September 13, 2022, marks the date of an unprecedented Learn&Earn campaign led by a recent Web3 Unicorn Unstoppable Domains and a leading global crypto educator BitDegree.

Companies join forces to distribute up to $50 million worth of NFT domains to all students who complete any Web3-related course on the BitDegree platform.

“BitDegree and Unstoppable Domains have agreed to reward people who invest their time learning about crypto and Web3, incentivizing them to learn more and attracting newcomers to Web3 through learning. Web3 adoption will happen faster if we make the crypto community deepen its knowledge. So, we have decided to launch a massive campaign to capture the world’s attention – which we believe is the biggest Learn&Earn campaign in the history of crypto. In particular, we want our students to learn about the Web3 identity as the time is ripe for its adoption,” – Danielius Stasiulis, CEO and Co-Founder of BitDegree.

The 30-day Learn&Earn campaign aims to bring Web3 closer to the people by educating the existing crypto community and industry newbies. Students who completed any Web3 course before this campaign will also be able to claim a free NFT domain.

To signify the importance of the Web3 identity and its potential, BitDegree developed a dedicated LearnDrop course: NFT Domains: The Future of Web3 Identity. It is dedicated to educating students on the issues related to digital identities and solves a global lack of learning opportunities covering this topic.

“Web3 is still in its dial-up days, and education is the key to getting more people started. That’s why we’re so excited to help more people start their Web3 journey through this campaign,” – Sandy Carter, SVP and Channel Chief of Unstoppable Domains.

In Web2, our likes, comments, purchases, passwords, and posts are controlled by a handful of large tech companies that gather this data. Web3 identity enables individuals to have a single login and a portable digital identity that they own and control.

As an advocate of decentralization, Web3 identities, and user empowerment, BitDegree also supports Login with Unstoppable, a single-sign-on product by Unstoppable Domains. Login with Unstoppable allows BitDegree students to log in with their NFT Domain and keep control of their data.

This partnership with Unstoppable Domains is the most recent for BitDegree. The company’s goal is to educate the crypto community about exciting crypto businesses and projects through the prism of the issues they solve. In the near future Unstoppable will be delivering profile badges to BitDegree students that have finished a web3 course.

Earlier this year, BitDegree announced transitioning into Learnoverse – the first crypto learning metaverse. All current and future crypto content and features developed by the Web3 learning platform or its partners will be transferred to Learnoverse.

About BitDegree

BitDegree is a blockchain-enabled online educational platform that aims to connect educators, learners, and employers in a way that benefits every party. The company is focusing on innovating online learning methods with crypto tools. BitDegree is currently moving toward building an educational metaverse to provide an immersive learning experience. The goal is the create a space for everyone to teach and learn Web3, crypto, blockchain, and other skills.

About Unstoppable Domains

Founded in 2018, Unstoppable Domains is an NFT domain name provider and digital identity platform working to onboard the world onto Web 3. Unstoppable Domains offers NFT domains minted on the blockchain, giving people full ownership and control of their digital identity with no renewal fees.

With Unstoppable Domains, people can replace lengthy alphanumeric crypto wallet addresses with a human-readable name and log into and transact with over 200 apps, wallets, exchanges, and marketplaces.

Forbes named the company one of America’s Best Startup Employers in 2022. In July 2022, Unstoppable Domains achieved Unicorn status after raising a $64 million Series A funding round led by Pantera Capital.

Bitcoin held above $22,000 on Monday as it continues a week-long rally ahead of U.S. inflation data and a highly anticipated Ethereum network upgrade.

The world’s largest cryptocurrency was trading at $22,328.27 at around 9:15 a.m. ET, according to CoinDesk data.

After falling below $19,000 on Wednesday to its lowest level since June, bitcoin has since rallied around 17%.

This also comes off the back of a winning week last week for U.S. stocks. Bitcoin has been closely correlated to equity markets, particularly the Nasdaq, and often moves higher when the tech-heavy index rises.

Crypto investors are looking ahead to the August consumer price index report, scheduled to be released Tuesday, to see the direction inflation is headed which could give hints toward future policy moves by the U.S. Federal Reserve.

Stocks have been under pressure this year as the Fed has hiked interest rates to try to control rampant inflation.

Cryptocurrencies, which are also risk assets, have been battered. Nearly $2 trillion has been wiped off the entire crypto market since its all-time high in November. Bitcoin is down more than 50% this year.

That decline has also been driven by crypto-specific issues including the collapse of key projects and bankruptcies that have spread across the industry.

Meanwhile, the Ethereum network will complete a long-awaited upgrade called the merge. This will transform the Ethereum blockchain from a proof-of-work to proof-of-stake model and significantly reduce the amount of energy required for the network to operate.

Proponents say this could pave the way for a broader use of ether, the token that runs on Ethereum.

“Crypto faces an unusual double whammy this week: U.S. inflation data and [hopefully] the long-awaited and oft-delayed Ethereum Merge. Hold your breath for a rollercoaster ride,” Antoni Trenchev, co-founder of Nexo, said in a note on Monday.

“In a time awash with narratives, there’s none bigger than the Merge in crypto and it’s one which the wider world should take notice of with Ethereum’s carbon footprint set to be slashed by 99%.”

However, analysts cautioned that the merge will not necessarily speed up the Ethereum network, which is known to be slow, nor will it reduce the fees associated with transactions.

Still, excitement has been growing for the merge. Since ether hit its low for the year in mid-June, the price for the world’s second-largest cryptocurrency has far outpaced bitcoin’s. Ether is up more than 90% since June. 19 while bitcoin has risen just over 20%, begging the question of how much the merge has already been priced in.

The Federal Reserve is also widely expected to increase interest rates again next week when its Federal Open Market Committee (FOMC) meets, which is another dark cloud hanging over the crypto market.

“The Merge may trigger a ‘sell the fact’ situation in the crypto market and we still need to be careful for next week’s FOMC meeting. Bitcoin could continue to rally but it could be quite short lived,” Yuya Hasegawa, crypto market analyst at Japanese exchange Bitbank, said in a note Monday.

Follow Crypto Intelligence on Google News to never miss a story

Fintech disruptor @Pay has announced their listing of their token ATPAY on MEXC and Raydium this Monday at 10 am UTC.

The app will begin launching to merchants and customers in Q4 2022. @Pay is a DEFI (Decentralized Finance) protocol that is the first BNPL (Buy Now Pay Later) platform built to integrate blockchain technology with its own cryptocurrency. @Pay is one of the largest projects in the DeFi space aiming to power millions of real-world transactions while taking on the multi-trillion dollar payments industry.

About ATPAY token

The @Pay token (ATPAY) is a Solana (SPL) based asset. The SPL token framework will allow a fast, scalable and efficient structure for the distribution, support and functionality of the native token.

The @Pay token is the token that powers the @Pay integrated rewards program available to all users that successfully complete their repayments in a timely fashion. The @Pay token can be used in various ways such as buying into a higher credit limit, used as currency to purchase products and services from @Pay merchants in the @Pay marketplace and, in time, able to vote on certain outcomes that can shape the outcome of the @Pay platform.

Token listing metrics:

- Listing will commence on 12 September 2022 at 10:00 am UTC on MEXC

- Total Token Supply 300 million

- Circulating Supply 100 million with the majority held by @Pay and subject to lock-ups. with the majority held by @Pay and subject to lock-ups.

From the date of distribution, ATPAY token holders with 200,000 or more tokens will be locked. These tokens will be unlocked annually as per the following schedule:

- 10% of the total @Pay tokens held by an owner will be unlocked 31 Dec 2022.

- 10% of the total @pay tokens held by an owner will be unlocked 31 Dec 2023.

- 40% of the total @pay tokens held by an owner will be unlocked 31 Dec 2024.

- The remaining balance of the total @pay tokens held by an owner will be unlocked 31 Dec 2025.

About the Project

@Pay aims to become a first of its kind platform for BNPL solutions, combining three emerging markets; Buy Now Pay Later (BNPL), Crypto and Traditional Currency, and Blockchain and Smart Contracts.

@Pay is taking on the global payments and BNPL industry which is projected to reach 233 billion by 2025* (consensus.gov). Even if it only takes 1% market share; annual turnover could reach $2.3billion USD. That’s hundreds and thousands of transactions powered by @Pay’s blockchain technology.

@Pay aims to be a key participant in offering decentralised finance (DeFi) eCommerce and in-store solutions to shoppers & merchants. @Pay will also allow users to pay for their shopping with any traditional currency (fiat) or approved cryptocurrency they hold in their wallets. Shoppers and merchants will be rewarded with tokens for all transactions and repayments. This places @Pay in the unique position to become the premier BNPL solution for gaming platforms, esports, NFT marketplaces, Web 3 businesses whilst also targeting traditional BNPL merchants.

@Pay has also already signed up over 500 affiliate merchants. This includes major retailers such as adidas, Calvin Klein, JD Sports, North Face, Dior, F1, Fanatics, Coach, GAP and Lacoste amongst others. This is in addition to industry partnerships such as MetaRun, Fomolabs, Algorand, Solana and more. Other key partnerships in the works include Binance Pay and global football clubs.

Further, @Pay has developed its own APis allowing @Pay to be easily integrated into merchant payment gateways giving it access to thousands and thousands of merchants around the World.

Here’s a summary of what users can expect of this unique ecosystem that stands out from its competitors:

- Pay with Cash or crypto

- Buy now – Repay in 4 instalments

- No interest or late fees

- Earn rewards for completing repayments on time

- Earn rewards in crypto

- Stake

The @Pay protocol and app will earn revenue in 4 key ways:

- Merchant fees for BNPL – a merchant pays @Pay 4-8% of every transaction when a shopper chooses to purchase a good or service using the BNPL feature.

- Affiliate merchants’ payments. @Pay receives 5-10% of the transaction amount for driving shopper traffic..

- Monthly account keeping fee of $8 payable by anyone that has repayments outstanding from using the BNPL feature..

- Crypto Pay transaction fees – 1% fee of the transaction amount.

All this is made possible by launching and growing usage of our app. The app will begin launching to merchants and customers in Q4 2022. A single app for shoppers and retailers to manage all their crypto and cash payments seamlessly. Switching between cash and crypto is as easy and fast as changing channels on your tv. It’s a little bit of @Pay magic.

Alongside the app launch, @Pay business is set to launch in October; unlocking the ability for businesses across Australia and overseas to be able to accept cash payments in store and have these converted into crypto, instantly. @Pay business will be great for professionals (doctors, lawyers, accountants , beauty therapists, tradespersons etc..

Then we are rolling out with crypto BNPL late this year, followed by a virtual card early next year. Jump on in early into this thrilling project! Get MEXC and buy now

Follow Crypto Intelligence on Google News to never miss a story

Tron is thrilled to announce that Wintermute is now the official market maker for TRX and a strategic partner of the entire Tron ecosystem. In this capacity, Wintermute will provide liquidity for major TRX pairs across various exchanges, boosting greater accessibility to the TRX token. This strong alliance will foster further growth of Tron as the go-to global layer-1 blockchain.

“This latest partnership between Wintermute and Tron is an extension of our efforts to partner with leading DeFi projects and offer our support through what we do best: making markets more liquid. We’re thrilled for the opportunity to contribute to the Tron ecosystem as a liquidity provider.” – David Micley, director of business development at Wintermute.

Earlier this month, Wintermute became the latest whitelisted member to join the Tron DAO Reserve, gaining access to minting and redeeming USDD, the overcollateralized decentralized stablecoin powered by the Tron network.

Wintermute provides liquidity for digital assets and, as a leading global market maker, has helped a multitude of high-profile projects. Wintermute has a selective approval process before it begins partnering with a particular digital asset. Accordingly, Wintermute has a track record of working with the most prominent projects, which is further strengthened by its partnership with Tron and USDD.

Other market-making initiatives that Wintermute will provide for Tron’s native utility token, TRX, include providing coverage across centralized and decentralized exchanges, fostering more competitive spreads during all types of market conditions, offering insights on market conditions to help create a sustainable liquidity model and more. Wintermute will also provide strategic guidance to help better the Tron ecosystem.

Every major project in the Web3 space needs a reliable and innovative market maker. Wintermute aims to drive a tailored model, using the initiatives mentioned above, to reduce market takers or crypto whales’ influence over asset prices.

Such an approach leads to a more decentralized ecosystem that allows for greater user autonomy. Wintermute is lowering barriers for general market participants by providing liquidity on major exchanges, which, in turn, reduces disruptions and slippage during trading.

Tron is proud to partner with Wintermute strategically and looks forward to continuing to work toward their shared goal to decentralize the web.

About Tron DAO

Tron is dedicated to accelerating the decentralization of the internet via blockchain technology and decentralized applications. Founded in September 2017 by Justin Sun, the Tron network has continued to deliver impressive achievements since the mainnet launch in May 2018.

July 2018 also marked the ecosystem integration of BitTorrent, a pioneer in decentralized Web3 services boasting over 100 million monthly active users. The Tron network has gained incredible traction in recent years. As of August 2022, it has over 109 million total user accounts on the blockchain, more than 3.7 billion total transactions, and over $13.2 billion in total value locked, as reported on Tronscan.

In addition, Tron hosts the largest circulating supply of Tether (USDT) stablecoin across the globe, overtaking USDT on Ethereum in April 2021. The Tron network completed full decentralization in December 2021 and is now a community-governed decentralized autonomous organization.

Most recently, the overcollateralized decentralized stablecoin USDD was launched on the Tron blockchain, backed by the first-ever crypto reserve for the blockchain industry, Tron DAO Reserve, marking Tron’s official entry into decentralized stablecoins.

Organizers of Europe’s most-anticipated Ethereum hackathon confirmed that applications for ETHLisbon 2022 are officially open, and the first badge of hackers will be notified of their admission by the end of this week. Between Oct. 28 and Oct. 30, Ethereum builders will get together in teams to earn sponsor bounties or kick-start their own idea. Applications will be open right up until the event; hackers have the chance to secure their spot here.

What is Lisbon Blockchain Week and why is it a must?

Hosted by some of the most legitimate names in the industry, the hackathon aims to provide the best possible experience to builders.

Lightshift Capital, 1kx and Activate are partnering up to take hackathons to the next level. In 2021, this successfully attracted thousands of crypto enthusiasts from all over the world to Portugal. Subsequently, Lisbon Blockchain Month was started as a community initiative for everyone who wanted to get involved and plan a complementary side event.

Not unlike ETHDenver, the event turned into an opportunity to meet and build alongside some of the biggest names in the industry: Austin Griffith, Stani and Protolambda participated as judges and mentors during the hackathon.

This makes an equal or better 2022 lineup promising. Although judges and mentors are not announced yet, the 2022 edition will be sponsored by even more quality projects: Wallet Connect, ZKsync, IPFS/Filecoin, Euler Finance, Gnosis Chain, Ledger and, according to the organizers, more to come.

Lisbon, which was already a paradise for entrepreneurs and digital nomads quickly accelerated into a European crypto hub following Lisbon Blockchain Week. The rich culture, developed infrastructure, climate and proximity to the ocean attract talent from all over the world. Simão Cruz, managing partner of Lightshift Capital, described it as the following: “We can definitely feel the growing network and community spaces for crypto enthusiasts. People are coming here to be part of something bigger and events like ETHLisbon are important to use these new-found synergies and create more opportunities for everyone.”

How can you participate?

Hackers can apply to hack through the official website. Non-coders and those who want to contribute in other ways can start their own side event and submit it to the Lisbon Blockchain Month website — the organizers strongly encourage diversity and participation during these days.

Most importantly, Lisbon is the perfect city to travel to for learning, networking and experiencing a unique, in-person community movement.

Co-hosted by the Blockchain Research Institute (BRI) and MCI Canada, registration is now open for Web3 and Blockchain World (W3B), to be held on Nov. 8 and 9, 2022 at the Metro Toronto Convention Center in Toronto, Canada.

Formerly known as Blockchain Revolution Global, W3B is a global event bringing together the foremost leaders, thinkers and innovators in the Web3 ecosystem to educate, inspire and prepare you to be part of the transformation that Web3 and blockchain are bringing to business, government and society.

The event, hosted online in 2020, had 210 speakers and attendees representing 45 countries. Over two thirds of attendees were senior management.

The overall theme for this year’s event is “Digital assets: digital transformation.” Sponsored by leading companies including FedEx, Input Output, BTP, Prophecy DeFi, EY and Hedera, the W3B program will explore how blockchain and Web3 are becoming the operating system of the next era of the digital age, enabling the digitization of all assets and the transformation of enterprises.

As the presenting media partner, Fortune will provide full editorial coverage of the event. Speakers include Charles Hoskinson, CEO and founder of Input Output; Rob Carter, executive VP of FedEx Information Service and chief information officer of FedEx Corporation; and Cleve Mesidor, executive director of the Blockchain Foundation. W3B strives to achieve gender balance and diversity among its speakers.

“This November, we invite you to join us as we convene some of the best and brightest speakers from across the globe, along with some of the world’s most important companies,” said Don Tapscott, executive chairman of the Blockchain Research Institute. “W3B 2022 will celebrate and explore how Web3 and blockchain are transforming business and industry ecosystems around the world.”

The November event will provide a Canadian camp experience, which will include keynotes at the main lodge, fireside chats, campfire sessions and other festive events. The sessions have been designed to maximize opportunities for interaction among invited experts and attendees — whether in-person or online.

Attendees will have the option to navigate between eight different thematic streams: decentralized finance, supply chain revolution, Web3 platforms and DAOs, NFTs and other digital assets, environmental social governance, digital identity, the Metaverse and hybrid spaces, and healthcare revolution.

“We are looking forward to welcoming decision makers, innovators and blockchain trailblazers for a newly designed experience at W3B 2022,” said Juliano Lissoni, managing director at MCI Canada. “We will be working diligently to provide a safe and welcoming environment for our participants at the MTCC, and we will be investing in a multi-platform execution to connect the world.”

The early-bird registration deadline is Sept. 14. Visit the site for more information about the event and how to register.

About the Blockchain Research Institute

The Blockchain Research Institute (BRI) is an independent, global think-tank dedicated to inspiring and preparing private and public-sector leaders to drive blockchain transformation. Funded by a member community of more than 100 companies, government agencies and technology platforms, the BRI brings together some of the world’s leading thinkers to undertake groundbreaking research on the strategic implications of blockchain technology, producing practical insights to help its members drive digital transformation across industries.

About MCI Canada

MCI is a global engagement and marketing agency that creates human-centric touch points that unleash the power of people. Firm believers in the power of building community since 1987, MCI is helping brands, associations and nonprofit organizations solve key people challenges through its expertise in live and virtual events, strategic digital communications, and consulting and community solutions. MCI Canada provides live and digital event and association services to influence, engage, connect, interact, immerse and educate key target audiences.

Digital asset services provider, Blockchain.com recently announced that the company has signed a Memorandum of Understanding (MoU) with the Virtual Assets Regulatory Authority (VARA) in Dubai.

According to the details shared by Blockchain.com, retail and institutional clients in Dubai will soon be able to access technology-driven financial services.

Digital asset services provider, Blockchain.com recently announced that the company has signed a Memorandum of Understanding (MoU) with the Virtual Assets Regulatory Authority (VARA) in Dubai. According to the details shared by Blockchain.com, retail and institutional clients in Dubai will soon be able to access technology-driven financial services.

In the last few years, several blockchain firms have opened their offices in Dubai. In November 2020, Ripple announced the selection of Dubai for its regional headquarters. Blockchain.com highlighted that the company is also in process of opening a local office in Dubai.

“Crypto investors in Dubai and its surrounding regions will soon be able to experience Blockchain.com’s full suite of retail and institutional brokerage tools including custodial services, an exchange, and OTC crypto brokerage services for institutional clients.

“As part of our local commitment, Blockchain.com is in the process of opening a local office and intends to hire in the region. We are also actively pursuing a local Minimum Viable Product license, followed by a full license as soon as it becomes available,” the company noted.

Follow Crypto Intelligence on Google News to never miss a story

Bitcoin rallied the most since July, breaking out of the narrowest trading range in about two years, as a drop in the dollar renewed demand for battered risk assets worldwide.

The largest cryptocurrency by market value advanced as much as 10.1% to $21,341 as of 12:05 p.m. in New York. The increase was the most since July 19. Bitcoin is outperforming most of the other top tokens such as Ether and Cardano. Bitcoin and Ether are still both down about 50% this year.

“It’s too early to predict that we are approaching another bull run, but if Bitcoin regains a higher support level between $22,000-$25,000 then it may boost investor confidence and ease off the selling pressure across crypto assets,” said Tarusha Mittal, co-founder of crypto staking platform UniFarm. “Given the fact that central banks around the world remain cautious due to the high inflation numbers, the current surge in the crypto market might be short-lived,” she adds.

The Bloomberg Dollar Spot Index tumbled 0.9% on Friday after surging to the highest on record this week. Every Group-of-10 currency strengthened against the greenback, with the risk-sensitive Australian dollar and Norwegian krone leading gains.

Bitcoin has been stuck in the tightest trading range in almost two years in September, in part reflecting uncertainty about how far central banks will go in raising interest rates in the face of a slowing global economy. Amid the lack of direction, some analysts have pointed to activity in futures markets as suggesting Bitcoin may be poised to break out.

Riyad Carey, an analyst at crypto researcher Kaiko, highlighted a jump in open interest in Bitcoin futures on some of the biggest exchanges.

“It appears that there was a bit of pent up demand for BTC (and BTC volatility), which has traded in a relatively tight range for the past couple months with decreasing volatility,” Carey said in a direct message over Twitter.

Friday’s move was unusual in that Bitcoin outperformed almost all other top tokens tracked by Bloomberg. The MVIS CryptoComparte Digital Assets 100 Index advanced 6.1%. Smaller so-called altcoins typically fluctuate by larger magnitudes than Bitcoin, the industry’s bellwether.

Follow Crypto Intelligence on Google News to never miss a story

Dancing Seahorse, an innovative Web3 business that aims to disrupt the music industry, has announced that it will be the headline sponsor at the forthcoming Web3 conference Zebu Live. The annual two-day conference’s second edition will bring together some of the brightest minds in the Web3 industry, as well as showcase the talent and innovation that is taking place in the nascent Web3 space.

Following the success of last year’s Web3 conference — conceived and executed by leading Web3 marketing agency Zebu Digital — this year’s Zebu Live event will see even more participation from high-profile sponsors, media partners and key industry figures, including Dragon and Thirdweb co-founder Steven Bartlett and Aave founder and CEO Stani Kulechov.

As the headline sponsor for Zebu Live, and as firm believers in the Web3 space, Dancing Seahorse will provide fundamental support and expertise, bringing immense value to the conference and reflecting the core tenets and principles of Zebu Live.

Ashton Barger, events and partnerships manager at Zebu Digital, commented: “We are partnering with Dancing Seahorse as we share the same core vision of driving adoption and pushing for greatness in the Web3 space. Zebu Live supports the way in which Dancing Seahorse aims to disrupt the music industry by using the technologies of Web3. We are extremely grateful for its support as our title sponsor and for trusting us to put on a great event. We can’t wait to see Dancing Seahorse achieve greatness, as they are backed by a phenomenal team with some of the best connections in the music and Web3 industries. We know they have some really exciting plans lined up that will wow the attendees at the conference venue and the after party!”

Dancing Seahorse is perfectly situated to drive adoption of the Web3 industry, with its goal to fund the future of the music industry through NFTs providing the perfect collaboration between the traditional music industry and the growing Web3 space.

Dancing Seahorse provides access to once-in-a-lifetime exclusive experiences, financial rewards and a wealth of networking opportunities — all backed by some of the world’s most prominent music artists and investors. For the last six months, the whole Web3 and NFT community has been craving a project that demonstrates how blockchain technology can disrupt global industries. Dancing Seahorse provides the most amazing in-person experiences with the highest-quality handcrafted 3D art.

As an exhibit of prowess within the crypto world, the partnership between Zebu Live and Dancing Seahorse is an example of how collaboration is key to the development of the Web3 space.

Chris Joyce, creative director at Dancing Seahorse, commented on the partnership between Dancing Seahorse and Zebu Live, noting: “We are thrilled to be supporting Zebu Live as headline sponsor at this year’s event. As a project that demonstrates how blockchain technology can disrupt global industries, Dancing Seahorse is perfectly positioned to be a representative of the limitless possibilities of Web3. We look forward to showcasing the brilliance of the Web3 industry, and anticipate celebrating the success of London’s leading Web3 conference.”

In addition to headline sponsor Dancing Seahorse, Zebu Live is sponsored by key industry figures, including Koinly, Tezos and Algorand, whose participation will allow the event to bring together some of the most influential communities in Web3. Further sponsors include Near, Cudos, SparkWorld, Lens Protocol, Swapsicle, The Nemesis, Bolide, Thirdweb and over 50 more partners.

Zebu Live will also feature more than 40 sessions on Web 3, DeFi, NFTs, the Metaverse, DAOs and GameFi, and is part of London Web3 Week, running from Sept. 19 to 25, featuring networking events and parties all week long. Alongside the array of partners, panels and keynote speakers, Zebu Live will feature a Press Van, an NFT gallery by Ethereal Collective that will showcase the top artists and creators in the industry, as well as a chill room, alpha stage and a VIP dinner.

With Zebu Live quickly becoming one of the top Web3 event brands in the world, its focus on curating the most innovative and interactive conferences will also reflect in the unmissable afterparty at the infamous Koko nightclub in Camden, which has free entry for those with a ticket. Afterparty sponsors include Dancing Seahorse, Swapsicle and Luno, with DJ Madlib set to headline and additional entertainment taking place throughout the night.

Tickets are available now.

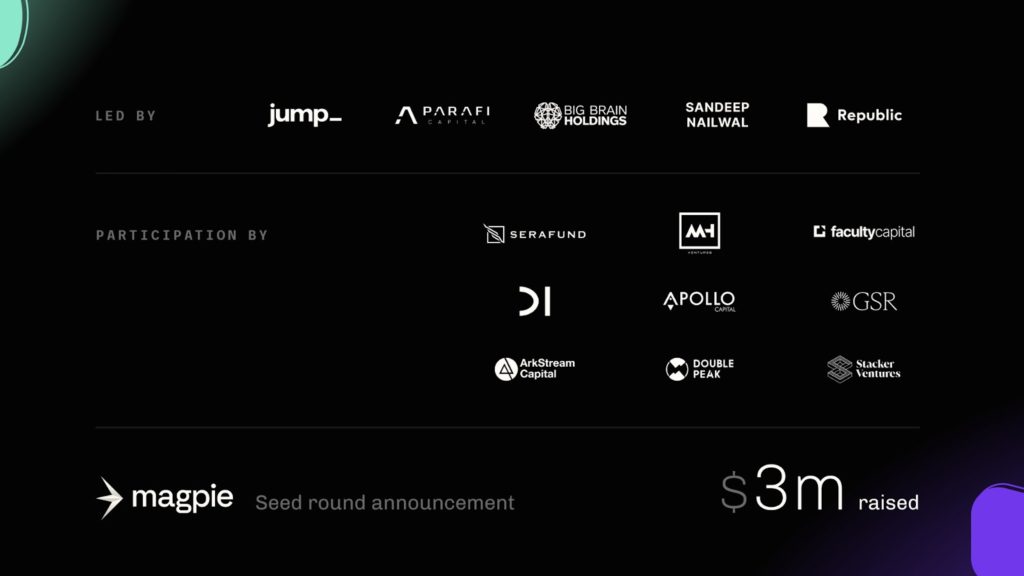

The team at Magpie Protocol is pleased to announce that its $3-million Seed round has been completed.

With Jump’s assistance, Magpie Protocol is poised for success and is additionally supported by notable investors, such as Sandeep Nailwal, GSR Markets, ParaFi Capital, Republic Capital, Big Brain Holdings, Serafund, Faculty Group, MH Ventures, D1 Ventures, ArkStream, Apollo Capital and more.

After seeing what Magpie Protocol is developing and offering to the crypto space, Jump Crypto — which looks for projects full of passion for decentralized finance (DeFi), focused on innovation and is full of engineers, investors and traders consumed by building the future of DeFi — made the decision to cement itself as the lead investor in the project.

“As the crypto infrastructure landscape expands multichain, Magpie’s cross-chain liquidity aggregation protocol and array of other cross-chain microservices offer the much-needed abstraction layer and seamless execution for the end-user.” — Saurabh Sharma, head of investments at Jump Crypto

Next is GSR Markets, which partners with brave and brilliant entrepreneurs who are building the future of finance. GSR works with cryptocurrency projects at crucial points in their life cycle, providing robust liquidity that helps enable their technology. Together, we’re going to change the landscape of DeFi and the global economy. We’re very excited to be supported by them.

“We’re excited to be working with the Magpie Protocol team as they continue expanding decentralized liquidity provision to clients through bridgeless, cross-chain liquidity aggregation.” — GSR Markets

Republic Capital selects investments based on business fundamentals with a focus on unit economics, strategy and the opportunity to disrupt a market. Everyone believes in Magpie Protocol to be a part of this changing of the future of DeFi and the global market.

“We are thrilled to be early backers of Magpie and its team. Interoperability is a key component of the crypto ecosystem, and we believe Magpie’s solution is one of the most elegant and easiest to use in the space.” — Republic Capital

Magpie Protocol is a decentralized liquidity aggregation protocol for cross-chain swaps aiming to provide the best deal on any asset across top blockchains without the need to bridge assets independently. Instead, our novel architecture uses bridges primarily as a data transfer layer to communicate swap signals between chains. The result is an extremely fast and secure solution to cross-chain swaps.

Bridge security concerns are at the forefront of DeFi at this time, being a crucial component in promoting the trustless and inclusive foundations upon which DeFi is built. Most bridges are custodial, meaning users must entrust their tokens with the security of the bridge by locking assets in a smart contract. This centralization of bridged assets creates single points of failure, which can put multiple ecosystems in danger if they are exploited.

A recent report by Chainalysis, a blockchain data platform, estimates a total of $2 billion in cryptocurrency has been stolen from cross-chain bridges in 2022 alone. This goes to prove that creating a secure cross-chain bridge solution is a must in DeFi.

Magpie is a project that was incubated by Saxon, which helps idea-stage crypto entrepreneurs to launch game-changing DeFi and infrastructure projects. They provide holistic support, spanning from product market fit and business development to tokenomics and fundraising.

“It’s been a pleasure working with Ali and the wider Magpie team to bring this disruptive approach to cross-chain swaps to market. With the launch of a new generation of L1s just around the corner, the timing could hardly be better.” — Ultan Miller, Saxon managing partner

Magpie’s architecture uses bridges to communicate swap signals between chains, without the need to lock, burn or mint assets on or within a bridge. By combining an off-chain liquidity network and bridge liquidity with a proprietary liquidity aggregation protocol, Magpie is chain-agnostic, meaning it is compatible and able to initiate swaps for the desired token on any chain, without limiting factors as other aggregation protocols, and whether or not the chain is Ethereum Virtual Machine-compatible or not. Not only does this result in near instant finality for users but it also enables Magpie to be fully noncustodial by keeping assets in control of the user rather than a third party or bridge, which greatly improves the security of users’ assets.

“I’d like to personally thank all of our investors and team members for your support in Magpie. We’re all incredibly proud of the work the team has done thus far, but it’s only the beginning. Now the work begins for the next round of funding as well as preparing to launch our private and public alpha testing events in the coming weeks. It has been an amazing journey so far, and we have a lot in store for us in the coming years.” — Ali Raheman, CEO and founder of Magpie Protocol

At the time of writing, Magpie Protocol is compatible with many established chains and DeFi protocols, including Ethereum, Polygon, Avalanche and BNB Chain. Additionally, we have announced plans to expand to Fantom, Solana and other blockchains in the near future.

On the back of this successful raise, Magpie Protocol will continue expanding strategic relationships and partnerships once its private alpha testing has concluded.

For additional information on Magpie, check out our website and follow us on social media.

Website | Twitter | Discord | LinkedIn | Telegram | Medium