Amid concerns about a potential denial-of-service (DoS) attack on the Bitcoin network, several prominent Bitcoin maximalists have stepped forward to allay fears, insisting that the network remains secure and robust.

Rumors of a potential DoS attack began circulating when users started noticing delays in Bitcoin transactions. This fueled speculation that malicious actors were attempting to flood the network with low-fee transactions in order to slow it down.

However, Bitcoin maximalists were quick to refute these claims, emphasizing that the network is designed to withstand such attacks. These experts argue that the recent congestion is primarily due to an increase in legitimate trading activities, as well as a higher demand for block space.

Notably, Bitcoin developer Jimmy Song took to Twitter to address the concerns, stating that the network is not under attack and that the delayed transactions are simply a result of increased demand. Song further clarified that Bitcoin’s sophisticated fee system is designed to prevent DoS attacks by prioritizing transactions with higher fees, ensuring that the network remains functional even during periods of high demand.

Other prominent figures in the Bitcoin community, such as Adam Back, CEO of Blockstream, and Jameson Lopp, CTO of Casa, also chimed in to support this stance. They emphasized that the Bitcoin network has demonstrated its resilience over the years and that it is highly unlikely that a DoS attack could be successful in disrupting the network.

While the recent congestion on the Bitcoin network has raised concerns, the reassurances from Bitcoin maximalists have helped to ease fears and reinforce the network’s reputation for security and reliability. Users are encouraged to remain patient during periods of high demand and adjust their transaction fees accordingly to ensure timely processing.

For the second time within a 12-hour timeframe, Binance, the world’s largest cryptocurrency exchange by trading volume, has temporarily halted Bitcoin (BTC) withdrawals. The exchange has assured its users that the suspension is only temporary and is due to network congestion.

On May 7th, Binance first announced that it had suspended Bitcoin withdrawals for a brief period. The exchange cited a “large backlog of outgoing BTC transactions” as the reason for the halt. Within a few hours, the platform resumed its withdrawal services, but only to suspend them again later in the day.

Binance’s CEO, Changpeng Zhao, took to Twitter to address the situation, explaining that the suspensions were necessary to address the congestion and ensure the smooth functioning of the platform. He assured users that their funds were safe and that the situation would be resolved as quickly as possible.

The suspension of Bitcoin withdrawals on Binance has raised concerns among users and the wider cryptocurrency community, with some speculating about the possibility of a security breach or other issues. However, no evidence has been found to support these claims, and Binance has maintained that the issue is purely related to network congestion.

In the past, Binance has experienced similar issues with other cryptocurrencies, such as Ethereum, due to increased trading volumes and congestion on the networks. The exchange has always managed to resolve these issues swiftly, and it is expected that the current situation with Bitcoin withdrawals will be no different.

While the temporary suspension of Bitcoin withdrawals on Binance may cause inconvenience for some users, the platform’s commitment to addressing the issue and ensuring the safety of its users’ funds has been appreciated by the community.

Bitcoin’s price has reached a new high for May, surpassing $29,500, as traders keep a close eye on the potential for a breakout. The leading cryptocurrency has been experiencing significant fluctuations in recent weeks, with both gains and losses seen in the market.

The recent upswing in Bitcoin’s price has been attributed to a combination of factors, including positive market sentiment, increased institutional adoption, and the growing mainstream acceptance of cryptocurrencies. Furthermore, the ongoing discussions around the potential for inflation have led some investors to view Bitcoin as a hedge against inflationary pressures.

As Bitcoin’s price continues its upward trajectory, traders are closely monitoring the market for signs of a breakout, which could potentially push the cryptocurrency to new heights. Some analysts believe that if Bitcoin can maintain its momentum and surpass key resistance levels, it could open the door for substantial gains in the near future.

However, market participants should remain cautious, as the cryptocurrency space is notoriously volatile and can be subject to rapid price fluctuations. While some traders are optimistic about Bitcoin’s prospects, others warn of potential risks and uncertainties that could impact its trajectory.

The recent surge in Bitcoin’s price highlights the growing interest in cryptocurrencies, as well as their potential to play a significant role in the global financial landscape. As traders and investors continue to monitor Bitcoin’s performance, its future trajectory will likely be shaped by ongoing developments in the cryptocurrency ecosystem, regulatory changes, and broader market trends.

The United Kingdom’s financial watchdog, the Financial Conduct Authority (FCA), has announced plans to inspect locations suspected of operating unregistered cryptocurrency ATMs. The move comes as part of the regulator’s ongoing efforts to combat the illicit use of digital assets and ensure compliance with anti-money laundering (AML) regulations.

The FCA aims to identify and take action against operators of unregistered cryptocurrency ATMs, which are believed to facilitate money laundering and other illegal activities. The regulator’s announcement follows a recent crackdown on unauthorised crypto exchanges and custodian wallet providers, which saw a number of firms shut down or subjected to enforcement action.

In response to the growing prevalence of crypto-related crimes, the FCA has increased its efforts to monitor and regulate the digital asset space. The regulator has also urged consumers to exercise caution when engaging with virtual assets and to report any suspicious activities.

The FCA’s crackdown on illegal crypto ATMs is expected to contribute to a more transparent and secure digital asset environment in the UK. By ensuring that all crypto ATM operators adhere to AML regulations and maintain appropriate registrations, the regulator aims to protect consumers and prevent criminal activities.

As digital currencies become more mainstream, regulatory oversight is becoming increasingly important to prevent fraud and other illegal activities. The FCA’s efforts to clamp down on unregistered crypto ATMs demonstrate its commitment to maintaining a safe and compliant cryptocurrency ecosystem in the UK.

In the first quarter of 2023, Cash App, a popular mobile payment service owned by Block, Inc., generated over $2 billion in Bitcoin revenue, marking a significant milestone for the company. Block, formerly known as Square, reported its Q1 financial results, revealing impressive growth in its Bitcoin business.

Cash App’s thriving Bitcoin operations are attributed to the increasing demand for the cryptocurrency and its ease of access on the platform. The app allows users to effortlessly buy, sell, and transfer Bitcoin, contributing to its widespread adoption.

In addition to the company’s Bitcoin revenue, Cash App reported a substantial increase in its total net revenue, reaching $6.04 billion in the first quarter, a remarkable 266% year-over-year growth. The company’s gross profit also experienced significant growth, surging 166% year-over-year to $1.14 billion.

Block’s financial results highlight the rapidly growing interest in Bitcoin and other digital currencies, as well as the potential for mobile payment services like Cash App to facilitate the adoption of cryptocurrencies. By simplifying the process of acquiring and transacting in digital assets, Cash App is positioning itself as a key player in the evolving world of finance.

Coinbase, one of the leading cryptocurrency exchanges, has decided to halt the issuance of new Bitcoin-backed loans via its Borrow service. The exchange made this announcement on its website, but assured customers that existing loans would remain unaffected and continue as per their terms.

The Borrow service, launched by Coinbase in 2020, allowed qualified customers to borrow cash against their Bitcoin holdings. This move to discontinue new loans comes amidst increasing regulatory scrutiny of cryptocurrency lending services and related products. However, the specific reasons for the suspension of new loans have not been provided by the company.

Existing loans will continue to be serviced by Coinbase, with customers required to meet their repayment obligations as stipulated in the loan agreements. The company has emphasized that this change will not impact the other services offered on their platform.

While the decision to cease issuing new Bitcoin-backed loans marks a significant change for Coinbase, the company remains focused on expanding its offerings to cater to the evolving demands of the cryptocurrency market. As the regulatory environment evolves, it is expected that exchanges like Coinbase will continue adapting their services to maintain compliance and support the growth of the crypto ecosystem.

The centralized exchange (CEX) trading volumes have seen a drop in April, marking an end to the months-long growth streak, as reported by Kaiko, a leading provider of institutional-grade cryptocurrency market data. This decline signifies a shift in the market, with decentralized exchanges (DEX) maintaining their growth momentum.

Throughout the first quarter of 2023, CEXs experienced a significant increase in trading volumes. The growth trend, however, came to a halt in April as the trading volumes declined, though it is yet to be determined whether this trend will continue. In contrast, decentralized exchanges (DEX) have maintained their upward trajectory, with their trading volumes steadily increasing.

The recent decline in CEX trading volumes could be attributed to several factors, including increased regulatory scrutiny, the growing popularity of decentralized finance (DeFi) platforms, and the overall maturation of the cryptocurrency market. As a result, investors are turning their attention to DEXs that offer enhanced privacy and autonomy.

While the April downturn may be temporary, the growing interest in decentralized exchanges and DeFi platforms signals a potential shift in the market landscape. Centralized exchanges will need to adapt to these changes and offer innovative solutions to remain competitive in the evolving crypto ecosystem.

As the cryptocurrency landscape evolves, the BRC-20 token standard on the Bitcoin network has become a new hub for meme tokens. The rise of these tokens is attracting attention from investors who previously targeted ERC-20 meme tokens on the Ethereum network.

The BRC-20 token standard, which is similar to Ethereum’s ERC-20, allows for the creation of tokens on the Bitcoin network. It has been gaining traction as developers and investors seek new opportunities beyond Ethereum-based platforms. The increasing popularity of these tokens could be attributed to lower transaction fees, faster transaction times, and the Bitcoin network’s overall reputation.

Meme tokens have been a significant part of the cryptocurrency market in recent years, with some experiencing massive price gains and creating overnight millionaires. These tokens often gain traction due to their unique branding, strong communities, and viral marketing campaigns. Examples of successful meme tokens include Dogecoin (DOGE), Shiba Inu (SHIB), and SafeMoon (SAFEMOON).

The shift from Ethereum-based ERC-20 meme tokens to BRC-20 variants may be attributed to several factors. One reason is the high gas fees and network congestion experienced on the Ethereum network, which has led some developers and investors to seek alternative platforms. Additionally, the Bitcoin network’s increasing adoption of smart contracts and DeFi infrastructure has made it more appealing for building new tokens and decentralized applications.

Although the BRC-20 token standard is still in its early stages, the growing popularity of meme tokens on the Bitcoin network could potentially lead to increased adoption and pave the way for more innovative projects in the future. However, as with any investment, it is essential to exercise caution and thoroughly research potential projects before committing funds.

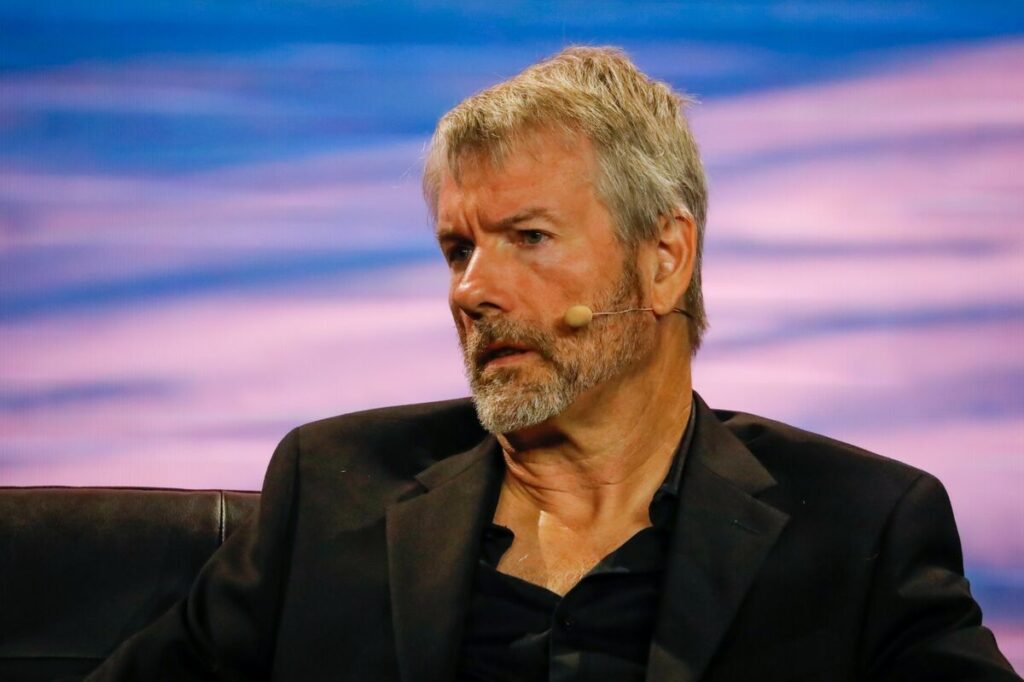

MicroStrategy, the business intelligence software company, continues to display unwavering confidence in Bitcoin as it posts a return to profitability in the first quarter of 2023. The firm’s CEO, Michael Saylor, shared the positive financial results while emphasizing the company’s ongoing dedication to the leading cryptocurrency.

The enterprise software provider has turned a corner from previous financial difficulties, reporting a profit in Q1 2023. This turnaround can be partially attributed to MicroStrategy’s substantial investments in Bitcoin, which have paid off significantly.

In a recent interview, Saylor emphasized that the company’s conviction in Bitcoin is stronger than ever, with no plans to relinquish its position as a primary institutional investor in the digital asset. The CEO also highlighted Bitcoin’s potential as a store of value, stating that it surpasses traditional assets like gold.

Since its initial investment in August 2020, MicroStrategy has consistently increased its Bitcoin holdings, currently owning over 124,946 BTC. This unwavering support has positioned the company as one of the most significant institutional investors in the cryptocurrency space.

MicroStrategy’s commitment to Bitcoin has also influenced other major companies to consider the digital asset as part of their investment strategy. Saylor’s advocacy for Bitcoin’s adoption has encouraged businesses to reevaluate their approach to the evolving world of digital currencies.

In summary, MicroStrategy’s return to profitability in Q1 2023 is a testament to the company’s steadfast belief in Bitcoin’s potential. As one of the foremost institutional investors in the cryptocurrency, the firm’s success serves as a prime example for other businesses considering digital asset investment.

As the Federal Open Market Committee (FOMC) meeting approaches, the mood in the market seems to be impacting Bitcoin (BTC) price as it hovers near the $28,000 support level.

The strengthening of the US dollar ahead of the FOMC meeting has put pressure on Bitcoin, with traders keeping a close eye on market movements.

The FOMC meeting, where interest rate decisions are made, has the potential to affect the global economy and impact various financial markets, including cryptocurrencies. Market participants are anticipating the Federal Reserve’s comments on inflation, tapering, and the overall economic outlook, which could influence the value of the US dollar and, in turn, the price of Bitcoin.

At the time of writing, Bitcoin is struggling to maintain its support level at $28,000, with the possibility of dipping even lower if the US dollar continues to strengthen. Although the flagship cryptocurrency has faced multiple challenges in recent months, including regulatory crackdowns and energy consumption concerns, the upcoming FOMC meeting adds another layer of uncertainty for investors.

As a result, traders and investors are advised to remain cautious and stay informed about developments surrounding the FOMC meeting and its potential impact on cryptocurrency markets.