Miami, FL, United States, May 18th, 2023, Chainwire

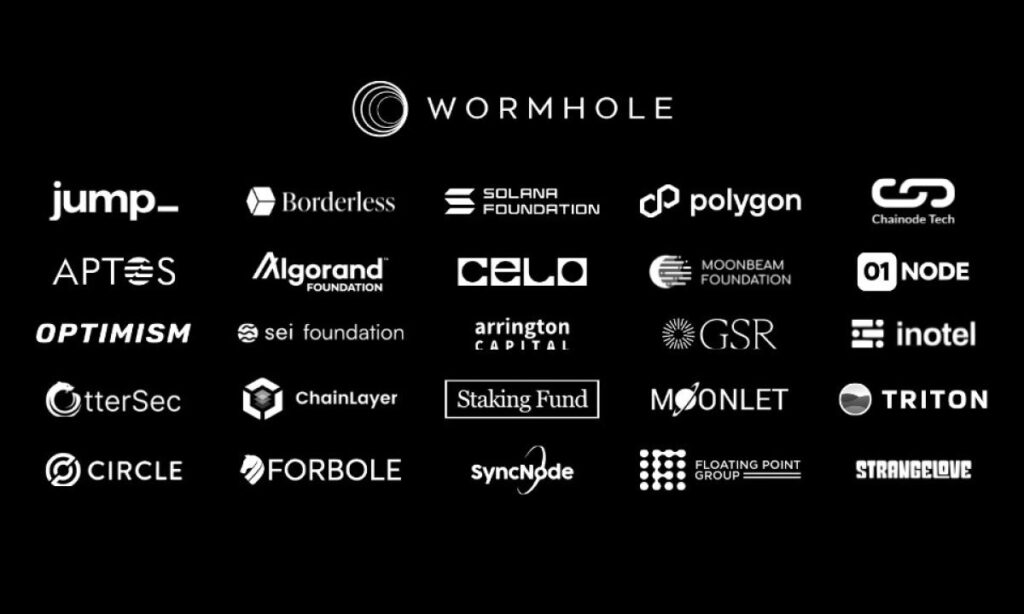

Borderless Capital is the manager behind this new fund. Investors include Jump Crypto, Aptos Labs, Polygon Ventures, Solana Foundation, Algorand Foundation, GSR, Arrington Capital among other institutions

Over twenty blockchain teams and venture funds have teamed up to launch a $50 million Cross-Chain Ecosystem Fund focused on backing and growing new startups that leverage the Wormhole cross-chain messaging protocol. The Cross-Chain Ecosystem Fund is being managed and operated by Borderless Capital, a leading venture capital firm in the Web3 space.

Backed by top blockchain protocols, infrastructure providers, and institutional investors, the fund aims to support cross-chain innovations that will drive the growth and adoption of the Web3 industry. The Cross-Chain Ecosystem Fund is backed by Jump Crypto, Polygon Ventures, Aptos Labs, Solana Foundation, Sei Foundation, Algorand Foundation, CLabs (the company behind the Celo Blockchain), the Moonbeam Foundation, Optimism, Circle, MultiCoin GP’s Tushar Jain and Kyle Samani, Arrington Capital, GSR, Floating Point Group, Chainlayer, Chainode Tech, 01Node, Staking Fund, Moonlet.io, Forbole Ventures, Syncnode, Inotel, Triton One, Strangelove, Securitize’s CEO Carlos Domingo, OtterSec among others.

Navigating the Web3 landscape is becoming increasingly challenging due to the proliferation of numerous layer-1 blockchains, layer-2 scaling solutions, and specialized appchains with unique purposes and parameters. This complexity poses difficulties for users and alienates developers who are restricted from accessing a single ecosystem, hindering their growth. The Cross-Chain Ecosystem Fund seeks to unlock the full potential of a cross-chain future, aiming to redefine users’ experiences and establish Wormhole as the cross-chain standard for builders to transcend the limitations of individual ecosystems. This innovation prioritizes aggregation, security, scalability, compatibility, and composability.

“We believe in a borderless Web3 future and are thrilled to have the support of our partners and investors who share our vision. In the same way that in Web2 the value was created through aggregating the relationship with the users we believe that in Web3 this is the natural next step” said David Garcia, CEO & Managing Partner of Borderless Capital. “Our goal is to empower builders to transcend the limitations of individual ecosystems, paving the way for blockchain applications and protocols to realize their full potential.”

Wormhole, the technological focus of the Fund, is a foundational protocol that enables cross-chain messaging of value and data across more than 23 high-value chains, already leveraged by influential protocols and companies like Uniswap, Circle and Base from Coinbase.

“Crypto is still a nascent industry with essentially limitless growth opportunity, and we should be doing nothing but working together, regardless of which specific networks individuals may be more passionate about. It’s really exciting to see so many ecosystems come together with leading venture funds to unite on solving the interoperability challenge by supporting startups that integrate Wormhole’s cross-chain messaging standard,” said Dan Reecer, Head of Operations at Wormhole Foundation.

Builders, founders and developers looking to reach across ecosystems can apply to the Cross-Chain Ecosystem fund at wormhole.com/programs. Applications will be reviewed by the fund manager, Borderless Capital, starting this month.

About Borderless

Borderless is a leading investment management firm focused on Web3 technology, dedicated to supporting the next generation of innovators who are driving the development of groundbreaking technologies that will enable the creation of value without borders. Borderless comprises a team of builders, partners, and investors who adopt a long-term perspective and strive to unleash the full potential of open, community-driven networks. Since 2018, Borderless has invested in 200+ protocols/companies across infrastructure, business applications, and nascent cryptographic protocols, and has played an integral role in the development of some of the most significant and innovative Web3 communities. For more information, please visit their website.

About Wormhole

Wormhole is the industry standard cross-chain messaging protocol powering applications across Web3. Wormhole provides developers access to liquidity and users on over 20 of the leading blockchain networks, enabling use cases that span DeFi, NFTs, governance, and more. Wormhole enables a growing suite of products to build on its messaging layer. Wormhole Connect is an in-app bridging widget that can be integrated in as few as 3 lines of code. The wider Wormhole network is trusted and used by teams like Circle (USDC) and Uniswap, and to date, the platform has facilitated the transfer of over 35 billion dollars through hundreds of millions of cross-chain messages.

Contact

Borderless Team

media@borderlesscapital.io

Miami, USA, May 17th, 2023, Chainwire

IOVLabs, one of the global blockchain technology leaders, announced the launch of a $2.5 million strategic grants program to further enhance the development and adoption of Rootstock, the world’s first Bitcoin sidechain which has become a growing hub of DeFi activity on the Bitcoin network.

The program was revealed today at the inaugural Bitcoin Builders Conference in Miami, a pioneering event focused on Bitcoin Layer 1 and Layer 2 developers.

To discover eligible candidates for the grant program, IOVLabs also announced the launch of a Hackathon in partnership with HackerEarth, a global community of over 4 million developers.

The Hackathon will run from May to July, featuring an ideation stage, a development stage, and a final pitch to an esteemed panel of judges from the Bitcoin and Rootstock ecosystems. Blockchain developers from all over the world are invited to apply.

Given Rootstock’s compatibility with Ethereum Virtual Machine (EVM), no prior knowledge is required to build decentralized applications (dApps) and integrations on the network. Developers can use the same solidity tools and libraries they are accustomed to, including Hardhat, Truffle, web3.js, and ethers.js.

In addition to the possibility of qualifying for the $2.5 million grant program, all Hackathon participants stand a chance to win over $25,000 in prizes.

Hackathon Judges include Rootstock Co-founder Sergio Lerner and mentors include Rootstock Co-founder Diego Gutiérrez Zaldívar. Rootstock ecosystem leaders including representatives from Sovryn and Tropykus will also be judging the hackathon.

Developers can leverage Rootstock’s extensive resources on the DevPortal and gain the ability to incorporate the RIF’s pre-built open-source protocols into their current and future projects.

This is part of a broader effort by IOVLabs to extend the possibilities of Bitcoin beyond being a store of value and help the ecosystem become a full-fledged financial system. The dual-pronged approach of supporting established financial institutions building and launching Web3 products and aiding entrepreneurs and builders with funding and support through hackathons and grants all speaks to IOVLabs’ desire to empower the community. Co-creation and the continual growth of Rootstock’s ecosystem partner list further attribute to that mission.

IOVLabs VP of Growth Pei Chen comments:

“IOVLabs’ support of the strategic grants program demonstrates our strong commitment to provide the tools needed to build a truly decentralized financial system on Bitcoin. This is an opportunity for the next generation of developers to harness the Rootstock sidechain to extend the capabilities of Bitcoin and help create a freer and fairer financial system for all.”

“Rootstock is rapidly becoming known as the home of DeFi on Bitcoin. But we believe now is the time to make it available to everyone, regardless of their technical ability. That’s why the overarching theme of this year’s grant programme is Everyday DeFi. This is how the first billion users will be onboarded to Web3 and together we can make it happen.”

The Hackathon and grants program will encourage developers to explore a range of concepts and projects aligning with the “Everyday DeFi” theme, including:

- Greater interoperability for different blockchains built on or with Bitcoin (dApps, bridges, technical implementations)

- User-centric utility to achieve effective user engagement (real-world use cases, compelling DAO governance modules, data dashboards)

- Unlocking new functionality and liquidity for DeFi (strategic integrations of marketplaces, dApps, DEXes, aggregators, wallets, on/off ramps, oracles)

- Developer Hackathon Bounties for Rootstock infrastructure & tooling (enhancing the foundational tools and resources for sustainable ecosystems, e.g. compiler support, SDKs, libraries, node-as-a-service, merge mining, rollups, etc.)

The Bitcoin Builders Conference, set for May 17th in Miami, will provide an opportunity for hands-on workshops, panel discussions with engineering leaders, and insightful industry keynotes for developers and innovators. The conference will also showcase the latest development tools for Bitcoin.

IOVLabs President Daniel Fogg adds:

“With the Bitcoin Builders Conference underway, I’m excited to see how developers are harnessing Bitcoin’s potential to solve everyday challenges for people around the world. IOV Labs strongly believes Bitcoin sidechains like Rootstock will play a major role in bringing the first billion users to crypto. This conference is an opportunity to celebrate and share our progress so far while acknowledging there’s still work to do. Every network has its sweet spot, and for Rootstock, it’s all about using Bitcoin to create a more accessible and fairer financial system for all. By bringing together EVM compatibility with the unmatched security of Bitcoin, Rootstock offers developers a network that can be trusted to support the financial futures of people worldwide, no matter their economic status.”

Both the grants scheme and the Hackathon aim to encourage developers to build on Bitcoin by leveraging the smart contract capabilities of its Rootstock sidechain.

This initiative helps to futureproof Bitcoin by enhancing its long-term value proposition and promoting sidechains for complex transactions, thereby addressing the ongoing congestion issue on the leading network.

The $2.5 million grants program is fully funded by IOV Labs, which contributes to the development of Rootstock, a decentralized blockchain protocol.

Rootstock use continues to grow, with close to $400m in Total Value Locked (TVL) and over 60 protocols in its ecosystem.

About IOVlabs

IOVlabs develops the blockchain technologies needed for a new global financial ecosystem that fosters opportunity, transparency, and trust.

The organization currently contributes to the development of the Rootstock blockchain and Rootstock Infrastructure Framework (RIF).

The Rootstock network is one of the more secure smart contract platforms in the world, designed to leverage Bitcoin’s unparalleled hash power while extending its capabilities.

Rootstock Infrastructure Framework (RIF) is a suite of open and decentralized infrastructure protocols that enable faster, easier and scalable development of distributed applications (dApps) within a unified environment.

For more information, visit the IOVLabs website.

About Rootstock

Rootstock is the world’s most secure, permissionless and censorship-resistant Bitcoin sidechain. It provides EVM-compatible smart contract functionality using Bitcoin as the native asset. Rootstock takes Bitcoin from a simple store of value and turns it into the foundations of a fully-fledged decentralised financial system.

Rootstock’s native token RBTC is known as “Smart Bitcoin” and lets users use their BTC to interact with a range of services on the Rootstock Bitcoin layer 2. RBTC is an exact 1:1 peg with BTC. (1 RBTC = 1 BTC) When you transfer bitcoin into Rootstock, your bitcoin is locked and the equivalent amount is released as RBTC.

Rootstock is a Bitcoin sidechain that provides EVM-compatible smart contract functionality using Bitcoin as the native asset. Rootstock is the most permissionless and censorship-resistant Bitcoin sidechain. People around the world use Rootstock every day to interact with a range of DeFi protocols such as Sovryn, Tropykus and stablecoin Money on Chain.

Rootstock is permissionless, and its consensus mechanism is merge-mined proof of work (PoW) with over 50% of Bitcoin’s hash power currently mining Rootstock. This means that Rootstock is mined with more hash power than any other chain, except Bitcoin itself.

RBTC is used as gas to pay for smart contract execution on the network, such as the transaction fee for trading Rootstock ecosystem tokens, the same way as ETH is used as gas for Ethereum. Unlike other blockchain native tokens, Rootstock is non-custodial and maintains the censorship resistance of Bitcoin.

Contact

Director of Brand & Communications

Sam Golden

IOV Labs

samuel.golden@iovlabs.org

Creditors of the insolvent cryptocurrency lending business BlockFi have lodged a fresh court document, challenging the company’s most recent restructuring proposal.

On May 12, BlockFi detailed its Chapter 11 restructuring strategy in a document submitted to the United States Bankruptcy Court in Trenton, New Jersey. The firm suggested that a sale of BlockFi might not yield sufficient value for its creditors given its outstanding debt of nearly $1.3 billion to its top 50 creditors.

Countering this, BlockFi creditors filed an additional court document on May 15, accusing BlockFi of intentionally delaying the court proceedings.

Represented by the Brown Rudnick law firm, the creditors of BlockFi highlighted that the firm liquidated approximately $240 million in cryptocurrency prior to declaring bankruptcy in late November 2022. They underlined that the crypto assets were sold “at the nadir,” referring to a substantial market decline following the FTX collapse.

The creditors criticized BlockFi’s decision to liquidate almost all domestic cryptocurrency in November 2022 as ill-judged, costing them over $100 million in subsequent months. They also pointed out “unnecessary and undesired tax consequences,” asserting that the sale was not relevant to its bankruptcy proceedings. The filing stated:

“Selling $240 million in cryptocurrency was never rationally related to bankruptcy funding needs, given that no reasonable estimate would peg the costs of this bankruptcy at $240 million.”

According to the creditors, BlockFi expended $22.5 million of client funds to purchase a $30 million insurance policy, following the disposal of digital assets before filing for bankruptcy.

The creditors argued in their document, “By selling everything pre-petition, BlockFi provided itself with an almost unlimited budget, essentially shielded from the bankruptcy’s adversarial process, to conduct its case for as long and as contentious as it deems appropriate without the ‘typical milestones’ in a DIP or cash collateral order.”

The plaintiffs urged the court to expedite the case’s conclusion by transferring the estate assets “into the hands of new management.” They reiterated that such a situation appears incongruous with the debtors’ case objectives.

BlockFi did not immediately respond to Cointelegraph’s request for comment.

The total count of Bitcoin wallet addresses possessing at least one BTC has crossed the milestone of one million.

Data from Glassnode confirms that this benchmark was achieved on May 13.

A significant rise in wallet addresses owning a minimum of one Bitcoin was observed last year as the cryptocurrency’s price plummeted by over 65%. The most prominent increases happened during a severe market downturn in June and from November 11, following the bankruptcy declaration by FTX.

As Bitcoin’s price declined from its peak in November 2021, approximately 190,000 “wholecoiners” joined the ranks from early February 2022.

Glassnode co-founder Negentropic advised his 54,000 Twitter followers that the optimal time to invest in Bitcoin is during market distress.

This advice comes amidst several major bank failures in the U.S. and potential halting of interest rate hikes by the Federal Reserve. These factors contribute to Glassnode’s continued belief in Bitcoin’s potential to reach $35,000 in the mid-term.

While the milestone of “one million” is notable, it’s essential to remember that a single Bitcoin wallet address doesn’t necessarily equate to one individual.

Many Bitcoin investors manage multiple addresses, and others belong to major entities like cryptocurrency exchanges and investment firms that often hold substantial Bitcoin quantities.

CoinGlass, a crypto analytics provider, estimates that out of the roughly 19 million Bitcoin in circulation, 1.89 million BTC — valued at $50.7 billion — are held by large centralized exchanges such as Binance and Coinbase.

Moreover, Glassnode’s estimates suggest that an astonishing 3 million BTC — equivalent to $80.4 billion and 17% of the total circulating supply — are irretrievably lost. These estimations are based on various data sources, including BTC sent to “burn addresses,” wallets with lost keys, and substantial accounts that have been inactive for over a decade.

Salem, Oregon, May 15th, 2023, Chainwire

Merov is proud to announce the launch of its comprehensive suite of services designed for the Bitcoin mining industry. The suite of services includes Merov Hosting, Rejuvit Systems by Merov, and Merov Marketplace, each providing solutions to the needs of the Bitcoin mining industry.

“As a pioneer in the industry, we are excited about the opportunities these services present, and we look forward to continuing to innovate and provide exceptional services to the Bitcoin mining community,” said Montana L. Dukes, Founder and Chief Executive Officer of Merov.

Merov Hosting offers state-of-the-art colocation facilities designed to provide the highest levels of performance, reliability, and security for Bitcoin miners.

Rejuvit Systems by Merov is a US-based parts distributor and ASIC repair company with high-quality repair, training, and tools at competitive prices.

Merov Marketplace is an innovative platform that provides due diligence, asset sale, distribution, and procurement services to the Bitcoin mining industry. It is currently in beta testing and will launch in Q3 ‘23.

Milestones Achieved

- $771.96mm in ASIC mining infrastructure deals closed or currently engaged in.

- 105,455 ASICs processed through Merov’s acquisition, verification, repair, or fulfillment services.

- 400+ megawatts of colocation capacity becoming available ’23-’24.

About Merov:

Merov is a team of passionate and experienced professionals committed to enhancing the Bitcoin industry. With a deep understanding of the industry and a range of expertise in related fields, we strive to deliver innovative, reliable, and comprehensive solutions tailored to our clients’ needs.

Our mission is to bridge gaps and streamline operations, enabling businesses and individuals to thrive in the rapidly evolving world of Bitcoin. By pushing the boundaries of technology and staying at the forefront of industry developments, we are dedicated to driving growth, fostering innovation, and empowering our clients to reach their full potential.

Follow Merov on Telegram and Twitter.

Merov is a proud sponsor of the Bitcoin Conference, May 18-20, 2023. Come meet the Merov team at booth 1206.

Contact

Chief Creative Officer

Rachel Schimelman

Merov

press@merov.io

The US Department of Justice (DOJ) is intensifying its efforts against hackers and exploiters in the Decentralized Finance (DeFi) sector, following a significant increase in illicit cryptocurrency activities over the past four years.

Eun Young Choi, the head of the DOJ’s National Cryptocurrency Enforcement Team (NCET), shared in a Financial Times report on May 15 that the DOJ is zeroing in on thefts and cyber-attacks related to DeFi, with a special focus on “chain bridges.”

Choi highlighted that this is a considerable concern for the DOJ, especially since North Korean state-sponsored hackers have been identified as major players in this area.

Cointelegraph reported in February that North Korean hackers had pilfered an estimated $630 million to $1 billion in cryptocurrency assets in 2022 alone.

Choi, who has nearly ten years of prosecutorial experience with the DOJ, was named the inaugural director of the NCET in February 2022. The DOJ stated at that time that the NCET would act as the primary hub for the department in dealing with matters related to cryptocurrency, cybercrime, money laundering, and asset forfeiture.

The DOJ underscored that they would specifically target “mixing and tumbling services,” but there was no mention of DeFi platforms in their initial announcement.

Speaking at the recent Financial Times Crypto and Digital Assets Summit, Choi reaffirmed that the DOJ is targeting cryptocurrency companies that either commit crimes or knowingly permit such activities to occur, thereby facilitating money laundering.

Choi underlined that focusing on the platforms where these activities originate could have a multiplying effect by making it harder for criminals to reap the benefits of their illicit activities.

She also noted that the extent and variety of illicit uses of digital assets have significantly increased in the past four years.

Riot Platforms, previously known as Riot Blockchain, a crypto mining company, has initiated legal proceedings against Rhodium Enterprises, a Bitcoin miner based in Texas. The dispute involves recovering an alleged unpaid sum exceeding $26 million in mining facility fees.

Riot Platforms, in its Q1 2023 financial statement released on May 10, claimed that Rhodium violated their contract by not meeting the payment obligations for hosting and service fees. These fees were related to the use of Whinstone’s Bitcoin mining facilities, which Riot Platforms fully owns.

On May 2, a legal petition was lodged against Rhodium Enterprises in the Milam County Court in Texas. The petition seeks to recoup “over $26 million” and requests reimbursement for any legal expenses incurred.

In addition, Riot has asked for authorization to end “certain hosting agreements” with Rhodium. They also proposed that they should not be obligated to pay back any remaining power credits after stopping these services.

Riot Platforms acknowledged the uncertainty surrounding the possible recovery of these unpaid fees at this stage of the litigation. They stated:

“At this early stage of the litigation, it’s not possible to reasonably predict the probability of a negative outcome or the extent of such an outcome, if it happens.”

According to the report, Rhodium was served on May 8 and given until May 30 to respond.

The report also disclosed that Riot Platforms had successfully mined “2,115 Bitcoins” in the first quarter of 2023, marking a 50.5% rise from Q1 2022.

The report clarified that Riot Platforms had no involvement with recent bank failures, stating:

“We have no banking relationships with Silicon Valley Bank, Silvergate Bank, or First Republic Bank, and currently we keep our cash and cash equivalents in several banking institutions.”

Riot Platforms anticipates ongoing challenges for crypto mining businesses in 2023. This is due to the “significant drop in Bitcoin’s value” and “other national and global macroeconomic factors.”

However, Riot believes its “relative position” in the industry, coupled with its “liquidity and lack of long-term debt,” places it in a strong position to “benefit from such consolidation.”

Cryptocurrency exchange Binance announced via Twitter on May 12 that it is ceasing operations in Canada. The decision is a “proactive” response to the new regulatory guidelines enforced by Canadian authorities, which are significantly impacting the nation’s cryptocurrency sector.

This move makes Binance the latest among several other cryptocurrency entities to exit Canada, following the implementation of new rules by the Canadian Securities Administrators (CSA) on February 22. These rules mandate that all crypto firms must submit new preregistration undertakings and comply with additional restrictions.

Despite having reportedly submitted a new preregistration undertaking, Binance clarified in a tweet: “Regrettably, new guidelines related to stablecoins and investor limits on crypto exchanges make it untenable for Binance to continue operations in the Canadian market at this time.”

The newly introduced CSA rules forbid companies from allowing Canadian clients to enter into contracts to purchase and sell any crypto asset classified as a security and/or a derivative, and they categorize stablecoins as securities.

Previous to Binance’s announcement, OKX exited the Canadian market in March, followed by decentralized exchange dYdX in April and blockchain fintech Paxos afterward.

An email from Binance to its Canadian users, as seen by Cointelegraph, asked them to settle their open positions by September 30, 2023. It cautioned that, “Starting October 1, 2023, Canadian customers will be transitioned to liquidation only mode.”

Binance further stated: “Although we disagree with the new guidelines, we intend to remain in dialogue with Canadian regulators in the hope of establishing a comprehensive, thoughtful regulatory framework.”

Binance had previously been operating in all Canadian provinces and territories, except Ontario. It had withdrawn from this province in March 2022, following an extended dispute with its regulatory authorities.

However, not all is doom and gloom for Canadian crypto enthusiasts. Kraken, another major player in the space, submitted a new preregistration undertaking in March and has pledged to maintain its operations in Canada. According to the CSA, there are 11 platforms “Authorized to Do Business with Canadians.”

Cryptocurrency exchange OKX has launched an audacious new marketing campaign, encouraging a comprehensive overhaul of existing financial and digital systems. The campaign subtly takes aim at the American exchange Coinbase and the wider conventional finance sector.

OKX unveiled its latest high-quality commercial, with its CMO, Haider Rafique, explaining the firm’s conviction in a Cointelegraph interview that blockchain technology is crucial for revamping financial infrastructure and promoting digital ownership.

During Rafique’s tenure, OKX has engaged in significant partnerships and daring ad campaigns with entities such as Manchester City and the McLaren Formula1 team, thereby bringing cryptocurrencies and Web3 offerings to broad global audiences.

The “Rewrite the System” initiative uses potent imagery to underscore issues like inflation, data breaches, and censorship as evidence of a flawed system. Rafique stressed that discussions about updating existing financial and digital structures do not address the deep-seated problems that inspired the campaign:

“The current system is not really designed to be updated and then updated into a system that can really solve some of the problems that the entire system has created.”

Several events over the past year have revealed the deficiencies of current financial systems, as well as the lapses of conventional finance and decentralized finance (DeFi) entities.

The notorious fall of FTX and the subsequent arrest of its former CEO, Sam Bankman-Fried, tarnished the cryptocurrency sector’s reputation. Traditional finance institutions, meanwhile, grappled with their own crises in a high-inflation economy, leading to the folding of Silicon Valley Bank, Silvergate Bank, and Signature Bank.

Rafique is of the opinion that these ongoing system failures highlight the stress on the financial ecosystem. He believes that these events will demonstrate how blockchain-based software offers individuals more control over their financial and digital independence:

“Our hope is that we can give the tooling to people that Web3 starts with, ultimately downloading software on your machine or your phone that enables you to be your own bank.”

The campaign also emphasizes interoperability as a key element in the case for blockchain-based, Web3 tools to revolutionize financial systems and platforms. Rafique cites the isolated nature and incompatibility of Google’s Play Store and Apple’s App Store as an example where blockchain-based applications could offer superior interoperability:

“Crypto and blockchain-based apps are actually designed to connect with each other and drive their interoperability.”

OKX aims to offer a wallet service that connects public chains, simplifying the management of digital assets, and exemplifying the interoperability inherent in blockchain technology:

“We want to connect all crypto ecosystems together so you can hop from one place to another place or another place very easily, but also at very low transaction costs.”

Rafique is firm in his belief that OKX’s advertising efforts, which include engaging audiences through partnerships in diverse markets, have shaped the exchange’s image.

According to a recent report by Goldman Sachs, an increasing number of home offices are investing in digital assets, with 32% now participating in the market. This trend demonstrates the growing interest and adoption of cryptocurrencies and other digital assets by these private wealth management entities.

The report highlights that these investments are driven by a desire to diversify their portfolios and protect their wealth against economic uncertainties. Furthermore, the increasing number of institutional investors entering the market has helped solidify the legitimacy of digital assets as an investment class.

As part of the study, Goldman Sachs surveyed home offices across the globe, including those in the United States, Europe, Asia, and the Middle East. The results showed that while some home offices are still hesitant about the risks associated with digital assets, a significant number are embracing the opportunity to invest in this emerging asset class.

In addition to the 32% of home offices investing in digital assets, the study found that many are also considering investments in blockchain technology and related start-ups. This interest suggests that these investors recognize the potential for digital asset technology to revolutionize various industries and provide significant long-term growth opportunities.

The rising interest in digital assets among home offices indicates a growing level of trust in this asset class, and is a testament to the increasing recognition of cryptocurrencies and blockchain technology as valuable investments for private wealth management.