Ripple chief executive Brad Garlinghouse has tweeted that he was “cautiously optimistic” about a breakthrough in cryptocurrency regulations across the United States for 2023.

His tweet comes as the 118th Congress kicks off on Capitol Hill. Garlinghouse said in his tweet he hoped 2023 would see US lawmakers gain clarity on “bipartisan [and] bicameral” cryptocurrency regulations.

Today is the first day of the 118th Congress. While prior efforts at regulatory clarity for crypto in the US have stalled, I am cautiously optimistic that 2023 is the year we will (finally!) see a breakthrough. A thread on why…

— Brad Garlinghouse (@bgarlinghouse) January 3, 2023

He said that the stakes “couldn’t be higher,” adding that no bill was perfect and “there likely never will be one that satisfies everyone.”

Garlinghouse continued that the US lagged behind crypto hubs such as the European Union, Brazil, Japan, and Singapore.

Continuing, he said that US lawmakers failed to create a joint effort to build a framework for regulations in the US and worldwide.

He said the lack of coordination “continues to push business to countries [with] lower regulatory bars [leading to] sometimes catastrophic results.”

The news comes after the US Securities and Exchange Commission (SEC) sued Ripple for allegedly selling its native token XRP as an unregulated security. The SEC accused Ripple of not registering its earnings on XRP as securities, according to its regulations. Ripple has strongly and vehemently denied the allegations.

Several major analyses for the Bitcoin (BTC) and cryptocurrency markets have surfaced in recent reports around the New Year season.

Standard Chartered, a major multinational bank, and a cryptocurrency exchange have offered widely disparate predictions for the coming year, reports have found.

Here are three top predictions from key players in the crypto market.

BTC to Hit $40K by Summer

ShapeShift crypto exchange founder and CEO, Eric Voorhees, said in a recent interview he was optimistic of Bitcoin’s price recovery. He added he would not be shocked if the digital currency reached “like $40K” by the summertime.

He continued that it a 2.5 jump from its current price would be a “great return,” adding a potential bull run could take place in the next six months to three years.

A ten-year timeline for BTC’s recovery would indicate a major failure in the coin’s performance. His analysis cited rising interest rates and stricter regulations as major market disrupters for 2023.

Crypto to Fall to $5,000 in 2023

Conversely, additional media reports warned that BTC could plummet to $5,000 in 2023 due to reported investor underpricing.

Citing a Standard Chartered report, CNBC reported the valuation shift could see Bitcoin prices crash far below its nearly $17,000 price tag.

Eric Robertsen, the bank’s global chief of research, commented in a Sunday note,

“Yields plunge along with technology shares, and while the Bitcoin sell-off decelerates, the damage has been done. More and more crypto firms and exchanges find themselves with insufficient liquidity, leading to further bankruptcies and a collapse in investor confidence in digital assets.”

He concluded that extreme scenarios had a “non-zero probability of occurring in the year ahead, and [may] fall materially outside of the market consensus or our own baseline views.”

Venture Capitalists to Tighten Belts

In a statement cited by crypto media, Outlier Ventures chief executive Jamie Burke said that crypto funding would remain “critical” to the health of the future market.

He added: “[The] strength of the venture market has persisted, with billions of funding still pouring into the space and high levels of capital waiting to be deployed […] we have seen a record number of applications in our most recent cohorts for 2022.”

Concluding, the metaverse and Web3 executive noted ‘undeniable’ changes in the venture landscape. Many fund managers would conserve capital rather than deploy a “spray and pray” investment tactic to avoid risky investments.

2023 is set to see fresh waves of malicious attacks, phishing, scams, and other hacking attempts on cryptocurrency and decentralised finance (DeFi) platforms, a recent CertiK report has revealed.

It was considered the worst year for the industry, with losses increasing from $3.2 billion from the previous year, the company added in a statement to the media.

November was the worst month for cryptocurrency platforms after thieves stole over $595 million in tokens, the company said in its report.

According to a recent CertiK report teaser, cryptocurrency markets saw nearly $3.7 billion USD wiped out due to hackers, scammers, and platform exploits.

#CertiK Annual Report 2022 – Part 1 of 3 ⌛️

— CertiK (@CertiK) January 3, 2023

The largest losses of user funds this year resulted from centralized platforms going insolvent…

From #Luna, to #FTX and #BlockFi, and beyond, let's go through what went down this year 👇

Full Report coming soon 👀 #Crypto pic.twitter.com/e2XbiU42r9

It said in a tweet,

“2022 was a painful year for the many in crypto. Alongside a broad market downturn, the year was punctuated by a number of exploits, hackers, and bankruptcies, with one major exception. The largest losses of user funds this year resulted from centralized platforms going insolvent as falling asset prices exposed their unsustainable business practices”

The company cited the fall of Terra/LUNA, a stablecoin that had lost its currency peg in May last year, triggering a rapid collapse of the cryptocurrency.

Speaking to Business Insider, Ronghui Gu, CertiK chief executive and co-founder, added: “With almost three times as much value lost from Web3 protocols in 2022 compared to 2021, it’s clear that there’s still a lot of work to be done to secure the Web3 world.”

Hacktober to Poor-vember?

The news comes amid the ongoing collapse of FTX, one of the world’s largest trading platforms, which filed for Chapter 11 bankruptcy in mid-November.

Investors saw roughly $8 billion USD in assets wiped from the platform, namely after a massive liquidity crunch ahead of its bankruptcy at the time. Numerous executives, including ex-chief executive Sam Bankman-Fried and former Alameda Research CEO Caroline Ellison, among others, face significant charges for fraud, misappropriation of funds, and defrauding several systems.

Hackers also stole $28 million from Derebit, a massive cryptocurrency exchange for derivatives and other securities, forcing the company to temporarily halt withdrawals.

The incident took place in early November, with the exchange stating it was still in a “financially sound position.” CoinGecko data verified its daily trading volumes were $280 million.

Additional hacks have taken place on Binance, forcing the world’s largest exchange by trading volume to suspend transactions due to the attacks temporarily.

Company chief executive Changpeng Zhao later apologised for the breach, with a further spokesperson stating that roughly $100 million remained “unrecovered.”

Additionally, in March, hackers hit blockchain platform Ronin Bridge in one of the world’s largest crypto thefts on record. North Korean hackers allegedly stole the funds, according to US authorities.

A young Australian crypto trader that sold off roughly $2 billion USD in cryptocurrencies in 2021 is a man aged 25 who operated his platform from his parent’s home in Sydney, reports revealed.

The Australian noted the public filings in an article on Sunday, which document Darren Nguyen’s PO Street Capital and its successes.

According to the documents, Nguyen’s cryptocurrency venture earned around $10.41 million AU by 30 June 2021, filings from the Australian Securities and Investments Commission (ASIC).

It also revealed at the time a total of $2.98 billion AU in crypto trading over a 12-month period, a massive 1,404.12 percent increase from the previous year of $692,182 AU.

It also found that PO Street Capital’s short-term provisions in June 2021 were 4.3 million USD and no debts, with an additional $873,200 in dividends at the same time.

He, his family, including his mother, declined to comment on the business’s activities, including the company’s performance last year.

The successes come amid a major shift in cryptocurrency markets, which saw the massive collapse of FTX in November 2022. Other failing crypto businesses such as Terra/Luna and Voyager also suffered insolvencies the same year.

The boomer generation is performing better in cryptocurrency projects and investments than millennials and Generation Z, new research cited by Cointelgraph has revealed.

According to research from Bybit and consumer research firm Toluna, 34 percent of boomers have conducted due diligence for “a few days” prior to investing in cryptocurrencies, or 50 percent more than Millennials and Gen Z crypto aficionados.

The boomer generation researched tokenomics, competitors, and potential revenues before investing. Conversely, younger traders preferred reputations and “website aesthetics.”

Research added that “64 percent of North American investors spend less than two hours or don’t DYOR at all.”

Boomers are defined as those born from 1946 to 1964, and typically follow a more conservative approach to investments compared to subsequent generations.

The research added that baby boomer and older generations also scrutinised cryptocurrency purchases along with other monetary investments.

Losing the Love for Crypto?

The news comes after a survey found that just 8 percent of US citizens had positive views on cryptocurrency by late November, namely after the FTX collapse.

A CNBC survey of over 800 respondents found that market sentiment in the digital currency market fell significantly from 19 percent in March last year. Negative responses to cryptocurrency jumped from 25 percent to 43 percent in the eight-month period, it found.

The loss of public support comes amid the ongoing collapse of FTX, Alameda Research, and over 130 affiliate firms, who filed for Chapter 11 bankruptcy in mid-November.

The ailing firm faced a huge liquidity crisis ahead of its 11 November bankruptcy, fuelled by a massive bank run on the platform’s native token, FTT. Before the crisis erupted, the troubled company reportedly hired a retainer worth $12 million to conduct services on behalf of the crypto firm.

Sam Bankman-Fried, the disgraced former chief executive of FTX, has been released on $250 million bail following his arrest in the Bahamas, where he was extradited to the United States.

Australia has edged up a further spot on the list of the world’s largest cryptocurrency hubs, surpassing El Salvador in total numbers of automatic teller machines (ATMs), data has revealed.

The Oceanic country reached 216 ATM by the end of the year, CoinATMRadar found in its most recent figures. Currently the country stands at 225 ATM locations, with the United States, Canada, and Spain topping the list at 33952, 2649, and 273 spots, respectively.

El Salvador, once a leading country for cryptocurrency cashpoints, has slipped two places after Poland and Australia overtook the Central American nation.

According to reports, Australia’s crypto ATM installations consist of 0.6 percent of total units. Globally, the world currently has 38,614 ATMs across locations.

The news comes as Australia steps up its efforts to regulate cryptocurrencies, namely after the FTX scandal which rocked crypto markets worldwide.

Australia’s Treasury recently pledged to develop a plan for regulating digital currencies due to the ongoing bankruptcy, which saw FTX, Alameda Research, and 130 affiliates file for Chapter 11 bankruptcy in mid-November.

Canberra aims to protect investors with the new regulations and has vowed to monitor the ongoing crisis and additional “spillovers into financial markets.”

Sam Bankman-Fried, FTX’s former and disgraced chief executive has been released on $250 million bail and awaits his first hearings on his role in corruption in the company.

Charges against himself, Alameda Research CEO Caroline Ellison, and others, include fraud, misappropriation of funds, and many others.

Bitcoin cheerleader Nic Carter has published data detailing proof-of-reserves (PoR) activity from major centralised cryptocurrency exchanges.

According to his analysis, Carter monitored attestation to assets held, liabilities, third-party auditors, among others, to determine the top exchanges for PoR.

Crypto exchanges Kraken and BitMex were ranked the highest on the list. His analysis found that Kraken hired Armanino for its PoR and offered clients a “good level of confidence” against hidden liabilities while re-evaluating its operations every six months.

no one asked for it, but here it is anyway: my 2022 Proof of Reserve year in review https://t.co/x6UjmHTrms

— happy nic year (@nic__carter) December 29, 2022

BitMEX, the second-highest crypto platform, utilised transparent operations models for assets, liabilities, and PoR verification.

Regarding assets, it listed its Bitcoin (BTC) holdings along with liquidity data verified by the BitMEX multisignal. It also published full Merkle tree data of user wallets.

Binance Ranking, Rebuttal to FUD Claims

Conversely, Binance scored lower on the rankings chart, indicating the Chinese-owned cryptocurrency exchange’s data was not complete.

He accused Binance’s Changpeng Zhao (CZ) of urging exchanges to post PoR but had not “yet risen to his own challenge.”

He added: “Binance’s first PoR doesn’t grant strong assurances. It only covers Bitcoin, which only represents 16.5% of their client assets.”

Binance Rebuttal to FUD Claims

Despite the accusations, Binance posted a seven-point rebuttal to accusers stating the company failed to live up to transparency and PoR expectations.

The world’s largest crypto platform hit back at such claims, citing accusations on its stablecoin consolidation, liquidity, and reserves, among others. It later verified in a CryptoQuant audit that its reserves were 99 percent accurate.

A Pacific Island nation has adopted a pro-Bitcoin prime minister.

Tongan native Lord Fusitu’a assumed office on 24 December and tweeted support for Fiji’s Bitcoin adoption. In the recent past, Tonga set new regional records by using Bitcoin as a legal tender.

According to the new prime minister, he believes that “Fiji can do bitcoin legal tender like Tonga” and that there would be two “Legal Tender Bills for the Pacific in 2023.”

A new pro-#Bitcoin friendly Prime Minister in the South Pacific.☀️🌊🏝️

— Lord Fusitu'a (@LordFusitua) December 29, 2022

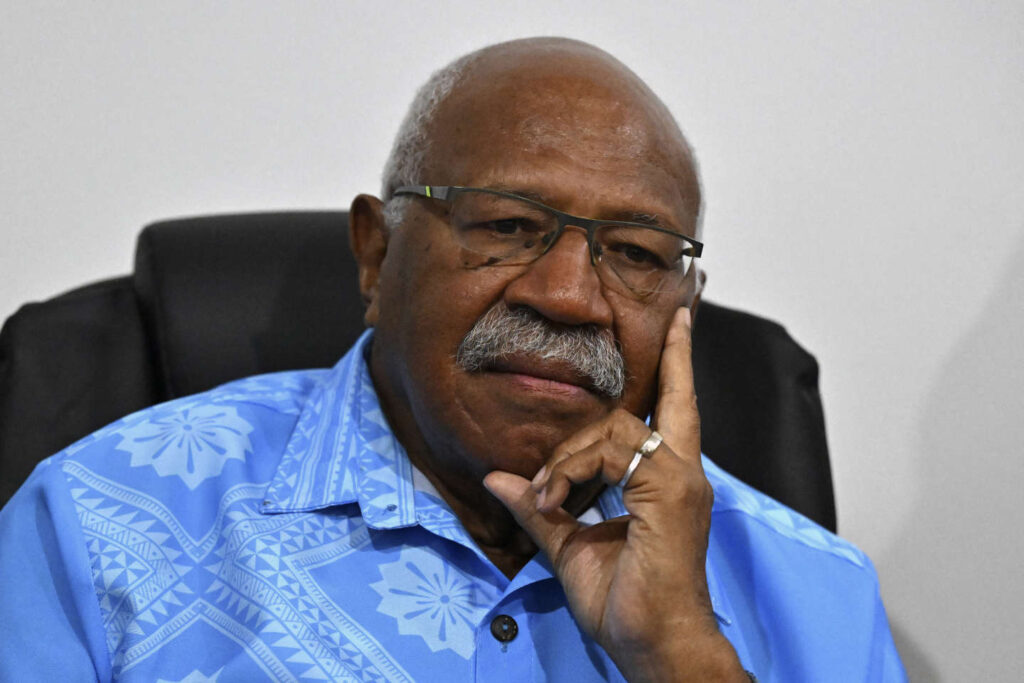

Fiji 🇫🇯‘s newly elected Prime Minister @slrabuka.

Let’s go 2 for 2 – BTC Legal Tender Bills for the Pacific in 2023 👊🏽💯🇹🇴🇫🇯

Due to economical and geographical differences, Tonga and Fiji face challenges to building their economies and national development agendas. Bitcoin adoption aims to boost financial inclusivity to eliminate high poverty, crime, and fossil fuel reliance rates.

Similar countries such as El Salvador and the Central African Republic (CAR) have passed similar measures for crypto to become a nationally-recognised legal tender.

One of the advantages to Fiji is its use of geothermal and volcanic power, which the nation can use for its Bitcoin mining activities, offering a competitive advantage over Tonga.

Sounds great👊🏽.

— Lord Fusitu'a (@LordFusitua) December 29, 2022

Our economies similar in some aspects:

-Archipelagos with an agriculture,fisheries & tourism base;

-But also vastly different in others.

-Fiji:

-10x our size [100K vs 1m]

-Mineral deposits

-Massive hydro & renewables

-Thriving stock exchange & business sector)

Lord Fusitu’a continued: “Like Tonga, how to do nationalized Bitcoin mining, specifically how we were going to do geothermal volcano mining so they could both do the same but also make use of their massive hydro and other renewable stranded energy they have, which we don’t.”

The news comes amid the archipelagic country’s National Development Plans to provide only renewable energy to all islands by 2030. The country must generate an additional 120 megawatts to reach its goal, which authorities aim to achieve with Bitcoin mining.

Several debates over the value of cryptocurrencies such as Bitcoin and gold have erupted across media. One discussion involved Dallas Mavericks owner Mark Cuban and Bill Mahar on his 26 December Club Random podcast.

In the talks, he staunchly backed Bitcoin over gold, stating he was “rooting for Bitcoin.”

Mark Cuban: If you have gold you’re dumb as f*ck. Just get bitcoin. 😮 #bitcoin pic.twitter.com/sKt1cWuKsR

— Neil Jacobs (@NeilJacobs) December 27, 2022

He said: “I want Bitcoin to go down a lot further so I can buy some more [..] If you have gold, you’re dumb as fuck.” He concluded that people should “just get Bitcoin.”

Despite some lauding his comments, others voiced outrage on social media, slamming him for his alleged lack of knowledge of virtual currencies.

Peter Schiff, chief economist and global strategist for Euro Pacific Asset Management, hit back at his comments. He said:

“After Bitcoin crashes I hope [Mark Cuban] does buy more as he told [Bill Mahar] he would. It’ll give others an opportunity to sell. His lack of understanding of Bitcoin is only exceeded by his lack of understanding of #gold. He proves that you don’t have to understand money to make it.”

Stalwart Crypto Supporters

The news comes after

In late November, US lawmaker Cynthia Lummis doubled down on her support for including Bitcoin and other currencies in her 401(k) retirement plans, despite backlash from other Senators.

In a Semafor article, she stated that she was “very comfortable” with allowing people to include Bitcoin in retirement funds, adding, “it’s just different than other cryptocurrencies.”

Pershing Square Capital Management founder Bill Ackman also tweeted support for cryptocurrencies amid the ongoing aftermath of the FTX scandal.

In late November, he said the “crypto is here to stay” but added regulators should tighten restrictions and remove “fraudulent actors.”

He added: “I am making the case that crypto can facilitate potentially useful and important businesses that heretofore could not exist. That said, the success of any individual project is a function of the ultimate.”

Bitcoin (BTC) miners publicly listed on exchanges have sold nearly their entire mined BTC in 2022, sparking discussion on the gains for Bitcoin prices previously stated in media reports.

According to Tom Dunleavy, an analyst for Messari, a blockchain research company, cryptocurrency miners sold roughly 40,300 out of 40,700 BTC mined in the crypto space.

Involved crypto miners include Riot, Core Scientific, Marathon, Hive, Bit Digital, and others, with transactions taking place from 1 January to 30 November this year.

BTC miners sell roughly 100% of the coins they mine

— Tom Dunleavy (@dunleavy89) December 26, 2022

The 10 public bitcoin miners

detailed here mined ~40.7k BTC and sold ~40.3k in 2022

This is a persistent headwind for BTC and for no other reason a good thesis to be bullish the ETHBTC ratio trade pic.twitter.com/L1iI6Z07p7

This has significantly lowered reserves in the second half of the year, with lows peaking in November due to the ongoing FTX collapse. This has caused Bitcoin prices to slump, Dunleavy added.

Despite this, numerous reports have evidenced Dunleavy’s claims, with Bitcoin Visuals noting on 26 December that Bitcoin’s daily trade volumes topped $12.2 billion. Conversely, CryptoQuaint figures showed outflows reached $15.35 million the same period, or 0.13 percent of total trading volumes.

December saw miner reserves recover by roughly 1 percent despite ongoing challenges such as skyrocketing electricity costs, a turbulent crypto market, several collapsed cryptocurrency platforms such as FTX, and increasing difficulty mining digital coins.

Core Scientific Sell-Off

The news comes after numerous mining firms were forced to sell reserves for their operations and expansion plans, namely due to declining hash rates, reports have shown.

Core Scientific, one of the biggest firms to date, sold 9,618 in Bitcoin in April 2022 to cover the costs of plummeting revenues.

Bitcoin's global hashrate dropped by an estimated 40% during the polar blast that swept across the US. Many miners voluntarily suspended operations to help stabilize the grid; the network has already recovered half of the observed loss. pic.twitter.com/9jJKAv3dX5

— Jameson Lopp (@lopp) December 26, 2022

It reportedly filed for Chapter 11 bankruptcy despite efforts to bail out the embattled company. While facing its earnings crisis, it stated it would continue cryptocurrency mining operations.

B Riley proposed a $72 million non-cash lifeline as Core Scientific nosedived from $4.3 billion USD in July 2021 to $78 million as of December.