As Bitcoin’s price experiences fluctuations, the cryptocurrency market is closely monitoring key support levels that could determine the next phase of its bull market. This week presents several factors that traders and investors should consider to assess Bitcoin’s trajectory.

Current Market Overview

Bitcoin recently surpassed the $100,000 mark, reaching an all-time high of $108,309 on December 17, 2024. However, it has since experienced volatility, with prices oscillating between $93,000 and $100,000. This movement has raised questions about the sustainability of the current bull market and the potential for further gains or corrections.

Historical Cycles Suggest Imminent Peak

Analyzing Bitcoin’s historical data reveals a pattern of cyclical peaks following significant rallies. If history repeats itself, Bitcoin could reach a new all-time high by January 17, 2025. This projection aligns with the typical duration from the first to the last record high observed in previous cycles. Such patterns are often influenced by Bitcoin’s four-year halving events, which reduce the supply of new coins and can impact price dynamics.

Potential Barriers to New Highs

Despite optimistic projections, several factors could impede Bitcoin’s ascent to new highs:

- Diminishing Halving Effects: The impact of halving events on Bitcoin’s price may be decreasing over time, potentially leading to less pronounced price increases.

- Market Sentiment: A softening in investor enthusiasm could result in reduced buying pressure, limiting upward momentum.

- Trading Volumes: Decreased trading activity may indicate lower market engagement, which can affect liquidity and price stability.

Technical Analysis Highlights Key Levels

From a technical standpoint, Bitcoin’s ability to maintain certain support levels is crucial for sustaining its bullish trend. A significant support level to watch is $91,500. A drop below this threshold could signal a deeper correction, potentially targeting the $73,400 range. Conversely, reclaiming and holding above the $100,000 mark could reinforce bullish sentiment and pave the way for further gains.

On-Chain Metrics and Network Activity

On-chain analysis provides additional insights into Bitcoin’s current state:

- Network Activity: A decline in active addresses and transaction volumes may suggest reduced user engagement, which can impact demand.

- Liquidity Indicators: Monitoring the flow of Bitcoin into and out of exchanges can offer clues about potential selling or buying pressure.

Macroeconomic Influences

External economic factors also play a role in Bitcoin’s price movements:

- Inflation Concerns: Rising inflation rates can drive investors toward assets like Bitcoin, perceived as hedges against currency devaluation.

- Regulatory Developments: Changes in cryptocurrency regulations, especially in major markets like the United States and China, can significantly impact investor confidence and market dynamics.

Conclusion

As Bitcoin navigates this critical juncture, a combination of historical patterns, technical indicators, on-chain metrics, and macroeconomic factors will influence its next move. Traders and investors should remain vigilant, keeping a close eye on key support levels and broader market conditions to make informed decisions in the coming days.

The cryptocurrency market has recently exhibited signs of weakness, prompting analysts to adjust their forecasts for Bitcoin’s price trajectory. Amidst this cautious sentiment, a new price target of $86,000 has emerged, reflecting the current market dynamics and investor behavior.

Recent Market Performance

Bitcoin has experienced a notable decline from its peak of $108,309 on December 17, 2024, trading between $93,000 and $100,000 in recent sessions. This downward movement has raised concerns about the sustainability of the previous bullish trend and the potential for further corrections.

Technical Indicators Signal Potential Downside

Technical analysis suggests that Bitcoin’s recent price action has breached critical support levels, indicating a possible continuation of the downward trend. The next significant support is identified at $91,500. A decisive break below this level could open the path toward the $86,000 target, representing a substantial retracement from recent highs.

On the other hand, if Bitcoin can sustain itself above the $91,500 threshold, it may have a chance to recover and attempt a retest of the $100,000 resistance zone. However, for bullish momentum to return, it would need to establish strong support above this level.

On-Chain Analysis Reflects Reduced Activity

On-chain metrics reveal a decline in network activity, with reduced transaction volumes and active addresses. This decrease suggests waning user engagement and may contribute to the selling pressure observed in the market. Such trends often precede further price declines as demand diminishes.

Additionally, Bitcoin reserves on exchanges have slightly increased, indicating that some investors may be preparing to sell rather than hold. When exchange inflows rise, it often signals a shift toward short-term profit-taking or risk-off sentiment among traders.

Macroeconomic Factors Influence Investor Sentiment

Broader economic conditions, including concerns over inflation and monetary policy adjustments, have contributed to increased uncertainty in financial markets. These factors have led investors to reassess their risk exposure, impacting assets like Bitcoin that are often viewed as speculative investments.

Geopolitical tensions and regulatory uncertainties have also weighed on investor confidence. Recent developments in China and the United States regarding cryptocurrency regulations have caused market participants to exercise caution, limiting the influx of new capital into the market.

Historical Context and Future Projections

Historically, Bitcoin has experienced cyclical patterns of rapid appreciation followed by corrections. The current market behavior appears to align with these historical trends, suggesting that the recent weakness may be a natural part of Bitcoin’s long-term price movements.

Many analysts believe that if Bitcoin does drop to $86,000, it could present a buying opportunity for long-term investors. Institutional interest in Bitcoin remains strong, and any significant pullback could encourage accumulation before the next potential leg up in price.

Conclusion

The current market weakness has raised concerns about Bitcoin’s short-term trajectory, with analysts setting an $86,000 price target as a potential bottom if selling pressure intensifies. However, whether Bitcoin reaches this level depends on key technical support holding firm and broader macroeconomic conditions stabilizing.

For now, traders and investors should remain cautious while monitoring critical support levels and market sentiment. Despite short-term uncertainty, the long-term outlook for Bitcoin remains optimistic, particularly with continued institutional interest and the upcoming impact of Bitcoin’s next halving cycle.

Crypto exchange-traded products (ETPs) have experienced another week of significant outflows, with $508 million exiting the market. This marks the second straight week of substantial withdrawals, raising concerns about investor sentiment and the future of institutional involvement in digital assets.

Why Are Investors Withdrawing from Crypto ETPs?

The recent trend of outflows comes amid increased market uncertainty, regulatory developments, and macroeconomic factors that have influenced investor sentiment.

One major driver behind these outflows is the cooling enthusiasm for Bitcoin and Ethereum after their recent rallies. As prices consolidate or decline, some investors are moving capital to less volatile assets, reducing exposure to crypto-backed financial products.

Additionally, regulatory concerns continue to weigh on the market. The U.S. Securities and Exchange Commission (SEC) has maintained a strict stance on crypto regulation, causing hesitation among institutional investors who rely on clarity before making long-term commitments.

Bitcoin ETPs Lead the Outflows

A large portion of the $508 million outflows came from Bitcoin-focused ETPs. Investors who had previously entered the market during Bitcoin’s rally to new all-time highs may now be cashing out as the asset experiences corrections.

“We’ve seen increased selling pressure in Bitcoin ETPs, which suggests that some investors are locking in profits after the recent bull run,” noted an institutional market analyst.

Ethereum-based ETPs also saw declines, although at a smaller scale. Altcoin-focused products, including those tied to Solana and other Layer 1 networks, experienced relatively minor movements in comparison.

Broader Implications for Institutional Investment

While outflows from ETPs indicate short-term caution, the long-term outlook for institutional crypto investment remains mixed. Some analysts believe that these movements are temporary and could reverse once market conditions stabilize.

Crypto ETPs have been a gateway for traditional investors to gain exposure to digital assets without directly holding cryptocurrencies. A continued trend of outflows could signal broader hesitation among institutions, while a reversal in sentiment could bring fresh capital into the market.

What’s Next for Crypto ETPs?

Investors will be watching for signs of renewed inflows, particularly if Bitcoin and Ethereum regain bullish momentum. If macroeconomic conditions improve and regulatory clarity emerges, institutional interest in crypto ETPs may rebound.

For now, the trend of withdrawals suggests that market participants are reassessing their positions, potentially waiting for a stronger confirmation of crypto’s long-term price direction before re-entering.

Bitcoin exchange-traded funds (ETFs) have recorded significant outflows totaling $1.14 billion over the past two weeks. The sell-off comes as global financial markets face increasing uncertainty, with geopolitical tensions between the U.S. and China adding to investor caution.

Investor Sentiment Shifts as Bitcoin Pulls Back

After experiencing strong inflows earlier in the year, Bitcoin ETFs are now seeing a reversal as traders and institutions take profits. The outflows coincide with Bitcoin’s price correction, which has seen the asset struggle to maintain momentum after reaching record highs.

Some analysts suggest that investors are reallocating capital into traditional assets, particularly amid rising concerns over global economic instability.

“Bitcoin ETFs have been a popular investment vehicle, but with geopolitical risks increasing, some investors are choosing to reduce exposure to volatile assets,” one analyst explained.

Impact of US-China Trade Tensions on Crypto Markets

The ongoing trade disputes between the U.S. and China have created economic uncertainty, affecting various financial markets, including cryptocurrencies. Bitcoin, often seen as a hedge against inflation and geopolitical risks, has faced mixed reactions in this environment.

While some investors view Bitcoin as a safe-haven asset, others are moving away from riskier investments amid economic instability. The result has been a shift in Bitcoin ETF flows, reflecting broader sentiment changes in global finance.

ETF Market Trends and Institutional Behavior

The $1.14 billion in outflows suggests that some institutional investors are adjusting their portfolios in response to market conditions. However, it remains unclear whether this trend will persist or if inflows will return once uncertainty eases.

Bitcoin ETFs have played a crucial role in bringing institutional capital into the crypto space, and any prolonged decline in demand could influence Bitcoin’s price trajectory. However, previous trends have shown that ETF interest can fluctuate based on market cycles and macroeconomic developments.

Conclusion

The recent outflows from Bitcoin ETFs highlight the impact of broader financial market trends on crypto investments. As U.S.-China trade tensions continue to evolve, investors will closely monitor how Bitcoin and ETF markets react.

For now, Bitcoin remains a key asset in the global financial landscape, but its price and institutional adoption will likely be influenced by ongoing geopolitical and economic developments.

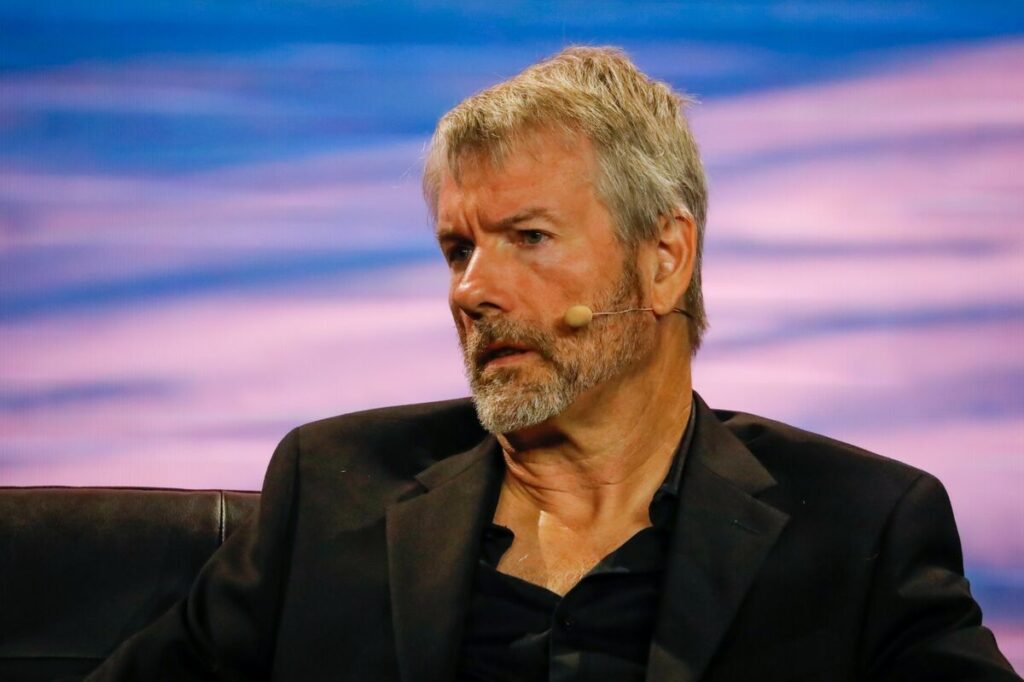

MicroStrategy, the business intelligence firm led by Michael Saylor, has successfully completed a $2 billion convertible note offering, with the proceeds expected to be used for further Bitcoin acquisitions. The move reinforces the company’s ongoing commitment to accumulating Bitcoin as a core component of its corporate strategy.

MicroStrategy’s Bitcoin Investment Strategy

Since 2020, MicroStrategy has positioned itself as one of the largest institutional holders of Bitcoin. Under Michael Saylor’s leadership, the company has aggressively acquired BTC, viewing it as a superior store of value compared to traditional assets.

With this latest $2 billion fundraising, the company intends to expand its Bitcoin holdings even further. Given the recent price movements of Bitcoin, the purchase could have a significant impact on market sentiment.

Details of the Convertible Note Offering

The convertible notes issued by MicroStrategy have a maturity date set for 2030, with an annual interest rate of 2.25%. Investors purchasing these notes will have the option to convert them into shares of MicroStrategy stock at a predetermined price.

According to a company statement, the offering was oversubscribed, reflecting strong investor interest in MicroStrategy’s Bitcoin strategy.

“The demand for our convertible notes demonstrates the confidence investors have in our long-term Bitcoin vision,” Saylor stated.

Potential Impact on Bitcoin’s Price

MicroStrategy’s Bitcoin acquisitions have historically influenced the crypto market, often triggering short-term price increases. Given that this $2 billion investment will likely be deployed in purchasing Bitcoin over the coming weeks, analysts speculate that it could provide additional bullish momentum for BTC.

However, some skeptics warn that such aggressive Bitcoin buying strategies come with risks, particularly if Bitcoin experiences significant price volatility. If the market enters a prolonged correction, MicroStrategy’s highly leveraged position could face challenges.

Institutional Interest in Bitcoin Remains Strong

Despite concerns about Bitcoin’s recent volatility, institutional interest in the asset remains strong. Several major firms have either increased their Bitcoin holdings or introduced new investment vehicles that provide exposure to BTC.

The completion of MicroStrategy’s convertible note offering signals continued institutional confidence in Bitcoin’s long-term potential. Other companies may follow suit, seeking alternative ways to gain exposure to digital assets.

Conclusion

MicroStrategy’s successful $2 billion convertible note offering underscores its unwavering commitment to Bitcoin. While the move is seen as a bullish sign for the cryptocurrency market, it also highlights the risks associated with heavily leveraging corporate finances for Bitcoin acquisitions.

As the company moves forward with its latest BTC purchase, all eyes will be on how the market reacts and whether MicroStrategy’s continued accumulation will further fuel Bitcoin’s price trajectory.

Strategy, formerly known as MicroStrategy, is signaling another major Bitcoin acquisition following a brief pause. Co-founder Michael Saylor recently posted a BTC chart indicating that the firm is gearing up for another purchase.

On Feb. 10, the company acquired 7,633 BTC for over $742 million, bringing its total holdings to 478,740 BTC. As of now, Strategy’s Bitcoin reserves are valued at over $46 billion, marking a 47.7% increase on its investment, according to SaylorTracker.

Leveraging Bitcoin Investments

Saylor previously revealed that the company intends to intensify its “intelligent leverage” strategy in Q1 2025 to finance further Bitcoin purchases. As the largest corporate holder of BTC, Strategy aims to maximize shareholder value through continued acquisitions.

Institutional Investors Bet on Strategy

Despite concerns over sustainability, institutional investors remain confident in Strategy’s Bitcoin strategy. A Feb. 6 SEC filing revealed that BlackRock, the world’s largest asset manager, has increased its stake in the company to 5%.

Additionally, 12 U.S. states, including California, Texas, and Florida, hold Strategy stock in pension programs or treasury funds. California’s State Teachers’ Retirement Fund leads with nearly $83 million in Strategy stock, followed by the California Public Employees Retirement System with $76.7 million.

New Financing for BTC Expansion

On Feb. 20, Strategy announced a $2 billion convertible note offering to fuel additional Bitcoin acquisitions, further solidifying its commitment to Bitcoin investment.

Two newly launched cryptocurrency exchange-traded funds (ETFs) holding a combination of Bitcoin and Ether have seen modest inflows since their recent debuts, according to data from Cointelegraph.

Franklin Templeton’s Franklin Crypto Index ETF (EZPZ) has attracted around $2.5 million in net assets since launching on Feb. 20, while Hashdex’s Nasdaq Crypto Index US ETF (NCIQ) has gathered just over $1 million since its Feb. 14 debut.

By comparison, Franklin Templeton’s spot Bitcoin ETF (EZBC) saw significantly higher interest, pulling in approximately $50 million on its first day in January 2024, with Bitwise Bitcoin ETF (BITB) reaching nearly $240 million on its debut.

Diversification Limits and Regulatory Barriers

The two ETFs aim to provide investors with exposure to a diverse crypto index. However, due to regulatory restrictions, they currently hold only Bitcoin and Ether, which dominate their portfolios. The hope is to expand to other cryptocurrencies pending regulatory approval.

A broader ETF, the Grayscale Digital Large Cap Fund, already includes assets like Solana and XRP but has yet to be exchange-traded. The SEC continues to evaluate various applications, with analysts expecting more ETF approvals in 2025.

BlackRock’s Bitcoin exchange-traded fund (ETF) now commands a significant 50.4% share of the total U.S. Bitcoin ETF market. The asset management giant currently holds over $56.8 billion worth of Bitcoin, contributing to a combined total of $112 billion managed by all U.S. Bitcoin ETF issuers, according to Dune data.

Bitcoin ETFs Face Sell-Off

Despite BlackRock’s dominance, the overall Bitcoin ETF market has experienced a three-day selling streak. On February 20, Bitcoin ETFs saw cumulative net outflows of $364 million, with BlackRock’s iShares Bitcoin Trust ETF (IBIT) accounting for $112 million, as per Farside Investors data.

Bitcoin’s Price Remains Resilient

Despite ETF outflows, Bitcoin’s price has remained relatively stable, climbing back above $99,300 on February 21.

Marcin Kazmierczak, co-founder of RedStone, believes that ETFs are not the primary force driving Bitcoin’s price movements.

“This indicates that other forces — such as broader market liquidity, institutional accumulation, or macroeconomic trends — are also at play,” he told Cointelegraph.

Price Action Raises Concerns

While Bitcoin has shown resilience, some experts worry about prolonged range-bound trading. Samson Mow, CEO of Jan3, suggested the price movement may be manipulated.

“It seems like it’s some sort of price suppression,” Mow stated at Consensus Hong Kong 2025, adding that Bitcoin’s price has been peaking and then moving sideways in an unnatural manner.

Bitcoin bulls pushed the price close to $100,000 at the Wall Street open on February 21, reaching $99,500 on Bitstamp.

However, a pattern of selling pressure emerged as U.S. markets opened, contrasting with gains seen in Asia and Europe.

Market Liquidity and Resistance Levels

Trading resource Material Indicators noted shifting liquidity dynamics as Bitcoin recovered from a recent dip. “Whether this develops into a bull trap or a bonafide breakout remains to be seen,” analysts stated, emphasizing the importance of the $100K resistance level.

Traders Weigh In on Bitcoin’s Future

Popular trader CRG observed that bears were attempting to cap gains at a key midpoint in Bitcoin’s multimonth trading range. Meanwhile, Rekt Capital highlighted a bullish divergence forming on Bitcoin’s Relative Strength Index (RSI), suggesting potential upside momentum.

U.S. Dollar Weakness Provides Tailwind

Bitcoin and other risk assets received support from a weakening U.S. dollar, with the U.S. Dollar Index (DXY) dropping to 106.38, its lowest level since December 2024. Analysts believe this could provide a favorable environment for further Bitcoin gains.

Cryptocurrency app downloads in the United Arab Emirates (UAE) have seen a massive uptick in 2024, according to data from app analytics firm AppsFlyer.

The report revealed that downloads of the top 49 crypto apps soared from 6.2 million in 2023 to 15 million in 2024, marking a 41% increase. This surge was particularly prominent in the latter half of 2024, with over 1 million installs per month in the final quarter. December alone recorded a staggering 2.8 million downloads.

Key Drivers Behind the Growth

AppsFlyer attributed this rapid adoption to a combination of favorable market conditions and significant political developments.

On November 6, 2024, Donald Trump secured the U.S. presidential election, which was widely seen as a positive shift for the crypto industry. Trump had vowed to end regulatory crackdowns on digital assets and position the U.S. as the global hub for crypto innovation.

“There has been a strong correlation between these market factors and the UAE’s crypto market momentum,” said Shani Rosenfelder, director of market insights at AppsFlyer.

Trump’s Memecoin and Investor Surge

Adding to the excitement, Trump launched his own memecoin in January 2025, attracting a wave of new investors. According to a survey by NFT Evening, many first-time crypto users entered the market following the launch.

The U.S. crypto app market also experienced a boom, with platforms like Crypto.com, Moonshot, and Coinbase dominating the Apple App Store’s finance category.

However, while Trump’s memecoin drew in fresh investors, a Chainalysis report indicated that 813,000 wallets suffered losses of up to $2 billion after purchasing the token, highlighting the volatile nature of the crypto market.