XRP, the native cryptocurrency of the Ripple network, has long been a favorite among investors due to its potential for fast transactions and institutional adoption. With increasing regulatory clarity and growing partnerships, many are wondering about the future of XRP. In this XRP price prediction, we analyze market trends, expert forecasts, and key factors influencing its potential price movement in 2025 and beyond.

XRP Price History and Market Performance

Before diving into XRP price prediction, let’s review its historical performance:

- 2017 Bull Run: XRP reached an all-time high of $3.84 in January 2018.

- Bear Market Decline: XRP fell below $0.20 in 2019-2020 due to market downturns.

- SEC Lawsuit Impact: The 2020 lawsuit against Ripple by the U.S. SEC caused XRP to drop sharply.

- Recent Recovery: In 2023 and 2024, XRP rebounded as Ripple secured partial legal victories.

With this context, let’s explore the XRP price prediction for 2025.

Factors Influencing XRP Price Prediction

Several key factors will shape XRP’s future price:

1. Regulatory Clarity

The ongoing legal battle between Ripple and the SEC has significantly impacted XRP. If Ripple secures a final legal win, we could see increased institutional adoption and price growth. On the other hand, unfavorable outcomes could suppress its price.

2. Adoption and Utility

XRP is designed for fast and low-cost cross-border payments. Major financial institutions like Santander and SBI Holdings use Ripple technology, which could drive demand for XRP and push its price higher.

3. Crypto Market Trends

Like all cryptocurrencies, XRP follows broader market trends. If Bitcoin and Ethereum enter a bull cycle in 2025, XRP is likely to benefit as well.

4. Ripple’s Business Developments

Ripple’s expansion into Central Bank Digital Currencies (CBDCs) and partnerships with global financial institutions could increase XRP’s utility and boost its price.

5. Macroeconomic Conditions

Interest rates, inflation, and institutional investment trends in the crypto space will influence XRP’s future price.

XRP Price Prediction for 2025

Based on market analysis, expert opinions, and historical trends, here are some possible scenarios for XRP in 2025:

Bullish Scenario ($3.00 – $5.00)

If Ripple secures a legal victory, institutional adoption increases, and the crypto market experiences a strong bull run, XRP could surge back to its previous all-time high of around $3.00 or even exceed it, reaching $5.00.

Moderate Growth Scenario ($1.50 – $2.50)

If XRP maintains steady adoption and the market remains positive but not overly bullish, it could range between $1.50 and $2.50.

Bearish Scenario ($0.50 – $1.00)

If the SEC lawsuit drags on, or if market conditions turn bearish, XRP might struggle to break past $1.00, with prices hovering between $0.50 and $1.00.

Long-Term XRP Price Prediction (2030 and Beyond)

Looking beyond 2025, XRP’s potential largely depends on its role in global finance. If Ripple successfully integrates with banking systems and CBDCs, XRP could become a key player in digital payments, potentially reaching $10 or more in the long run.

Summary

XRP remains one of the most intriguing cryptocurrencies with strong institutional backing and use cases. While regulatory uncertainty still looms, positive market trends and adoption could see XRP reclaiming its previous highs. As always, investors should conduct thorough research before making any investment decisions.

The cryptocurrency market has seen a major shift in 2024, with Bitcoin’s dominance surging to 71%, leading analysts to declare the end of the latest altseason. As capital continues to flow into Bitcoin at the expense of alternative cryptocurrencies, many investors are now questioning the future of the altcoin market in the near term.

Bitcoin dominance—measuring BTC’s market cap as a percentage of the total crypto market—has steadily climbed, reinforcing its position as the preferred digital asset for investors. The shift has coincided with a broader sell-off in altcoins, many of which have failed to sustain their gains from earlier in the year.

Prominent crypto analyst Rekt Capital noted that “altseason is over,” pointing to the sharp decline in altcoin performance relative to Bitcoin. “The market is cycling back into Bitcoin, and historically, when BTC dominance nears these levels, altcoins struggle to gain traction,” the analyst stated.

The term “altseason” refers to periods when altcoins significantly outperform Bitcoin, typically driven by speculative enthusiasm and capital rotation. However, this trend often reverses as market conditions shift, leading investors to consolidate their holdings back into Bitcoin, widely considered the safest bet in the crypto space.

Historically, Bitcoin dominance has fluctuated depending on investor sentiment and macroeconomic conditions. During the last major altseason in 2021, BTC dominance fell below 40% as Ethereum and other altcoins saw significant gains. However, the current market cycle has seen Bitcoin reclaim a commanding share, reflecting cautious investor behavior amid regulatory uncertainty and shifting liquidity conditions.

Ethereum, the largest altcoin by market cap, has also struggled to keep pace with Bitcoin in recent weeks. While ETH remains a key player in the crypto ecosystem, its market share has declined as BTC continues to attract institutional interest, particularly following the approval of Bitcoin spot ETFs in the U.S. earlier this year.

The altcoin market, which includes thousands of smaller cryptocurrencies, has experienced increased volatility as Bitcoin continues its upward trajectory. Many smaller projects have faced sharp declines, leading some analysts to warn of a prolonged period of underperformance for altcoins.

Rekt Capital also highlighted that while individual altcoins may still see occasional breakouts, the overall trend suggests a prolonged phase of Bitcoin dominance. “Historically, when BTC dominance reaches these levels, it takes a significant shift in market structure to bring back altcoin momentum,” the analyst explained.

Bitcoin’s growing dominance is also tied to macroeconomic factors, including inflation concerns, central bank policies, and increased institutional adoption. With the next Bitcoin halving event scheduled for 2024, many investors anticipate continued strength for BTC, potentially extending the altcoin downturn.

Despite the current market trend, some traders remain optimistic that altcoins could see a resurgence later in the year if Bitcoin stabilizes and capital begins rotating back into smaller assets. However, for now, Bitcoin’s dominance remains firmly in place, signaling a more challenging environment for altcoin investors.

XRP has caught the attention of market analysts, with some predicting a significant price surge in the coming months. Despite mixed market sentiment, experts remain optimistic about the cryptocurrency’s long-term potential, with price targets ranging from $5 to as high as $18.

XRP has struggled to gain momentum recently, trading within a narrow range as Bitcoin’s dominance continues to grow. However, technical analysts believe the asset is poised for a breakout, supported by historical price patterns and growing institutional interest.

Prominent crypto analyst EGRAG CRYPTO has shared an optimistic outlook, stating, “XRP is in a strong accumulation phase, and once it breaks key resistance levels, we could see a rally to $5 in the mid-term.” The analyst further highlighted that the long-term target for XRP could extend to $18 if market conditions align.

The bullish sentiment around XRP is fueled by several factors, including ongoing developments in the Ripple ecosystem and increasing adoption of XRP for cross-border payments. Ripple’s ongoing legal battle with the U.S. Securities and Exchange Commission (SEC) remains a point of uncertainty, but many investors believe a favorable resolution could drive further price appreciation.

XRP has historically experienced rapid price movements following prolonged consolidation periods. Analysts point to past cycles where the asset surged significantly after breaking through resistance levels. If history repeats itself, XRP could be on the verge of a major rally.

Crypto analyst CryptoBull emphasized the importance of key support levels, stating, “If XRP holds above $0.70 and builds momentum, a breakout to $5 becomes more likely.” The analyst also noted that a broader altcoin recovery could further fuel XRP’s upward trajectory.

Despite the bullish predictions, XRP faces challenges, including regulatory uncertainty and competition from other blockchain-based payment solutions. However, its established position in the financial sector, combined with Ripple’s ongoing partnerships, provides a strong foundation for potential growth.

The broader cryptocurrency market has experienced increased volatility, with Bitcoin and Ethereum leading the way. XRP’s price movement has largely mirrored the overall market trend, but analysts believe its breakout potential remains strong.

While some traders remain cautious, long-term investors see XRP as an undervalued asset with significant upside potential. With key resistance levels being closely watched, the next few months could be crucial for determining whether XRP can reach the ambitious price targets set by analysts.

The Dogecoin price has been on a steady decline since the start of February. This abysmal performance has seen crypto analysts predict that DOGE could continue plunging. As a result, investors are flocking to RCO Finance (RCOF), an emerging AI altcoin that has raised over $12.73 million during its ongoing public presale.

Why are Dogecoin (DOGE) investors pivoting toward RCO Finance (RCOF)? Let’s find out!

Dogecoin Price Dumps 25% In A Week: What’s Next?

Dogecoin has performed dismally over the past week, tumbling by double digits. On January 27, the Dogecoin price was trading at around $0.3335. After trading around this range for days, the Dogecoin price experienced a sharp drop on February 2.

This slump came after Bitcoin (BTC) plunged below the $100,000 support level, triggering a bearish trend in the altcoin market. The resulting downtrend saw Dogecoin (DOGE) trade as low as $0.2477 on February 3.

Notably, this price means Dogecoin (DOGE) has plunged 25% in a week. Moreover, experts expect the Dogecoin price to plummet further as investors migrate to tokens with better prospects.

RCO Finance: A Trading And Investment Hub With AI Features

With the Dogecoin price grappling with the renewed bearish trend in the crypto market, investors are searching for alternative investments to hedge against further losses. To address this need, investors are flocking to RCO Finance, a budding DeFi platform that supports over 12,500 asset classes, including tokenized real-world assets (RWAs).

By combining the crypto and TradFi industries, RCO Finance lets you create a robust investment portfolio that can withstand the current bear market. While this offering is impressive, it mainly complements RCO Finance’s top feature, an AI-powered robo advisor.

The robo advisor is RCO Finance’s flagship feature because it leverages machine learning and advanced algorithms to analyze data from prominent sources like Bloomberg and Reuters. With the carefully curated data, the robo advisor is able to offer custom investment insights based on your risk tolerance and financial goals.

These recommendations can tell you when to enter, double down, or exit positions for the highest possible returns and minimal risk exposure. For example, the robo advisor could have suggested purchasing Dogecoin (DOGE) before the Q4 2024 rally. Also, the robo advisor could have prompted you to sell before the Dogecoin price crashed.

RCO Finance designed its robo advisor with you in mind. To this end, RCO Finance allows you to customize your trading station, giving the robo advisor the power to trade on your behalf. This feature saves you the time and effort needed to find high-potential investments early.

Thus far, RCO Finance has launched its beta platform, allowing you to interact with the robo advisor and other features early. Notably, RCO Finance has rolled out its beta platform while still running its presale. This milestone explains why this budding DeFi platform has already onboarded over 10,000 users.

RCOF: A One-Of-A-Kind Investment Opportunity

As the Dogecoin price continues crashing, investors are shifting to RCOF to hedge against more losses. DOGE investors and other crypto enthusiasts are rushing to buy RCOF because it is a safe investment. It is worth noting that SolidProof, a leader in blockchain security, audited RCOF’s smart contract and found it was vulnerability-free.

The crypto space is also buzzing about RCOF because of its robust tokenomics. Notably, RCOF is a deflationary token with a maximum supply of 800 million tokens. This tokenomics model positions RCOF for tremendous growth as the RCO Finance ecosystem scales.

As of February 3, RCOF was in Stage 5 of its presale. RCOF’s price during this stage is $0.1. This price is set to jump to $0.13 when RCOF kickstarts Stage 6. Also, RCOF is poised to generate more gains for Stage 5 investors, seeing as its listing price is $0.4-$0.6.

Astonishingly, experts foresee RCOF surging 12,000% in Q1 2025. In doing so, RCOF will have mirrored the 12,800% climb in the Dogecoin price in 2021. This forecast explains why you should snag this rare opportunity and join the RCOF presale today!

For more information about the RCO Finance (RCOF) Presale:

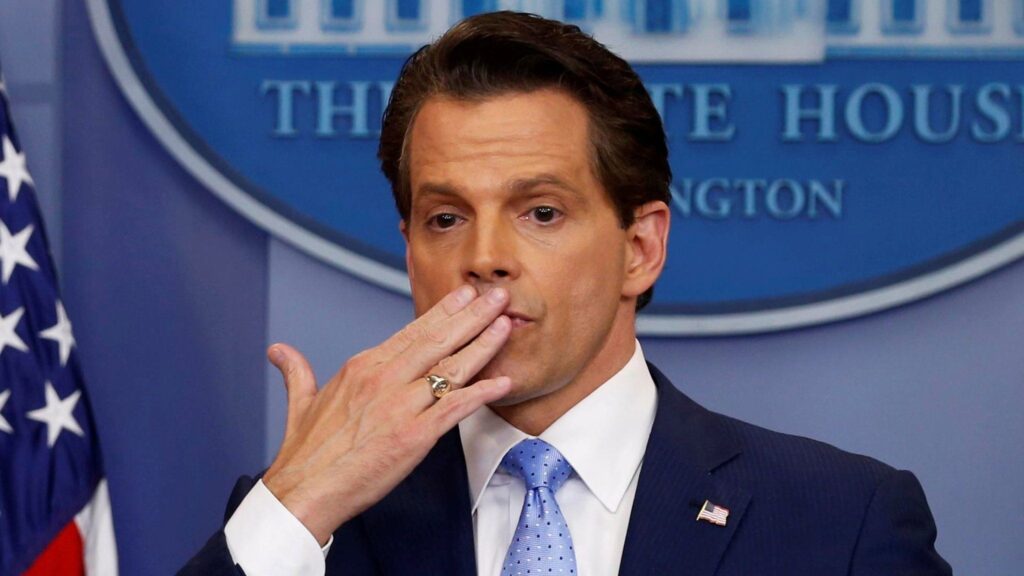

As the debate over cryptocurrency regulation intensifies, prominent figures in the financial sector are urging US lawmakers to establish clear guidelines for the industry. Anthony Scaramucci, founder of investment firm SkyBridge Capital and former White House communications director, has emphasized the need for regulatory clarity, warning that the US risks falling behind in the rapidly evolving digital asset space.

Regulation has been a contentious topic in the crypto industry, with lawmakers and financial institutions struggling to balance innovation with consumer protection. While some officials advocate for stricter oversight, others argue that excessive regulation could stifle technological advancements and push companies to relocate to more crypto-friendly jurisdictions. The lack of comprehensive regulation has led to uncertainty, making it difficult for businesses and investors to navigate the market.

Scaramucci has been vocal about the importance of clear and fair regulations, stating, “We need to make sure that Washington is creating a framework that allows the industry to thrive while also protecting investors.” He believes that bipartisan cooperation is necessary to implement policies that foster innovation without excessive restrictions. His comments come as lawmakers ramp up discussions on cryptocurrency-related legislation, including proposals addressing stablecoins, securities classification, and anti-money laundering measures.

One of the key issues in crypto regulation is defining whether digital assets should be classified as securities or commodities. The Securities and Exchange Commission (SEC) has taken an aggressive stance, arguing that many cryptocurrencies fall under its jurisdiction as unregistered securities. However, industry leaders and some lawmakers have pushed back, advocating for a more nuanced approach that differentiates between various types of digital assets.

The regulatory uncertainty has led to high-profile legal battles, with major crypto companies facing lawsuits over alleged violations of securities laws. This has further fueled concerns that the US is taking a hostile approach to the industry, potentially driving innovation offshore. In contrast, regions like the European Union and the United Arab Emirates have introduced clearer regulatory frameworks, attracting businesses looking for legal stability.

Despite the challenges, Scaramucci remains optimistic about the future of crypto regulation in the US. “The key is finding common ground,” he said. “We need sensible rules that provide clarity for businesses while ensuring that bad actors are kept in check.” He believes that engaging with lawmakers and educating them on blockchain technology will be crucial in shaping balanced policies.

The push for regulation comes at a time when crypto adoption is growing among institutional investors and traditional financial institutions. Major banks and asset managers have increasingly explored digital asset offerings, signaling a shift in how cryptocurrencies are perceived in mainstream finance. However, without a well-defined regulatory framework, concerns about compliance and legal risks remain a major hurdle.

As discussions continue, the crypto industry will be closely watching legislative developments in Washington. The outcome of these debates could have a significant impact on the future of digital assets in the US, determining whether the country remains a leader in blockchain innovation or lags behind in the global market.

Crypto.com is set to make a significant move in the crypto investment space with the planned launch of an exchange-traded fund (ETF) based on its native blockchain, Cronos (CRO). The company aims to introduce the ETF by 2025 as part of a broader initiative to enhance mainstream adoption of its ecosystem. This development comes amid increasing institutional interest in crypto ETFs, which provide investors with a regulated and accessible way to gain exposure to digital assets.

Exchange-traded funds (ETFs) have become a major gateway for institutional and retail investors to enter the cryptocurrency market without directly holding digital assets. Crypto ETFs track the performance of specific cryptocurrencies or blockchain networks, allowing investors to trade them like traditional stocks. The approval of Bitcoin spot ETFs in the U.S. in early 2024 marked a turning point for institutional adoption, leading to speculation about the expansion of similar products for other cryptocurrencies, including Ethereum and alternative blockchain ecosystems like Cronos.

Crypto.com’s decision to launch a Cronos ETF highlights the company’s ambition to solidify its position in the growing crypto investment sector. The CEO of Crypto.com, Kris Marszalek, stated, “This is a strategic step forward for Cronos and its entire ecosystem. We believe institutional adoption is key to long-term success.” The ETF is expected to track the performance of Cronos, making it easier for investors to gain exposure to the asset without directly purchasing and storing CRO tokens.

Cronos, which operates as Crypto.com’s blockchain network, has seen steady growth since its launch. It is designed to support decentralized applications (dApps) and decentralized finance (DeFi) projects while maintaining compatibility with the Ethereum Virtual Machine (EVM). With a focus on scalability and low transaction costs, Cronos has attracted developers and projects looking for alternatives to more congested networks like Ethereum.

The ETF launch aligns with Crypto.com’s broader expansion strategy, which includes new product offerings and potential developments in the stablecoin sector. The company is also exploring the possibility of launching a stablecoin, a move that could further strengthen its financial ecosystem. While specific details remain undisclosed, Marszalek hinted at future plans, stating, “We are continuously working on innovations that enhance our ecosystem and provide users with new financial tools.”

The launch of the Cronos ETF could significantly impact the crypto investment landscape by offering a regulated and institutionally friendly way to invest in the network. Given the success of Bitcoin and Ethereum ETFs, analysts predict that investors could show strong interest in ETFs tied to alternative blockchains, especially those with strong use cases in DeFi and dApps.

As Crypto.com prepares for the 2025 launch, industry experts will be closely watching how regulators respond to new ETF proposals beyond Bitcoin and Ethereum. With increased institutional interest and a growing demand for diversified crypto investment products, the Cronos ETF could mark another step in the mainstream adoption of digital assets.

Ethereum (ETH), the second-largest cryptocurrency by market capitalization, is at a critical price level, with analysts warning that a drop below $2,700 could lead to a further decline toward $2,300. As the broader crypto market experiences volatility, traders are closely monitoring ETH’s movements to assess potential risks and opportunities.

Ethereum, originally launched in 2015 by Vitalik Buterin and a team of developers, is a decentralized blockchain network that enables smart contracts and decentralized applications (dApps). Unlike Bitcoin, which primarily serves as a store of value and a medium of exchange, Ethereum’s blockchain is designed for programmability, making it the backbone of decentralized finance (DeFi) and non-fungible tokens (NFTs). Over the years, Ethereum has undergone several major upgrades, including the transition to a proof-of-stake (PoS) consensus mechanism through the Merge in 2022, significantly reducing its energy consumption and improving scalability.

Currently, Ethereum is struggling to maintain its position above the $2,700 support level. Analysts have pointed out that if this level is breached, ETH could face a deeper correction, potentially dropping to $2,300. One analyst stated, “If Ethereum fails to hold the $2,700 level, we could see a swift decline toward $2,300. However, if bulls can defend this zone, ETH may consolidate before attempting another upward move.”

Market sentiment around Ethereum remains mixed, as macroeconomic factors and investor sentiment influence its price movements. The cryptocurrency market has been reacting to regulatory developments, economic data, and movements in traditional financial markets. Some traders remain optimistic that Ethereum will recover, especially as institutional adoption continues to grow.

One factor contributing to Ethereum’s price fluctuations is its correlation with Bitcoin, which often sets the direction for the overall crypto market. When Bitcoin experiences volatility, Ethereum tends to follow suit. Additionally, the network’s usage and transaction fees, known as gas fees, play a crucial role in its price dynamics. High gas fees can sometimes deter users, impacting demand and overall network activity.

Another significant aspect of Ethereum’s future is the ongoing development of its Layer 2 scaling solutions, such as Optimistic Rollups and zk-Rollups, which aim to improve transaction speeds and reduce fees. These innovations could enhance Ethereum’s usability and drive further adoption, potentially supporting its price in the long run.

Despite the short-term uncertainty, long-term investors remain confident in Ethereum’s potential, given its strong fundamentals and continuous development. Some analysts believe that if ETH can sustain its support level and regain momentum, it could target higher price levels in the coming months. However, they caution that a break below $2,700 could lead to further downside before a recovery takes place.

As Ethereum navigates this critical phase, traders and investors will be watching key support and resistance levels closely. The coming days will be crucial in determining whether ETH can hold above $2,700 or if a deeper correction is on the horizon.

The cryptocurrency market witnessed a dramatic $10 billion liquidation event, with Bybit alone accounting for $1 billion in liquidated positions. The sudden market downturn led to a widespread sell-off, impacting traders who had leveraged positions across multiple exchanges.

Leverage trading in cryptocurrency allows investors to borrow funds to increase their position size, amplifying both potential gains and losses. However, it also carries significant risks, especially in highly volatile markets. When prices move sharply in the wrong direction, traders who use leverage may see their positions forcibly closed, or “liquidated,” as exchanges move to protect borrowed funds.

Bybit, one of the major cryptocurrency derivatives exchanges, saw over $1 billion in liquidations, reflecting the severity of the market crash. The broader crypto market experienced a total of $10 billion in liquidations, with Bitcoin and Ethereum leading the losses. The sharp declines came as unexpected price swings wiped out traders who were overleveraged.

“The scale of the liquidations shows just how fragile the market can be when leverage is involved,” noted a market analyst. High leverage levels can create a cascading effect, where initial sell-offs trigger further liquidations, leading to even greater price drops.

The incident highlights the risks associated with crypto leverage trading, which has become increasingly popular among retail and institutional investors. Many exchanges offer leverage of up to 100x, meaning traders can open positions far larger than their initial investment. While this can result in significant profits when the market moves in their favor, it also exposes traders to extreme losses if prices move against them.

A spokesperson for Bybit commented on the situation, stating that the platform had handled the high volatility efficiently. “Despite the unprecedented liquidations, our systems functioned smoothly, ensuring that risk management mechanisms were in place to protect traders and the broader market,” they said.

The impact of the liquidations was felt across the crypto industry, with Bitcoin dropping sharply before partially recovering. Ethereum and other major altcoins also saw significant price swings, as traders scrambled to manage their positions amid the turmoil.

Experts believe that the event underscores the need for caution when using leverage in crypto trading. “This kind of volatility is inherent in the crypto market, and leveraged traders need to be prepared for rapid price movements,” said a senior analyst at a trading firm.

Despite the massive liquidations, some market participants see potential buying opportunities. Historically, large liquidation events have been followed by price rebounds as the market stabilizes. However, uncertainty remains, especially with ongoing regulatory discussions and macroeconomic factors influencing investor sentiment.

The liquidation event serves as a reminder of the risks and rewards of leverage trading in crypto. While it can enhance profits, it can also lead to severe losses, particularly in a market known for its unpredictability. Traders are advised to use risk management strategies, such as stop-loss orders and lower leverage levels, to protect their investments from unexpected market swings.

Kraken, one of the world’s leading cryptocurrency exchanges, has obtained a MiFID (Markets in Financial Instruments Directive) license, allowing it to expand its crypto derivatives offerings across Europe. This regulatory approval marks a significant step for the exchange as it aims to strengthen its position in the European market.

Kraken has been a major player in the cryptocurrency industry since its founding in 2011. Known for its focus on security, transparency, and regulatory compliance, the exchange offers spot trading, futures, and staking services to millions of users worldwide. With headquarters in the U.S., Kraken has been actively working to expand its presence in Europe, a key market for crypto adoption and regulation.

The new MiFID license, issued by the Spanish financial regulator, enables Kraken to offer regulated investment services, including crypto derivatives trading. Crypto derivatives are financial contracts that derive their value from underlying digital assets like Bitcoin and Ethereum. These instruments, such as futures and options, allow traders to hedge risk, speculate on price movements, and increase exposure through leverage.

“This is a significant milestone that strengthens our commitment to regulatory compliance while enhancing our ability to serve European clients,” said a Kraken spokesperson. “The MiFID authorization ensures that we can offer our derivatives products in a fully regulated environment, providing greater transparency and investor protection.”

The European crypto market has been evolving rapidly, with regulators implementing new frameworks to oversee digital assets. The Markets in Crypto-Assets (MiCA) regulation, set to take full effect in 2024, is expected to bring further clarity to the industry. Kraken’s move to secure a MiFID license aligns with its strategy of adapting to Europe’s changing regulatory landscape while expanding its derivatives offerings.

By securing this license, Kraken is positioning itself alongside other major exchanges that have been pushing for greater regulatory approval in Europe. The demand for crypto derivatives has been growing, particularly among institutional investors seeking sophisticated trading tools and risk management strategies.

Kraken’s derivatives platform has already gained traction among traders looking for advanced trading options. With this regulatory approval, the exchange can now offer these services with greater legitimacy and investor confidence. “This license allows us to bridge the gap between traditional finance and crypto markets by offering innovative trading products in a regulated manner,” Kraken’s statement added.

Despite regulatory uncertainty in other parts of the world, Europe has emerged as a key region for crypto firms looking to establish themselves under a clear legal framework. Kraken’s approval under MiFID further cements its reputation as a compliant and reliable exchange, distinguishing it from unregulated platforms.

With the crypto industry facing increasing scrutiny from financial watchdogs, Kraken’s latest regulatory achievement is expected to reinforce trust among users and institutional clients. The exchange remains committed to expanding its services while adhering to the highest standards of security and compliance.

As the European crypto landscape continues to develop, Kraken’s move to secure a MiFID license signals a broader trend of exchanges aligning with regulatory requirements to ensure long-term growth and stability in the market.

Bitcoin has bounced back after a recent price dip, showing signs of recovery as a rare Relative Strength Index (RSI) pattern appears on the charts. The world’s largest cryptocurrency fell to multi-week lows before rebounding, with analysts closely watching the market for signs of a potential trend shift.

Bitcoin, often referred to as digital gold, is the first and most widely adopted cryptocurrency. Launched in 2009 by the pseudonymous Satoshi Nakamoto, Bitcoin was designed as a decentralized form of money that operates without the need for a central authority. Over the years, it has become a store of value and a hedge against traditional financial risks, often reacting to macroeconomic trends and investor sentiment.

The recent price movement saw Bitcoin drop to its lowest level in several weeks, triggering concerns among traders. However, a rare RSI signal suggests that a possible reversal could be on the horizon. The RSI is a momentum indicator that measures whether an asset is overbought or oversold. When it falls to extreme lows, it can indicate that selling pressure may be exhausted and that a rebound is likely.

Market analysts have taken note of the unusual RSI reading, with some suggesting that Bitcoin could be gearing up for a recovery. “We are seeing a rare RSI structure, which historically has been a precursor to significant price reversals,” noted a trader. This has led to renewed optimism among investors who see the current dip as a buying opportunity.

Despite the recent decline, Bitcoin has a history of bouncing back from downturns, often fueled by institutional adoption and growing interest from retail investors. Over the past decade, Bitcoin has experienced multiple boom-and-bust cycles, with each dip eventually leading to new highs.

Traders are now watching key support and resistance levels to determine Bitcoin’s next move. “If Bitcoin manages to hold above its current support zone, we could see a strong recovery in the coming weeks,” said a crypto analyst. However, others remain cautious, citing ongoing market volatility and macroeconomic uncertainties.

Bitcoin’s price fluctuations are often influenced by broader economic factors, including inflation rates, interest rate policies, and investor sentiment in traditional markets. With central banks worldwide adjusting monetary policies, the crypto market remains highly sensitive to external financial events.

At the same time, Bitcoin’s long-term fundamentals remain strong. The upcoming Bitcoin halving event, expected in 2024, is another factor that could drive demand. The halving, which occurs approximately every four years, reduces the number of new Bitcoins entering circulation, historically leading to price increases due to reduced supply.

As the market digests the latest RSI signal and Bitcoin’s recent rebound, investors are closely monitoring price movements for confirmation of a sustained recovery. While short-term volatility remains a challenge, many believe that Bitcoin’s long-term outlook continues to be bullish, driven by increasing adoption and growing institutional interest.