Only1, the Web3 social platform backed by Alameda Research and Animoca Brands — where users launch Passes as semi-fungible tokens (SFTs) and post exclusive content for holders — is about to launch a new ex-Marvel artist-designed nonfungible token (NFT) collection, “Acid Monkeys,” on Sept. 1.

Web3 OnlyFans to bring adoption to the masses by Q4 2022

Similar to Patreon and OnlyFans, Only1 allows content creators to monetize their content through a paywall, where instead of a subscription, creators launch their own passes as SFTs, and the holders are granted access to the creator’s content.

The future of NFTs and SFTs

Most SFTs and NFTs today are profile picture collectibles; however, the market is at a turning point now where developers are starting to give these tokens real utility. GameFi is one of the focuses for such utility, such as using NFTs as tradable in-game items. SocialFi is the other major focus using NFTs as a means of access to content creators. This allows creators to monetize their content directly and connect with fans through Web3.

Many innovative creators have already experimented with NFTs and found massive success. Gary Vaynerchuk famously launched VeeFriends, a collection of 10,255 NFTs on the Ethereum blockchain that grants holders different levels of access to Gary, including FaceTime calls, or even having a one-on-one workout with him. Irene Zhao, the famous ex-chief marketing officer of Konomi Network, also launched her NFT collection, IreneDAO, on the Ethereum blockchain to grant holders access to her exclusive Discord channel and even the opportunity to invest in her new startup, So-Col.

The creator economy will drive the next bull cycle

The narrative to drive the industry to the next bull cycle is going to be end-consumer adoption, and the $100-billion creator economy is in the middle of it with all its Generation Z TikTok dance videos and content creators as businesses-of-one. Only1 has been building through the bear market and is ready to launch the passes feature for the whole world in Q4 2022.

Unlike Zhao or Vaynerchuk, who have to go through a lengthy process of hiring developers and using multiple platforms, anyone can soon launch passes for their fans and connect with them through exclusive content, Web3 messengers and more. The Only1 ecosystem is powered by LIKE, while platform revenue from NFT launches and creator passes will be used for token buyback, burn and redistribution to active users on the platform, a process called create-to-earn.

Only1’s initial NFT offering: An innovative and fair launchpad

An initial NFT offering (INO) is a new funding model for creators where NFTs are offered to the public for the first time on the Only1 launchpad. The term INO was coined by Only1 on CoinMarketCap and featured on Cointelegraph as early as September 2021.

How does an INO work?

At the beginning stage, creators and upcoming projects provide plans and roadmaps to the community. Creators would launch on a first-come-first-serve basis or lottery model to fairly distribute their NFTs. NFT launches may require LIKE staking in order to receive whitelists or allocations from upcoming NFT projects.

Easy-to-launch NFT projects

Through INOs, anyone can issue limited-edition NFTs through the Only1 launchpad. INOs enable everyone with both big and small ideas to be recognized by a wider range of audiences. Many creators who are still in the process of creating their masterpieces would need new funding to finance their projects. With INOs, any artist can raise the needed funds before creating.

On-chain random function to ensure fairness

Only1 developed its own on-chain randomness function on Solana using Zig technology. This ensures the lottery system or allocation of NFTs is fair.

Early community building

Only1 will allow the community to vote for promising projects to be listed on the platform and reward the winners. The exposure encourages potential investors to look into NFT projects. The mechanism enables creators to build an early community of active traders and experienced investors around the NFT project.

For NFT projects and creators, an INO rises as a brand new type of offering that leverages the strongest elements of NFT technology by empowering them to kick-start their success stories. To apply for an INO, click here.

Acid Monkeys NFT launches on Only1 Sept. 1

Acid Monkeys is a dark age comic-inspired profile picture collection of 5,000 escaped lab experiments on the Solana blockchain. The project is backed by a strong focus on lore and community and designed and cultivated by ex-Marvel artists.

Mint details:

- Quantity: 5,000 NFTs

- Price: Whitelist — 1.38 SOL; Public — 1.68 SOL

- Launch Model: Lottery

- Launchpad Link: https://only1.app/launchpad/acid-monkeys

Follow Crypto Intelligence on Google News to never miss a story

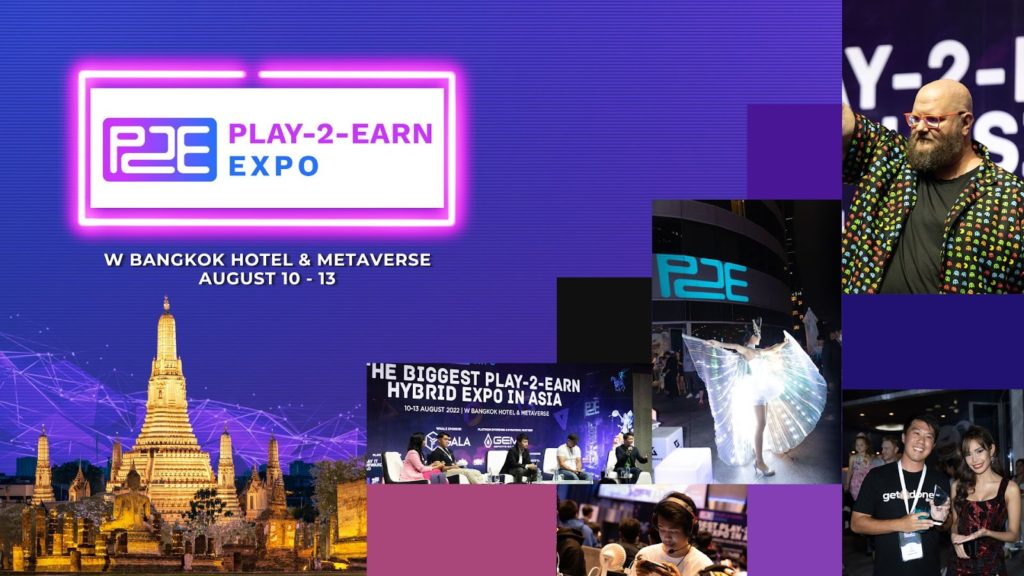

Known as Asia’s biggest play-to-earn expo, Play-2-Earn Hybrid Expo Asia finally took place from Aug. 10 to 13 at the W Bangkok and in the Metaverse. The four-day event was the first of its kind to focus specifically on the play-to-earn industry.

The event’s guest list comprised over 260 physical and 300 virtual C-suite attendees. This included Jason Brink from Gala Games, Rich Robinson from Animoca, Andy Koh from the Gems esports 3.0 platform, Tatsuya Kohrogi from Digital Entertainment Asset (PlayMining), Irene Umar from YGG SEA and Cholo Maputol from Play It Forward DAO.

Day one: Welcome drinks and snacks at The House on Sathorn

Welcoming Play-2-Earn’s biggest names from all over the world, the first day of Play-2-Earn Hybrid Expo Asia kicked off with welcome drinks and snacks in the House on Sathorn, a multi-entertainment venue adjacent to W Bangkok.

The driveway leading up to the entrance had rows of banners with P2E’s valued sponsors, including Gala Games, ByBit, Ethlas and Playgroundzero.io. By the DJ booth, there were also light-up cubes with P2E sponsor logos.

All guests had access to a wide spread of food and an open bar, which quickly livened up the evening. A short program featured the official launch of the event and a special performance from traditional Thailand dancers.

The night was also a chance for guests to start building their bridges within the industry. Many networked and made friends, some of whom were meeting for the first time.

Day two and three: Keynotes, panels, networking, game pitches and afterparties

The next two days for Play-2-Earn Hybrid Expo Asia had a packed schedule, beginning with special keynotes from Jason Brink of Gala Games (“The Web3 future of play-and-earn gaming”) and Andy Koh of Gems (“Riding on the wave of blockchain and Web3”) for days two and three, respectively.

The event also featured back-to-back panel discussions that featured names such as Corey Wilton of Pegaxy, Paul Kim of Com2Us, Adrian Ho of Binance, Anastasia Drinevskaya of Cointelegraph and Charles Huh of WeMade.

On the hybrid side, business matching portals were set up for all attendees. Through the official P2E app, guests could schedule meetings with each other, meeting up physically through P2E’s meeting rooms or online. Virtual booths were also live during the expo, ensuring that attendees around the world can not only watch, but also participate in Play-2-Earn Hybrid Expo Asia.

Game pitch competition

Another highlight of the expo was its game pitch competition, where eight nominees shortlisted from hundreds of applicants were given a chance to pitch to an impressive lineup of judges from DFG/Jsquare, Faculty Group, Openspace ventures, SeaX Ventures and YGG SEA.

Each game project was given 15 minutes to present its pitch, including Q&As. This was easily one of the most sought-out parts of the expo, showcasing the up-and-coming talent of the P2E industry.

Osbiome took home the trophy for its Omeverse pitch, which is the first health-to-earn metaverse for personalized health. Omeverse users will have their own Web3 digital pet that will guide them on their future health journeys.

Play hard, party harder

Back-to-back afterparties were scheduled for days two and three, with the GameFi community gathering at Woo Bar and the Wet Deck respectively. DJs Nicole Chen, Celeste Chen and Amy Kao led the night to a state of pure hype and energy, invigorating the P2E Expo spirit in Bangkok.

Both parties had an open bar, served a mix of international and local cuisines, and were conducive to networking. The third day’s afterparty at the Wet Deck was top notch, with special drumming and dancing performances as well as appearances from mermaids.

Day four: Gems mobile gaming tournament

Thirty-two teams and a total of 120 PubG players competed for a $1,370 (50,000 THB) prize pool on the last day of Play-2-Earn Hybrid Expo Asia. Known as the Gems Thailand PubG Mobile Tournament, the event’s platinum sponsor and strategic partner Gems took over operations for the fourth day, which were held in the main expo hall.

Team ChaPoKit was hailed as the champion of the nine-hour tournament. Bacon Times and E29 Esports Gaming placed second and third place, respectively.

What’s next for Asia’s largest play-to-earn expo?

Play-2-Earn Hybrid Expo Asia, the first business-to-business play-to-earn event in Asia, is looking to host a subsequent expo in Bali, Indonesia during the first quarter of 2023. Like Bangkok, Bali is known worldwide as a hotspot of talent for the Web3 and blockchain industry.

The Harvest has announced that they will be holding their NFT Sale on Binance NFT on August 29th, 2022. The Harvest has been among the most promising game launches of 2022 thus far, and their first NFT sale with Fractal in July of this year was a resounding success, selling out in just a few minutes.

Why does the sale matter?

This is an early-bird opportunity to acquire the O’Ree-Jin Limited NFT Collection that contains one of the rarest sets for the first four heroes of the game. Binance users can enjoy a discounted price prior to the open beta scheduled for October 2022. There are 500 Legendary Boxes for sale at 200 BUSD each, which sets the overall sale value at 100,000 BUSD.

As to why the sale is significant, the NFTs provide a completely new experience in the game and adds massive replay value. Also, although players begin with common free cards, they will eventually be given the opportunity to earn or buy NFT cards with unique abilities as they progress through the game, which can then be utilized during matches, leveled up, or even sold in the marketplace if desired.

What can the cards be used for?

The most important part about the cards is that they represent different useful abilities and have a rarity index as well as a level system associated with them. The cards can also be upgraded in addition to granting the hero new powers or enhancements. They even include scarce characteristics like glossy images or unique traits.

Each type of card will also play a vital role in the game. For instance, the ‘Ability Cards’ are crucial because they allow players to upgrade and expand their abilities. There are also other types of cards like the ‘Companion Cards’ and ‘Calling Cards’. Finally, skins, player icons and emoticons allow players to personalize their appearance, enhancing user experience by providing an even greater sense of individuality in the game.

What else is there to know?

The Harvest is currently in pre-alpha, and anyone can join their Discord server to play. The Open Beta version will be available in early October of this year, with the full game expected to be available in February 2023.

Furthermore, The Harvest has achieved significant PR, partnered with large investors, and engaged a massive community consisting of tens of thousands across multiple platforms like Twitter, Discord, and their YouTube channel in a relatively short period of time. The game’s popularity and reach are expected to grow even further with the announcement of their second NFT sale on one of the biggest cryptocurrency exchanges, Binance.

About The Harvest

The Harvest is a fast-paced P&E (Play and Earn) shooter with MOBA (Multiplayer Online Battle Arena) elements that utilizes cutting-edge emerging technologies such as NFTs and the metaverse. It’s a new take on the ‘Class-Based Hero-Shooters’ genre in which the player fights alongside teammates from various civilizations against other players in order to gain control of the universe’s essence. Players can select their own heroes and play to earn #HAR tokens, which can be used to buy in-game NFTs or redeemed for real money.

The Harvest is developed by Falco, a Web3 gaming publisher founded by industry experts and notable crypto entrepreneurs, and is backed by impressive founders like Justin Kan (Twitch Co-founder), Robin Chan (serial gaming and tech entrepreneur and Fractal Co-founder), and Andres Bilbao (Co-founder of Rappi, Latin American Unicorn), as well as funds like Goat Capital Amber Group, Spartan Capital, Sanctor Capital, and Greek Cartel.

For additional information and regular updates, be sure to check out Falco’s official website as well as The Harvet’s official website along with the Twitter, Medium and YouTube channels. Language options in English, Spanish and Filipino are also available.

Follow Crypto Intelligence on Google News to never miss a story

Nolcha Shows, now in its 14th year, will be producing the two-day NYFW Web3 edition on the 69th floor of the iconic 3 World Trade Center on Sept. 13 and 14, 2022.

Nolcha Shows is where fashion and Web3 communities gather in real life to share knowledge, experiences and insights. Creators, investors, founders and industry leaders connect through education, entertainment and networking opportunities that spark collaboration toward building the future.

Building on their successful Web3 event series during NFT.NYC, Art Basel, Bitcoin Conference, Consensus and Permissionless, Nolcha Shows is going back to its roots and elevating the concept of NYFW.

The independent fashion pioneering brand will continue to serve as a platform for driving Web3 culture forward. The multi-day event will combine an NFT gallery, Web3 panel discussions and runway shows.

Web3 and its technology will enable unprecedented consumer experiences.

Schedule for Sept. 13

- Runway shows

- Sustainable fashion brands: Embracing fashion designers focused on sustainability and demand for ethical fashion featuring clothing brands Host and Var, Kaiane Designs, The Tailory NYC, Mauricio Alpizar, Maya Seyferth & accessory brands CoFi, Zashadu, Aumora Gems, and Anna Zuckerman.

- “Ones to Watch”: Web3, ready-to-wear and bridal wear brands ChainGuardians, Oh Polly and Nazranaa.

The highlight of the first day focuses on the emergence of AR in fashion.

ChainGuardians will showcase a Phygital Meta Street Wear collection that is inspired by the ChainGuardians Super Heroes, featuring virtual immersion technology that allows users to wear the clothing in the real world and on avatars in the Metaverse.

OhZone will bring Metaverse fashion to life through the patented 3DReal technology that automates turning physical garments into virtually stunning NFT wearables ready for the Metaverse.

Schedule for Sept. 14

The second day will consist of a series of web panel discussions that will highlight various aspects of Web3 and its impact on the fashion industry. Panel topics include:

- Female-led investments and innovation presented by Bad Bitch Empire: Women’s innovation and investment opportunities in Web3 and beyond, presented by Bad Bitch Empire and hosted by its CEO Lisa Carmen Wang, along with special guests.

- The Fashion Metaverse Economy, presented by Landvault and moderated by Ornella Hernadez, Web3 and NFT reporter at Blockworks. Panelists include LandVault CEO Sam Huber, Reed Smith partner Nick Breen, LandVault director John Kraski and Space Runners director of strategy Josh Ramjit.

- Luxury in the Metaverse, presented by Galaxy. Panelists include Andrew Isaacs, managing director in investment banking at Galaxy, and special guests.

- The Next Web, presented by Vatom. Panelists include Web3 brand activation strategist Paula Marie Kilgarriff, Vatom’s chief marketing officer Brian Wallace m and Cult & Rain founder George Yang.

- Community is the New Fashion Culture, presented by The Fashion DAO. Panelists include Echo Mah Creative Director at Tiffany & Co., Web3 digital luxury Matthew Pandolfe Web3 Digital Luxury Expert and Nico Fara CEO at Chief Metaverse Officer.

Onsite Web3 activations

ChainGuardians will offer attendees two consumer experiences. The first will be a virtual reality area where attendees can immerse themselves in a 3D digital fashion world to experience select items in the ChainGuardians Meta Street Wear line. An additional space will feature an augmented reality area that will allow attendees to interact with digital models wearing the ChainGuardians clothing.

Perfect Corp, the leading provider of AI and AR beauty and fashion tech, will offer fans an interactive runway beauty experience within the YouCam Makeup app, allowing fashion fans to immerse themselves in the glamor of New York Fashion Week by virtually trying on the beauty and fashion looks featured on the Nolcha runway through their smartphones.

NFT artist Talia Zoref, a Forbes 30 Under 30 fashion illustrator, will be sketching her illustration onsite while featuring digital wearables from her NFT collection Eyes of Fashion, whose mission is to bring more inclusion into the world of fashion, elevate strong women artists, and empower women through education.

In partnership with HeyLayer, attendees will be able to claim a Proof of Attendance Multipass NFT with unlockable content to be revealed at a later date.

Partners and sponsors include Saratoga, Vatom, LandVault, ChainGuardians, Hanjan, Chief Metaverse Officer, WHIM, AOFM Pro, Unite, Perfect Corp, PowerStation Studios, InstaSleep, Wear The Future L8, Holistic Spirits and TradeZing.

About Nolcha Shows NYFW Web3 edition

Nolcha Shows is a collection of leading award-winning experiential events. Over the past 14 years, the Nolcha Shows have become a discovery platform, promoting cutting-edge, innovative brands, connecting and building communities across the dynamic industries of lifestyle fashion and tech-driven Web3.

The curated event series is held during New York Fashion Week, NFT.NYC, Consensus, Art Basel and Bitcoin Miami.

Singapore is planning to roll out new regulations that will make it more difficult for retail investors to trade cryptocurrencies at a time when they seem to be “irrationally oblivious” about the risks, its central bank chief said.

Ravi Menon, managing director of the Monetary Authority of Singapore (MAS), said at an event on Monday that despite warnings and measures, surveys show that consumers are increasingly trading in cryptocurrencies globally, not just in Singapore, attracted by the prospect of sharp price increases.

“They seem to be irrationally oblivious about the risks of cryptocurrency trading,” he said.

“Adding frictions” on retail access to cryptocurrencies was an area the MAS was contemplating, he said.

“These may include customer suitability tests and restricting the use of leverage and credit facilities for cryptocurrency trading,” he added at a seminar titled “Yes to digital asset innovation, No to cryptocurrency speculation.”

Singapore’s welcoming approach has helped the financial hub attract digital asset services-related firms from China, India and elsewhere in the last few years, making it a major center in Asia.

But recent defaults of some global cryptocurrency-related firms based in Singapore, many of which are not subject to the financial regulator’s guidelines on consumer protection or market conduct, has triggered worries about tighter regulation.

The MAS will seek public feedback on its proposals by October, Menon said, adding that reviews are ongoing by regulators globally.

In January, the MAS issued guidelines to limit cryptocurrency trading service providers from promoting their services to the public. Read full story

Cryptocurrencies have plunged this year, as U.S. interest rate increases and runaway inflation prompt investors to ditch riskier assets.

“MAS’ facilitative posture on digital asset activities and restrictive stance on cryptocurrency speculation are not contradictory,” Menon said.

U.S. crypto exchange Gemini and Huobi, a crypto exchange initially focused on China, are among those with a major presence in Singapore.

About 180 crypto companies applied for a crypto payments license to the MAS in 2020 under a new regime but Singapore has handed out only about two dozen licenses so far after an elaborate due diligence process that is still going on.

Follow Crypto Intelligence on Google News to never miss a story

Recently, the world-renowned cryptocurrency trading platform MEXC launched a new M-Day event. This is a welfare event for MX Token holders and mainstream token traders. Participants can exchange new project tokens at a discounted price or free of charge.

The project launched by MEXC this time is the latest NFT Index token ENSDOMAIN. The index token is supported by more than 20 four-digit pure digital ENS domain names purchased by MEXC. These domain names have then been split into 26 million ENSDOMAIN index tokens.

According to MEXC’s announcement, the winning users who trade mainstream token spots, leveraged exchange-traded funds (ETFs) and futures during the event can use MX Token to exchange the index token ENSDOMAIN at a discounted price.

It is particularly worth mentioning that MEXC will burn all the MX Tokens received in this event.

Since December 2021, MEXC has continued to burn more MX Tokens. In MX Token 2.0, 100 million of the 450 million MX Tokens held by the team will be directly and permanently burned. Meanwhile, starting from Q1 this year, 40% of the platform’s profits will be used to repurchase and burn MX Token to ensure its deflation in the secondary market.

According to the data of the Ethereum explorer Etherscan, the total supply of MX Token has dropped from 450 million in December 2021 to about 443 million at present. Since the burning of MX Token in Q2 has not begun yet, the data only includes the number of MX Tokens burned in Q1 2022.

Up until now, the circulation of MX Token in the secondary market is about 93.8 million. Judging from this MEXC initiative, the platform will not only continue to use the platform’s profits to buy back MX Token to achieve its goal of substantial burning but will also continue to use the platform’s activities and events to strengthen the use cases of MX Token and the burning of MX Token in order to reduce its circulation in the secondary market.

Whether it is a centralized exchange or a decentralized exchange, these platform tokens have always been the sector and projects that have been paid attention to. However, the platform token of the decentralized exchange is currently used for governance only and lacks a certain value, while the platform token of the centralized exchange has already had a large number of use cases within the platform.

For example, MEXC has launched a series of activities, such as M-Day, Launchpad, MX DeFi and Kickstarter, that highlight MX Token. MX Token holders can participate in these activities to get rich rewards.

These moves have boosted the value of MX Token. Comparing platform tokens, BNB, MX Token, FTX Token (FTT) and KuCoin Token (KCS) have all increased by more than 800% in the past two years. In the past year, MX Token has had the most outstanding performance, achieving growth of up to 185.42%, while the growth of BNB, FTX and KCS in the past year is only -9.83%, 2% and 3.05%, respectively.

At present, the market capitalization of MX Token is $122 million, and the market cap of BNB, which ranks fifth, is $47.8 billion. The market cap of the former is only 1/391 of the latter.

The analysis agency ICO Analytics used SimilarWeb to analyze and conclude that MEXC’s network traffic increased by 27% in July, making it the trading platform with the largest traffic growth among the 20 mainstream cryptocurrency trading platforms in the world.

In 2021, MEXC won the title of “Best Crypto Exchange in Asia” at the Crypto Expo Dubai. Some analysts pointed out that the core reason why MEXC is well-known to global cryptocurrency traders in just a few years is that it is able to quickly discover high-quality crypto assets, provides professional products and user services, and puts more emphasis on localization when promoting its global operation strategies.

Judging from the achievements of MEXC’s global development in the past two years and the rapid growth of its global users, the market value of MX Token is at an early stage, and its valuation may also be seriously underestimated.

About MEXC

MEXC is the world’s leading cryptocurrency trading platform, providing one-stop cryptocurrency trading services for spot, ETF, futures, staking, NFT Index, etc., and serving more than 7 million users worldwide. The core team has a solid background in traditional finance and has professional financial product logic and technical security guarantees in terms of cryptocurrency products and services. Currently, it supports the trading of more than 1,400 cryptocurrencies and is the trading platform with the fastest launch speed for new projects and the most tradable categories. Visit the website and blog for more information and follow MEXC Global and MEXC Research.

TenUp Ludo NFT version 1.1 is here, and we couldn’t be more thrilled about what it means for the future of blockchain and gaming. By releasing version 1.1, we at TenUp hope to reach a wider audience and give people more influence.

TenUp Ludo NFT version 1.1, a digital recreation of the design and structure of the iconic arcade game, is currently playable at Ludo NFT. In order to play with other players, each player needs 10 TenUp smart coins in their MetaMask wallet. The loser must give the winner TenUp smart coins as a reward. This release features co-op plays for up to four opponents.

Each player’s “yard” starts with four pieces. The program randomly chooses the first participant. Players take turns rolling dice. Any piece from the player’s yard can be used if they roll a six. It can also move a piece by six squares. Any other throw moves the player’s piece to the appropriate number of spaces. If no pieces are on the track, the turn is lost, and the dice are passed clockwise. Players get another throw after rolling a six — and a third try after rolling a second six.

On a player’s third roll, the turn is over. Upon reaching an opponent’s square, a piece is caught and returned to its owner’s yard. To win, a player’s pieces must all be in the middle. Some may keep trying for the bottom rungs.

TenUp plans to release version 1.2 of its Ludo game by the end of 2022, following the successful completion of its first Ludo game. In addition, the company plans to implement nonfungible tokens (NFTs) as part of this endeavor.

In accordance with the terms of this new upgrade, the player will be eligible to receive a prize consisting of an NFT from the TenUp NFT marketplace once they have achieved victory in 20 games. After that, the gamer can utilize the NFT to stake on the company’s NFT marketplace, which will result in the player earning TenUp tokens. Players will have the opportunity to fight for massive bounties and bonus benefits by taking part in the Ludo tournaments hosted by the TenUp team thanks to this brand-new addition.

About TenUp

TenUp is a decentralized platform with the goal of developing Web3 decentralized applications. TenUp has already launched its staking platform and has created its own bridge in order to enhance its blockchain network.

TenUp also launched its analyzer, where users can make wise choices and analyze how markets will react and earn from it. In addition, trading opportunities for TenUp can be found on platforms such as OKX, Bitget, StakeCube, Uniswap, Stex, PancakeSwap and others.

Game: https://ludonft.tenup.io/

Elevate Labs presents a rare opportunity for holders to join the pack with the launch of an exciting new company — operating at the forefront of the global digital art revolution — which has created a unique collection of carbon-neutral nonfungible tokens (NFTs).

The Wolf of Kensington (TWOK), revealed today by Elevate Labs, is a collection of 3D generative digital art described as the most exclusive in the global community.

Each individual Wolf comes with a range of added benefits for its owner, including access to a prestigious concierge service and exclusive investment opportunities.

Elevate Labs is backed by Woodbourne Ventures, the venture capital initiative by Woodbourne Group. Chief executive Tani Dulay said they have invested close to 1 million pounds ($1.2 million) in developing the product. The team behind the new company includes thought leaders in the Web3 space — leading blockchain developers, artists, animators and marketers who have worked with blue-chip brands from eBay and EA Games to government entities.

Dulay said, “The launch of Elevate Labs and the The Wolf of Kensington NFT collection follows a long and intense period of creative development and significant investment led by a world-class team.

“We are incredibly proud of the product we have produced. TWOK is a highly coveted, carbon-neutral NFT collection of generative art with real-world utility. The digital assets give holders access to a global and leading concierge service and will also provide investment opportunities that they can benefit from that would otherwise be out of their reach.”

The Elevate Labs team has expertise across a range of specialist fields, including business, artistic and creative, technology and marketing.

Dulay said, “Each wolf provides access to a luxury lifestyle app and concierge service, ahead of the NFT fashion curve. The world class concierge service will provide access to 14,000 pounds ($16,879) per annum of benefits, and the new app will give holders all this luxury at their fingertips.

“Elevate Labs has the bandwidth to help shape the metaverse and create bold, new communities. TWOK is just the start.”

TWOK, which stands to be the most exclusive generative art in the global community, will be launched the third quarter of 2022. A modest, entry-level price will be set nearer to the time.

NFTs are cryptographic assets on a blockchain with unique identification codes and metadata that distinguish them from each other.

Woodbourne Group also recently launched an investment company that will champion the next generation of entrepreneurs and wealth creators and build exciting breakthrough businesses. Woodbourne Ventures is a new early-capital and pre-seed accelerator fund that will support other talented entrepreneurs.

Woodbourne Group is an investment and development group that exploits potential across all aspects of real estate through creative flair and entrepreneurial vision. Driven to reinforce Birmingham’s position as a leading sustainable city, its projects continue to regenerate the city and attract both cultural and business investment. Woodbourne Group is facing the sustainability challenge head on, creating people and planet-centered developments that unlock economic opportunities without costing the earth.

About Woodbourne Group

Based in Birmingham, West Midlands, Woodbourne Group’s team has a combined real estate experience of over 130 years and a track record surpassing 5 billion pounds ($6 billion. Its team’s skills and expertise have played a pivotal role in ensuring the successful delivery of some of the Uited Kingdom’s most notable and complex mixed-use schemes. It is a business built on integrity and hard work, supported by a robust financial position, working alongside joint venture partners and delivering excellent results for landowners, occupiers, fund partners and charitable and public sector organizations. For more information, please visit: woodbournegroup.com.

As crypto exchange Coinbase faces industry challenges and economic headwinds, the company is taking a close look at where it can cut costs, CEO Brian Armstrong told CNBC’s Kate Rooney.

Coinbase shares have lost more than 70% of their value this year as the company has grappled with a “crypto winter” tied to the plummeting of bitcoin and ethereum. Armstrong said the downturn is not unusual, as Coinbase has been through four down cycles in the 10 years since he started the company.

Coinbase is facing inflationary pressures and a potential recession, but Armstrong said the macro environment is reminiscent of what the company has dealt with in the past.

“We have this saying internally, I like to repeat a lot, which is you know, it’s never as good as it seems, it’s never as bad as it seems,” he said. “I think one of the reasons Coinbase has been so successful in the last 10 years is we just we try not to get focused on short-term ups and downs.”

Coinbase cut 18% of its workforce in June, and Armstrong previously attributed the layoffs to a possible recession and a need to manage the company’s burn rate and increase efficiency.

Armstrong said the layoffs were meant to be a one-time event, but that “anything could happen.”

“I can’t tell you what the world’s going to be like a year from now,” he said. Armstrong said Coinbase is looking closely at reducing costs related to marketing, external vendors and Amazon Web Services.

He added that the company is looking to convert as many fixed costs into variable costs as possible. That could mean Coinbase Super Bowl ads are a thing of the past, though Armstrong said there will still be a “variety of Coinbase ads out there.”

The bear case for Coinbase has been around potential pressure on trading fees, which accounted for more than 80% of revenue in the second quarter. Noted short seller Jim Chanos is among those betting against Coinbase, claiming that it over earns on fees and as “competition increases amongst the exchanges, you’re going to see fee compression.”

Armstrong said fees will eventually erode as they have in the stock brokerage industry. But Coinbase is not yet seeing price sensitivity.

“I do think there’s going to be margin compression, eventually it has to happen at some point because everything that we’re building, you know, others, eventually you’re going to build it and it’ll become a little bit more commoditized,” Armstrong said. “I’d like to get to a place where more than 50% of our revenue is subscription and services.”

That part of the business, subscription and services, has grown to roughly 18% of revenue from 4% a year earlier. It includes interest income, Coinbase’s premium membership, blockchain rewards and fees for storing crypto on the platform on behalf of customers.

Coinbase and the SEC

Coinbase has also dealt with SEC scrutiny in recent months. The agency charged an ex-Coinbase product manager with fraud and launched a probe into whether the platform is illegitimately allowing users to trade digital assets that haven’t been registered as securities.

Determining how to classify cryptocurrency tokens is controversial, and Armstrong said he expects the company will receive some regulatory clarity after the midterm elections. If cryptocurrencies are considered commodities like other kinds of currency, they would be governed by the Commodity Futures Trading Commission. But many crypto projects are funded by the sale of speculative tokens.

SEC Chair Gary Gensler has said that “many of these underlying tokens have the attributes of securities” and need to be regulated as such to protect investors.

Armstrong said he’s happy to be working with the SEC.

“You know, we’ve been in actually engaging with regulators and I actually think it’s a good thing,” Armstrong said. “And our overall goal is really to help drive regulatory clarity on a global scale.”

Company culture and remote work

Though Coinbase was started in San Francisco, it has no official headquarters and none of its employees are required to work in an office.

Armstrong said he thinks the remote-first structure has been positive for the company’s recruiting but that it has eroded some of the learning and development, creativity and trust. As a result, he said the company is trying to get employees together with some of their teammates in person at least once a quarter.

Coinbase’s mission statement says the company strives to be a “refuge from division” and does not “engage in social or political activism.” Armstrong gained a lot of attention from CEOs in Silicon Valley and beyond for a blog post he wrote in 2020, declaring that political debates about candidates are off limits.

Armstrong said he was “shocked” by the types of leaders who were reaching out to talk to him about it, but that he thinks the company has become almost too well known for its mission statement.

“I kind of want to just turn the page on it,” Armstrong said. “I’d rather be better known for our products and all the cool innovation that we’re doing, but, you know, in a way it was good that other companies found something interesting in it.”

“I think it’s net positive,” he said. “It’s given us access to a wealth of talent in small towns in various countries.”

Follow Crypto Intelligence on Google News to never miss a story

The ninth version of the Aging Research and Drug Discovery (ARDD) meeting is taking place in Copenhagen from Aug., 29 to Sept. 2, bringing the best speakers to Copenhagen to discuss all aging-related subjects, from technology to the most recent advances in cellular and molecular biology, translated into cutting-edge clinical approaches. This is the best opportunity to hear the most recent breakthroughs from world-leading researchers, clinicians, companies, innovators and investors in the field.

The ARDD meeting has a long history of delivering the best in the field. For its ninth version, it is inviting everyone from all over the globe to join online from Aug. 29 to Sept. 2, 2022. More than 90 speakers from top institutions will be gathered in Copenhagen with thousands watching online. The organization’s mission is to make science more accessible, and now the largest and most essential meeting on aging and drug discovery is just a couple of clicks away.

The nonprofit conference continues to grow every year, hosting more than 2,000 delegates over the past two years and expecting an even bigger attendance this year. To add to the growth, it has developed a new workshop on emerging technologies, which will precede the longevity medicine workshop, tailored to clinicians with an interest in improving their patients’ longevity and quality of life. This is followed by four days packed with amazing speakers as part of the main event. Importantly, the first day is free to join. Attendees will have the chance to ask questions to the speakers via Slack, which will be answered even after the talk is finished.

“Aging is emerging as a druggable condition with multiple pharmaceuticals able to alter the pace of aging in model organisms. The ARDD brings together all levels of the field to discuss the most pressing obstacles in our attempt to find efficacious interventions and molecules to target aging. The 2022 conference is the best yet, with top-level speakers from around the globe. I’m extremely excited to be able to livestream our event from the amazing ceremonial hall here in Copenhagen,” said Dr. Morten Scheibye-Knudsen from University of Copenhagen.

“Aging research is growing faster than ever on both the academia and industry fronts. The ARDD meeting unites experts from different fields and backgrounds, sharing with us their latest groundbreaking research and developments. Our last ARDD meeting took place both offline and online, and it was a great success. I am particularly excited that being a part of the ARDD 2022 meeting will provide an amazing opportunity for young scientists presenting their own work as well as meeting the experts in the field,” said Dr. Daniela Bakula from University of Copenhagen.

“Many credible biopharmaceutical companies have now prioritized aging research for early-stage discovery or therapeutic pipeline development. It is only logical to prioritize therapeutic targets that are important in both aging and age-associated diseases. The patient benefits either way. The best place to learn about these targets is ARDD, which we have been organizing for nine years in a row. This conference is now the largest in the field and is not to be missed,” said Dr. Alex Zhavoronkov, founder and CEO of Insilico Medicine and Deep Longevity.

About the Aging Research and Drug Discovery meeting

At ARDD, leaders in the aging, longevity and drug discovery field will describe the latest progress in the molecular, cellular and organismal basis of aging as well as the search for interventions. Furthermore, the meeting will include opinion leaders in AI to discuss the latest advances of this technology in the biopharmaceutical sector and how this can be applied to interventions. Notably, it is expanding this year with a workshop specifically for physicians, where leading knowledge from clinical interventions for healthy longevity will be described. ARRD intends to bridge clinical, academic and commercial research, and foster collaborations that will result in practical solutions to one of humanity’s most challenging problems. ARRD’s quest is to extend the healthy lifespan of everyone on the planet.

About the Scheibye-Knudsen lab

The Scheibye-Knudsen lab uses in-silico, in-vitro and in-vivo models to understand the cellular and organismal consequences of DNA damage with the aim of developing interventions. It has discovered that DNA damage leads to changes in certain metabolites and that replenishment of these molecules may alter the rate of aging in model organisms. These findings suggest that normal aging and age-associated diseases may be malleable to similar interventions. The hope is to develop interventions that will allow everyone to live healthier, happier and more productive lives.