The Monetary Exchange of Singapore (MAS) has issued a stern warning to cryptocurrency exchanges operating in the nation to comply with ongoing Russian sanctions.

According to reports, Singapore’s central bank stated it would take action after alleged research found pro-Russian groups had received millions in crypto donations amid the ongoing war in Ukraine.

Numerous Russian entities, including individuals, institutions, and companies, have faced US and European Union (EU) sanctions over the last few months since the onset of the conflict in February.

The news comes after the EU slapped its eighth sanctions package on Moscow, which bans all cryptocurrency exchanges from operating in Russia.

Previous sanctions regimes limited Russian-EU crypto transactions to payments of $10,000 or less.

The news comes just months after Tharman Shanmugaratnam, senior minister and minister in charge of MAS, responded to Parliamentary questions that his institution required all financial entities to comply with measures regardless of whether they were decentralised or traditional channels, reports show.

Crypto Pushback Against Blanket Ban

The news comes months after Coinbase and Binance, the world’s top two crypto exchanges, rejected a blanket ban across Russian platform users amid the ongoing conflict.

Coinbase CEO Brian Armstrong tweeted in early March: “We believe everyone deserves access to basic financial services unless the law says otherwise.”

8/ Some ordinary Russians are using crypto as a lifeline now that their currency has collapsed. Many of them likely oppose what their country is doing, and a ban would hurt them, too. That said, if the US government decides to impose a ban, we will of course follow those laws.

— Brian Armstrong (@brian_armstrong) March 4, 2022

He continued in his thread, stating: “Some ordinary Russians are using crypto as a lifeline now that their currency has collapsed. Many of them likely oppose what their country is doing, and a ban would hurt them too. That said, if the US government decides to impose a ban, we will of course follow those laws.”

At the time, Binance also said it would not “unilaterally freeze millions of innocent users’ accounts.”

According to Reuters, Bitcoin prices spike after the conflict, namely after users moved their money and assets in anonymised crypto wallets. It is believed users took such measures to avoid frozen assets after sanctions hit Russian banks.

In a recent speech, United Nations (UN) Countering Financing of Terrorism Coordinator said in a speech that terrorist organisations were increasingly turning to emerging technologies to finance operations.

She warned at her speech in New Delhi that increasing use of such decentralised and emerging tools could trigger the expansion of terrorist financing networks and operations.

Terrorist organisations blocked from the “formal financial system” are circumventing restrictions with cryptocurrencies, Svetlana Martynova, United Nations (UN) Countering Financing of Terrorism Coordinator said in a speech at a recent event.

At the UN Counter-Terrorism Committee’s Special Meeting from 28 to 29 October, the official discussed measures to tackle terrorist financing from “new and emerging technologies.”

She mentioned that using cash were “predominant methods” to finance terrorist activities, adding: “We know terrorists adapt to the evolution of conditions around them and as technologies evolve they adapt as well.” Hawala is a system for transferring money in Arab and South Asian nations.

#UNCTCEmergingTech pic.twitter.com/mGzrn2xufB

— United Nations CTED (@UN_CTED) October 29, 2022

She continued, stating: “If they’re excluded from the formal financial system and they want to purchase or invest in something with anonymity, and they’re advanced for that, they’re likely to abuse cryptocurrencies.”

The UN aimed to tackle the issue internationally by persuading nations to adopt resolutions from the bloc’s regulatory body, the UN Security Council, along with measures from the Financial Action Task Force (FATF) she said, adding it was the main challenge.

She criticised some nations for failing to start working on and enforcing regulations for such threats.

Antonio Guterres, UN Secretary-General, echoed Martynova’s comments, explaining that emerging technologies improved the human condition but also had the potential to harm via terrorism financing.

He said: “Terrorists and others posing hateful ideologies are abusing new and emerging technologies to spread disinformation, foment discord, recruit and radicalize, mobilize resources and execute attacks.”

RAND Corporation and Crypto Terrorism

According to the RAND Corporation, several factors increased the likelihood of terrorist funding via cryptocurrencies, the organisation noted in a 2019 report.

It found that growth in the cryptocurrency market would “require increase reliability and more-widespread usage, leading to greater adoption of crypto financial systems, also in terrorist locations.

It also stated that second-generation cryptocurrencies with “advanced privacy features” could facilitate “more illicit use of these systems.”

Several superpowers such as the United States, China, and the European Union (EU) block bitcoin anonymity on exchanges, but decentralised platforms and countries with fewer or no regulations could create difficulties in tracing transactions.

Concluding, it added increased cryptocurrency use in “complementary and adjacent markets” could reveal growing use for terrorist organisations, including darknet and “illicit drugs and stolen identities” markets.

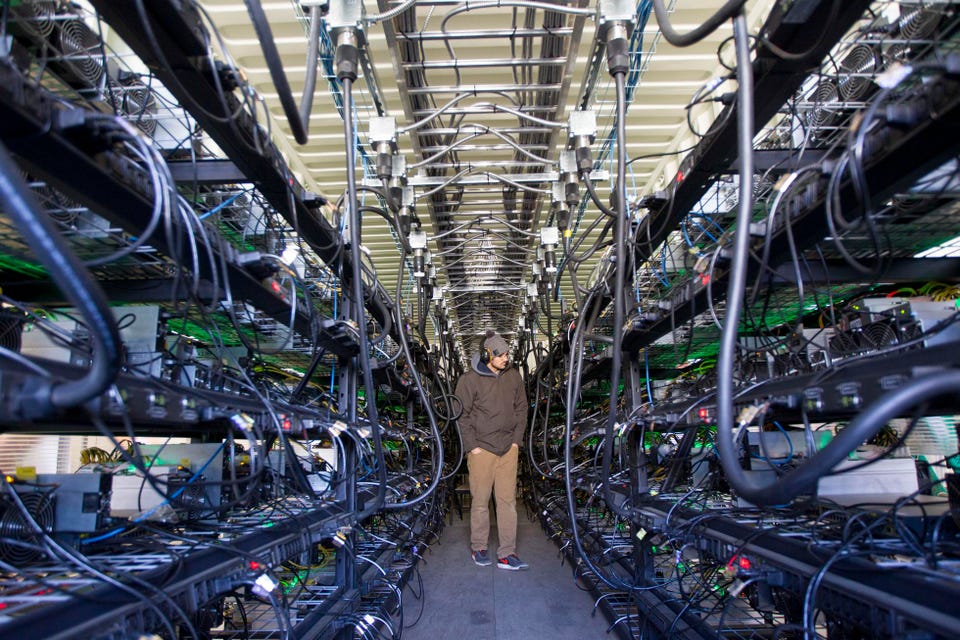

Argo Blockchain, a company listed on the London Stock Exchange, issued a warning on Monday it may close its business due to a lack of funds.

The company mines cryptocurrencies, but has failed to receive substantial capital from investors, leaving it with a major shortage of funds to continue operations, it announced at the time.

New RNS today contains updates on the strategic actions disclosed on 10/7.

— Argo (@ArgoBlockchain) October 31, 2022

We no longer expect to close the equity subscription on the terms disclosed and we’re exploring other financing options.

We also sold 3,843 S19J Pro machines for $5.6m.

Full RNS: https://t.co/KthypzXCAT

In its tweet, the company said it had sold 3,843 S19J Pro coin mining machines for $5.6 million.

Despite seeking fresh financing, there was “no assurance” it would sign any definitive agreements or consummate transactions, it said in its notice.

Explaining further, the company said: “Should Argo be unsuccessful in completing any further financing, Argo would become cash flow negative in the near term and would need to curtail or cease operations.”

Additionally, it stated it aimed to complete financing transactions to earn enough “working capital sufficient for its present requirements” up to 12 months from the announcement, it explained.

It added it hoped to raise roughly £24 million using a subscription service for ordinary shares. Concluding, it explained: “Should Argo be unsuccessful in completing any further financing, Argo would become cash flow negative in the near term and would need to curtail or cease operations.”

Crypto Crash and Freeway Diversion

The news comes amid a major Bitcoin crash triggered in June, which saw the leading coin plummet to around $17,000 amid a volatile bear market. Following the incident, Argo sold 637 BTC and 887 BTC in June and July, respectively. It became a major seller of self-mined Bitcoins along with several other firms.

The news comes just a day after cryptocurrency platform Freeway halted several of its services amid rising instability in the current crypto market, forcing it to diversify assets to tackle the ongoing fluctuations.

Freeway later suspended its Supercharger simulation purchases amid its restructurings due to the “unprecedented volatility.”

Binance has remained open to unsanctioned Russian nationals following sweeping sanctions from the European Union (EU), a key executive told Cointelegraph on Friday.

Chagri Poyraz, Binance’s recently-appointed global head of sanctions, stated it had blocked several territories involved in the ongoing Ukraine-Russia war such as Donetsk and Luhansk.

Russia is one of Binance’s top ten markets, it noted in 2019.

In his interview, he noted there was “still an active war going on in the region” and that his company would continue to monitor developments with its massive workforce of compliance executives.

Roughly half of its 500 executives work with sanctions control mechanisms such as anti-money laundering and name screening, the report noted. He added Binance had “zero tolerance” for blocked accounts due to targeted sanctions directed at specific people or entities.

What are the Latest Sanctions?

He stated that EU sanctions were the “hardest part” and lacked clarity, namely after the bloc launched its eighth sanctions package. The firm claims it reached “no particular dialogue” with EU regulators.

Speaking further, he said: “We do obviously follow all the EU sanctions, but there is room for improvement when it comes to clarity. […] We are trying to follow sanctions as they are. The challenge is not overdoing, doing what you’ve been told. The regulation has to be clear.”

He added the lack of clarity over EU sanctions on Russia was an “industry problem” rather than solely with Binance. The EU’s sweeping restrictions in October ban “all crypto-asset wallet, account, or custody services, irrespective of the amount of the wallet.”

The news comes after platforms like Crypto.com, Blockchain.com, and LocalBitcoins informed users in October they would halt services across Russia after the EU imposed the sanctions.

The EU recently capped Russian crypto investments at 10,000 Euros, but the new regulations now ban “IT consultancy, legal advisory, architecture and engineering services.” Such measures aim to hit Russia’s dependence on importing foreign services amid the ongoing conflict, an EU spokesperson wrote.

Ethereum (ETH) has hit new liquidation highs, revealing the bearish nature of the ongoing cryptocurrency crisis, figures from CryptoQuant revealed this week.

The on-chain analytics platform found that short liquidations in USD had reached $500 million in just two days, shattering the market and leading to significant losses for traders.

Despite this, ETH/USAD climbed from $1,337 to $1,593 on Bitstamp, data from TradingView showed from 25-26 October. Markets were hit with both BTC and ETH shorts, triggering macro lows across platforms.

1) Total Liquidations

— BlackSwan DAO (@DAOblackswan) October 26, 2022

The number of liquidations of Short and long BTC positions jumped to 550M dollars in the last 24 hours.

If we add other coins to Bitcoin, then in total over 1.1 billion positions were liquidated in 24 hours! 🔥#Bitcoin #volatility #Liquidation #crypto pic.twitter.com/T0uc3jFxvw

Figures show that liquidations erased $275 million and $250 million USD on the 25 and 26, respectively, wiping out over half a billion in positions by the week’s end.

CryptoQuant Chief Executive Ki Young Ju said in a statement: “$ETH short squeezes for the last two consecutive days. Daily short liquidations across all exchanges reached an all-time high.”

The news comes after exchange platform FTX noted the event was the single largest liquidation in its history. Binance followed shortly after with $57.58 million and OKX reported a $46.72 million change.

A new report has found that the ongoing cryptocurrency crash has set record lows in average daily aggregate product volumes across digital assets.

CryptoCompare published the findings on Thursday, where it noted that global crypto products had plummeted 34.1 percent in average daily trading volumes in October, or $61.3 million USD.

/2 Despite this, average daily trading volumes of #crypto products fell 34.1% to $61.3mn – the lowest-ever volume reported (data tracked since June 2020).

— CryptoCompare (@CryptoCompare) October 27, 2022

Click below for the full Digital Asset Management Review report!https://t.co/s1cgGQTPWM

Currently, Bitcoin (BTC) sits just above $20,000, the benchmark health indicator for the coin following a heavy crash in June that plunged its value to $17,600.

Products featured in the report faced similar declines up to 77.5 percent, indicating a major fall in daily trading. October was one of the worst-performing months for crypto trading since September 2020, where volumes fell below $100 million USD.

Conversely, total assets under management (AUM) climbed 1.76 percent to $22.9 billion USD compared to the month before. AUM for trust products jumped 2.34 percent, or $17.7 billion, with exchange-trade funds (ETF)-linked AUM dropped 1.59 percent at $2.21 billion.

The report also mentioned that Valour’s Bitcoin product remained the highest-traded Ethereum Classic (ETC) despite the ongoing plunge in volumes across the market. Other products such as XBT Provider’s Ether (ETHONE) also recorded heavy losses at 54.7 percent, or $1.38 million, the report found.

A South Korean businessman may face up to eight years imprisonment for his alleged role in a cryptocurrency fraud scandal totalling $70 million USD, reports found on Wednesday.

Lee Jung-Hoon, former Bithumb chairman, has been charged with scamming cryptocurrency investors of roughly 70 million USD (100 billion won) from the chairman of the BK Group, Kim Byung Gun.

According to Yonhap News Agency, prosecutors involved in the case have asked the Seoul District Court to sentence Lee on 25 October, with a further hearing on 20 December.

Kim was chairman of the cosmetic surgery conglomerate in October 2018 and planned at the time to buy out the cryptocurrency exchange platform.

Kim alleges he transferred the $70 million to Lee for a “down payment” for the exchange, providing Lee listed the BXA token from the Blockchain Exchange Alliance formed.

Local prosecutors asked the 34th Criminal Settlement Section of the Seoul District Court for the sentence on Oct. 25, with a hearing to take place on Dec. 20, according to a report from Yonhap News Agency.

Bithumb never listed the token, causing the deal to fall through.

Responding, Lee Jung-Hoon’s lawyer stated the deal’s structure was a “typical stock sale contract” and had been carried out as needed according to the normal procedures for the contract.

Lee added in a final statement he was “very sorry for making it difficult for employees and causing social pressure,” just weeks after failing to join a parliamentary hearing on 6 October.

He stated he failed to show up for the meeting involving the $40 billion collapse of Terra Luna due to having a panic disorder.

Bybit Buyouts

The news comes just a day after Bybit, a Dubai-based cryptocurrency exchange, invested $3.8 million in the third-largest shareholder of the South Korean platform, T-Scientific, media reports found.

T-Scientific issued the 16 billion won of convertible debt at the end of September, allowing the firm to leverage its debt on interest, convertible to equity with stipulations.

The recent acquisition of debt will allow Bybit potentially a massive stake in the South Korean crypto platform with trading volumes of $239 million USD.

In late July, cryptocurrency trading platform FTX also entered talks with Bithumb to discuss acquiring the latter, Bloomberg reported, citing anonymous sources.

Both Bithumb and FTX spokespeople could not confirm the talks, the report added. Bloomberg based the report, which stated that the discussions have been underway for months, on an unnamed source.

The buyout comes as Sam Bankman-Fried, FTX co-founder, aims to buy out Bithumb to gain access to capital used for further acquisitions, it concluded.

A popular cryptocurrency analyst has recently claimed that Bitcoin could reach $100,000 in 2023, but would face a huge bear market afterwards.

Credible Crypto wrote in a Twitter thread that BTC could potentially halve sometime next year to roughly $10,000, becoming a major struggle for the leading cryptocurrency.

The analyst believes Bitcoin would settle from its “blow-off top” all-time high (ATH) to figures below its low of $17,600 this year, reaching around $10,000 up to 2025.

He agreed with Mr Parabullic, stating investors would face “the largest bear market we have seen yet that is worse than the current one in both time and price” which would take it “to the 10-14k” mark.

Agreed, probably in 2025 methinks. First, new ATH in 2023- blow-off top 5th wave above 100k- followed by the largest bear market we have seen yet that is worse than the current one in both time and price- taking us to the 10-14k that everyone is waiting for now. $BTC https://t.co/bv0jvzOG2A

— CrediBULL Crypto (@CredibleCrypto) October 21, 2022

IncomeSharks, another analyst, stated the rally would follow the “final Facebook adoption cycle” where “everyone and their parents and grandma finally buy after they’ve been skeptical [all] year.”

I call this the final Facebook adoption cycle. When everyone and their parents and grandma finally buy after they’ve been skeptical al year.

— IncomeSharks (@IncomeSharks) October 21, 2022

DecenTrader co-founder Filbfilb initially estimated $10,000, while Capo of Crypto speculated a return to $14,000-16,000 after a potential relief bounce of $21,000.

The Great Bitcoin Buyout

The developments come just hours after investors triggered a massive purchasing rush of 55,000 Bitcoin on the Binance exchange, following the coin’s return to $20,000.

Analyst Michael Wrubel said that he had seen “derivatives platform outflows now setting multi-month records.”

55,000 #Bitcoin (approximately $1.1 billion) were just withdrawn from #Binance.

— Michael Wrubel (@michaelwrub) October 27, 2022

This is a record high and we are seeing derivatives platform outflows now setting multi-month records.

I’m bullish. pic.twitter.com/jDgXCiuXCX

“I’m bullish,” he concluded, hinting at further potential instability in the market.

The purchase was the largest outflow in the platform’s history, topping its nosedive to $17,600 in June and the coin crash in March 2020, according to reports.

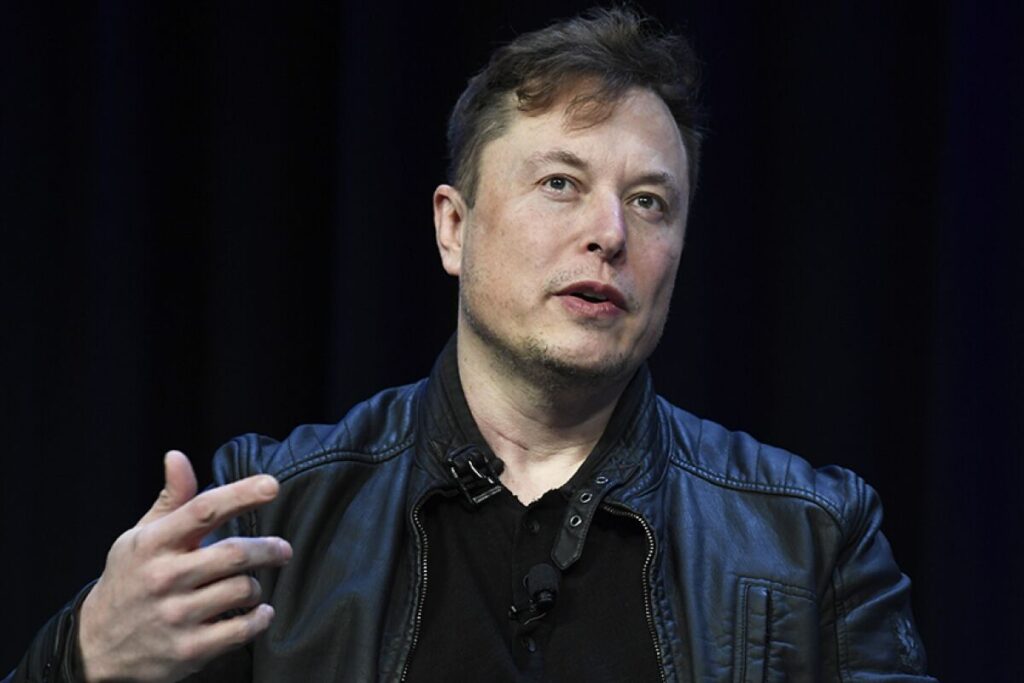

Tesla and SpaceX founder and Chief Executive Elon Musk officially acquired Twitter on Thursday following a series of court battles, memes, and terminations.

The $44 billion USD deal comes as Musk bought out the social media giant for $54.2 per share, following his successful bid on 11 April this year.

Musk also took the company private and delisted it from the New York Stock Exchange to remove it from public shareholders, the first time since it was listed in 2013.

To be super clear, we have not yet made any changes to Twitter’s content moderation policies https://t.co/k4guTsXOIu

— Elon Musk (@elonmusk) October 29, 2022

The NYSE mentioned Twitter will no longer be a public company and that the exchange would freeze its shares on 28 October, along with several trading platforms.

Public listing provides regulatory scrutiny, a key advantage following numerous rows the billionaire has faced with the Securities and Exchange Commission (SEC) in recent years over Twitter posts.

Conversely, Twitter as a private firm will allow it to avoid public oversight as it no longer needs to disclose quarterly reports.

Musk also ordered Twitter employees to print up to 60 pages of code from the platform for further evaluation, following his requests in recent months.

Why Musk Is Taking Twitter

The news comes as Musk, 51, aims to drastically restructure the social media platform by slashing key positions and hiring executives to lead the company’s new direction.

Speculators also believe the measures will allow for more free speech and less censorship under the new board’s leadership, which may entice a fresh user base to join the platform.

According to the New York Times, the company has struggled to grow its advertising operations and attract new users, triggering sweeping measures after he purchased the firm. Musk has dismissed several executives from the San Francisco-based firm, including CEO Parag Agrawal, general counsel Sean Edgett, chief financial officer Ned Segal, and legal and policy executive Vijaya Gadde.

The Twitter executives who were fired on Thursday include Parag Agrawal, the chief executive; Ned Segal, the chief financial officer; Vijaya Gadde, the top legal and policy executive; and Sean Edgett, the general counsel, said two people with knowledge of the matter. At least one of the executives who was fired was escorted out of Twitter’s office, they said.

Downing Street continued its drive for its Financial Services and Markets Bill on Tuesday to ink its position on using cryptocurrencies such as Bitcoin, following a crucial vote in the House of Commons in favour of the bill.

Commons scrutinised the legislation at the time to determine amendment and determine its value in post-Brexit Britain’s economic strategy.

The Bill is one of Rishi Sunak’s first successes as Prime Minister of the UK following the resignation of former PM Liz Truss, and aims to incorporate digital assets under the Financial Services and Markets Act 2000, which regulates financial activities unauthorised by the Government.

What’s in the Bill?

The bill advocates using “digital settlement assets” along with numerous measures “to maintain and enhance the UK’s position as a global leader in financial services,” it said.

Doing so would allow the UK to reach its goal of becoming a major hub for cryptocurrencies by implementing digital settlement assets (DSAs) rather than “crypto assets.”

According to the Government, the change in definition comes as it states crypto assets use “some form of distributed ledger technology (DLT)” compared to DSAs and stablecoins, which have greater potential to “develop into a widespread means of payment.”

Downing Street stated it would launch a “package of measures” to improve governance of cryptocurrencies, months after Rishi Sunak, then-Chancellor of the Exchequers at the time, backed digital monies after creating a Royal Mint non-fungible token (NFT) under the Johnson Administration.

As Prime Minister of the UK, he continues his push for cryptocurrency acceptance, namely central bank digital currencies (CBDCs).

Despite this, the bill must still face the House of Lords before receiving royal ascent under King Charles III.

The recognition of crypto and digital assets as financial instruments is yet to be scribed into law. The bill must pass crucial steps: The House of Lords will be required to approve or amend the bill before final royal approval by the new monarch, King Charles III.