United States Commodity Futures Trading Commission (CFTC) chief Rostin Behnam commented that Bitcoin is the only crypto-based commodity to date, while speaking to an audience at an event at Princeton University.

In a Fortune report, the publication cited Benham’s comments, which contradicted his positive sentiments on Ether as a commodity. According to the interview, he aimed to explain whether a crypto asset was a commodity or security.

Today at Princeton, CFTC Chair Rostin Behnam said that the only cryptocurrency that should be viewed as a commodity is #Bitcoin, walking back from previous remarks made in October when he suggested Ether may also be a commodity.https://t.co/o5NrejDVaU

— Michael Saylor⚡️ (@saylor) December 1, 2022

In the US, Republican lawmakers have slammed the Securities and Exchange Commission (SEC) chairperson of collaborating with the now-bankrupt FTX to “obtain regulatory monopoly.”

Despite this most do not consider Bitcoin a security due to its decentralisation. The news comes after SEC officials targeted Ripple with a massive lawsuit, sparking backlash from blockchain advocate groups such as the Blockchain Association.

SEC Ties to FTX

Conversely, the SEC has been similarly lambasted due to links with FTX. The Digital Commodities Consumer Protection Act (DCCPA) provided the CFTC with oversight capacities, with the CFTC exec defending the Committee’s actions.

He said that it had limited oversight powers and slammed authorities for creating a “matrix of regulators.” The leader also urged better collaboration to manage the growing number of regulations on crypto.

Following the statements, Benham attended a congressional hearing on Thursday to explore the downfall of the FTX exchange, triggered by massive liquidity instability and a major bank run on the FTT cryptocurrency.

Global Crypto Crackdown?

The news comes as the United States, Bahamian, South Korean, Singaporean, and Australian regulators launch a heavy crackdown on crypto platforms to regulate their activities.

Many governments have reconsidered the stability of some cryptocurrencies and aim to require licences of operation for crypto firms in their respective countries, among other measures.

Cryptocurrency proof of reserves has become a major focus for trading exchanges following the bankruptcy of FTX, but some have slammed the measure as “pointless,” according to a Kraken executive.

Jesse Powell, Kraken chief executive and co-founder, said in a recent Twitter post that using proof of reserves failed to disclose liabilities publicly and needed to include them to offer full transparency.

Powell has previously slammed other exchanges for failing to include crypto accounts with negative balances, adding reserves were not wallet listings but rather assets minus their liabilities.

The news comes after Binance and other exchanges published their proof of reserves amid the ongoing FTX collapse, but despite this, Powell called for greater transparency.

I’m sorry but no. This is not PoR. This is either ignorance or intentional misrepresentation.

— Jesse Powell (@jespow) November 25, 2022

The merkle tree is just hand wavey bullshit without an auditor to make sure you didn’t include accounts with negative balances. The statement of assets is pointless without liabilities. https://t.co/b5KSr2XKLB

In a Twitter thread, he called the publication “either ignorance or intentional misrepresentation.”

Powell added: “The merkle tree is just hand wavey b*llshit without an auditor to make sure you didn’t include accounts with negative balances. The statement of assets is pointless without liabilities.”

Further in the thread, he said the point of proof of reserves was to “understand whether an exchange has more crypto in its custody than it owes to clients.”

He also urged global media to avoid “overselling it and misleading consumers,” but rather learn how proof of reserve systems operate.

The news comes after multiple exchanges, including Binance, Kraken, and Coinbase have called for greater evidence to show the financial health of cryptocurrency exchanges. This comes after former FTX chief executive Sam Bankman-Fried’s mishandled crypto assets, leading to the collapse of the exchange.

Crypto owners have begun moving their assets to self-custodial wallets to avoid further issues with trading exchanges, and governments such as Singapore and Australia have begun tightening regulations for platforms operating in their respective nations.

Binance, the world’s largest cryptocurrency exchange plans to rejoin the Japanese crypto market after it bought out a 100 percent share of Sakura Exchange BitCoin (SEBC), reports revealed on Wednesday.

Company chief executive Changpeng Zhao said in an announcement that his crypto platform had vowed to reenter the Japanese market and would strictly comply with regulations.

#Binance Acquires JFSA Registered Sakura Exchange BitCoin, Committed to Enter Japan Under Regulatory Compliancehttps://t.co/xfdnaY2hiO

— CZ 🔶 Binance (@cz_binance) November 30, 2022

The acquisition would signal a reentry to the world’s third-largest economy after a four-year pause.

In a statement, a Binance spokesperson told the media: “We can say that the acquisition of SEBC marks Binance’s first license in East Asia, and as Asia is a market with potential, we hope to expand in other regions.”

Rethinking Market Strategies

The news comes after the Japanese Financial Services Agency (FSA) hit the crypto trading firm with a notice for failing to obtain an operating licence. Japanese authorities issued similar warnings in 2021.

Binance has acquired similar stakes in major firms in Malaysia after it faced difficulties entering the Southeast Asian nation’s cryptocurrency markets.

It also resurfaced in Singapore after buying 18 percent of shares in a national stock exchange and regained access to the United Kingdom’s pound payment systems after teaming up with Paysafe due to blocks from regulators.

Location, Location, Regulation

According to Binance, the SEBC acquisition notes Binance’s first East Asian operating licence. It previously secured approvals to conduct business in Bahrain, Italy, France, Abu Dhabi, Spain, New Zealand, Dubai, Poland, Cyprus, Lithuania, and Kazakhstan.

Takeshi Chino, general manager of Binance Japan, said in a statement the Japanese market would “play a key role in the future of cryptocurrency adoption.

He added: “As one of the world’s leading economies with a highly-developed tech ecosystem, it’s already poised for strong blockchain uptake. We will actively work with regulators to develop our combined exchange in a compliant way for local users. We are eager to help Japan take a leading role in crypto.”

Hitomi Yamamoto, Chief Executive of SEBC, added that his company was “honored and delighted” to announce the news with Binance.

She concluded: “On top of our effort to prioritize user protection, Binance’s strong compliance system will contribute to building a more compliant atmosphere for users in Japan and help them access key crypto services needed for mass adoption in the future.”

Shira Greenberg, Israel’s chief economist for the Ministry of Finance, outlined several recommendations for regulating digital assets amid the country’s cryptocurrency adoption plans.

The 109-page report urges lawmakers to develop a more comprehensive set of regulations to control cryptocurrency trading platforms via Tel Aviv’s financial watchdogs.

She said that the country should restrict licencing requirements for trading platforms and crypto issuers along with the safe management of digital assets and subsequent funds.

Expanded Powers across Crypto Industry

Greenberg also calls for expanding powers to regulate licencing rules and build a better framework for taxing, buying, and selling cryptocurrencies. It also recommends that the government determine if it should monitor digital assets and cryptocurrency payments under Israeli law.

She also urged licencing and supervision mandates for stablecoin-issuing firms and an interministerial committee for scrutinising decentralised autonomous organisations (DAOs) using the blockchain.

Despite this, she noted technological neutrality was crucial while imposing cryptocurrency regulations.

She also cited data that Israelis only comprised 0.04 percent of total global cryptocurrency transactions, or 21 million transactions, with 2 percent owning or using crypto digital wallets.

ISA Cautions Crypto Investors

The figures come after the Israel Securities Authority (ISA) cautioned investors on cryptocurrencies in a statement, stating such investments “carry heavy risks for investors, including a tangible risk of loss of the entire investment amount.”

It added: “The ISA urges investors who are considering putting their money in this field, either directly or indirectly, to read this warning carefully before making a decision.”

Reasons behind the statement included market risks such as low liquidity and market bubbles, operational risks involving fraud or trade manipulations, cybersecurity risks due to hacking and theft of passwords, and regulatory risks leading to “significant” restrictions for companies in the sector.

Cryptocurrency leader Bitcoin (BTC) may risk plummeting below $7,000 in a worst-case scenario, DecenTrader co-founder FilbFilb said in a recent broadcast.

Speaking on Thanksgiving day in a live stream, he warned of a sub-$7,000 trading bottom for BTC/USD.

In his talks, he said: “In my worst case scenario, I think that would be probably where we end up, like [old-school], rock-hard support.”

He referenced a bidding zone of roughly $6,500, where purchasers would likely “start refilling their bags” as the market reached bear market levels double those seen in 2018 and the onset of the coronavirus pandemic in March 2020.

Filbfilb stated the situation would “unlikely” take place but cautioned that the ongoing FTX collapse could worsen market sentiment, leading to such an incident.

He added: “Until we have further information, that seems unlikely, and as I say, I think the fact that we haven’t dumped harder than we actually really could have done is a good sign for the bulls.”

Regarding measures to take to avoid such a market bottom, crypto may have to “dodge some bullets” over the FTX crisis, he said, adding the greater market would need to keep resilient.

Historic Highs, not Market Lows?

Speaking on BTC bear market pits, Philip Swift, Decentrader’s co-founder, added Bitcoin wallets with roughly 1 BTC or more would reach one million for the first time in history due to exchange withdrawals linked to the FTX scandal.

A future Bitcoin block subsidy halving incident set to take place in 2024 may also play a key role over the next 18 months, leading to “some positive effect on price in terms of media coverage and anticipation of that next halving event,” Swift added.

Other reports from Glassnode found BTC could reach the end of its bear market cycle. Prior to the most recent developments, it speculated that the market could have reached its macro price bottom and would weather the “perfect storm” of major on-chain losses.

Belgium’s Financial Services and Markets Authority (FSMA) issued a statement this week that cryptocurrencies such as Bitcoin, Ether, and others do not constitute securities.

The FSMA’s statement comes amid a report published in July, with the most recent statement clarifying questions on how the nation’s finance regulations affect digital assets.

The FSMA’s “stepwise plan” aims to classify cryptocurrencies issued by individuals and entities as a security in a non-legally binding agreement.

#News 📰 | Kwalificatie van cryptoactiva als effecten, beleggingsinstrumenten of financiële instrumenten

— FSMA (@FSMA_info) November 25, 2022

➡️ https://t.co/j5UZXXx214#tcrypto #cryptoactiva #MiFID #mededeling pic.twitter.com/r9xa2ryjG0

It explained in the statement: “If there is no issuer, as in cases where instruments are created by a computer code and this is not done in execution of an agreement between issuer and investor (for example, Bitcoin or Ether), then in principle the Prospectus Regulation, the Prospectus Law and the MiFID rules of conduct do not apply.”

It added that cryptocurrency not categorised under the new stepwise plan regulations could potentially face further restrictions if companies use the assets as a medium of exchange.

It added: “Nevertheless, if the instruments have a payment or exchange function, other regulations may apply to the instruments or the persons who provide certain services relating to those instruments.”

The Belgian regulators also explained its plan was neutral to the blockchain and other cryptocurrency technologies, but rather their use in markets.

The news comes after the first draft of the report, issued in July this year, to address Belgian digital asset entities. The European Parliament is set to adopt its Market in Crypto Assets regulation (MiCA), with Belgium adopting its stepwise plan before EU legislation takes effect in 2024.

The New South Wales Police Force has warned Australian crypto investors to avoid fake Bitcoin paper wallets.

Such wallets attract victims with crypto wallets with seemingly great benefits but gradually steal holdings from the owners.

The NSW Police Force wrote in a Facebook post that scams began as a paper crypto wallet with a QR code. Scammers leave paper wallets in public spaces such as streets and parks, they warned.

People scanning the QR codes for the wallets receive access links to crypto accounts with $16,000 Australian Dollars, but then users are requested to pay withdrawal fees and wallet credentials.

The NSW Police Force added: “Once the withdrawal fee is paid and the person’s crypto wallet details provided, the person’s cryptocurrency is stolen from their crypto wallets.”

Authorities have informed people to remain vigilant and avoid scanning paper QR codes or entering their personal credentials. They have been advised to turn in the wallets to local authorities.

Australia has been hit by previous paper crypto wallet scams, namely after Reddit users flagged a similar incident circulating in public places.

One user Pinnymc warned of the 0.5 percent transaction fee, stating: “If this was a legit wallet I should be able to withdraw and the transaction fee comes out of the balance. It’s such a shame because this looks so legit.”

According to Australia’s consumer watchdog site, Scamwatch, Australia has lost $242.5 million AUD to scammers in 2022 alone, leading authorities to monitor and respond to changing criminal activity.

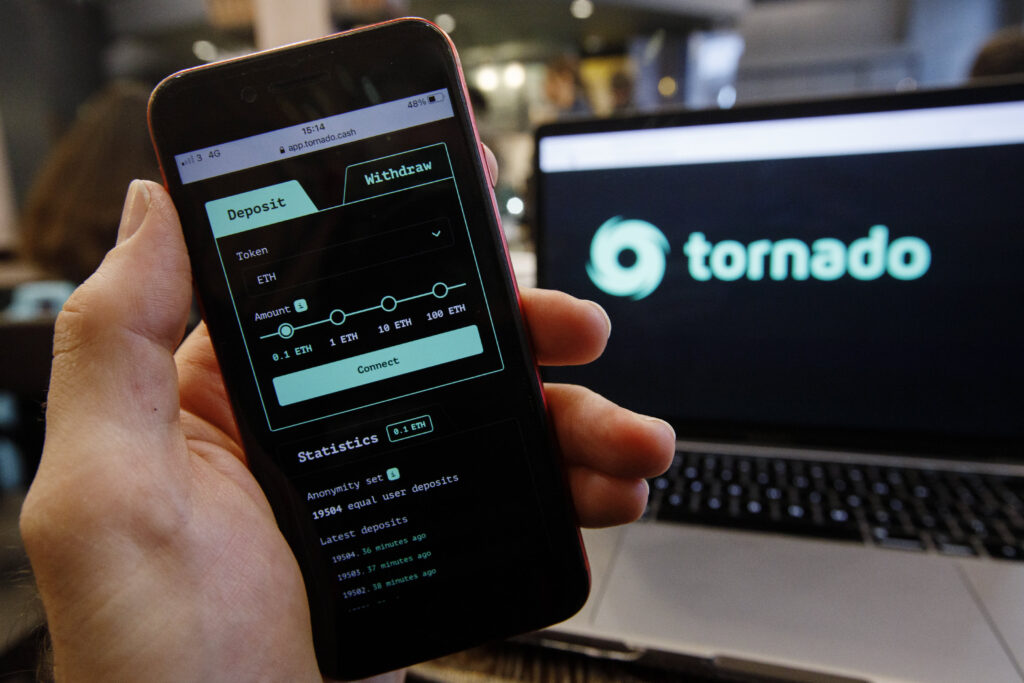

Tornado Cash developer Alexsey Pertsev will remain detained for a further three months in the Netherlands, a court hearing on 22 November revealed.

To date, Dutch authorities have detained Pertsev for 103 days.

According to the hearing, which took place at the Palace of Justice in ‘s-Hertogenbosch, prosecutors stated Pertsev was central to Tornado Cash’s business.

WK Cheng defended Pertsev, stating the embattled company’s use cases and attempting to clear up misunderstandings from its operations.

During the trial, prosecutors officially accused him of money laundering, citing Tornado Cash’s protocol code.

Meanwhile the Tornado cash dev still sits in jail… https://t.co/NREbBBdZXY

— Coin Bureau (@coinbureau) November 24, 2022

Pertsev, from Moscow, Russia, is a flight risk and will not be released on bail, Dutch courts said. Dutch Public Prosecutor Martine Boerlage argued that Pertsev had complete control of the crypto platform.

Boerlage added that Pertsov and two additional developers, Semenov and Storm, held sufficient governance tokens to “always outvote everyone else” in proposals.

The US Treasury sanctioned Tornado Cash for alleged use from North Korean hackers laundering over $1 billion in digital assets, leading to Pertsev’s arrest in mid-August.

The Netherlands Public Prosecution Service said in a statement at the time: “On August 24th the Den Bosch District Court held a session regarding the [pre-trial] detention of the suspect. The courts chamber consisted of three judges, they heard the public prosecutor on the investigation and the suspicion. They also heard the defense. Afterwards the court decided to extend the pre-trial detention of the suspect by 90 days.”

The arrest has triggered outcry among open-source developers creating Web 3.0 platforms, many of whom are concerned how code will be used. Many have also slammed the detention as unjust, adding that disgraced former chief executive of the bankrupt FTX platform, Sam Bankman-Fried, remains at large and is still active in the crypto community after millions of customers lost their crypto holdings.

Genesis Global Capital, a crypto lending company, has hired restructuring advisors to discuss a possible bankruptcy, reports revealed on Tuesday.

The firm has sought advice from investment bank Moelis & Company to discuss its options, adding it has not made a final decision on the matter, a 22 November New York Times report claims, citing sources familiar with the matter.

The investment firm also worked with Voyager Digital after the latter suspended transactions in early July this year, citing the need to explore “strategic alternatives” just days ahead of its bankruptcy.

The company filed Chapter 11 bankruptcy in New York to restructure and “return value to customers,” it said at the time.

We have hired the best advisors in the industry to explore all possible options. Next week, we will deliver a plan for the lending business. We’re working tirelessly to identify the best solutions for the lending business, including among other things, sourcing new liquidity.

— Genesis (@GenesisTrading) November 16, 2022

In a statement to numerous media outlets, a Genesis spokesperson said: “We have no plans to file bankruptcy imminently. Our goal is to resolve the current situation consensually without the need for any bankruptcy filing. Genesis continues to have constructive conversations with creditors.”

According to sources, the troubled lending firm is seeking from $500 million to $1 billion to tackled issues from “unprecedented market turmoil,” namely the collapse of cryptocurrency trading exchange FTX.

Bloomberg reported on 22 November that Genesis owes creditors $2.8 billion. Roughly 30 percent of the loans funded “related parties” such as its parent company Digital Currency Group and its affiliate and lending wing, Genesis Global Trading. Grayscale Investments has also been affected.

Digital Currency Group owes roughly $575 million to Genesis Global Capital by May 2023, a letter from the former’s chief executive Barry Silbert read.

8) We have compiled more information for investors on our website. We hope to alleviate any potential uncertainties and reaffirm the safety and security of the assets underlying Grayscale’s products. https://t.co/MvTfUoKCdE

— Grayscale (@Grayscale) November 18, 2022

Grayscale Investments tweeted to investors: “the safety and security of the holdings underlying Grayscale digital asset products are unaffected”

Silbert also stated that his firm was set to receive $800 million USD in earnings this year, adding: “We have weathered previous crypto winters and while this one may feel more severe, collectively we will come out of it stronger.”

Crypto investors across institutions have hit back at negative commentary linked to the collapse of FTX, indicating record levels of inflows from short-investment crypto products.

CoinShares chief strategy officer James Butterfill said that 75 percent of inflows from institutional cryptocurrency investors last week were short investments on the decline of crypto prices.

Deeply negative sentiment in crypto assets with the largest inflows into short-investments on recordhttps://t.co/zW0ZfGZDTo

— James Butterfill (@jbutterfill) November 21, 2022

He stated the bets were potentially “a direct result of the ongoing fallout from the FTX collapse,” adding total assets under management (AUM) from institutional investors stood at $22 billion.

Investment products on Ether reached $14 million, the “largest weekly inflow on record,” according to Coinshares. The company speculates that “renewed uncertainty” on Ethereum’s Shanghai upgrade along with massive amounts of the currency on the FTX exploiter were potential causes for negative outlooks.

Short investment product inflows for Bitcoin (BTC) also reached $18.4 million with a reported AUM of roughly from $173 million to $186 million.

FTX, Crypto Fire Sale?

The findings show a small increase from the previous week, which saw 14-week highs from crypto products reaching $42 million. Bitcoin short products also reached inflows of $12.6 million, reports found.

Numerous exchanges have also been hit by investors taking their holdings offline to self-custody exchanges. Coinbase, one of the world’s largest exchanges, recorded its lowest share prices in history on Monday, dropping 8.9 percent or $41 per share, MarketWatch data revealed.

The number of #Bitcoin held on exchange have fallen 27% from their 2020 peak and 11% this year. Are people losing trust in centralised exchanges? Quite possibly.. pic.twitter.com/0WY3NIIDxe

— James Butterfill (@jbutterfill) November 14, 2022

Its stocks have plummeted roughly 88 percent after the firm publically traded shares on 16 April last year.

Cryptocurrencies have also suffered from the ongoing fallout from FTX, with Bitcoin (BTC) nosediving 4 percent to roughly $15.725.02, CoinGecko data showed. Ether also tumbled 8 percent to $1,081.56.