A cryptocurrency-exchange company accidentally transferred almost $10.5 million to an Australian woman but failed to notice the error for seven months, according to a legal document.

Crypto.com made the mistaken payment in May 2021 when it was supposed to pay Thevamanogari Manivel $100 but instead entered the wrong account number into the payment-amount field, according to a default judgment released on Friday in the Supreme Court of Victoria.

Manivel therefore received $10,474,143 from Crypto.com by mistake.

The cryptocurrency firm failed to spot the erroneous payment until a company audit was carried out in late December — seven months later, according to the judgment.

Crypto.com then launched legal action against Manivel and her sister Thilagavathy Gangadory, who received some of the $10.5 million payment, the judgment said.

The company was granted freezing orders in February against Manivel’s bank account but discovered that she had sent most of the money to other accounts, the judgment said.

In late January, Manivel sent $430,000 to her daughter, the judgment said. A month later, Manivel purchased a $1.35 million house in Craigieburn, a suburb of Melbourne, with the money that was mistakenly sent to her, the company added in the judgment.

Manivel then transferred the ownership of the house to Gangadory, who lives in Malaysia, the judgment said.

Crypto.com tried to freeze Gangadory’s bank accounts in March, but it proved unsuccessful, the judgment said.

Gangadory didn’t respond to correspondence from Crypto.com’s solicitors but did reply to one email from Manivel’s lawyers, saying “received, thank you,” according to the judgment.

Manivel’s solicitors told Crypto.com that Gangadory was seeking legal advice, the judgment said.

The default judgment ordered Gangadory to pay Crypto.com $1.35 million, sell the property, and pay interest of $27,369.64 and costs.

Crypto.com didn’t immediately respond to Insider’s request for comment. The company declined to comment to The Guardian and Daily Mail Australia while the case was before the courts.

Follow Crypto Intelligence on Google News to never miss a story

After tremendous success with its prominent presence at last year’s Gitex Dubai, crypto incubator and advisor TDeFi is returning to the Middle East’s premier technology gathering, which promises to be even bigger and better than last year.

Gitex Global (Gulf Information Technology Exhibition) is one of the world’s most influential gatherings in the tech industry. Attended by more than 250,000 people from over 140 countries, the event brings together many of the sector’s brightest minds and greatest innovators to discuss the state of the space, showcase new products and identify emerging opportunities.

More than 4,000 exhibitors will be taking part in Gitex Dubai 2022, including hundreds of the most active VCs from over 30 countries. More than 1,000 prominent speakers will deliver over 280 hours of exclusive content live on stage from the Dubai World Trade Center between Oct. 10 and 14, 2022. The packed Gitex agenda will span every corner of the industry, from cybersecurity, energy and education to healthcare, Web3 and digital cities. It’s the ultimate technology networking event, attended by some of the sector’s most revered luminaries.

Leaders from more than 1,200 private companies, government entities and startups — including many of the tech industry’s most successful organizations — descend on Dubai each year for the Gitex conference, representing more than 170 countries. GITEX dates back to 1981 and has since grown into one of the industry’s must-attend events, where exhibitors and presenters from all corners of the globe come together to share knowledge and show off their latest innovations.

This year, TDeFi will again participate at Gitex with an exhibition of its portfolio showcasing its latest projects. TDeFi is an incubator and advisory firm for blockchain startups, affording them seamless access to many resources, such as high-quality mentorship, financial support, marketing, community building, exchange listings, liquidity provisioning and growth hacking partnerships.

One of the most memorable events from last year’s Gitex was BizThon 1.0, a unique blockchain hackathon where over 10,000 participants put their collective brainpower together to turn their blockchain-based business ideas to life with the help of TDeFi and its partners. After months of offline developing, 25 finalists were selected to pitch their ideas live on stage in front of an esteemed panel of judges. This year, TDeFi will host BizThon 2.0 with the help of partners including MythX, Metamazonia, Faith Tribe, Edverse, Vulcan Forged, Sinverse, Bridge Network, EQ8 and more than 30 of its portfolio companies.

TDeFi is excited to once again be taking part in one of the region’s and planet’s most important gatherings of the technology industry.

About Gitex Dubai

Gitex Dubai is one of the world’s biggest and most influential technology conferences, attended by over 250,000 participants representing more than 140 countries. This year’s event will have more than 4,000 exhibitors, 800 startups and over 1,000 speakers, with the roster including some of the space’s most prominent names. It will be held in Dubai, UAE from Oct. 10 to 14, 2022.

About TDeFi

TDeFi incubation provides access to world-class mentors, industry connections, transactional token economics, network of experts in technology, marketing and community, exchanges, liquidity and growth hacking partnerships. It seeks projects not just looking to survive, but those looking to thrive for years to come and disrupt the status quo in their respective fields.

London, the United Kingdom, Sept. 2 — Reef, a layer-1 Substrate-based blockchain for decentralized finance (DeFi), nonfungible tokens (NFTs) and gaming, announced today its highly anticipated Reef Card is now available for people in the United Kingdom and Europe.

Reef has been working with Baanx, an experienced partner for revolutionary Web3 financial solutions, to create and produce Reef Card. Reef Card, powered by Baanx, is part of the Mastercard crypto debit line. Due to COVID-19 and material production delays, the card was put on hold until this year. Now it’s officially available to everyone in the U.K. and European Economic Area.

Denko Mancheski, CEO of Reef said, “We feel good about the future of Reef, and over the past year, we’ve been working hard with Baanx to get Reef Card out. We’re excited to have it available now and allow hodlers the opportunity to spend their cryptocurrencies in the physical world.”

Crypto debit cards have become a hot ticket in the physical world as they add another layer of utility to tokens and the cryptocurrency landscape. Reef Card owners will be able to spend their crypto and have their card convert it to fiat only at the time of purchase, and they will be able to use their card at over 90 million merchants worldwide and even withdraw fiat at certain ATMs. To start, Reef Card will be available as a physical card and Google Play right away. Apple Pay will come next.

Garth Howat, CEO of Baanx said, “It’s very exciting to see that more companies and communities are adopting our solutions to bridge the gap between DeFi and traditional finance. We’ve been working hard with the Reef team on this project, allowing the community to enjoy Reef’s ecosystem to the fullest.”

Reef continues to evolve and expand its blockchain, quickly gaining momentum on the lead to becoming one of the top five Web3 blockchains. Recently, Reef launched an NFT division, attended Binance Blockchain Week in Dubai, launched ReefScan V2, and a new REEF Community Staking Bond. Reef Card is another innovative addition to the rise of the chain and its native token, REEF.

About Reef

Reef’s Substrate-based layer-1 blockchain with smart contract functionality offers an intuitive user experience, high scalability and low fees, helping the ecosystem to be a go-to platform for NFT projects. Reef is the most advanced Ethereum Virtual Machine-compatible blockchain with smart contract functionality. Based on a nominated proof-of-stake consensus mechanism, the network offers low fees and scalability, as well as myriad features, including native token bridges, on-chain governance, recurring payments and much more. Eventually, the platform will also support an additional virtual machine that will allow developers to write code in several different programming languages.

About Baanx

Baanx offers fintech services to the digital asset sector, including Cryptodraft and payment authorization integration into Visa, Mastercard and other transaction payment systems. Baanx headquarters are in London, U.K. with subsidiaries in Delaware, United States, Portugal and Lithuania. Baanx manages digital assets with maximum privacy and security. The company is launching services for more than 25 top-tier clients, including Ledger and Reef. Baanx is managed by a seasoned team with over a hundred years of combined experience in banking, financial technology, cryptography, finance and digital marketing.

In its first foray into the crypto sector, the House Committee on Oversight and Reform is dialing up the pressure on federal agencies and crypto exchanges to protect Americans from fraudsters.

In a series of letters sent Tuesday morning, the committee asked four agencies, including the Department of the Treasury, the Federal Trade Commission, the Commodity Futures Trading Commission, and the Securities and Exchange Commission, as well as five digital asset exchanges — Coinbase, FTX, Binance.US, Kraken, and KuCoin — for information and documents about what they are doing, if anything, to safeguard consumers against scams and combat cryptocurrency-related fraud.

More than $1 billion in crypto has been lost to fraud since the start of 2021, according to research from the FTC.

“As stories of skyrocketing prices and overnight riches have attracted both professional and amateur investors to cryptocurrencies, scammers have cashed in,” wrote Rep. Raja Krishnamoorthi, D.-Ill., Chair of the Subcommittee on Economic and Consumer Policy. “The lack of a central authority to flag suspicious transactions in many situations, the irreversibility of transactions, and the limited understanding many consumers and investors have of the underlying technology make cryptocurrency a preferred transaction method for scammers.”

The letters ask that the federal agencies and crypto exchanges respond by Sept. 12 with information about what they are doing to protect consumers. The committee says that these responses could be used to craft legislative solutions.

In particular, the letters ask that the exchanges produce documents dating back through Jan. 1, 2009, which display efforts to combat crypto scams and fraud, as well as show attempts made to “identify, investigate, and remove or flag potentially fraudulent digital assets or accounts,” as well as highlight discussions around “whether to adopt more stringent policies.”

In one letter, addressed to Sam Bankman-Fried, the CEO and founder of FTX, the committee notes that “while some exchanges review cryptocurrencies before listing them, others allow digital assets to be listed with little or no vetting.”

Blockchain analytics firm Chainalysis found that 37% of crypto scam revenue last year went to “rug pulls,” a type of scheme that involves developers listing a token on an exchange, pumping it up, and then vanishing with the funds.

Binance.US, which also received an inquiry from the committee on Tuesday, has been accused in a class action lawsuit of misleading consumers about the safety of investing in the U.S. dollar-pegged stablecoin known as terraUSD (or UST, for short) and its sister token, luna. At their height, luna and UST had a combined market value of almost $60 billion. Now, they’re essentially worthless.

Concern over the safety of crypto funds parked on centralized platforms has also been gaining traction following the recent collapse of Voyager Digital and Celsius, both popular apps among retail traders because of the double-digit annual percentage yield once offered by the two companies. The subsequent bankruptcies of these two platforms have highlighted the question of who owns cryptocurrency assets when a custodial business goes belly up. In the bankruptcy proceedings of both Voyager and Celsius, customers are considered unsecured creditors, rather than federally-insured bank depositors, meaning there is no guarantee they will get any of their money back.

As for the relationship between investor and crypto exchange, the terms and conditions vary. In a financial filing released in May, Coinbase said its users would be treated as “general unsecured creditors” in the event of bankruptcy.

Krishnamoorthi also noted that the agencies often seem to be acting at cross-purposes and giving inconsistent guidance to private-sector players. “Without clear definitions and guidance, agencies will continue their infighting and will be unable effectively to implement consumer and investor protections related to cryptocurrencies and the exchanges on which they are traded.”

Follow Crypto Intelligence on Google News to never miss a story

Only1, the Web3 social platform backed by Alameda Research and Animoca Brands — where users launch Passes as semi-fungible tokens (SFTs) and post exclusive content for holders — is about to launch a new ex-Marvel artist-designed nonfungible token (NFT) collection, “Acid Monkeys,” on Sept. 1.

Web3 OnlyFans to bring adoption to the masses by Q4 2022

Similar to Patreon and OnlyFans, Only1 allows content creators to monetize their content through a paywall, where instead of a subscription, creators launch their own passes as SFTs, and the holders are granted access to the creator’s content.

The future of NFTs and SFTs

Most SFTs and NFTs today are profile picture collectibles; however, the market is at a turning point now where developers are starting to give these tokens real utility. GameFi is one of the focuses for such utility, such as using NFTs as tradable in-game items. SocialFi is the other major focus using NFTs as a means of access to content creators. This allows creators to monetize their content directly and connect with fans through Web3.

Many innovative creators have already experimented with NFTs and found massive success. Gary Vaynerchuk famously launched VeeFriends, a collection of 10,255 NFTs on the Ethereum blockchain that grants holders different levels of access to Gary, including FaceTime calls, or even having a one-on-one workout with him. Irene Zhao, the famous ex-chief marketing officer of Konomi Network, also launched her NFT collection, IreneDAO, on the Ethereum blockchain to grant holders access to her exclusive Discord channel and even the opportunity to invest in her new startup, So-Col.

The creator economy will drive the next bull cycle

The narrative to drive the industry to the next bull cycle is going to be end-consumer adoption, and the $100-billion creator economy is in the middle of it with all its Generation Z TikTok dance videos and content creators as businesses-of-one. Only1 has been building through the bear market and is ready to launch the passes feature for the whole world in Q4 2022.

Unlike Zhao or Vaynerchuk, who have to go through a lengthy process of hiring developers and using multiple platforms, anyone can soon launch passes for their fans and connect with them through exclusive content, Web3 messengers and more. The Only1 ecosystem is powered by LIKE, while platform revenue from NFT launches and creator passes will be used for token buyback, burn and redistribution to active users on the platform, a process called create-to-earn.

Only1’s initial NFT offering: An innovative and fair launchpad

An initial NFT offering (INO) is a new funding model for creators where NFTs are offered to the public for the first time on the Only1 launchpad. The term INO was coined by Only1 on CoinMarketCap and featured on Cointelegraph as early as September 2021.

How does an INO work?

At the beginning stage, creators and upcoming projects provide plans and roadmaps to the community. Creators would launch on a first-come-first-serve basis or lottery model to fairly distribute their NFTs. NFT launches may require LIKE staking in order to receive whitelists or allocations from upcoming NFT projects.

Easy-to-launch NFT projects

Through INOs, anyone can issue limited-edition NFTs through the Only1 launchpad. INOs enable everyone with both big and small ideas to be recognized by a wider range of audiences. Many creators who are still in the process of creating their masterpieces would need new funding to finance their projects. With INOs, any artist can raise the needed funds before creating.

On-chain random function to ensure fairness

Only1 developed its own on-chain randomness function on Solana using Zig technology. This ensures the lottery system or allocation of NFTs is fair.

Early community building

Only1 will allow the community to vote for promising projects to be listed on the platform and reward the winners. The exposure encourages potential investors to look into NFT projects. The mechanism enables creators to build an early community of active traders and experienced investors around the NFT project.

For NFT projects and creators, an INO rises as a brand new type of offering that leverages the strongest elements of NFT technology by empowering them to kick-start their success stories. To apply for an INO, click here.

Acid Monkeys NFT launches on Only1 Sept. 1

Acid Monkeys is a dark age comic-inspired profile picture collection of 5,000 escaped lab experiments on the Solana blockchain. The project is backed by a strong focus on lore and community and designed and cultivated by ex-Marvel artists.

Mint details:

- Quantity: 5,000 NFTs

- Price: Whitelist — 1.38 SOL; Public — 1.68 SOL

- Launch Model: Lottery

- Launchpad Link: https://only1.app/launchpad/acid-monkeys

Follow Crypto Intelligence on Google News to never miss a story

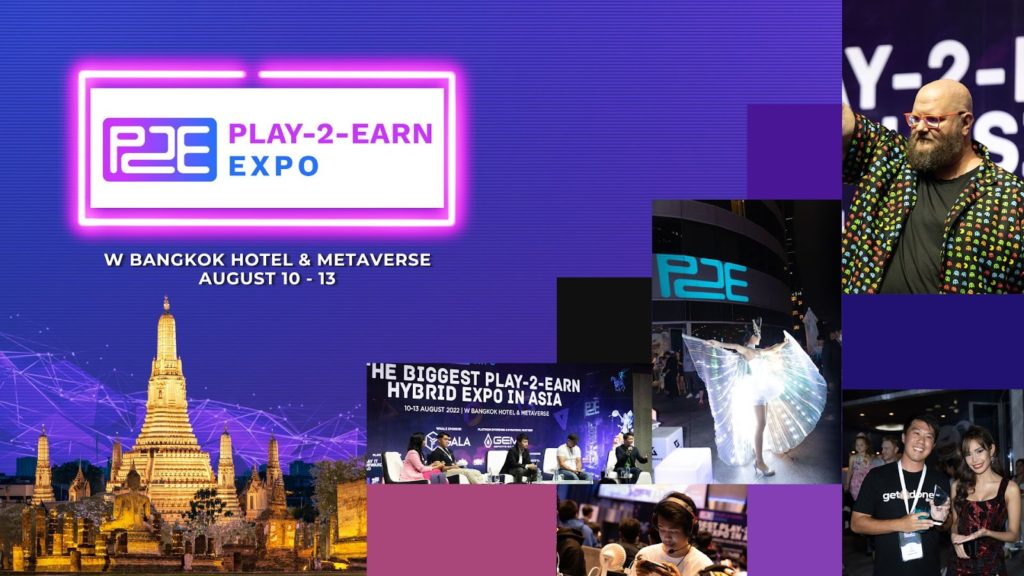

Known as Asia’s biggest play-to-earn expo, Play-2-Earn Hybrid Expo Asia finally took place from Aug. 10 to 13 at the W Bangkok and in the Metaverse. The four-day event was the first of its kind to focus specifically on the play-to-earn industry.

The event’s guest list comprised over 260 physical and 300 virtual C-suite attendees. This included Jason Brink from Gala Games, Rich Robinson from Animoca, Andy Koh from the Gems esports 3.0 platform, Tatsuya Kohrogi from Digital Entertainment Asset (PlayMining), Irene Umar from YGG SEA and Cholo Maputol from Play It Forward DAO.

Day one: Welcome drinks and snacks at The House on Sathorn

Welcoming Play-2-Earn’s biggest names from all over the world, the first day of Play-2-Earn Hybrid Expo Asia kicked off with welcome drinks and snacks in the House on Sathorn, a multi-entertainment venue adjacent to W Bangkok.

The driveway leading up to the entrance had rows of banners with P2E’s valued sponsors, including Gala Games, ByBit, Ethlas and Playgroundzero.io. By the DJ booth, there were also light-up cubes with P2E sponsor logos.

All guests had access to a wide spread of food and an open bar, which quickly livened up the evening. A short program featured the official launch of the event and a special performance from traditional Thailand dancers.

The night was also a chance for guests to start building their bridges within the industry. Many networked and made friends, some of whom were meeting for the first time.

Day two and three: Keynotes, panels, networking, game pitches and afterparties

The next two days for Play-2-Earn Hybrid Expo Asia had a packed schedule, beginning with special keynotes from Jason Brink of Gala Games (“The Web3 future of play-and-earn gaming”) and Andy Koh of Gems (“Riding on the wave of blockchain and Web3”) for days two and three, respectively.

The event also featured back-to-back panel discussions that featured names such as Corey Wilton of Pegaxy, Paul Kim of Com2Us, Adrian Ho of Binance, Anastasia Drinevskaya of Cointelegraph and Charles Huh of WeMade.

On the hybrid side, business matching portals were set up for all attendees. Through the official P2E app, guests could schedule meetings with each other, meeting up physically through P2E’s meeting rooms or online. Virtual booths were also live during the expo, ensuring that attendees around the world can not only watch, but also participate in Play-2-Earn Hybrid Expo Asia.

Game pitch competition

Another highlight of the expo was its game pitch competition, where eight nominees shortlisted from hundreds of applicants were given a chance to pitch to an impressive lineup of judges from DFG/Jsquare, Faculty Group, Openspace ventures, SeaX Ventures and YGG SEA.

Each game project was given 15 minutes to present its pitch, including Q&As. This was easily one of the most sought-out parts of the expo, showcasing the up-and-coming talent of the P2E industry.

Osbiome took home the trophy for its Omeverse pitch, which is the first health-to-earn metaverse for personalized health. Omeverse users will have their own Web3 digital pet that will guide them on their future health journeys.

Play hard, party harder

Back-to-back afterparties were scheduled for days two and three, with the GameFi community gathering at Woo Bar and the Wet Deck respectively. DJs Nicole Chen, Celeste Chen and Amy Kao led the night to a state of pure hype and energy, invigorating the P2E Expo spirit in Bangkok.

Both parties had an open bar, served a mix of international and local cuisines, and were conducive to networking. The third day’s afterparty at the Wet Deck was top notch, with special drumming and dancing performances as well as appearances from mermaids.

Day four: Gems mobile gaming tournament

Thirty-two teams and a total of 120 PubG players competed for a $1,370 (50,000 THB) prize pool on the last day of Play-2-Earn Hybrid Expo Asia. Known as the Gems Thailand PubG Mobile Tournament, the event’s platinum sponsor and strategic partner Gems took over operations for the fourth day, which were held in the main expo hall.

Team ChaPoKit was hailed as the champion of the nine-hour tournament. Bacon Times and E29 Esports Gaming placed second and third place, respectively.

What’s next for Asia’s largest play-to-earn expo?

Play-2-Earn Hybrid Expo Asia, the first business-to-business play-to-earn event in Asia, is looking to host a subsequent expo in Bali, Indonesia during the first quarter of 2023. Like Bangkok, Bali is known worldwide as a hotspot of talent for the Web3 and blockchain industry.

The Harvest has announced that they will be holding their NFT Sale on Binance NFT on August 29th, 2022. The Harvest has been among the most promising game launches of 2022 thus far, and their first NFT sale with Fractal in July of this year was a resounding success, selling out in just a few minutes.

Why does the sale matter?

This is an early-bird opportunity to acquire the O’Ree-Jin Limited NFT Collection that contains one of the rarest sets for the first four heroes of the game. Binance users can enjoy a discounted price prior to the open beta scheduled for October 2022. There are 500 Legendary Boxes for sale at 200 BUSD each, which sets the overall sale value at 100,000 BUSD.

As to why the sale is significant, the NFTs provide a completely new experience in the game and adds massive replay value. Also, although players begin with common free cards, they will eventually be given the opportunity to earn or buy NFT cards with unique abilities as they progress through the game, which can then be utilized during matches, leveled up, or even sold in the marketplace if desired.

What can the cards be used for?

The most important part about the cards is that they represent different useful abilities and have a rarity index as well as a level system associated with them. The cards can also be upgraded in addition to granting the hero new powers or enhancements. They even include scarce characteristics like glossy images or unique traits.

Each type of card will also play a vital role in the game. For instance, the ‘Ability Cards’ are crucial because they allow players to upgrade and expand their abilities. There are also other types of cards like the ‘Companion Cards’ and ‘Calling Cards’. Finally, skins, player icons and emoticons allow players to personalize their appearance, enhancing user experience by providing an even greater sense of individuality in the game.

What else is there to know?

The Harvest is currently in pre-alpha, and anyone can join their Discord server to play. The Open Beta version will be available in early October of this year, with the full game expected to be available in February 2023.

Furthermore, The Harvest has achieved significant PR, partnered with large investors, and engaged a massive community consisting of tens of thousands across multiple platforms like Twitter, Discord, and their YouTube channel in a relatively short period of time. The game’s popularity and reach are expected to grow even further with the announcement of their second NFT sale on one of the biggest cryptocurrency exchanges, Binance.

About The Harvest

The Harvest is a fast-paced P&E (Play and Earn) shooter with MOBA (Multiplayer Online Battle Arena) elements that utilizes cutting-edge emerging technologies such as NFTs and the metaverse. It’s a new take on the ‘Class-Based Hero-Shooters’ genre in which the player fights alongside teammates from various civilizations against other players in order to gain control of the universe’s essence. Players can select their own heroes and play to earn #HAR tokens, which can be used to buy in-game NFTs or redeemed for real money.

The Harvest is developed by Falco, a Web3 gaming publisher founded by industry experts and notable crypto entrepreneurs, and is backed by impressive founders like Justin Kan (Twitch Co-founder), Robin Chan (serial gaming and tech entrepreneur and Fractal Co-founder), and Andres Bilbao (Co-founder of Rappi, Latin American Unicorn), as well as funds like Goat Capital Amber Group, Spartan Capital, Sanctor Capital, and Greek Cartel.

For additional information and regular updates, be sure to check out Falco’s official website as well as The Harvet’s official website along with the Twitter, Medium and YouTube channels. Language options in English, Spanish and Filipino are also available.

Follow Crypto Intelligence on Google News to never miss a story

Nolcha Shows, now in its 14th year, will be producing the two-day NYFW Web3 edition on the 69th floor of the iconic 3 World Trade Center on Sept. 13 and 14, 2022.

Nolcha Shows is where fashion and Web3 communities gather in real life to share knowledge, experiences and insights. Creators, investors, founders and industry leaders connect through education, entertainment and networking opportunities that spark collaboration toward building the future.

Building on their successful Web3 event series during NFT.NYC, Art Basel, Bitcoin Conference, Consensus and Permissionless, Nolcha Shows is going back to its roots and elevating the concept of NYFW.

The independent fashion pioneering brand will continue to serve as a platform for driving Web3 culture forward. The multi-day event will combine an NFT gallery, Web3 panel discussions and runway shows.

Web3 and its technology will enable unprecedented consumer experiences.

Schedule for Sept. 13

- Runway shows

- Sustainable fashion brands: Embracing fashion designers focused on sustainability and demand for ethical fashion featuring clothing brands Host and Var, Kaiane Designs, The Tailory NYC, Mauricio Alpizar, Maya Seyferth & accessory brands CoFi, Zashadu, Aumora Gems, and Anna Zuckerman.

- “Ones to Watch”: Web3, ready-to-wear and bridal wear brands ChainGuardians, Oh Polly and Nazranaa.

The highlight of the first day focuses on the emergence of AR in fashion.

ChainGuardians will showcase a Phygital Meta Street Wear collection that is inspired by the ChainGuardians Super Heroes, featuring virtual immersion technology that allows users to wear the clothing in the real world and on avatars in the Metaverse.

OhZone will bring Metaverse fashion to life through the patented 3DReal technology that automates turning physical garments into virtually stunning NFT wearables ready for the Metaverse.

Schedule for Sept. 14

The second day will consist of a series of web panel discussions that will highlight various aspects of Web3 and its impact on the fashion industry. Panel topics include:

- Female-led investments and innovation presented by Bad Bitch Empire: Women’s innovation and investment opportunities in Web3 and beyond, presented by Bad Bitch Empire and hosted by its CEO Lisa Carmen Wang, along with special guests.

- The Fashion Metaverse Economy, presented by Landvault and moderated by Ornella Hernadez, Web3 and NFT reporter at Blockworks. Panelists include LandVault CEO Sam Huber, Reed Smith partner Nick Breen, LandVault director John Kraski and Space Runners director of strategy Josh Ramjit.

- Luxury in the Metaverse, presented by Galaxy. Panelists include Andrew Isaacs, managing director in investment banking at Galaxy, and special guests.

- The Next Web, presented by Vatom. Panelists include Web3 brand activation strategist Paula Marie Kilgarriff, Vatom’s chief marketing officer Brian Wallace m and Cult & Rain founder George Yang.

- Community is the New Fashion Culture, presented by The Fashion DAO. Panelists include Echo Mah Creative Director at Tiffany & Co., Web3 digital luxury Matthew Pandolfe Web3 Digital Luxury Expert and Nico Fara CEO at Chief Metaverse Officer.

Onsite Web3 activations

ChainGuardians will offer attendees two consumer experiences. The first will be a virtual reality area where attendees can immerse themselves in a 3D digital fashion world to experience select items in the ChainGuardians Meta Street Wear line. An additional space will feature an augmented reality area that will allow attendees to interact with digital models wearing the ChainGuardians clothing.

Perfect Corp, the leading provider of AI and AR beauty and fashion tech, will offer fans an interactive runway beauty experience within the YouCam Makeup app, allowing fashion fans to immerse themselves in the glamor of New York Fashion Week by virtually trying on the beauty and fashion looks featured on the Nolcha runway through their smartphones.

NFT artist Talia Zoref, a Forbes 30 Under 30 fashion illustrator, will be sketching her illustration onsite while featuring digital wearables from her NFT collection Eyes of Fashion, whose mission is to bring more inclusion into the world of fashion, elevate strong women artists, and empower women through education.

In partnership with HeyLayer, attendees will be able to claim a Proof of Attendance Multipass NFT with unlockable content to be revealed at a later date.

Partners and sponsors include Saratoga, Vatom, LandVault, ChainGuardians, Hanjan, Chief Metaverse Officer, WHIM, AOFM Pro, Unite, Perfect Corp, PowerStation Studios, InstaSleep, Wear The Future L8, Holistic Spirits and TradeZing.

About Nolcha Shows NYFW Web3 edition

Nolcha Shows is a collection of leading award-winning experiential events. Over the past 14 years, the Nolcha Shows have become a discovery platform, promoting cutting-edge, innovative brands, connecting and building communities across the dynamic industries of lifestyle fashion and tech-driven Web3.

The curated event series is held during New York Fashion Week, NFT.NYC, Consensus, Art Basel and Bitcoin Miami.

Singapore is planning to roll out new regulations that will make it more difficult for retail investors to trade cryptocurrencies at a time when they seem to be “irrationally oblivious” about the risks, its central bank chief said.

Ravi Menon, managing director of the Monetary Authority of Singapore (MAS), said at an event on Monday that despite warnings and measures, surveys show that consumers are increasingly trading in cryptocurrencies globally, not just in Singapore, attracted by the prospect of sharp price increases.

“They seem to be irrationally oblivious about the risks of cryptocurrency trading,” he said.

“Adding frictions” on retail access to cryptocurrencies was an area the MAS was contemplating, he said.

“These may include customer suitability tests and restricting the use of leverage and credit facilities for cryptocurrency trading,” he added at a seminar titled “Yes to digital asset innovation, No to cryptocurrency speculation.”

Singapore’s welcoming approach has helped the financial hub attract digital asset services-related firms from China, India and elsewhere in the last few years, making it a major center in Asia.

But recent defaults of some global cryptocurrency-related firms based in Singapore, many of which are not subject to the financial regulator’s guidelines on consumer protection or market conduct, has triggered worries about tighter regulation.

The MAS will seek public feedback on its proposals by October, Menon said, adding that reviews are ongoing by regulators globally.

In January, the MAS issued guidelines to limit cryptocurrency trading service providers from promoting their services to the public. Read full story

Cryptocurrencies have plunged this year, as U.S. interest rate increases and runaway inflation prompt investors to ditch riskier assets.

“MAS’ facilitative posture on digital asset activities and restrictive stance on cryptocurrency speculation are not contradictory,” Menon said.

U.S. crypto exchange Gemini and Huobi, a crypto exchange initially focused on China, are among those with a major presence in Singapore.

About 180 crypto companies applied for a crypto payments license to the MAS in 2020 under a new regime but Singapore has handed out only about two dozen licenses so far after an elaborate due diligence process that is still going on.

Follow Crypto Intelligence on Google News to never miss a story

Recently, the world-renowned cryptocurrency trading platform MEXC launched a new M-Day event. This is a welfare event for MX Token holders and mainstream token traders. Participants can exchange new project tokens at a discounted price or free of charge.

The project launched by MEXC this time is the latest NFT Index token ENSDOMAIN. The index token is supported by more than 20 four-digit pure digital ENS domain names purchased by MEXC. These domain names have then been split into 26 million ENSDOMAIN index tokens.

According to MEXC’s announcement, the winning users who trade mainstream token spots, leveraged exchange-traded funds (ETFs) and futures during the event can use MX Token to exchange the index token ENSDOMAIN at a discounted price.

It is particularly worth mentioning that MEXC will burn all the MX Tokens received in this event.

Since December 2021, MEXC has continued to burn more MX Tokens. In MX Token 2.0, 100 million of the 450 million MX Tokens held by the team will be directly and permanently burned. Meanwhile, starting from Q1 this year, 40% of the platform’s profits will be used to repurchase and burn MX Token to ensure its deflation in the secondary market.

According to the data of the Ethereum explorer Etherscan, the total supply of MX Token has dropped from 450 million in December 2021 to about 443 million at present. Since the burning of MX Token in Q2 has not begun yet, the data only includes the number of MX Tokens burned in Q1 2022.

Up until now, the circulation of MX Token in the secondary market is about 93.8 million. Judging from this MEXC initiative, the platform will not only continue to use the platform’s profits to buy back MX Token to achieve its goal of substantial burning but will also continue to use the platform’s activities and events to strengthen the use cases of MX Token and the burning of MX Token in order to reduce its circulation in the secondary market.

Whether it is a centralized exchange or a decentralized exchange, these platform tokens have always been the sector and projects that have been paid attention to. However, the platform token of the decentralized exchange is currently used for governance only and lacks a certain value, while the platform token of the centralized exchange has already had a large number of use cases within the platform.

For example, MEXC has launched a series of activities, such as M-Day, Launchpad, MX DeFi and Kickstarter, that highlight MX Token. MX Token holders can participate in these activities to get rich rewards.

These moves have boosted the value of MX Token. Comparing platform tokens, BNB, MX Token, FTX Token (FTT) and KuCoin Token (KCS) have all increased by more than 800% in the past two years. In the past year, MX Token has had the most outstanding performance, achieving growth of up to 185.42%, while the growth of BNB, FTX and KCS in the past year is only -9.83%, 2% and 3.05%, respectively.

At present, the market capitalization of MX Token is $122 million, and the market cap of BNB, which ranks fifth, is $47.8 billion. The market cap of the former is only 1/391 of the latter.

The analysis agency ICO Analytics used SimilarWeb to analyze and conclude that MEXC’s network traffic increased by 27% in July, making it the trading platform with the largest traffic growth among the 20 mainstream cryptocurrency trading platforms in the world.

In 2021, MEXC won the title of “Best Crypto Exchange in Asia” at the Crypto Expo Dubai. Some analysts pointed out that the core reason why MEXC is well-known to global cryptocurrency traders in just a few years is that it is able to quickly discover high-quality crypto assets, provides professional products and user services, and puts more emphasis on localization when promoting its global operation strategies.

Judging from the achievements of MEXC’s global development in the past two years and the rapid growth of its global users, the market value of MX Token is at an early stage, and its valuation may also be seriously underestimated.

About MEXC

MEXC is the world’s leading cryptocurrency trading platform, providing one-stop cryptocurrency trading services for spot, ETF, futures, staking, NFT Index, etc., and serving more than 7 million users worldwide. The core team has a solid background in traditional finance and has professional financial product logic and technical security guarantees in terms of cryptocurrency products and services. Currently, it supports the trading of more than 1,400 cryptocurrencies and is the trading platform with the fastest launch speed for new projects and the most tradable categories. Visit the website and blog for more information and follow MEXC Global and MEXC Research.