A South Korean think tank specializing in finance and economics has advised against approving spot crypto exchange-traded funds (ETFs) in the country.

Bo-mi Lee, a researcher at the Korea Institute of Finance, argued in a paper that global experiences with spot Bitcoin and Ether ETFs indicate that the potential losses outweigh the benefits.

Lee emphasized that the introduction of spot crypto ETFs could jeopardize financial stability in South Korea.

The paper suggested that the approval of these ETFs could lead to a significant influx of capital into the crypto market, especially if digital asset prices rise.

This, in turn, could cause inefficiencies in resource allocation.

Furthermore, Lee pointed out that financial market liquidity and the health of financial companies could deteriorate when asset prices fall.

Given these risks, Lee stressed the need for more thorough research into the potential consequences of introducing spot crypto ETFs.

The researcher currently believes that the potential losses exceed any possible benefits.

Lee also highlighted the ongoing lack of understanding of digital asset value and their high volatility.

The introduction of such products might mislead market participants into perceiving them as “proven assets.”

READ MORE: Mark Cuban Falls Victim to Hoax Call, Loses Gmail Access Months After Crypto Wallet Hack

Lee also warned that risks would increase with the introduction of spot crypto ETFs.

He argued that robust regulatory measures must be in place to mitigate these risks.

Lee underscored the uncertainty surrounding the impact of digital assets on investors and the financial market, urging regulators to develop comprehensive measures before proceeding with the approval of such ETFs.

In response to growing concerns, South Korea’s financial regulator is tightening its rules on crypto assets to enhance user protection.

Beginning July 19, registered crypto exchanges in South Korea will be required to evaluate the tokens listed on their platforms.

These exchanges must determine whether to continue supporting or delist these tokens.

Under the new regulations, all registered exchanges must review over 600 listed crypto assets.

Exchanges that fail to comply with the new regulations will face severe penalties, including fines and potential jail sentences.

To submit a crypto press release (PR), send an email to sales@cryptointelligence.co.uk.

CoinShares International, a European investment company specializing in digital assets, has successfully sold its FTX claim.

The sale, pending customary closing conditions, is expected to yield a recovery rate of 116% after broker fees, according to an official press release. This results in a return of 31.32 million British pounds ($39.78 million) on a claim of 26.6 million pounds ($33.78 million).

This successful sale allows CoinShares to offer increased returns to its shareholders and provide enhanced services to its clients. Jean-Marie Mognetti, CEO of CoinShares, highlighted the significance of this development, stating,

“The resolution of the FTX situation has been highly favorable for CoinShares.

“This exceptional recovery rate is a testament to the diligence and expertise of our team.”

The sale will enable CoinShares to reinvest in growth opportunities to improve its market position. Mognetti emphasized,

“We remain dedicated to leveraging this success to reward our shareholders and to drive further growth and innovation within the digital asset industry.”

READ MORE: Mark Cuban Falls Victim to Hoax Call, Loses Gmail Access Months After Crypto Wallet Hack

In August 2022, CoinShares reported its interim second-quarter results, revealing $21.7 million in losses due to its exposure to Terra (LUNA), which collapsed in May of the same year.

Despite this setback, Mognetti assured that CoinShares had “sufficient resources” to continue market activity, thanks to an effective strategy.

The company’s recent 116% recovery on its $39.78 million FTX claim underscores its resilience and strategic success.

On June 20, the Japanese crypto exchange bitFlyer announced its plan to acquire the Japanese arm of the collapsed FTX exchange.

Initially, bitFlyer Holdings will rebrand FTX Japan as New Custody Company until a new name is determined.

According to local news sources, this acquisition will cost bitFlyer billions of yen or tens of millions of dollars.

This series of events highlights the ongoing developments and strategic maneuvers within the digital asset industry, showcasing the resilience and adaptability of key players like CoinShares and bitFlyer amidst the challenges posed by significant market disruptions.

To submit a crypto press release (PR), send an email to sales@cryptointelligence.co.uk.

In the past two days, Bitcoin whales have significantly reduced their transaction activity just before Bitcoin’s price dipped below $63,000.

According to data from Santiment, on June 23, the total number of Bitcoin whale transactions (those exceeding $100,000) dropped to 9,923, marking a 42% decrease from the 17,091 transactions recorded during the two preceding days.

This shift in whale behavior coincided with Bitcoin’s price decline from $64,685 to $63,422, and it has since fallen further to $62,531 at the time of publication, as reported by CoinMarketCap.

At the same time, whale traders who speculate on Bitcoin’s future price have also pulled back, as noted by CryptoQuant CEO Ki Young Ju.

“Whale traders on derivatives exchanges are in risk-off mode,” Ki stated in a June 23 X post, referring to a bearish shift in market sentiment.

Ki attributed the decline to the inter-exchange flow pulse (IFP) turning “red.” The IFP, which tracks Bitcoin movements between spot and derivative exchanges, reflects market sentiment.

A red IFP indicates that more traders are withdrawing their Bitcoin from derivatives exchanges, which are used for entering financial contracts based on Bitcoin’s future price.

READ MORE: Softbank CEO Predicts AI Will Be 10,000 Times Smarter Than Humans by 2035

Additionally, the Crypto Fear and Greed Index, which gauges crypto market sentiment, fell to a “Neutral” score of 51.

This is the lowest score in 51 days, following Bitcoin’s drop below the critical $60,000 level to $59,122.

Spot Bitcoin exchange-traded funds (ETF) have also experienced a series of outflows over the past six trading days, according to Farside data. T

he largest single-day outflow during this period was $226.2 million on June 13.

Despite these bearish indicators, some analysts see signs of optimism for Bitcoin’s price.

Glassnode lead analyst James Check, known as “Checkmatey,” highlighted the Bitcoin Sell-side Risk Ratio as a positive indicator in a June 23 X post.

“The Bitcoin Sell-side Risk Ratio has reached levels signaling it is time for the market to move,” Check wrote.

“All the profits that were going to be taken, have been. Same for losses,” he added, suggesting that Bitcoin will need to “find a new price range to stoke the fire of fear, greed, panic, or euphoria.”

To submit a crypto press release (PR), send an email to sales@cryptointelligence.co.uk.

Mt. Gox, the cryptocurrency exchange that lost 850,000 Bitcoin in investor funds in 2014, will begin repaying its defunct users.

Starting July 2024, the rehabilitation trustee will process repayments in Bitcoin (BTC) and Bitcoin Cash (BCH), according to a note from the exchange issued on June 24.

“The Rehabilitation Trustee will commence the repayments in Bitcoin and Bitcoin Cash in due course to the cryptocurrency exchanges with which the Rehabilitation Trustee has completed the exchange and confirmation of the required information for implementing the repayments.”

The trustee has asked users for patience, emphasizing that the order of payments will depend on the respective cryptocurrency exchange: “We will commence the repayments in the order of the cryptocurrency exchanges with which the Rehabilitation Trustee will complete the exchange and confirmation of the required information. Please wait for a while until the repayments are made.”

Approximately $9.4 billion worth of Bitcoin is owed to about 127,000 creditors of Mt. Gox.

These creditors have waited over 10 years to recover their funds following the exchange’s collapse in 2014 due to multiple unnoticed hacks.

The repayment process includes the $9.6 billion Bitcoin transfer in May, which was already part of this process.

On May 28, Mt. Gox moved 141,686 BTC, valued at $9.62 billion, into a new wallet, “1Jbez,” from several other cold wallets associated with Mt. Gox.

READ MORE: Binance Aids BtcTurk in Cyber Attack Investigation, Freezes $5 Million in Stolen Funds

This marked the first on-chain movement of funds from the collapsed exchange in over five years.

Shortly after these reports, Mt. Gox rehabilitation trustee Nobuaki Kobayashi confirmed that the consolidation was part of the repayment plans but did not specify when repayments would start.

Kobayashi stated on May 28: “The Rehabilitation trustee is preparing to make repayment for the portion of cryptocurrency rehabilitation claims to which cryptocurrency is allocated… As the Rehabilitation trustee is proceeding with the preparation for the above repayments, please wait for a while until the repayments are made.”

Mt. Gox was one of the earliest cryptocurrency exchanges, once handling more than 70% of all trades within the blockchain ecosystem.

The exchange went offline in 2014 after a security breach led to the loss of over 850,000 BTC in user funds, worth over $51.9 billion at today’s Bitcoin price of $61,100.

Despite the announcement, the repayment deadline could face further delays, as it was initially set for October 31, 2023.

To submit a crypto press release (PR), send an email to sales@cryptointelligence.co.uk.

Ether could drop to as low as $2,400 following the launch of spot Ether exchange-traded funds (ETFs), according to Andrew Kang, founder and partner at crypto-focused venture capital firm Mechanism Capital.

As per CoinGecko, Ether is currently trading at $3,410. A fall to $2,400 would represent a nearly 30% decrease from its current price.

In a June 23 X post, Kang noted that, unlike Bitcoin, Ether attracts less institutional interest, there are few incentives to convert spot Ether into ETF form, and the network cash flows have been underwhelming.

“How much upside would an ETH ETF Provide? I would argue not much,” Kang said.

The projected price drop would be significant for the asset, especially since Ether had previously surpassed $4,000 in March when Bitcoin reached a new all-time high.

It nearly hit the same level again just before the United States Securities and Exchange Commission (SEC) approved Ether ETFs.

Kang predicts that spot Ether ETFs will attract only 15% of the flows that spot Bitcoin ETFs have seen.

Bloomberg ETF analysts Eric Balchunas and James Seyffart estimate these flows to be in the 10-20% range.

Kang pointed out that only $5 billion in new funds, excluding converted funds, flowed into spot Bitcoin ETFs in the first six months.

Applying this data to Ethereum suggests that spot Ether ETFs could see $840 million in “true” inflows over the same period.

“I believe that the expectations of crypto natives are overinflated and disconnected from the true preferences of tradfi allocators,” Kang said. “This implies that the ETF is more than priced in.”

READ MORE: Binance Aids BtcTurk in Cyber Attack Investigation, Freezes $5 Million in Stolen Funds

However, not everyone agrees with Kang’s prediction. Industry analyst Patrick Scott (widely known as Dynamo DeFi) told Cointelegraph Magazine that he “expects a similar directional movement” to how the spot Bitcoin ETFs have performed, though he doesn’t foresee Ether’s price doubling.

VanEck, an asset management firm, believes spot Ether ETFs could help drive Ether to $22,000 by 2030.

Kang argued that Ethereum’s appeal as a decentralized financial settlement layer or Web3 app store is less convincing when considering the data.

He noted that Ethereum’s promising future as a cash flow “machine” has waned since fees were driven up by decentralized finance and the last non-fungible token cycle.

“At $1.5B 30d annualized revenue, a 300x PS ratio, negative earnings/PE ratio after inflation, how will analysts justify this price to their daddy’s family office or their macro fund boss?” Kang questioned.

The surprise approval of Ether ETFs means issuers have less time to market to institutional investors. Bitwise and VanEck are among the few approved applicants that have already released Ethereum-themed ads.

Kang also mentioned that the removal of staking from proposed spot Ether ETFs might deter investors from converting their spot Ether into ETF form.

While institutions like BlackRock are venturing into the real-world asset tokenization space on Ethereum, Kang is unsure of its impact on Ether’s price.

He predicts the ETH/BTC price ratio could drop from 0.054 to as low as 0.035 in the next 12 months.

However, he believes a Bitcoin rally to $100,000 in the next six to nine months could “drag” Ether to a new all-time high.

To submit a crypto press release (PR), send an email to sales@cryptointelligence.co.uk.

Cryptocurrency portfolio manager CoinStats has suspended user activity temporarily following a security breach that impacted 1,590 crypto wallets.

“The attack has been mitigated, and we have temporarily shut down the application to isolate the security incident,” CoinStats wrote in a June 22 X post.

“Thanks to the immediate incident response from the CoinStats team, only 1.3% of all CoinStats Wallets were affected, totaling 1,590 wallets,” it added, emphasizing that “none of the connected wallets and CEXes were impacted.”

The full extent of the security breach’s impact remains undisclosed, but CoinStats has promised to provide “updates as soon as they become available.”

On its website, CoinStats claims that since it “asks for read-only access” to connected crypto wallets, users’ holdings remain “perfectly safe under any conditions.”

CoinStats enables users to connect all their crypto wallets, serving as a comprehensive crypto portfolio tracker that allows viewing all wallets in one place.

The platform has published a Google document listing the currently affected crypto wallets, noting that the list “might change” as the investigation continues, though significant changes are not expected.

“If your wallet address is in this affected list, please move your funds immediately using your exported private key,” CoinStats advised.

Meanwhile, members of the crypto community have warned victims to be wary of scammers pretending to offer assistance.

READ MORE: Bitcoin Faces Rare ‘FUD’ Surge Amid Sideways Trading, Analysts Predict Potential Price Surge

“Scammers are smart. If your addy is in this list or if you’ve used coinstats and posted about it scammers may be trying to reach out to you to “help” you.

“Do not trust anyone,” pseudonymous crypto commentator PPman wrote.

This incident follows a series of security breaches affecting other crypto platforms.

Recently, crypto data aggregator CoinGecko confirmed a data breach suffered by its third-party email management platform GetResponse, exposing the contact information of over 1.9 million CoinGecko users.

Additionally, on June 12, Crystal Intelligence reported that the crypto industry has faced 785 hacks and exploits over the past 13 years, resulting in nearly $19 billion worth of digital assets being stolen since the first known crypto hack in 2011.

Cointelegraph reached out to CoinStats for comment but did not receive a response in time for publication.

To submit a crypto press release (PR), send an email to sales@cryptointelligence.co.uk.

Binance is reportedly aiding in the investigation of a malicious attack on Turkish cryptocurrency exchange BtcTurk, resulting in the freezing of over $5 million in stolen funds, according to Binance CEO Richard Teng.

“Binance is assisting BtcTurk with investigations and have frozen over $5.3M in stolen funds so far,” Teng shared in a June 22 X post.

BtcTurk disclosed on its website that the attack primarily targeted holdings in hot wallets, which are internet-connected software-based crypto wallets.

While hot wallets facilitate frequent transactions, they are more susceptible to cyberattacks compared to offline cold storage.

“Only a portion of the balances of 10 cryptocurrencies in our hot wallets were affected by this cyber attack, while the majority of assets held in our cold wallets remain secure,” stated BtcTurk in a June 22 announcement, translated from Turkish.

The exchange boasts over five million users.

Teng also informed his 299,800 followers on X that Binance would provide updates as more information becomes available.

READ MORE: Top Asset Managers File Revised Proposals for Ethereum ETFs with SEC, Eye July Launch

“Our investigations & security teams work around the clock as part of our proactive efforts to protect the ecosystem from bad actors.

“We will provide further updates as relevant,” Teng stated.

Blockchain investigator ZackXBT commended Binance for its community support during security breaches.

“Binance gets crucified by the media when in reality their security team generally does more for victims + goes out of their way to assist in incident response,” ZackXBT posted on June 22.

BtcTurk’s CEO Özgür Güneri has not publicly commented on X regarding the incident.

This event follows closely on the heels of another incident where Swiss-based crypto exchange Lykke halted withdrawals after an exploit on June 4.

Blockchain security researcher SomaXBT accused Lykke of attempting to conceal the breach, stating, “@lykke CTX got exploited and lost $19.5 million worth crypto assets but the team is still trying to hide this fact.”

Cointelegraph has reached out to BtcTurk for comment but did not receive a response at the time of publication.

To submit a crypto press release (PR), send an email to sales@cryptointelligence.co.uk.

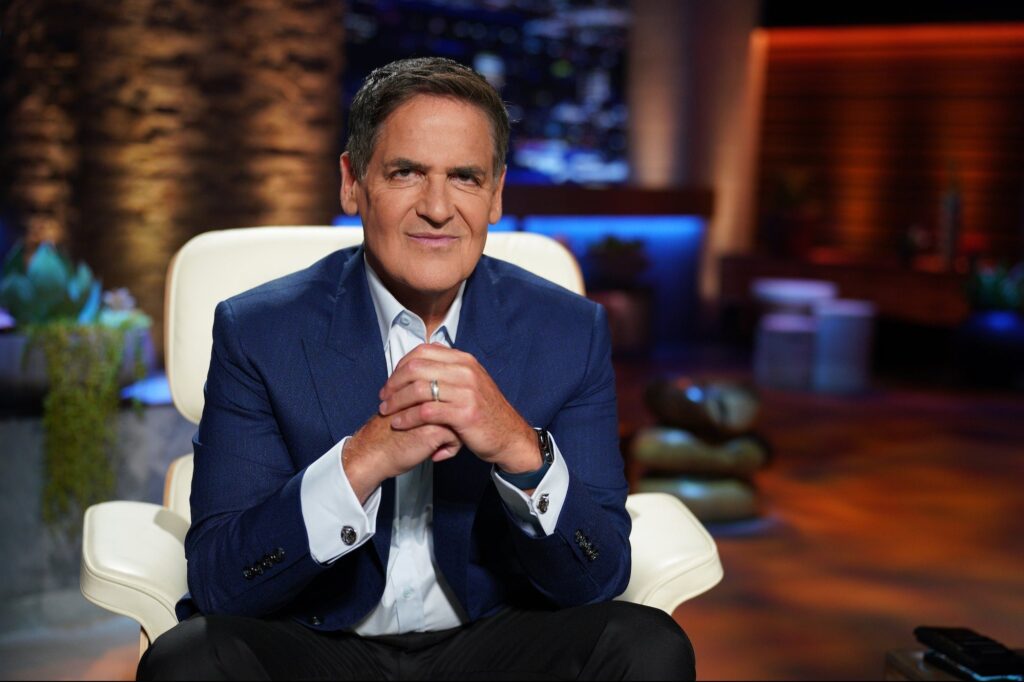

Billionaire investor Mark Cuban has revealed that he lost access to his Gmail account following a hoax call, just months after more than $800,000 was drained from his cryptocurrency wallet.

“I just got hacked at my mcuban@gmail.com because someone named Noah at your 650-203-0000 called and said I had an intruder and spoofed Google’s recovery methods,” Cuban posted on X (formerly Twitter) on June 22.

This scam typically involves tricking users into providing personal information or account credentials by pretending to be an official representative, in this case, from Google.

Cuban cautioned his 8.8 million followers, “If anyone gets anything from mcuban@gmail.com after 3:30pm pst it’s not me.”

The crypto community responded with supportive messages, though some speculated about the number of emails he might miss during his lockout.

“When you get your access back, please post a screenshot of the number of unread emails.

“I’m betting it is up to 5 digits by now,” wrote Nick Percoco, chief security officer of crypto exchange Kraken. Some even wondered if his X account was also compromised.

READ MORE: LayerZero’s ZRO Token Launch Spurs 16,680% Surge in Arbitrum Fees, Sets Revenue Record at $3.43M

“Is it POSSIBLE that his X account has now been hacked also by the hackers?

“Therefore they’re trying to get more information,” speculated a user named Mickamious.

This incident follows a significant security breach Cuban experienced nine months ago, when his cryptocurrency wallet was drained of approximately $870,000.

Hackers likely targeted Cuban after he logged into MetaMask for the first time in months.

In September 2023, Cointelegraph reported that independent blockchain investigator Wazz noticed suspicious activity in one of Cuban’s wallets, which he had not used for about five months.

Despite these setbacks, Cuban has remained an outspoken advocate for cryptocurrency.

He has been particularly vocal about the need for more favorable crypto regulations in the United States.

Recently, Cuban argued that the U.S. Commodity Futures Trading Commission (CFTC) should regulate “all crypto” rather than the U.S. Securities and Exchange Commission (SEC), criticizing the SEC’s approach of regulation by enforcement in the crypto industry.

To submit a crypto press release (PR), send an email to sales@cryptointelligence.co.uk.

Masayoshi Son, the founder and CEO of Softbank, has predicted that artificial intelligence (AI) will surpass human intelligence significantly in the coming years.

By 2030, Son believes AI will be one to ten times smarter than humans, and by 2035, it will be 10,000 times smarter.

Son made these remarks during Softbank’s annual meeting in Tokyo on June 21.

In his emotional address, he outlined the company’s future priorities, emphasizing its commitment to developing “artificial super intelligence” (ASI), which he claims will revolutionize human life.

In his speech, Son differentiated between artificial general intelligence (AGI) and ASI. He explained that AGI would represent a human-level “genius” intelligence, up to ten times smarter than the average person. In contrast, ASI would be 10,000 times more intelligent, far exceeding the human brain’s capabilities.

It’s important to note that there is currently no scientific consensus on the capabilities of AGI or ASI, or even if such entities are achievable with today’s technology.

AI systems with human-level reasoning remain theoretical at this stage.

READ MORE: Bitcoin Faces Rare ‘FUD’ Surge Amid Sideways Trading, Analysts Predict Potential Price Surge

Son also discussed Softbank’s future and his own mortality, which seemed to concern some investors.

This sentiment was reflected in the stock market, as Softbank’s shares dropped more than 3% when the Tokyo Stock Exchange closed following the meeting.

In a video of the event, Son mentioned that two years ago, he realized he was “getting old” and felt a strong desire to achieve more before his life ends.

He added, “SoftBank was founded for what purpose? For what purpose was Masa Son born? It may sound strange, but I think I was born to realize ASI. I am super serious about it.”

Son’s vision underscores Softbank’s ambitious goal of leading the development of AI technologies that could profoundly impact society.

Despite current technological limitations, his commitment to advancing AI reflects a bold and futuristic outlook for the company.

To submit a crypto press release (PR), send an email to sales@cryptointelligence.co.uk.

The founder of the Rizz (RIZZ) memecoin experienced a dramatic downturn during a live pitch on X, as the cryptocurrency’s value plummeted by 90% in real-time, leaving viewers in shock.

Nicolas Vaiman, CEO of Bubblemaps, joined the X Space just before the collapse and witnessed the events unfold. Bubblemaps detailed the incident in a thread on X with the heading, “This Space was wild.”

According to Bubblemaps, RIZZ was launched on the Solana platform on June 18.

“With a decent $8M in volume,” the team noted, “the founder was invited to introduce his token on a live Space.”

“However, things quickly deteriorated.

The Bubblemaps team raised questions about the “bubbles” – clusters showing large holdings in a few accounts – displayed on the coin’s bubble map.

The thread revealed that “their team quickly confirmed they controlled over 80% of the supply.”

Bubblemaps indicated that early transactions suggested the sell-off was driven mainly by initial snipers who bought within the first minutes of the token launch.

READ MORE: Bitcoin Drops Below $64,000: Potential Further Decline to $60,000 Amid Market Volatility

Cointelegraph reached out to Nicolas Vaiman, who revealed he joined the Space unexpectedly. During the event, the founder became emotional.

“When the price collapsed, the founder of Rizz sounded emotional, and I felt uncomfortable asking questions. At one point, I even thought he might be crying,” Vaiman said.

Vaiman also mentioned a claim that Rizz founder “Rick” wasn’t actually in control. “Instead,” he said, “a group of devs from Singapore, known for creating meme coins and rugging, were running things.”

“These devs try to keep a large portion of the supply by receiving tokens from the initial deployer wallets and sniping tokens with fresh wallets funded by centralized exchanges.

This makes tracing the wallets difficult, but timing analysis can reveal connections as they snipe tokens very early.”

To submit a crypto press release (PR), send an email to sales@cryptointelligence.co.uk.