Shiba Doge Hybrid (SHIDOGE) could turn early investors into multi-millionaires if it becomes a mainstream coin, like Shiba Inu (SHIB) and Dogecoin (DOGE).

Shiba Doge Hybrid (SHIDOGE), a new Solana memecoin that was launched this week, is poised to explode over 8,000% in price in the coming days.

This is because SHIDOGE has announced its first centralized exchange listing, which will be on MEXC.

This will give the Solana memecoin exposure to millions of additional investors, who will pour funds into the coin and drive its price up.

Currently, Shiba Doge Hybrid (SHIDOGE) can only be purchased via Solana decentralized exchanges, like Jupiter and Raydium, and early investors stand to make huge returns in the coming days.

Early investors in SHIB and DOGE made astronomical returns, and Shiba Doge Hybrid (SHIDOGE) could become the next viral memecoin.

To buy Shiba Doge Hybrid on Raydium or Jupiter ahead of the MEXC listing, users need to connect their Solflare, MetaMask or Phantom wallet, and swap Solana for SHIDOGE by entering its contract address – 797CmcxqkLZaSjMd7MdyNZ9swuSzaGdYWkJ65jehiXWa – in the receiving field.

In fact, early investors could make returns similar to those who invested in Shiba Inu (SHIB) and Dogecoin (DOGE) before these memecoins went viral and exploded in price.

If this happens, a new wave of memecoin millionaires could be created in a matter of weeks – or potentially even sooner.

The Solana memecoin craze continues amid larger memecoins, like Shiba Inu (SHIB), Dogecoin (DOGE) and DogWifHat (WIF) trading sideways in recent weeks and losing momentum.

This is why many SHIB, DOGE and WIF investors are instead investing in new Solana memecoins, like SHIDOGE.

Book of Shiba Inu (BOSHIBA) could turn early investors into multi-millionaires if it becomes a mainstream coin, like Shiba Inu (SHIB) and Dogecoin (DOGE).

Book of Shiba Inu (BOSHIBA), a new Solana memecoin that was launched today, is poised to explode over 9,000% in price in the coming days.

This is because BOSHIBA has announced its first centralized exchange listing, which will be on MEXC.

This will give the Solana memecoin exposure to millions of additional investors, who will pour funds into the coin and drive its price up.

Currently, Book of Shiba Inu can only be purchased via Solana decentralized exchanges, like Jupiter and Raydium, and early investors stand to make huge returns in the coming days.

Early investors in SHIB and DOGE made astronomical returns, and Book of Shiba Inu could become the next viral memecoin.

To buy Book of Shiba Inu on Raydium or Jupiter ahead of the MEXC listing, users need to connect their Solflare, MetaMask or Phantom wallet, and swap Solana for Book of Shiba Inu by entering its contract address – 24YoPq1drHd7Xs7NbYhU3HvBCMsGZqmSefD7FYeZ6W5D – in the receiving field.

In fact, early investors could make returns similar to those who invested in Shiba Inu (SHIB) and Dogecoin (DOGE) before these memecoins went viral and exploded in price.

If this happens, a new wave of memecoin millionaires could be created in a matter of weeks – or potentially even sooner.

The Solana memecoin craze continues amid larger memecoins, like Shiba Inu (SHIB), Dogecoin (DOGE) and DogWifHat (WIF) trading sideways in recent weeks and losing momentum.

This is why many SHIB, DOGE and WIF investors are instead investing in new Solana memecoins, like BOSHIBA.

Bitcoin‘s price recently approached the $60,000 support level as it faced the post-halving “danger zone,” causing concern among investors.

On May 10, data from Cointelegraph Markets Pro and TradingView highlighted Bitcoin’s intraday lows reaching $60,190 on Bitstamp.

The cryptocurrency experienced a sharp decline from around $63,000, sparking varied speculations about the cause of this drop.

Trader Skew, discussing the market dynamics on X (formerly Twitter), pointed out, “Monthly open has been swept again as well monthly buyers taken out.

“If bulls want higher & want to break this downtrend its here imo,” indicating a critical juncture for Bitcoin bulls around the $60.8K to $61K range, which he identifies as a key area for potential bullish action.

Material Indicators, a trading resource, suggested that large-volume institutional players might be influencing the market, speculating, “that some institutional entity may not want to see Bitcoin breakout over the weekend while the BTC ETF market is closed,” reflecting concerns over market manipulation during off-hours.

An analysis of the order book on Binance showed a new sell block around $62,500, which was predicted to possibly adjust post-weekly close.

READ MORE: Toncoin Surges Ahead of Notcoin Game Launch, Outshines Broader Crypto Market with Robust Growth

Material Indicators further speculated, “I won’t be the least bit surprised if this sell wall moves lower to push price down.

I also won’t be surprised if we see a roof pull after the W candle closes on Sunday,” suggesting potential strategic moves in the market.

Rekt Capital, a popular trader and analyst, updated his views on Bitcoin’s behavior post-halving. He noted that the typical price drop following a halving event was nearing its end, marking a close to the “danger zone.”

He recalled his prediction from the end of April about a significant downturn, which materialized as Bitcoin fell to two-month lows at $56,500.

Reflecting on the market’s response, he concluded, “Bitcoin indeed downside wicked below the Re-Accumulation Range Low just like in 2016.

Thus price-wise, the Post-Halving ‘Danger Zone’ purple has been satisfied,” yet he also noted, “Time-wise however, the ‘Danger Zone’ officially ends in 2 days.”

To submit a crypto press release (PR), send an email to sales@cryptointelligence.co.uk.

Gensler Devil (GENDEV) could become a viral memecoin, like Shiba Inu (SHIB) and Dogecoin (DOGE).

Gensler Devil (GENDEV), a Solana memecoin that was launched today, is aiming to challenge other memecoin giants, such as Shiba Inu (SHIB) and Dogecoin (DOGE).

Early investors in SHIB and DOGE made astronomical returns, and Gensler Devil presents a similar opportunity.

Gensler Devil has a market cap below $14,000 at the moment, meaning that when it just reaches a modest market cap of $200,000-$500,000, early investors would generate returns of 2,000%-5,000% in a matter of days or hours.

The exciting memecoin is poised to rally 5,300% in the coming two days, and Gensler Devil could potentially reach a multi-million dollar market cap within a few weeks.

Currently, Gensler Devil can only be purchased via Solana decentralized exchanges, like Jupiter and Raydium, and early investors stand to make huge returns in the coming days.

To buy Gensler Devil on these platforms, users need to connect their Solflare, MetaMask or Phantom wallet, and swap Solana for Gensler Devil by entering its contract address – GwoY3GpqrSmws6QW88CyDaJkkTNfrQLGN2zZ1rSbJ6z9 – in the receiving field.

In fact, early investors could make returns similar to those who invested in Shiba Inu (SHIB) and Dogecoin (DOGE) before these memecoins went viral and exploded in price.

If this happens, a new wave of memecoin millionaires could be created in a matter of weeks – or potentially even sooner.

The Solana memecoin craze continues amid larger memecoins, like Shiba Inu (SHIB), Dogecoin (DOGE) and DogWifHat (WIF) trading sideways in recent weeks and losing momentum.

This is why many SHIB, DOGE and WIF investors are instead investing in new Solana memecoins, like GENDEV.

On May 10, the Bitcoin market experienced a significant drop, plunging over $2,000 in just an hour amidst a wave of volatility.

Before this sudden decline, Bitcoin had been relatively stable, with prices hovering around $63,494. However, the cryptocurrency soon fell to an intra-day low of $60,308, according to data from Cointelegraph Markets Pro and TradingView.

This sharp decline resulted in substantial losses for leveraged long traders who had not anticipated the drop.

Michaël van de Poppe, founder of MN Capital, commented on the situation, noting that Bitcoin had been showing “low volatility” and choppy price action since February 29.

He regarded the drop as part of a “final accumulation” phase, suggesting that if the support level was not maintained, prices could potentially fall further to between $52,000 and $55,000 as the final stage of correction.

Adding to the insights, Daan Crypto Trades mentioned that the previous day’s flash crash to $60,000 was a quick market movement meant to “punish those longs that aped in above $63K.”

This sentiment was echoed by the fact that the downturn on May 10 resulted in the liquidation of $127 million in long positions.

This contributed to a larger total wipeout of $175.17 million in a 24-hour period, as reported by Coinglass.

In just the last hour, $9 million worth of BTC leveraged positions were liquidated, which included $6.36 million from long positions alone.

This reflects the high stakes and rapid changes in the Bitcoin trading market, underlining the volatility and the dramatic impacts it can have on traders.

To submit a crypto press release (PR), send an email to sales@cryptointelligence.co.uk.

Two months after the highly anticipated Dencun upgrade, Ethereum has seen a shift in its Ether supply dynamics, no longer exhibiting deflationary characteristics.

According to CryptoQuant data, the total supply of Ether grew slightly from 120 million on March 12 to 120.1 million by May 7, marking the first inflationary trend since the Merge transition in September 2022.

The Merge was a significant shift for Ethereum, moving from a proof-of-work to a proof-of-stake consensus model.

This change included a mechanism for burning transaction fees, which initially led to a deflationary supply of Ether.

Since the implementation of the Merge, over 419,713 ETH has been permanently removed from circulation, based on data from ultrasound.money.

The recent Dencun upgrade, however, has reduced the median transaction fees by up to four times, despite maintaining the same level of network activity.

This reduction in fees has resulted in a decrease in the amount of Ether being burned, contributing to the increase in total supply.

READ MORE: U.S. Regulators Increase Scrutiny on Crypto Firms Amid Rising Market Manipulation Concerns

As noted in a CryptoQuant report from May 8, “The Dencun upgrade has made ETH inflationary again, potentially killing the narrative of ‘Ultra sound’ money as a structurally lower amount of transaction fees burned on Ethereum have had the corresponding effect of not decreasing the total supply of ETH to keep it deflationary.”

Ki Young Ju, founder and CEO of CryptoQuant, emphasized on May 9 that the loss of deflationary status is not particularly critical for Ethereum’s broader ecosystem.

He stated in an X post, “Post-Dencun upgrade, ETH lost deflationary status with reduced fees, departing from ‘ultrasound money.’ Ethereum’s strength lies in DApps; it’s wiser not to compare it to Bitcoin’s sound money narrative.”

This development signals a shift in the economic dynamics of Ether but does not undermine the foundational benefits of the Ethereum network, particularly its application in decentralized applications (DApps).

While the narrative of ‘ultra sound’ money may be diminishing, Ethereum’s core utility and innovation in decentralized solutions continue to hold strong.

To submit a crypto press release (PR), send an email to sales@cryptointelligence.co.uk.

Ethereum’s cryptocurrency, Ether (ETH), has experienced weaker performance compared to Bitcoin in the recent market cycle, according to analytics firm Glassnode.

In their May 7 newsletter, “The Week On-Chain,” they discussed the impact of speculators on ETH prices, highlighting the ongoing challenges facing Ethereum following Bitcoin’s block subsidy halving in April.

Post-halving, both Bitcoin and Ether saw a decline in prices.

The fall in BTC/USD was particularly significant, marking one of its largest since the FTX collapse in late 2022. Ethereum exhibited a similar trend but with less severe corrections, suggesting a level of resilience.

Glassnode noted, “For Ethereum, we can see a similar drawdown structure, with notably shallower corrections since the FTX lows.

This hits to a degree of resilience during pullbacks, as well as a net reduction in volatility across the digital asset space.”

Despite this resilience, Ethereum’s deepest drawdown this cycle reached -44%, which is over twice as severe as Bitcoin’s -21% dip.

This underperformance relative to Bitcoin over the last two years is also evident in a weakening ETH/BTC ratio.

Currently, ETH’s price drawdowns are lessening, but this offers little solace to new investors, particularly Ethereum’s short-term holders (STHs)—those who have held their coins for 155 days or less.

READ MORE: Ether Prices Drop Amid SEC Uncertainty and Technical Corrections, Despite Bullish Patterns

These investors face the possibility of falling into losses, with their aggregate cost basis hovering around $3,000, close to ETH’s current market price.

Glassnode’s analysis of the Market Value to Realized Value (MVRV) ratio, which assesses unrealized profit and loss at current prices, indicates potential panic among these new investors if prices fall further.

They stated, “Ethereum’s STH-MVRV is trading at a very slight premium at the moment, which could suggest that spot prices are very close to the cost basis of recent buyers, who may panic should the market experience downside volatility.”

The broader market is also closely watching regulatory developments in the U.S., particularly the decisions regarding the approval of spot Ether exchange-traded funds (ETFs).

Meanwhile, Ethereum’s long-term holders (LTHs) seem more patient, showing reluctance to sell despite having profitable positions.

Glassnode elaborates, “If we examine the Spent Volume in Profit for LTHs, we can see that the cohort of BTC holders who have held for between 6 months and 2 years increased their divestment during the ATH rally.

From this lens, Ethereum’s Long-Term Holders once again appear to still be waiting for better profit-taking opportunities.”

To submit a crypto press release (PR), send an email to sales@cryptointelligence.co.uk.

Early investors in memecoins like Shiba Inu (SHIB), Bonk (BONK) and Dogecoin (DOGE) made astronomical returns, and Donald Bitcoin (DONBTC) presents a similar opportunity for a limited time.

Donald Bitcoin (DONBTC), a newly launched Solana memecoin, is poised to explode over 11,000% in a matter of days, as former Shiba Inu (SHIB), Bonk (BONK) and Dogecoin (DOGE) investors pour funds into this new token.

DONBTC will be listed on MEXC, one of the largest centralized exchanges in the world, within a few days – and this is a massively bullish development for the token, as millions of new investors will easily be able to buy Donald Bitcoin.

Currently, Donald Bitcoin can only be purchased via Solana decentralized exchanges, like Jupiter and Raydium, and early investors stand to make huge returns in the coming days.

To buy DONBTC on these platforms, users need to connect their Solflare, MetaMask or Phantom wallet, and swap Solana for Donald Bitcoin by entering its contract address – 7nErZV74Y8L7zz1thKUczBniWMnLc74gQMdzbWnhr95e – in the receiving field.

DONBTC currently has a market cap of just under $15,000, meaning it has huge upside potential.

Early investors could make returns similar to those who invested in Shiba Inu (SHIB), Dogecoin (DOGE) and Bonk (BONK) before these memecoins went viral and exploded in price.

If this happens, a new wave of memecoin millionaires could be created in a matter of weeks – or potentially even sooner.

The Shiba Inu community faces an urgent alert as exciting developments in the cryptocurrency landscape unfold. “Shibarmy Scam Alerts,” a handle dedicated to protecting SHIB holders, has issued a critical warning about fraudulent activities aimed at the community.

Scammers, often impersonating official channels on platforms such as Telegram and X, create fake accounts to disseminate deceptive information, lure users to fraudulent websites, and gather personal details for malicious purposes.

These impersonators have particularly targeted Treat token accounts, posing significant risks to unsuspecting SHIB enthusiasts.

The alert from “Shibarmy Scam Alerts” emphasizes that no official team member will contact users through private messages, request wallet synchronization, or ask for sensitive personal data.

As anticipation mounts, the Shiba Inu ecosystem is gearing up for major advancements.

The introduction of the Shiba Eternity play-to-earn version on Shibarium and the upcoming launch of the TREAT token are set to expand the ecosystem’s reach and utility significantly.

These developments promise to enhance adoption, scalability, and usability, heralding a new era for blockchain technology and decentralized finance (DeFi).

READ MORE: Bitcoin Rebounds to $63,000 Amidst Surging Liquidity Over $100 Million

Recent integrations and technical upgrades, such as the ShibaSwap DEX’s integration into Shibarium and the successful completion of recent hard forks, underline the continuous improvements within the Shiba Inu framework.

Additionally, the community’s excitement is palpable, with Shiba Inu’s social dominance witnessing a significant surge of 46,339%.

The backdrop is ripe with speculation about potential partnerships that could further augment SHIB’s utility and market position.

Amidst this growing excitement, Shiba Inu lead Shytoshi Kusama tantalized the community with an “Evita” teaser, sparking discussions and anticipation about what lies ahead.

Overall, while the Shiba Inu community is on the brink of potentially transformative advancements, vigilance against scams is paramount to safeguard the interests and security of its members.

To submit a crypto press release (PR), send an email to sales@cryptointelligence.co.uk.

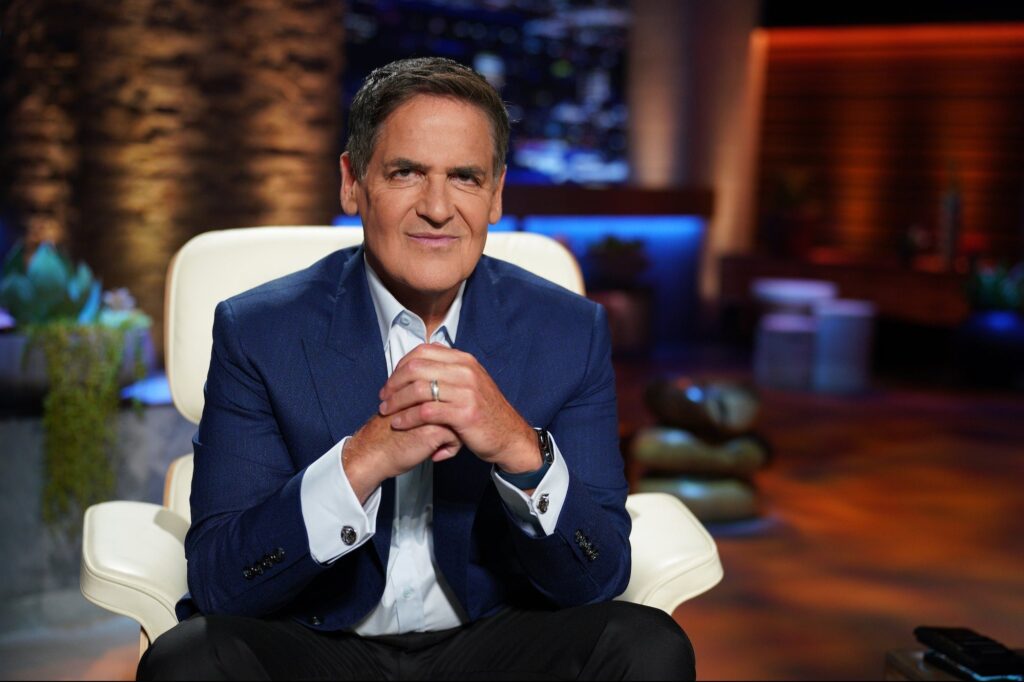

Billionaire investor Mark Cuban recently voiced strong opinions about the need for clearer regulatory frameworks within the cryptocurrency industry in the United States, urging the Commodity Futures Trading Commission (CFTC) to oversee all crypto-related activities.

In a post directed to his 8.8 million followers on X on May 10, Cuban emphasized the urgency of legislative action prior to the 2024 presidential election, suggesting that it could influence the re-election of President Joe Biden.

Cuban stated, “You could solve this problem for Biden by passing legislation that defines registration that is specific to the crypto industry just as other industries have registration that is defined for them.”

His comments reflect a broader concern within the crypto community about the need for tailored regulatory measures that can foster both innovation and consumer protection.

Highlighting the potential political repercussions of regulatory decisions, Cuban pointedly mentioned Gary Gensler, the Chair of the Securities and Exchange Commission (SEC), known for his stringent stance on cryptocurrencies.

Cuban argued that Gensler’s approach could alienate crypto voters, implying that this could be a decisive factor in the upcoming election.

“If Joe Biden loses, there is a good chance you will be able to thank Gary Gensler and the New York SEC,” Cuban said, suggesting that a more crypto-friendly regulatory approach could be more advantageous.

He proposed a more effective alternative, advocating for the CFTC to take charge of all crypto regulations.

This idea aligns with the growing consensus among younger and independent voters who perceive crypto as a significant part of their financial interaction and are critical of the SEC’s handling under Gensler’s leadership.

READ MORE: Toncoin Surges Ahead of Notcoin Game Launch, Outshines Broader Crypto Market with Robust Growth

Cuban harshly criticized Gensler’s record, saying, “Crypto is a mainstay with younger and independent voters. Gensler HAS NOT PROTECTED A SINGLE INVESTOR AGAINST FRAUD.”

Data from litigation consulting firm Cornerstone Research indicates that the SEC undertook 46 enforcement actions against crypto firms in 2023 alone, underscoring the aggressive regulatory landscape.

Meanwhile, Rostin Behnam, Chair of the CFTC, anticipates another wave of enforcement within the next six to 18 months, hinting at ongoing challenges for the sector.

The discourse around cryptocurrency regulation is poised to be a significant issue in the 2024 U.S. election.

A recent poll reported by Cointelegraph on May 7, conducted among 1,201 registered voters, found that over two-thirds resonate with the sentiment that “crypto is for people like them, and more equitable than the financial system.”

This unfolding narrative captures the complex interplay between politics, regulatory actions, and the vibrant dynamics of the cryptocurrency market, reflecting a critical juncture in the regulatory oversight of digital assets in the U.S.

To submit a crypto press release (PR), send an email to sales@cryptointelligence.co.uk.