR), send an email to sales@cryptointelligence.co.uk.

On March 13, a surprising development occurred when a post by Elon Musk, featuring a Pepe meme, captivated the attention of cryptocurrency enthusiasts worldwide.

This particular post on X sparked a notable rise in the value of the meme coin PEPE, contrasting with the recent downtrends observed in other meme cryptocurrencies such as SHIB, DOGE, and FLOKI.

Musk’s engagement with the Pepe meme not only highlighted his interest but also seemed to inject a new vigor into Pepe Coin, a cryptocurrency that blends the world of memes with blockchain technology.

This event came amid speculations about the potential end of the meme coin season, during which several prominent meme coins experienced significant value declines.

The reaction to Musk’s post was immediate, with Pepe Coin experiencing a bullish trend across the cryptocurrency market.

Noteworthy personalities on the platform also engaged with Musk’s post, further amplifying the interest in Pepe Coin.

As a result, the cryptocurrency saw a substantial price increase of 12.82% within 24 hours, trading at $0.000009314.

READ MORE: Starknet to Harness Ethereum’s Dencun Upgrade for Major Fee Reductions and Enhanced Scalability

This uptick was accompanied by a 28.53% rise in its 24-hour trading volume and a 13.40% increase in market capitalization, indicating strong bullish sentiment among investors.

Data from Coinglass corroborated this trend, showing a 15.33% rise in open interest for Pepe Coin, which amounted to $125.44 million, while its volume surged by 48.49% to reach $1.38 billion.

These figures suggest a growing interest in PEPE, as investors appear eager to inject new funds into the market, thereby enhancing market activity.

Technical analysis provided by Trading View further supported this optimistic outlook.

The Relative Strength Index (RSI) hovered around 72, suggesting that Pepe Coin might be entering a consolidation phase due to its overbought status.

Nonetheless, the rally induced by Musk’s meme-centric post has ushered in a wave of optimism for the meme coin, suggesting its potential resilience in the face of market fluctuations.

To submit a crypto press release (PR), send an email to sales@cryptointelligence.co.uk.

In 2021, Shiba Inu (SHIB), a meme cryptocurrency inspired by social media trends, experienced an unprecedented surge in its value, peaking at $0.000089 on October 28.

This rise was propelled by the enthusiasm on platforms like Reddit and the broader excitement around cryptocurrencies, especially following Dogecoin’s success.

There’s growing curiosity about SHIB’s ability to mimic its previous year’s performance.

Opinions on SHIB’s future prospects are divided among experts.

Alex Svanevik, CEO of Nansen, remains optimistic about meme coins, including SHIB and Dogecoin, predicting they could outperform other major cryptocurrencies like Cardano.

Conversely, analysts from The Motley Fool are skeptical, cautioning that the gains seen in 2021 may not be repeatable.

They highlight the mathematical challenges in expecting similar explosive growth, indicating “Those hoping for a repeat of 2021 might be disappointed because it would be mathematically impossible.”

Shiba Inu’s journey to replicate its 2021 success faces several obstacles.

With a circulating supply of 589 trillion coins, efforts to significantly impact its value through token burning have been sluggish.

READ MORE: Pepe Coin Surges to New Heights, Joining Bitcoin and Ether in Crypto Rally

Moreover, the coin’s practical use cases remain limited, despite initiatives like Shibarium aiming to improve transaction efficiency and reduce costs.

The slow pace of merchant adoption further restricts its utility beyond speculative trading.

However, the Shiba Inu community is actively working to enhance the token’s ecosystem and utility.

Projects like Shibarium and Shiba Eternity, a collectible card game, underscore the community’s commitment to building a more sustainable and valuable network for SHIB.

The future performance of SHIB will also be influenced by the overall health of the cryptocurrency market.

Despite the hurdles related to its supply and utility, the unwavering support from its community and the evolving crypto landscape could play pivotal roles in SHIB’s ability to achieve long-term success.

The debate over SHIB’s potential continues, reflecting the dynamic and speculative nature of the cryptocurrency market.

To submit a crypto press release (PR), send an email to sales@cryptointelligence.co.uk.

Grayscale‘s spot Bitcoin ETF, a pioneering financial product in the U.S. since its inception on January 11, has experienced a significant market share drop, marking the first time it has fallen below 50%.

According to Dune Analytics, as of March 12, the Grayscale Bitcoin Trust (GBTC) managed $28.5 billion, constituting 48.9% of the combined $56.7 billion in assets under management (AUM) across ten U.S. Bitcoin ETFs.

Initially, Grayscale dominated the market, with its fund representing approximately 99.5% of the total AUM of the first ten U.S. spot Bitcoin ETFs.

However, the landscape has shifted dramatically due to persistent daily withdrawals from GBTC, which averaged $329 million per day in the preceding week.

These outflows, particularly pronounced in the initial month post-launch, with $7 billion exiting the fund, have gradually decelerated.

Yet, a mid-February court decision enabling crypto lender Genesis to sell off approximately $1.3 billion in GBTC shares reignited the outflow trend. To date, GBTC has seen over $11 billion in outflows, as reported by Farside Bitcoin ETF flow data.

READ MORE: Grayscale Proposes New Bitcoin Mini Trust to Offer Tax-Efficient Investment Option

Grayscale’s fund transitioned from a trust to an ETF following a successful legal battle with the Securities and Exchange Commission (SEC) and subsequent approvals of other spot Bitcoin ETF applications.

This transformation allowed institutional investors engaged in GBTC arbitrage to permanently withdraw or reallocate their capital to other Bitcoin ETFs offering lower fees.

The market initially reacted negatively to GBTC’s outflows. However, optimism has been renewed by significant net inflows into other ETFs, such as BlackRock’s iShares Bitcoin ETF (IBIT) and the Fidelity Wise Origin Bitcoin Fund (FBTC), which have collectively attracted $16.9 billion in inflows since their launch.

Market analysts attribute the substantial inflows into these new ETFs as a key factor behind the recent surge in Bitcoin’s price, which hit a record high of $72,900 on March 11.

BlackRock’s ETF now holds over 200,000 BTC, valued at roughly $14.3 billion, underscoring the shifting dynamics within the cryptocurrency investment landscape.

To submit a crypto press release (PR), send an email to sales@cryptointelligence.co.uk.