London, UK, 12th October, 2022, Chainwire

MetaFi platform Choise.com has launched a new Price Prediction Challenge for its CHO token with a total prize fund of $1,500,000. The goal of the challenge is to correctly guess what the price of CHO is going to be on March 24, 2024. The prize for taking first place will be $1,000,000. The remaining $500,000 will be distributed between the other winners.

Choise.com is an ecosystem that combines all the advantages of centralised (CeFi) and decentralised (DeFi) financial services into a simple-to-use, reliable one-stop shop. The platform is designed for everyone, from crypto novices to experts, and allows users to take advantage of farming, decentralised exchanges, liquidity pools, interest accounts, and other features to earn on their digital assets with just a tap of a button.

The new Price Prediction Challenge is one of the many earning options that Choise.com offers to its users. It is the first challenge of its kind, as the $1M it offers is quite possibly the largest grand prize ever set up in such a competition in the history of the crypto market.

To participate in the challenge, users will need to make a Twitter post about what they think the price of the CHO token will be on March 24, 2024, and write out the reason why they think it will be so. Additionally, the user will have to include the hashtag #CHOprediction, tag @ChoiseCom, and attach a link to the Choise.com/million4cho website.

Up to 1000 winners can receive prizes for winning the challenge. The top prize is $1,000,000, while the remaining $500,000 will be divided among the other 999 participants, depending on how close their predictions are to the real CHO market price.

To increase the chances of winning, users can also complete tasks that Choise.com offers in Gleam in exchange for special points. If the price prediction turns out to be correct for several users at once, then the winner is selected between them by the number of points they scored. The details for the tasks are explained on the challenge website page.

“There have been plenty of crypto projects before that offered rewards to users for completing tasks. But what sets our Challenge apart is that we are the first to offer a prize pool as large as $1.5 million in a competition. At Choise.com we encourage people who seek new ways to earn, and the current CHO price prediction challenge is one such earning avenue. So keeping in line with our core mission we chose to offer our users a chance to compete for fairly large sums”, – states Anastasia Kor, Chief Marketing Officer at Choise.com.

The competition will be concluded on January 1, 2024. Following its completion, the CHO market price will become available at 00:00 GMT on March 24, 2024, on the Gate.io one-minute graph. Choise.com will also post the final price of the CHO token on its website. Additionally, a feedback form will be provided for participants who guessed the price. Participants will need to use said form to send their contact details, a link to their tweet with the correct prediction, as well as their user nickname in Gleam.

Once the final list of winners is compiled, Choise.com will publish it on the company’s social networks on June 1, 2024.

Contact

Alyona Akimova

Choise.com

pr@choise.com

Crypto investment products firm 21.co said on Wednesday its subsidiary 21Shares AG has listed a bitcoin exchange-traded product on Nasdaq Dubai, making it the Middle East’s first physically-backed bitcoin ETP.

The 21Shares Bitcoin ETP trades, under the ticker ABTC, in the same way as the 21Shares Bitcoin ETP in Europe, 21.co said in a statement.

Dubai has ambitions to become a global cryptocurrency hub and has attracted big industry players to set up shop like Binance, which went on a UAE hiring spree this year and is helping to shape the Middle East commercial hub’s virtual assets regulations.

Following the Dubai listing, 21Shares has 46 listed products in seven countries, 21.co added.

Swiss-based 21.co last month raised $25 million in a funding round that valued it at $2 billion, which it said made it “Switzerland’s largest crypto unicorn”.

The crypto market has suffered a rout that has forced some of its biggest players to lay off thousands of employees to cut costs.

But Sherif El-Haddad, appointed 21Shares head of Middle East in August, was upbeat, saying cryptocurrencies were “fast becoming the asset of the future for investors and wealth managers around the world”.

The Middle East and North Africa is the world’s fastest-growing cryptocurrency region, where the volume of crypto received jumped 48% in the year to June, blockchain researcher Chainalysis said in a report last week.

Hany Rashwan, CEO and co-founder of 21Shares, said in the statement the company “will continue to support the Middle East’s ambitions to become a global crypto hub”.

World Blockchain Summit (WBS), the largest global series of blockchain, crypto and Web3 events, is coming back to Dubai on Oct. 17 and 18 at Atlantis the Palm.

Held under the patronage of Sheikh Juma Ahmed Juma Al Maktoum, member of the ruling family of Dubai, WBS Dubai is hosting the most influential thought leaders on blockchain, crypto, NFTs, Web3 and the Metaverse to explore the market’s effects on commerce, banking, gaming, culture and community development.

Dubai is known for its welcoming stance on crypto and blockchain technology. This is evident in its eased regulations for crypto and blockchain technologies, making the city a great location for foreign companies looking to set up shop. This is further backed by the recent approval of the Dubai Virtual Asset Regulation Law providing for a more crypto-friendly structure that fosters investment and growth in blockchain adoption. With over 6,000 millionaire residents, the country’s private wealth has risen to over $40 billion, making it a hotspot for investments too.

“Dubai is the right place for innovation in the blockchain space. We are happy to be working with WBS to achieve the vision set by the government of Dubai on its Blockchain and Metaverse Strategy,” commented Furqan Rassul, CEO of Elite Partner Investment.

WBS will bring enlightening sessions discussing the blockchain and crypto space in response to some of today’s most pressing questions in the current industry. It will also feature panel discussions, industry highlights, use-case-studies, fireside chats and more.

Mohammed Saleem, founder and CEO of WBS, noted: “Dubai has positioned itself perfectly as one of the most crypto and blockchain friendly destinations in the world. With all the recent announcements around new crypto licenses being issued, Dubai Metaverse Strategy and more, we are super excited to be bringing WBS back to Dubai this October as we host some of the world’s leading experts to share their insights and showcase the latest innovations in the space.”

Speakers in focus include:

- Furqan Rassul — CEO of Elite partner Investment

- Marwan Alzarouni — CEO of Dubai Blockchain Center

- Ralf Glabischnig — founder of Crypto Oasis and CV VC

- Talal Tabbaa — CEO of CoinMENA

- Paul Veradittakit — partner at Pantera Capital

- Jemma Green — co-founder and executive chairman of Powerledger

- Sabinije von Gaffke — founder of Impactfulness Ventures and head of sustainability at Nibiru Software AB

- Sheraz Ahmed — co-executive director and head of business development at Crypto Valley Association

“The landscape of trust is changing and blockchain is arriving to fill the gaps,” added Jemma Green, co-founder and chairman of Powerledger.

Luna PR is WBS’ official PR partner, while some of the global blockchain and Web3 experts sponsoring the event include DIG (Decentralized Investment Group) as headline sponsor, Coinstore and Aura Dogs as silver sponsors and Dreamster as exhibitor. Crypto Oasis is the ecosystem partner, while media partners at the event include Bitcoin World, BinBits, Coinspeaker, CoinTelegraph MENA, Cointelegraph, Coinveestasi, Crypto Academy, Regtech Times, Security Middle East, The Cryptonomist and The Jordan Times.

About Elite Partner Investment

Elite Partner Investment is a UAE-based investment management company with interests in technology, mining, energy and real estate, chaired by Sheikh Juma Ahmed Juma Al Maktoum. Areas of the group’s interest include early-stage technology and creating value through innovation and synergies. Al Maktoum enables the company and its partners to access and work at the highest level with government and leading multinationals around the globe, enabling them to grow, expand and access new markets.

About World Blockchain Summit

World Blockchain Summit (WBS) is a global series of blockchain, crypto, Web3 and Metaverse-focused events that has brought together over 20,000 industry influencers, investors, enterprise decision makers and government stakeholders through physical events hosted in over 16 countries.

WBS is dedicated to fostering the growth of the decentralized economy through community development, boosting technological innovation with access to capital, and enabling enterprise and government adoption of Web3 technologies through deal facilitation. Each summit features enterprise and government use cases, inspirational keynotes, panel discussions, tech-talks, a blockchain exhibition, startup pitch competitions and a host of networking opportunities.

Other upcoming platforms organized by WBS Events in 2022 include the World Metaverse Show taking place on Oct. 5 and 6 in Dubai, the World Blockchain Summit Toronto taking place in November, and the World Blockchain Summit Bangkok in December.

Kevin Kelly has been famous for his sense of the direction of all things technological since the 1980s. His books on the subject published over a span of decades are consistent best sellers. When something new comes over the technological horizon, such as artificial intelligence (AI) and blockchain, the world is eager for his opinions, and HistoryDAO has the privilege of having his opinions directly for the second time this year.

In the first interview, HistoryDAO spoke with Kelly on the subject of “what technology wants,” and a good deal of the conversation covered specifically “what blockchain technology wants,” and the role of nonfungible tokens (NFTs).

“The fact that you know London is the capital of England is just a consensus,” said Kelly in the earlier interview. “The very thing itself is a consensus. Not just the representation of it.” This part of Kelly’s discussion brought to light the role of consensus in truth, implying that the Platonic ideal for truth may have been consensus all along. NFTs and blockchain, of course, are founded on the codification of consensus.

Taking these insights from Kelly to heart, the HistoryDAO team came to realize how important consensus has always been considered all the way back to the founding of Western philosophy by Plato, who believed that while objective truth existed, it could only be revealed through “dialectic,” which bears significant analogy to the modern concept of consensus.

In the coming weeks, HistoryDAO, represented by founder and CEO Sky Harris, and Kelly will add a favorite and increasingly critical topic to the dialectic: AI. Does AI have a role to play, or will it soon have a role to play, as a participant in dialectic itself? Do blockchain and NFTs have a unique touchpoint with truth? The conversation will pursue such questions with reference to lessons from history and technology’s role in the future. Kelly’s perspective on AI will be explored as well in the context of another passion of his art as a universal and uniquely human endeavor.

Look for the conversation on HistoryDAO’s YouTube channel in the coming weeks!

About HistoryDAO

HistoryDAO is where the world records history in Web3. The Web3 community comes together on the HistoryDAO platform to mint historic and current events immutably on the blockchain to be preserved — unchanged and indelible — as HistoryNFTs. The decentralization and democratization of history with blockchain and NFT technology are governed by you, the decentralized autonomous organization (DAO), the people. Write, record, analyze, adjudicate and mint our world as it unfolds across the globe every day with HistoryDAO and HistoryNFTs.

- Twitter: https://twitter.com/History_DAO

- Discord: https://discord.com/invite/MFCxaEp2Zn

- YouTube: https://www.youtube.com/c/HistoryDAO

- Website: https://historydao.io

About Kevin Kelly

Kevin Kelly is renowned for his seminal role in the history of the internet. It can be said that he “was there from the beginning.” Kelly co-sponsored the first Hackers Conference in 1984 under the auspices of the publisher of the Whole Earth Catalog, which also supported the oldest digitally based community bulletin board, The Well, founded in 1985, and still operating today. In the early 90s, he became the founding editor and “Senior Maverick” of Wired Magazine. In his career as a chronicler observing the relationship between human beings and technology, he became famous for making dependable predictions about what that relationship would produce in the future.

Kelly has published several best-selling philosophical books on technology over the past decades, and his most recent work is a labor of love from the time he first arrived in an Asian country with a camera in hand. It’s called “Vanishing Asia,” an anthology of more than 9,000 photographs he took while traveling through Asia since the 1970s.

Hong Kong/Sydney, Oct. 10, 2022 — Catheon Gaming, ranked as the No. 1 blockchain gaming emerging giant in the “2022 KPMG & HSBC Emerging Giants in Asia Pacific report,” is pleased to announce the official launch of the Catheon Gaming ecosystem, the Catheon Gaming white paper and the Catheon token.

The Catheon ecosystem is expected to be one of the industry’s deepest and most comprehensive, with four key pillars:

- An industry-leading blockchain gaming portfolio through our developing and publishing business.

- The Catheon Gaming Center (CGC), a chain-agnostic game explorer and launcher.

- Our Catheon Labs advisory and consulting arm for Web2 companies looking to transition to Web3.

- Catheon metaverse, the single unifying hub for all Catheon games.

Catheon Gaming is growing beyond the single-title approach of many existing projects by creating an ecosystem that will endure beyond the life cycle of any one game. Based on a unified platform and token, the ecosystem will connect the experience of playing individual games in a way that is only possible with blockchain technology and drive significant synergies between the different segments of the ecosystem. More information about the Catheon Gaming ecosystem can be found in the presentation and white paper and via the CEO’s announcement.

Catheon Gaming also announced the release of its universal utility token, Catheon, which will be used across the entire ecosystem. This will be done by an effective rebrand and relaunch of the existing SolChicks CHICKS token. With the entire Catheon Gaming brand and portfolio behind it, Catheon is expected to be the ecosystem token with more utility and development compared to any of the other similar blockchain gaming ecosystems.

There are several compelling drivers behind the rebrand:

- The first and only token of its kind for a gaming ecosystem on the Solana and Polygon blockchains, with down-the-line cross-bridging to other major chains.

- The token will have the position as the universal governance and utility token of the largest and one of the highest-quality blockchain gaming portfolios in the industry.

- Ecosystem utility beyond the game portfolio to the Catheon Gaming Center, the Catheon Labs advisory business and the Catheon metaverse.

- An imminent use case is given the largely complete and ready-to-release nature of the game portfolio, the expected release of the Catheon Gaming Center and staking benefits.

- Governance over the future of one of the most complete ecosystems in blockchain gaming.

As the Catheon network, community and the number of titles continue to grow, Catheon Gaming expects significant network effects and synergies that will help continue to accelerate the quality of the portfolio and ecosystem. With Catheon Gaming’s high-quality team and track record of rapid execution, evident in the company’s growth over the last 11 months, the company expects to continue growing rapidly as it builds out the ecosystem in the coming years.

William Wu, founder and co-CEO of Catheon Gaming, commented:

“Since we started this project, what has also become apparent is that this project, and our vision, has expanded to be so much more than just a single game. Today, we are extremely excited to announce our biggest update yet. We have been hard at work over the last 12 months to build the foundations required for this update and are finally in a position to do so. Our vision is to build one of the most comprehensive ecosystems in the industry to truly revolutionize the way we play, live and earn. We have a lot of work ahead to execute on our vision, but we are confident that we will be able to help to revolutionize blockchain gaming.”

About Catheon Gaming

Catheon Gaming, ranked by KPMG and HSBC as the No. 1 emerging blockchain giant in Asia–Pacific, is one of the world’s fastest-growing integrated blockchain gaming and entertainment companies. Catheon Gaming is the only end-to-end platform providing world-class technical, publishing and partnership capabilities for the world’s leading game studios, companies and brands seeking to navigate their path into Web3. By being the partner of choice, Catheon Gaming has built the industry’s largest portfolio of blockchain games and one of the deepest ecosystems to achieve its goal of being able to revolutionize the way we play, live and earn.

Coinbase, the largest crypto exchange in the United States, said it has received approval from Singapore’s central bank to offer payment services in the city-state.

The in-principle approval, which the central bank started giving out to crypto firms last year, means individuals and institutions can use digital payment token services and the firms are regulated by the central bank under its Payment Services Act.

Calling it a “significant milestone”, Coinbase said in a statement that it has been building up its presence in Singapore and currently had nearly 100 employees in the Southeast Asian state, with product engineers forming the largest bulk of hires.

“We see Singapore as a strategic market and a global hub for Web3 innovation,” said Hassan Ahmed, Coinbase’s regional director for Southeast Asia.

About 180 crypto companies applied for a crypto payments licence to the Monetary Authority of Singapore in 2020 under a new regime. Singapore has handed out 17 in-principle approvals and licences after an elaborate due diligence process that is still ongoing.

Besides Coinbase, Crypto.com and DBS Vickers – the brokerage run by Singapore’s largest bank DBS (DBSM.SI) – are among those that have received licences.

Singapore’s welcoming approach has helped the financial hub attract digital asset services-related firms from China, India and elsewhere in the last few years, making it a major centre in Asia.

However, there have also been quite a few cases of crypto fall-outs taking place in the city state. Singapore-based crypto hedge fund Three Arrows Capital began liquidation in June after it was unable to meet hundreds of millions of dollars in obligations.

The hedge fund had taken a hit from the collapse of cryptocurrencies Luna and TerraUSD in May. Both coins were developed by Terraform Labs, which was incorporated in Singapore. Terraform Lab’s founder Do Kwon is currently wanted by the South Korean police.

The chief of the MAS has, however, sought to distance Singapore from these firms and said in July that companies like Three Arrows and Terraform Labs were “so-called Singapore-based” firms that had “little to do” with the city state’s crypto regulations.

Singapore plans to roll out new regulations that will make it more difficult for retail investors to trade cryptocurrencies.

Cryptocurrency exchange Huobi Global said its founder had agreed to sell his controlling stake in the China-based company to buyout firm About Capital Management (HK) Co.

Upon completion of the transaction, the buyout vehicle of About Capital will control the majority stake of Huobi founder Leon Li, Huobi said in a statement on Friday.

The transaction involves only the change of controlling shareholder and has no impact on Huobi’s core operation and business management team, the company said.

The cryptocurrency industry has seen sharp declines this year amid a broader risk-off sentiment in the markets due to geopolitical turmoil, aggressive monetary policy tightening and decades-high inflation.

Li was exploring the sale of his almost 60% stake, people familiar with the matter had told Reuters in August. That month competitor FTX’s CEO Sam Bankman-Fried said that he had no plan to buy Huobi.

Huobi exited from China in December last year and closed off all mainland China user accounts.

The biggest international crypto, blockchain and Metaverse exhibition, ICBM Expo, is just around the corner. Events360 Group has announced the event to bring exhibitors, traders, specialists and fans out of the woodwork. The major tech exhibition will be held on March 3 and 4, 2023. Conferences will take place for two consecutive days of the exhibition at a constant pace at the Festival Arena, Festival City Dubai, UAE.

ICBM Expo is the only enormous meetup opportunity for tech companies to come up with all their pioneering offers. Moreover, people visiting it are expected to know about groundbreaking technologies, intelligent and safe business, and investment opportunities. They will discover what products or projects companies have to offer and in which direction they are heading. ICBM Expo will feature more than 100 tech companies, 50 speakers and expects more than 10,000 daily visitors. Moreover, entry passes for ICBM Expo are real NFTs. An extensive network of Metaverse, cryptocurrency and blockchain professionals from various exchanges, payment, liquidity solution providers, NFT, ICOs, play-to-earn projects, the Metaverse, influential industry experts and executives will come together for the two-day event.

Most importantly, doors are open to all the trendsetters and new startups in the fintech industry that are looking to discover fresh opportunities. It is all about innovation. ICBM Expo is avidly looking for emerging tech companies revolutionizing the cryptocurrency, blockchain and Metaverse industries. Moreover, there is a separate startup village in which founders will get an opportunity to pitch their innovative ideas to investors and close massive investments.

Dubai has enormous potential for regulating events regarding technology and adopting cutting-edge innovation. The UAE government is making strides in building a robust digital economy and utilizing the advantages and benefits that come with it. Visitors will know how to interact with one another digitally and develop a sense of community by using avatars in the Metaverse.

At ICBM Expo, attendees will be able to enjoyably and aimlessly traverse the Metaverse using a virtual reality headset and controllers. They’ll learn how participants can confirm transactions using blockchain technology without needing a centralized clearing house. It is a peer-to-peer network of decentralized ledgers for all trades. NFTs can be used to show ownership of unique items. Similarly, things like works of art, valuables and even real estate can be tokenized. No one can change the ownership record of an asset or copy/paste a new NFT into existence, which is how the Ethereum blockchain secures the ownership of an investment.

These virtual worlds are incredibly engaging and have significant economic and social potential. By utilizing blockchain structure, people may access the larger digital economy and make virtual goods exchangeable for actual economic value outside the Metaverse. As this interest in learning about and participating in digital asset investment and business opportunities has grown significantly in recent days, ICBM Expo guarantees to be an event of new talks and networking for the emergence of institutional interest and the expansion of crypto-focused venture capital, among other things.

There’s also some great news for kids: Parents can create a cryptocurrency wallet for their child and set up periodic donations via Crypto for Kids, which will accept presents from relatives and friends that are put immediately into their wallets.

ICBM Expo is an essential thought-leadership event, with a new lineup of key influencers leading talks about the future of relevant industries. It’s not to be missed, particularly because of the insightful and exciting conversations expected on new game-changing technologies (including blockchain, Metaverse and virtual assets), GameFi, DeFi, investing in virtual real estate, the future of the Web3 internet, digital payment solutions and getaways, talks on ICOs and STOs, progress in the crypto space, the role of AI and VR in the Metaverse and much more. A stellar lineup of conference speakers is already in the works, with some of the world’s most powerful influencers and officials expected to participate. Attendees see networking opportunities with significant industry executives, investors and guided business contacts.

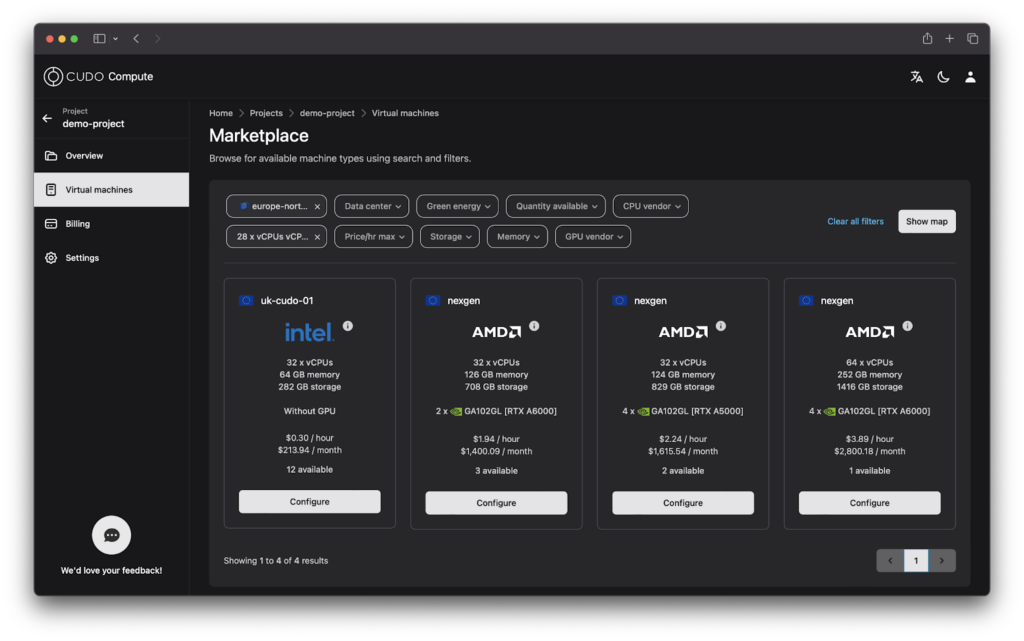

Cudo Compute is revolutionizing the cloud industry by providing a democratic and sustainable alternative to the centralized cloud.

Why it matters: The cloud industry is growing rapidly as innovations in artificial intelligence, scientific computing, virtual reality and augmented reality tech continue to develop.

But the public cloud, as it exists today, is primarily owned by just three companies. This highly centralized cloud model faces several issues:

- Disruptive outages can take down key services for hours at a time due to a single point of failure.

- Sustainability issues result from energy consumption, water usage and electronic waste.

- Latency problems due to the distance between the data center and the end-user.

Through its distributed cloud marketplace, Cudo Compute is tackling these problems by providing an efficient, robust and cost-effective way to connect buyers and sellers of computing power.

Go deeper

Cudo Compute allows companies and individuals to find and use available compute resources more efficiently, moving beyond the inherent constraints of on-premise and centralized cloud environments.

This radical new cloud model provides a host of benefits, including:

- Increased availability. Those seeking specific types of processing power — e.g., GPUs — can be easily matched with suppliers offering exactly what they need.

- Lower cost. Computing suppliers can improve their returns by reducing under-utilized capacity, with corresponding price reductions for buyers.

- Closer proximity. A geographically distributed cloud makes it far easier for those seeking computing power to find a location as close as possible to the point of delivery.

- Reduced waste. Building new infrastructure has an environmental cost. Just one data center can consume as much electricity as 50,000 homes. Instead, Cudo Compute will help to maximize existing resources and take advantage of the billions of dollars of under-utilized computing resources available across the globe.

At launch, Cudo Compute will offer a user-friendly cloud service allowing you to find and use virtual machines hosted by a wide range of data center providers around the globe. Key features include:

- A high-performance infrastructure offered at a fraction of the cost of existing cloud providers.

- Access to latest-generation processors, including Nvidia GPUs, Intel Xeon and AMD EPYC CPUs.

- Robust security through hosting in data centers with ISO 27001 security and ISO 9001 quality certifications.

- One-click solutions for businesses in a range of specialized applications, including data science, deep learning, rendering and more.

Solutions

At present, Cudo Compute focuses on the following use cases and applications:

- Artificial intelligence and machine learning — Use purpose-built images for machine learning with or without Docker using TensorFlow and PyTorch.

- 3D rendering and motion graphics — Scale your video rendering to 100,000 GPUs and CPUs, which is faster and more cost-effective with Blender.

- High-performance computing (HPC) — Run all your HPC workloads without investing CAPEX on high-performance hardware sitting idle outside office hours using Parabricks and GROMACS.

- GPU cloud — Access to on-demand GPU instances with per-second billing hosted in data centers with ISO 27001 security and ISO 9001 quality certifications.

The future

Cudo Compute will serve as the infrastructure backbone for Web3 by eventually integrating with its sister company Cudos. The 100% carbon-neutral layer-1 blockchain offers low-cost, fast transactions.

Since Cudos is interoperable, it will integrate with all other major layer-1 chains, bringing cloud and blockchain closer together. Think Filecoin but for the entire compute stack where developers can access resources on- and off-chain independent of the network where they launched.

Enjoy the commercial and project acceleration benefits of expanding your access to scarce resources by contacting us or registering for an account at cudocompute.com.

About Cudo Compute

Cudo Compute is an ecosystem providing access to decentralized and sustainable cloud computing resources by leveraging under-utilized computing power on idle hardware globally.

We are the Airbnb for sustainable computing. Like Airbnb’s marketplace, which allows owners to rent out their unused homes, we facilitate businesses and individuals to lend their hardware’s unused computing to users and organizations that might need it. Our platform allows organizations and developers to deploy, run and scale based on their cloud demands.

European Union rules to regulate crypto assets will curb the market share of non-euro denominated stablecoins from 2024, potentially limiting EU competitiveness, industry representatives have said.

Ambassadors for the 27 EU states on Wednesday gave their approval to a deal on the new Markets in Crypto Assets Regulation (MiCA) thrashed out in June with the European Parliament.

To become law, the Parliament must vote on the rules, something which is expected to happen in December or early 2023.

The ambassadors also published a full text of the deal, revealing details such as that stablecoins not denominated in the euro will be limited to 1 million transactions and 200 million euros ($196 million) in transaction value when marketed in the euro zone.

A joint letter by crypto industry groups Blockchain for Europe and the Digital Euro Association said that the world’s three largest stablecoins – Tether, USD Coin and Binance USD – account for 75% of crypto trade volumes and already exceed the transaction-count and volume limits set out in the EU rules.

Anto Paroian, CEO of cryptocurrency hedge fund ARK36, said the curb “will likely limit the EU’s competitiveness and innovation potential”.

The European Crypto Initiative, a Brussels-based crypto lobbying group, said in a statement the outcome could be “burdensome”.

But it said a more favourable approach to euro-denominated stablecoins was likely to emerge after “initial fears for the EU’s financial stability and monetary sovereignty”.

Stablecoins are a type of cryptocurrency designed to maintain a constant value, usually via a 1:1 peg with a fiat currency.

“If the directive’s current wording does not change, it will significantly restrict the use of dollar-denominated stablecoins such as USD Coin, Tether, and Binance US,” Fabian Astic, Global Head of DeFi and Digital Assets at Moody’s Investors Service, said.

Stefan Berger, a member of the European Parliament who helped to negotiate the final deal, told Reuters: “Indeed, this might increase the euro-pegged stablecoins, which is a welcome development.”

Tether’s dollar-pegged coin is the world’s third largest cryptocurrency, with a market cap of $68 billion, compared to$202 million for the euro-pegged version, CoinGecko data shows.