In a landmark case, Jian Wen, a former hospitality worker, has been convicted of money laundering in a UK court specializing in significant fraud cases, following the discovery of a staggering $2.5 billion in Bitcoin under her control.

The Southwark Crown Court’s ruling came after a detailed investigation into Wen’s financial activities, which included the purchase of luxury properties and expensive jewelry.

This investigation examined 48 electronic devices and thousands of files, many in Mandarin, the BBC reported.

Wen’s sudden shift in lifestyle from residing above a Chinese restaurant to renting a lavish six-bedroom house in North London, with a monthly rent of $21,420, signaled the authorities to her trail.

Moreover, her attempt to buy a $30 million mansion in London was a critical lead that prompted further scrutiny by the officials, Cointelegraph noted.

Wen’s ambitious real estate ventures in London, coupled with her inability to pass money-laundering checks despite claiming substantial earnings from Bitcoin mining, raised suspicions.

READ MORE: Bitcoin Futures Volatility Surges: Open Interest Hits $36 Billion Amid Price Fluctuations

The UK police branded the case as the largest Bitcoin seizure in the country, with Wen convicted for her involvement in a money laundering arrangement, awaiting sentencing on May 10.

Chief Crown Prosecutor Andrew Penhale stressed the growing use of cryptocurrencies like Bitcoin in criminal operations, facilitating asset disguise and transfer by fraudsters.

Contrary to the authorities’ stance on cryptocurrencies being widely used for money laundering, a recent US Treasury Department report argued that cash remains the preferred medium for such illicit activities, due to its anonymity and stability.

Adding to the discourse, Nasdaq’s “Global Financial Crime Report” shed light on the financial crime landscape, noting that approximately $3.1 trillion in illicit funds circulated through the global financial system in 2023.

Interestingly, the report did not specifically mention Bitcoin or cryptocurrencies, indicating a broader perspective on financial crime beyond the digital currency realm.

To submit a crypto press release (PR), send an email to sales@cryptointelligence.co.uk.

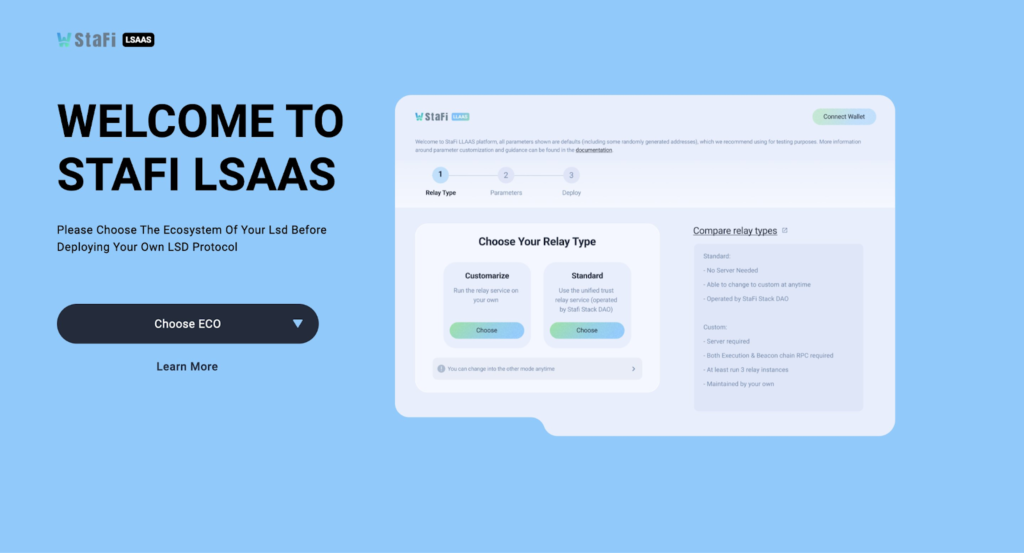

Multichain liquid staking platform StaFi is launching its Liquid Staking as a Service (LSAAS) testnet, in anticipation of its mainnet launch, StaFi 2.0. The latest iteration of its liquid staking platform will introduce a host of new features to push the protocol as the leading infrastructure solution for Ethereum-based and Cosmos blockchain staking.

Since its launch, StaFi has created solutions to extend liquid staking across multiple blockchains. With the current liquid staking model only servicing single blockchains, such as Lido Finance for Ethereum staking only, the StaFi 2.0 launch will allow users to stake on multiple blockchains. This is expected to unlock greater utility and economic rewards for stakers while enhancing blockchain security across multiple blockchains.

As StaFi co-founder Liam Young explained during the unveiling of the LSAAS testnet launch, the launch of its testnet will “provide a major boost for Layer 1 blockchains’ security” as well as “opening new opportunities for yield generation”.

“The launch of the StaFi 2.0 testnet is a major milestone in our journey to mainnet,” he continued. “The future of blockchain development is intertwined with liquid staking. StaFi 2.0 will play a crucial role in realizing that vision through pioneering Liquid Staking as a Service.”

The testnet supports liquid staking derivatives (LSD) for leading Layer 1 ecosystems such as Ethereum, EVM layer2s, and Cosmos. The CosWasm LSD framework supports diverse deployment approaches including Neutron, the native smart contract platform secured by Cosmos. StaFi 2.0 also supports native Cosmos chain deployment.

Notwithstanding, the LSAAS framework will also accelerate the development and upgrades of LSD innovations. It will facilitate the rapid deployment of highly secure and capital-efficient LSDs on layer1 and layer2 blockchains, opening the platform to more staking options and products.

Following the launch of StaFi’s LSAAS testnet, users on the platform can start experimenting with innovative LSD products and experience the convenience of being able to access Liquid Staking as a Service.

A successful testnet period will be followed by the unveiling of the StaFi 2.0 mainnet and a later launch of the innovative LRT Stack to power new re-staking applications. The timeline for the LRT unveiling is yet to be confirmed.

StaFi 2.0 will be a revolutionary liquid staking upgrade, transforming the platform into an infrastructure layer for stakers and LSD products. Additionally, it will support multiple virtual machines (VMs) including EVM and WASM, aiming to pioneer a new staking mechanism for the billion-dollar liquid staking industry and bring re-staking to several Layer 1 and Layer 2 blockchains.

As users and developers test and familiarize themselves with the LSAAS testnet, developers from StaFi will acquire the necessary information needed to further innovate the platform before its mainnet launch. It will allow further developments and bug fixes based on users’ feedback ahead of its mainnet launch schedules for Q3 later this year.

The United States Securities and Exchange Commission (SEC) has once more deferred its decision on the Grayscale Ethereum Futures Trust exchange-traded fund (ETF) application.

Initially set for March 31, the SEC pushed back the deadline to May 30, allowing more time to evaluate the application and address the concerns it raises.

This postponement follows a previous delay in December 2023, when the SEC sought further public feedback on the proposed ETF, which aims to invest in Ethereum futures contracts.

The SEC’s hesitance to make a swift decision underscores its cautious approach, emphasizing the need for thorough consideration: “The Commission finds that it is appropriate to designate a longer period within which to issue an order approving or disapproving the proposed rule change so that it has sufficient time to consider the proposed rule change and the issues raised therein.”

Grayscale’s push for the Ethereum Futures Trust ETF began in September 2023, seeking permission to list and trade shares under the New York Stock Exchange Arca Rule 8.200-E.

Bloomberg ETF analyst James Seyffart suggests that Grayscale’s move is strategic, using the futures ETF bid to potentially sway the SEC towards approving a spot Ether ETF.

According to Seyffart, approval of the futures ETF could strengthen Grayscale’s case for its spot Ether ETF.

READ MORE: Bitcoin Rallies Amid Fed’s Interest Rate Decision, Showcasing Resilience Against ETF Outflows

The SEC’s deliberation on Grayscale’s spot Ether ETF also lingers, with a decision postponed on January 25, following the call for public comments.

This delay reflects growing skepticism within the crypto community about the SEC’s stance on cryptocurrency-based ETFs, heightened by the approval of spot Bitcoin ETFs on January 10.

Industry observers, like Capital founder John Lo, anticipate increased scrutiny from the SEC on all forthcoming crypto-based ETF applications, particularly those related to Ether.

Lo remarks, “Scrutiny towards cryptocurrency ETFs has only grown… No doubt, the SEC internally views that as a huge loss for themselves,” referring to the SEC’s perceived forced approval of Bitcoin ETFs after its litigation with Grayscale.

The SEC’s cautious stance extends beyond Grayscale, affecting other asset management giants like BlackRock and Fidelity.

In early March, the SEC announced delays in deciding on BlackRock’s iShares Ethereum Trust and Fidelity’s Ethereum Fund, indicating a broader pattern of regulatory hesitation towards Ethereum ETFs.

To submit a crypto press release (PR), send an email to sales@cryptointelligence.co.uk.

Ether recently encountered significant resistance at the $4,100 level on March 12, leading to a 9% drop in its price over the past week, a sharper decline than the broader cryptocurrency market, which saw a 2.5% decrease in total market capitalization.

This downturn has prompted speculation about the durability of Ether’s current $3,200 support level.

A key potential driver for Ether is the possibility of the U.S. Securities and Exchange Commission (SEC) approving a spot Ethereum exchange-traded fund (ETF), with a decision expected by May 23.

Yet, Bloomberg’s James Seyffart remains skeptical of approval, stating, “However, Bloomberg senior ETF analyst James Seyffart does not consider approval as his base scenario.”

Despite the price setback, the Ethereum network saw significant upgrades with the Dencun hard fork on March 13, aimed at improving scalability and layer-2 data processing.

This update has led to reduced transaction fees on platforms like Arbitrum, Optimism, and Base, bolstering the case for layer-2 solutions among Ethereum users.

Cointelegraph highlights this trend, noting, “Data indicates a surge in 7-day volumes for Arbitrum, Optimism, and Base by 145%, 144%, and 203%, respectively, thereby alleviating some of the downward pressure on Ether’s price that was attributed to high gas fees.”

However, competition from networks like BNB Chain and Solana, which offer lower base-layer transaction fees, remains fierce.

1Despite this, Ethereum continues to see positive ecosystem developments, even as regulatory scrutiny in the U.S. intensifies, with the SEC investigating connections to the Ethereum Foundation to potentially classify Ether as a security.

The recent SEC actions, especially in light of Ethereum’s shift to proof-of-stake, have led to a mixed response from the market and industry figures.

Some, like Van Buren Capital and lawyer Scott Johnsson, view the SEC’s scrutiny as a potential obstacle to Ether ETF approvals, while Coinbase’s chief legal officer, Paul Grewal, contends, “The SEC has no valid reason to reject the Ether ETP applications.”

Market sentiment, as gauged by the ETH options 25% delta skew, reflects a cautious stance, with a recent shift from 0% to 5%, indicating skepticism but not outright bearishness towards the $3,200 support.

Despite this, Ethereum’s position as a leading network, with a total value locked (TVL) of $94 billion and BlackRock’s initiative to launch a tokenized asset fund on Ethereum, underscores its enduring significance.

This backdrop suggests that, despite current challenges, Ether’s foundational support level remains robust.

To submit a crypto press release (PR), send an email to sales@cryptointelligence.co.uk.

SEC Chair Gary Gensler recently highlighted the evasion of registration requirements by certain entities within the cryptocurrency industry.

In remarks prepared for a Columbia Law School event on March 22, Gensler emphasized the importance of transparency and regulatory compliance, invoking the words of Supreme Court Justice Louis Brandeis: “Sunlight is said to be the best of disinfectants.”

Gensler criticized the reluctance of some crypto market participants to adhere to the SEC’s disclosure regulations, pointing out that such avoidance leads to a lack of mandatory disclosure.

“There still are those who would like to whittle away at the SEC’s disclosure regime,” he remarked. Highlighting the opacity within the crypto sector, Gensler added, “There are participants in crypto securities markets that seek to avoid these registration requirements.

No registration means no mandatory disclosure. Many would agree that the crypto markets could use a little disinfectant.”

This stern critique comes amid the SEC’s active enforcement actions against prominent cryptocurrency companies, including Kraken, Binance, Ripple, and Coinbase.

The ongoing legal battles and the demand from crypto businesses and advocacy groups for clearer regulations underscore the tension between innovation and regulatory compliance in the United States.

Moreover, the SEC’s efforts to bring cryptocurrencies under its regulatory scope have intensified, with moves to potentially classify Ether as a security.

The past two years have seen the SEC making significant strides in approving cryptocurrency-related exchange-traded products (ETPs) for U.S. exchanges.

These advancements include investment vehicles based on ETH and Bitcoin futures, as well as the launch of the first spot BTC exchange-traded funds (ETFs) in January.

Gensler’s comments reflect a broader regulatory initiative to ensure transparency and investor protection in the rapidly evolving crypto industry, amidst calls for a balanced approach that fosters innovation while ensuring market integrity.

To submit a crypto press release (PR), send an email to sales@cryptointelligence.co.uk.

FTX, the cryptocurrency exchange that went bankrupt, is in the process of selling its investment in the artificial intelligence company Anthropic, valued at approximately $1 billion.

This move is part of FTX’s strategy to address its bankruptcy debts, a situation reported by CNBC on March 22.

Anthropic, an AI firm, is currently evaluating potential buyers for FTX’s stake, with a transaction expected to finalize within the next few weeks.

Sources close to the situation, preferring anonymity due to the sensitive nature of the financial discussions, informed CNBC of these developments.

The method of sale involves a special purpose vehicle (SPV), a separate corporate entity created to fulfill legal obligations during insolvency situations, indicative of FTX’s current financial state.

Interestingly, the sources revealed that Saudi Arabian entities have been excluded from the bidding process over national security concerns, although it remains unclear if this exclusion pertains to all Saudi investors or just state-related ones. It’s important to note that the shares in question are “Class B” non-voting shares.

The potential sale follows a decision by the Delaware Bankruptcy Court, where Judge John Dorsey authorized FTX to liquidate its Anthropic shares on February 22.

FTX initially acquired these shares for about $530 million in April 2022, and their value has nearly doubled since, propelled by the surge in generative AI technology, now estimated to be worth around $1 billion.

This development surfaces as FTX’s former CEO, Sam Bankman-Fried, prepares for his sentencing hearing on March 28, after being convicted on seven counts of fraud in November 2023.

Describing Bankman-Fried’s actions, U.S. Attorney Damian Williams stated, “a multibillion-dollar scheme designed to make him the king of crypto,” and highlighted the scale of the fraud as one of the most significant financial deceptions in U.S. history.

To submit a crypto press release (PR), send an email to sales@cryptointelligence.co.uk.

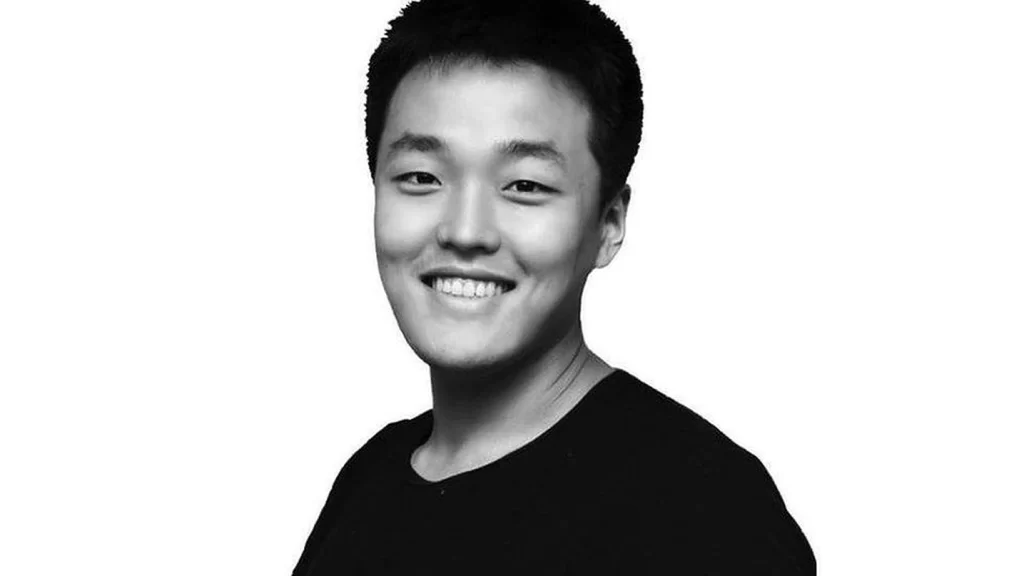

Montenegro’s authorities are set to release Terraform Labs co-founder Do Kwon from prison while his extradition to the United States or South Korea remains undecided.

Kwon, detained for approximately one year, will be released on March 23 but must relinquish his travel documents to ensure he does not leave the country, as reported by Montenegrin news outlet Vijesti on March 22.

This decision by the Council of the Supreme Court precedes a review that may either approve or reject his extradition to South Korea, his homeland.

Kwon’s arrest in Montenegro in March 2023 alongside Han Chang-joon, Terraform Labs’ ex-chief financial officer, was due to the use of counterfeit travel documents.

This arrest was complicated by extradition requests from both the U.S. and South Korea, where Kwon faces charges of fraud, although a final ruling on his extradition has yet to be made.

In the U.S., Kwon would confront eight felony charges filed by prosecutors in March 2023.

READ MORE: Vitalik Buterin Doubles Grant for ENS, Fueling Growth and Innovation in Web3 Addresses

Alternatively, South Korea might indict him for fraud and breaches of capital markets law. The destination of his potential extradition remains uncertain.

The plan involves confiscating Kwon’s South Korean passport, which was set to be revoked in 2022 following Terra’s downfall.

Despite this, Kwon used a falsified Costa Rican passport in Montenegro, claiming it to be genuine, which led to his arrest in 2023.

Additionally, Terraform Labs co-founder Shin Hyun-Seong, also known as Daniel Shin, and others linked to the platform are facing criminal charges for investor fraud.

Following Terra’s collapse in May 2022, Shin remained in South Korea.

The collapse brought significant regulatory attention to the platform and played a part in a broader downturn in the cryptocurrency market.

To submit a crypto press release (PR), send an email to sales@cryptointelligence.co.uk.

Bitcoin investors often crave the excitement of market volatility but usually find the reality less thrilling, especially when a surge in prices is swiftly followed by a sharp downturn.

This often results in forced liquidations of futures contracts, exacerbating the fall in Bitcoin’s value.

The Bitcoin futures market, vital for traders wanting to leverage their positions, grows in significance with its expansion, influencing Bitcoin’s price more markedly.

Recently, the aggregate open interest in Bitcoin futures soared to an all-time high of $36 billion on March 21, a significant increase from $30 billion just two weeks earlier.

Leading the charge, the Chicago Mercantile Exchange (CME) recorded $11.9 billion in open interest, overshadowing the inflow to U.S. spot Bitcoin exchange-traded funds (ETFs) since their launch.

Despite the advent of spot ETFs—which some expected would dampen volatility given their $3 billion average daily trading volume—Bitcoin’s volatility has escalated, contrary to these expectations.

Over the last four weeks, Bitcoin’s 30-day volatility index shot past 80%, the highest in over 15 months, starkly contrasting with the lower volatility seen in traditional markets and even in stocks known for their unpredictability.

This heightened volatility was highlighted by a dramatic price correction on March 19, followed by a significant recovery the next day, leading to substantial liquidations in the futures market.

Such volatility not only affects traders but also impacts the general perception of Bitcoin’s risk and its market trajectory.

READ MORE: Bitcoin Rallies Amid Fed’s Interest Rate Decision, Showcasing Resilience Against ETF Outflows

The futures market serves as a double-edged sword, offering opportunities for leveraged positions but also presenting risks of sharp corrections and liquidations.

This dynamic can lead to short-term buying pressure if the market reverses from bearish bets, contributing to the observed volatility.

Some analysts point to excessive leverage or market manipulation as causes, with instances where market movements in related sectors seemingly coincide with major Bitcoin price shifts, though the motivations behind such movements remain speculative.

To understand the impact of futures on Bitcoin’s price, examining the premium on monthly contracts is crucial.

These contracts, favored by professional traders for their lack of a funding rate, command a significant premium over spot prices, reflecting market sentiment.

Despite a recent price dip, the sustained high premium on futures contracts indicates a bullish stance among traders, yet the risk of forced liquidations looms large, especially with the substantial open interest in the market.

To submit a crypto press release (PR), send an email to sales@cryptointelligence.co.uk.

The United States Department of Justice (DOJ) has filed a significant antitrust lawsuit against Apple, accusing the technology behemoth of employing its app market regulations to illegally suppress competition and stifle innovation.

Filed on March 21 in a New Jersey federal court, and supported by 16 state attorney generals, the lawsuit claims that Apple maintains a monopolistic position in the smartphone market.

This, the DOJ contends, allows Apple to coerce developers into exclusively using its payment system, thereby locking in developers and users to its platform.

Central to the DOJ’s accusations are Apple’s App Store guidelines and developer agreements, which are criticized for their complex and variable rules.

These restrictions, according to the DOJ, enable Apple to charge excessive fees, hinder innovation, compromise user experience security, and limit competitive alternatives.

The lawsuit suggests that such practices notably restrict the functionality of crypto-based apps on iOS devices, impacting competition not only in the smartphone sector but also in financial services and other industries.

The DOJ specifically criticizes Apple for excluding alternative payment systems in a manner deemed anticompetitive and exclusionary.

Highlighting the controversial 30% commission, often referred to as the “Apple tax” on apps and in-app purchases, the complaint outlines how this policy and Apple’s fiat-only payment systems effectively block the integration of cryptocurrencies into apps, rendering it economically unfeasible for crypto-based applications to offer in-app purchases.

Additionally, the complaint notes that while Apple permits certain customers to distribute apps through custom app stores, it restricts iPhone users and developers from accessing these alternatives.

This restriction aims to protect Apple’s revenue from its App Store fees.

The DOJ accuses Apple of inconsistently enforcing its App Store rules to penalize developers leveraging technologies that could challenge Apple’s market dominance.

Specific examples include the disabling of functionalities in nonfungible token (NFT) marketplaces like OpenSea, and the social app Damus being forced to remove a Bitcoin tipping feature after Apple removed it from the App Store for circumventing its payment system.

Moreover, the DOJ alleges that Apple’s control extends to web apps, as it mandates the use of its WebKit engine for all iOS web browsers, further restricting competition.

In defense, an Apple spokesperson refuted the DOJ’s allegations, asserting the lawsuit is baseless and vowing to “vigorously defend against it.”

Apple argues that the lawsuit threatens to give the government undue influence over technology design, potentially compromising user privacy and security.

This defense comes as Apple faces pressure from regulations like the European Union’s Digital Markets Act, which mandates offering alternative browser engines and app stores, despite Apple’s concerns for user safety.

Following the lawsuit’s announcement, Apple’s stock price dropped by 4% to around $171, with no significant recovery in after-hours trading, as reported by Google Finance.

To submit a crypto press release (PR), send an email to sales@cryptointelligence.co.uk.

The United States Securities and Exchange Commission (SEC) has decided to postpone its verdict on the introduction of spot Ether exchange-traded funds (ETFs) proposed by Hashdex and ARK 21Shares.

The delay, announced on March 19, occurred shortly before the SEC’s third and final deadline for these applications, setting the stage for a conclusive decision in late May.

The SEC has scheduled May 24 for its final determination on ARK 21Shares’ application and May 30 for Hashdex’s, marking a critical period for the future of Ether ETFs.

This postponement reflects growing skepticism among analysts about the approval prospects for the eight Ether ETF proposals currently on the table from major firms including BlackRock, Grayscale, Fidelity, Invesco Galaxy, VanEck, Hashdex, and Franklin Templeton.

Bloomberg ETF analyst James Seyffart expressed a shift in optimism on March 19, citing a notable decrease in engagement between the SEC and the ETF issuers, leading him to anticipate likely denials of the applications by May 23.

Similarly, analyst Eric Balchunas adjusted the approval probability for Ether ETFs downward to 35%, highlighting a contrast in the SEC’s approach compared to the spot Bitcoin ETF applications, which experienced more open communication.

The public’s confidence in the approval of Ether ETFs by the end of May has also waned, as indicated by Polymarket odds which have fallen to 32% from January’s more hopeful 77%.

Polymarket, a decentralized betting platform, has seen around $2.2 million wagered on the outcome of these ETF decisions.

In a related development, Grayscale is exploring the addition of staking capabilities to its Ether ETF application.

Through a consent solicitation statement to Grayscale Ethereum Trust investors, the firm proposed enabling the trust to engage in proof-of-stake validation protocols, potentially providing consideration for the benefit of shareholders.

This move aims to counteract inflationary pressures from Ethereum’s proof-of-stake protocol and keep pace with competing products offering staking.

The proposals, requiring approval from over 50% of shareholders, could position Grayscale alongside ARK 21Shares, Franklin Templeton, and Fidelity, who have recently incorporated Ether staking into their ETF offerings.

To submit a crypto press release (PR), send an email to sales@cryptointelligence.co.uk.