New memecoins are attracting funds from investors who are cashing in their profits in tokens such as Book of Meme (BOME) and Shiba Inu (SHIB).

DinoCat (RAWR) and Furrari (FURRARI) are tokens that were both launched on 10 April, and they’re set to benefit massively from investors in other, larger memecoins, such as Book of Meme (BOME) and Shiba Inu (SHIB).

This is because these investors are redeploying their profits into smaller cap tokens, as they have potential for explosive growth due to their small market capitalizations.

For example, DinoCat has a market capitalization of just $9,000, while Furrari coin’s market cap is around the $14,000 mark.

And, with both of these coins set to announce bullish catalysts later in the week, their price is poised to surge 2,200% and 1,800%, before the end of next week.

This would still give them a market cap below $250,000 each, meaning both Furrari (contract address: 9oG3T8UMkFcjEEBQaEsU71B6Sa9grMbbP2SmKu6ed1T4) and DinoCat (contract address: 9khQG9Esv15TWf2F4kdx2ULmbhDvJQS7sDGPBpKLEA4G) would have plenty more potential for further, explosive gains.

These two tokens are currently only available to be traded on decentralized exchanges, such as Raydium and Jupiter.

The rise of these two new, cat-themed memecoins comes amid Book of Meme (BOME) and Shiba Inu (SHIB) trading sideways and posting sluggish gains in recent weeks.

For example, BOME is down 18% in the last 7 days, while SHIB has posted gains of just around 4%.

And, with smaller cap memecoins offering astronomical potential returns to early investors, it is not surprising that many memecoin traders are ditching SHIB and MEME for DinoCat (RAWR) and Furrari (FURRARI).

Hong Kong’s ZA Bank is set to propel local Web3 adoption with its latest initiative, offering specialized banking services tailored for stablecoin issuers.

The announcement on April 5 unveils the virtual bank’s plan to fortify security for fiat reserves, which issuers can utilize to support digital assets.

Stablecoin issuers will gain access to a range of banking services, including fund transfers, payroll management, and various deposit options.

Devon Sin, ZA Bank’s alternate chief executive, expressed the institution’s firm backing for the Web3 community, stating, “With these new services, we’re directly addressing the unique challenges faced by stablecoin issuers, ultimately promoting growth and stability within the Web3 economy.”

The necessity for stablecoin issuers to maintain the value of their assets by securely storing equivalent fiat currency reserves has been a persistent challenge, impeding broader adoption and highlighting a significant requirement within the wider Web3 community.

ZA Bank has been actively engaging with Hong Kong’s burgeoning Web3 sector. In 2023, it reported a transfer volume exceeding $1 billion from clients in the Web3 space.

The bank’s commitment to this sector was evident in May 2023 when it announced its foray into retail virtual asset trading shortly after the Hong Kong Securities and Futures Commission (SFC) signaled its readiness to accept retail virtual asset trading platform (VATP) license applications.

ZA Bank has reportedly captured over 80% of the client banking needs of VATPs in Hong Kong.

Moreover, the bank has facilitated the onboarding of more than 100 Web3 companies as part of its efforts to drive local adoption.

In December 2023, responding to a consultation paper from the Financial Services and the Treasury Bureau and the Hong Kong Monetary Authority, the Hong Kong government revealed its intention to mandate stablecoin issuers to obtain licenses.

The licensing criteria will require stablecoins to be fully backed by reserves “at least equal to the par value.”

To submit a crypto press release (PR), send an email to sales@cryptointelligence.co.uk.

New memecoins are attracting funds from investors who are cashing in their profits in tokens such as Book of Meme (BOME) and Shiba Inu (SHIB).

DinoCat (RAWR) and Furrari (FURRARI) are tokens that were both launched on 10 April, and they’re set to benefit massively from investors in other, larger memecoins, such as Book of Meme (BOME) and Shiba Inu (SHIB).

This is because these investors are redeploying their profits into smaller cap tokens, as they have potential for explosive growth due to their small market capitalizations.

For example, DinoCat has a market capitalization of just $9,000, while Furrari coin’s market cap is currently around the $14,000 mark.

And, with both of these coins set to announce bullish catalysts later in the week, their price is poised to surge 2,200% and 1,800%, before the end of next week.

This would still give them a market cap below $250,000 each, meaning both Furrari (contract address: 9oG3T8UMkFcjEEBQaEsU71B6Sa9grMbbP2SmKu6ed1T4) and DinoCat (contract address: 9khQG9Esv15TWf2F4kdx2ULmbhDvJQS7sDGPBpKLEA4G) would have plenty more potential for further, explosive gains.

These two tokens are currently only available to be traded on decentralized exchanges, such as Raydium and Jupiter.

The rise of these two new, cat-themed memecoins comes amid Book of Meme (BOME) and Shiba Inu (SHIB) trading sideways and posting sluggish gains in recent weeks.

For example, BOME is down 18% in the last 7 days, while SHIB has posted gains of just around 4%.

And, with smaller cap memecoins offering astronomical potential returns to early investors, it is not surprising that many memecoin traders are ditching SHIB and MEME for DinoCat (RAWR) and Furrari (FURRARI).

Bitkub Capital Group Holdings, the leading force behind Thailand’s most prominent cryptocurrency exchange, is setting the stage for an initial public offering (IPO) by bringing financial advisers on board.

This move aligns with its strategic vision to enhance its market presence and secure additional funding by going public on the Stock Exchange of Thailand (SET) by 2025, as confirmed by CEO Jirayut Srupsrisopa in a discussion with Bloomberg.

In a bid to strengthen its workforce, Bitkub is looking to recruit 1,000 more employees, aiming to double its current team size by 2025.

This decision marks a shift from the previous years, during which the company reduced its staff by 6%.

This expansion effort underlines Bitkub’s ambitious growth plans despite the workforce reduction in 2022 and 2023.

The announcement of Bitkub’s IPO was initially hinted at in a shareholder letter in 2023, albeit without much detail.

With its headquarters in Bangkok, Bitkub dominates the Thai cryptocurrency exchange market, boasting a 77% share as of December 2023, as per HashKey’s analysis.

The exchange sees about $30 million in daily transactions.

Thailand’s cryptocurrency scene is witnessing a surge, with over 13 million users as of 2023, which is expected to grow significantly in the coming years.

READ MORE: Bitcoin Surges to $70,000, Eyes Record Highs Amid Positive Economic Remarks from Fed Chair Powell

Amid this expanding market, Bitkub faces competition from local and international players, including the recent entrance of Binance’s local subsidiary in January 2024 and significant moves by Kasikornbank, one of Thailand’s largest banks.

Bitkub’s journey towards an IPO also follows a strategic partnership where Asphere Innovations acquired a 9.2% stake in Bitkub Online, the exchange’s operational arm, for 600 million baht ($16.5 million).

This collaboration is anticipated to bolster Bitkub Online’s valuation, particularly as its trading volumes approach the peak levels last seen during the crypto bull market in 2021.

Bitkub Online significantly contributes to Bitkub Capital’s profitability, accounting for about 80% of its earnings.

However, the path has not been without challenges. In 2022, a major acquisition deal by SCB X for a 51% stake in Bitkub Online was called off amid growing regulatory scrutiny.

This backdrop illustrates the evolving dynamics within Thailand’s cryptocurrency landscape, highlighting Bitkub’s strategic moves to consolidate its leadership while navigating through regulatory and competitive pressures.

To submit a crypto press release (PR), send an email to sales@cryptointelligence.co.uk.

Numerous dog-themed memecoins, such as Dogecoin (DOGE), Shiba Inu (SHIB), and Bonk (BONK), have risen to prominence and achieved billion dollar market caps.

Furrari (FURRARI) coin is set to become one of just a handful of cat-themed memecoins to go viral and achieve a multi-million dollar market cap.

The Solana-based coin, which was launched today and is now available to buy on decentralized exchanges, such as Jupiter, has been identified as a memecoin that has massive potential to grow in the coming months.

Furrari (contract address: 9oG3T8UMkFcjEEBQaEsU71B6Sa9grMbbP2SmKu6ed1T4) currently has a market cap of just $10,000, and it is projected to explode in the coming days and weeks, with a $1.4 million target set for the end of next week.

This would allow investors who buy in at the current price to generate a 140x return on their investment – something the large cap memecoins, such as Dogecoin (DOGE), Shiba Inu (SHIB), and Bonk (BONK), can no longer offer due to their market caps already being in the billions of dollars.

The sheer memeability of this coin – which mixes the cuteness of a cat with the luxury of the Ferrari brand – means it has the potentially to quickly go viral and target a market cap much higher than $1.4 million in the medium to long term.

Furthermore, the fact that all of Furrari’s liquidity is locked on Raydium, which prevents a rugpull, is another key attraction to the project for early investors, as they get exposure to huge upside gains, with reduced risk of a rugpull (unlike most other new memecoins.)

Another exciting, newly launched memecoin that has massive upside potential is Musk Eclipse (ECLIPSE).

This coin (contact address: D6QcGYbrpzFjVEmzARLzMC2TdFiHhWaRoieq6YMJVZf8) has already skyrocketed over 1,000% since we wrote about it less than 24 hours ago, with its market cap surging from $6,000 to around $67,000, generating huge gains for investors.

And, with Musk Eclipse looking to soon hit a $500,000 market cap before targeting further gains, it still has explosive upside potential.

Given the massive gains that new, small cap memecoins are delivering, it is not surprising that many BONK, SHIB and DOGE investors are investing their profits into such tokens, including Furrari and Musk Eclipse.

The Chinese government, in a pioneering move, has unveiled a new blockchain infrastructure platform spearheaded by the Conflux Network.

Named the “Ultra-Large Scale Blockchain Infrastructure Platform for the Belt and Road Initiative,” this project is designed to serve as a foundational public blockchain tailored for cross-border applications.

An announcement on April 1 by Conflux Network highlighted the platform’s ambition to foster cross-border cooperation along the Belt and Road Initiative, aiming to “create a public blockchain infrastructure platform” that supports the development of applications facilitating international collaboration.

Conflux Network, recognized for its multichain blockchain ecosystem, operates under the guidance of the Conflux Foundation, also known as the Shanghai Tree-Graph Blockchain Research Institute.

This initiative marks a significant stride in blockchain technology, especially within the context of China’s traditionally restrictive stance on cryptocurrencies.

Historically, China has exhibited a stringent approach toward the cryptocurrency market, intensifying its regulatory measures since 2017, including the shuttering of Bitcoin exchanges.

However, despite these restrictions, a considerable portion of Chinese investors continues to engage with cryptocurrencies.

A report by Kyros Ventures in December 2023 indicated that 33.3% of Chinese investors hold a significant amount of stablecoins, ranking just below Vietnam.

This persistence underscores the innovative methods employed by Chinese traders to navigate the constraints imposed on crypto trading.

READ MORE: Whale’s Massive SHIB Sale Shakes Market: $16 Million Offloaded Sparks Speculation

The Chinese government’s ban on crypto trading and mining in 2021, along with its prohibition of offshore exchange services within its borders, significantly impacted the global cryptocurrency landscape, particularly diminishing China’s once-dominant role in Bitcoin mining.

Nonetheless, amid these regulatory challenges, China is preparing for a comprehensive overhaul of its Anti-Money Laundering (AML) laws, set to encompass cryptocurrency transactions.

This amendment, the first major update since 2007, seeks to introduce more stringent measures against crypto-related money laundering activities.

This development comes in the wake of reports highlighting the misuse of “virtual currency trading platforms” in facilitating substantial underground banking operations, emphasizing the government’s intent to tighten control over the digital currency sphere.

To submit a crypto press release (PR), send an email to sales@cryptointelligence.co.uk.

Upbit, a leading cryptocurrency exchange in South Korea, experienced a notable decrease in its 24-hour trading volume, which fell to $3.8 billion at the beginning of April, a stark contrast to its performance in early March.

The exchange had previously witnessed a remarkable spike in daily trading volume, reaching nearly $15 billion on March 5, marking its highest trading volume for the year.

This surge was closely linked to Bitcoin’s climb to an unprecedented peak of $69,200 on the same day, fueled significantly by the influx of capital into newly introduced spot Bitcoin exchange-traded funds (ETFs) in the United States.

Notably, Bitcoin’s price on Upbit soared to a new all-time high of 96,734,000 South Korean won (approximately $72,504) at around 3:00 pm UTC on March 5, while it remained under $70,000 in global markets.

READ MORE: Crypto Analyst Altcoin Sherpa Predicts Over 200% Surge for Dogecoin, Bullish on Bitcoin and Fetch.ai

This distinct price gap, known as the “Kimchi Premium,” refers to the variation in Bitcoin prices between South Korean exchanges and those abroad, drawing its name from a popular Korean dish.

However, the excitement was short-lived, as trading volumes plummeted to as low as $2.6 billion by the end of March.

As of April 1, according to CoinGecko, Upbit’s trading volume has modestly recovered to $3.8 billion.

Despite the fluctuations in trading volume, Upbit’s parent company, Dunamu, faced a significant financial setback in 2023, with an 81% drop in net profits.

On November 28, Dunamu reported earnings of $23 million, a decrease from the $123 million earned in the same period in 2022.

The company attributed the decline to a “sluggish investment market” due to economic downturns and the diminished value of digital assets.

In the face of these challenges, Dunamu has not halted its expansion efforts.

On January 9, Upbit received a Major Payment Institution license from the Monetary Authority of Singapore, enabling the company to provide a range of crypto and fiat-related services in Singapore, signaling its commitment to growth despite the financial downturn.

To submit a crypto press release (PR), send an email to sales@cryptointelligence.co.uk.

Leading international cryptocurrency exchange Bybit has today announced an integration with Google Pay that will make buying cryptocurrencies easier for millions of users across the globe.

Users of the Bybit exchange will now be able to purchase various cryptocurrencies in 35 fiat currencies via Google Pay, in a matter of seconds.

This integration is part of Bybit’s mission to ensure users of its trading platform have a “frictionless” experience when buying and selling cryptocurrencies, whether it’s large cap cryptos like Bitcoin (BTC), or small cap altcoins.

Additionally, the new payment integration will ensure Bybit users have access to the best exchange rates when converting between currencies.

Commenting on this development, Ben Zhou, Co-founder and CEO of Bybit, hailed the move as a positive stride for users of the exchange.

“Bybit is committed to providing users with the most convenient and cost-effective ways to enter the exciting world of cryptocurrency. The Google Pay integration marks a significant step towards achieving this goal, offering a seamless and secure experience for all,” he said.

Aside from being able to purchase cryptocurrencies via Google Pay, Bybit users also have the option of using a bank card, and numerous third party apps, such as Banxa.

Together, these various payment options offered by Bybit support over 65 different fiat currencies.

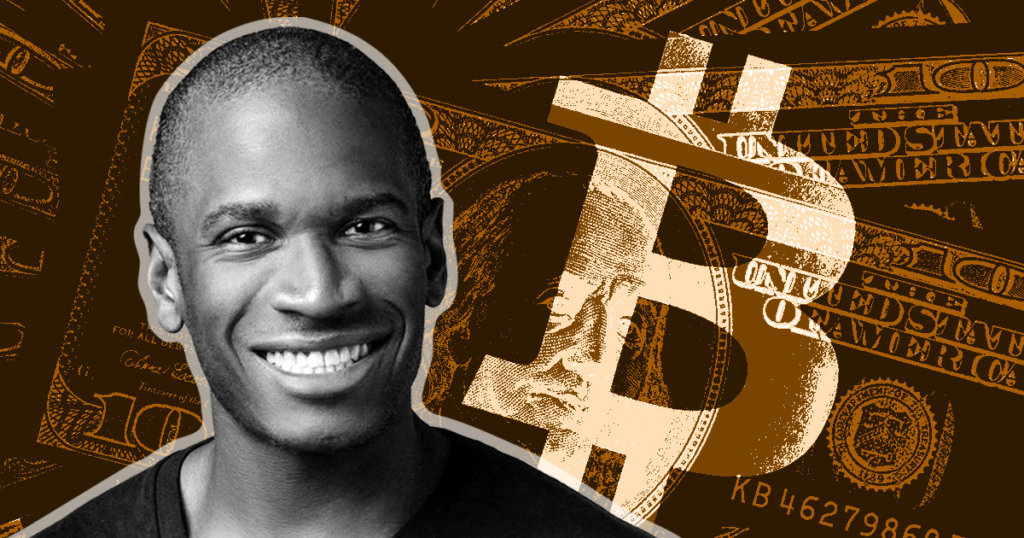

In a recent dialogue with Real Vision CEO Raoul Pal, BitMEX co-founder Arthur Hayes advocated a nuanced view of memecoins, suggesting that despite their seemingly frivolous nature, they contribute significantly to the blockchain ecosystem.

During their March 30 interview, Hayes emphasized the positive impact of memecoins in attracting new users and engineers to blockchain networks, thereby enhancing their value.

“You can poo-poo these things as stupid and valueless, but if it brings attention and more engineers to the space, it’s positive value for the chain itself,” Hayes stated, highlighting the benefit of increased attention and development activity.

Hayes further noted that blockchain networks like Solana and Ethereum, which embrace memecoin culture, are poised to benefit the most from this trend.

He pointed out how Solana experienced a surge in network activity following a memecoin frenzy last November, which was also accompanied by a growth in non-meme projects on the platform.

Similarly, the Bitcoin network saw a significant increase in activity with the advent of BRC-20 tokens and Ordinals.

The conversation also touched on the appeal of memecoins to younger investors, with Pal drawing parallels between the trend and the gaming mentality prevalent among Gen Z and Millennials.

READ MORE: Whale’s Massive SHIB Sale Shakes Market: $16 Million Offloaded Sparks Speculation

“This is the same thing, just gaming with money,” Pal remarked.

The duo predicted that the popularity of memecoins, such as the Solana-based Dogwifhat (WIF), would continue to rise, noting its upcoming projection on the Las Vegas Sphere and its impressive market capitalization, which recently surpassed that of the Ethereum layer-2 network Arbitrum.

Despite the enthusiasm, the discussion acknowledged the risks associated with memecoins.

Franklin Templeton, in a March 14 investor note, warned of the dangers posed by their lack of fundamental value or utility.

Additionally, Ethereum co-founder Vitalik Buterin expressed a lukewarm stance towards memecoins in a March 29 blog post.

While he recognized the enjoyment they bring to the crypto space, Buterin urged for a more constructive approach that adds utility or charitable value to these tokens.

Nevertheless, memecoins have demonstrated remarkable performance in the crypto market, outperforming other asset classes over the past month, as reported by CoinGecko.

Memecoins have seen an aggregate growth of 20% in the last week, surpassing gains in layer-1 network tokens and decentralized finance (DeFi) tokens, thereby illustrating their significant yet contentious role within the cryptocurrency landscape.

To submit a crypto press release (PR), send an email to sales@cryptointelligence.co.uk.

Musk Eclipse (ECLIPSE) is a new Solana memecoin that was launched on 9 April, and it has rallied 1,900% in the last 24 hours, while popular memecoins like Shiba Inu (SHIB) and Dogecoin (DOGE) have dropped in price.

Musk Eclipse has enjoyed an explosive rally in the last 24 hours, with its pricing surging 1,900% as it currently trades at $0.00001935.

Its market cap currently sits at just $19,000, with $7,900 in locked liquidity according to DEX Screener, meaning it has tremendous potential for more price growth in the coming days, weeks and months.

This rally has occurred while, in the last 24 hours, Shiba Inu (SHIB) and Dogecoin (DOGE) have both dropped in price.

Specifically, SHIB is down 4.47%, while DOGE has seen a 5.6% decline in its price.

It has been predicted that Musk Eclipse’s market cap will hit $500,000 by Monday, delivering around 2,900% returns to investors who buy in at the current price point.

And, if the memecoin is able to eventually achieve a multi-million dollar market cap, like many other newly launched memecoins, early investors would see their positions surge to hundreds of thousands or millions of dollars.

Investors are targeting further gains once this price target is reached, with many investors expecting ECLIPSE’s (D6QcGYbrpzFjVEmzARLzMC2TdFiHhWaRoieq6YMJVZf8) market cap to rally further.

The coin can currently only be purchased on Solana decentralized exchanges, like Raydium and Jupiter, with investors needing to first buy Solana’s SOL token and then swap it for Musk Eclipse (ECLIPSE).

Due to the token’s small market cap, even an investment of just a few hundred dollars could turn into millions of dollars, if the coin’s market cap continues to build momentum and surge.