In a recent interview with the Wall Street Journal, Coinbase CEO Brian Armstrong insisted that the regulation of cryptocurrencies isn’t as complicated as it might seem. He expressed his confidence that the United States would achieve clear regulatory guidelines for the crypto industry, even though it might take time.

This interview comes on the heels of a lawsuit filed against Coinbase by the Securities and Exchange Commission (SEC) on June 6, alleging that the exchange was operating as an unregistered securities exchange, broker-dealer, and clearinghouse. Armstrong argued in the interview that Coinbase’s operations do not require these registrations.

“The assets that we trade are commodities, not securities, hence they do not necessitate such registrations. We operate our exchange on crypto commodities,” Armstrong explained.

He also noted that despite not claiming to be a broker-dealer, Coinbase had faced difficulties in activating its acquired broker-dealer license.

When discussing regulations, Armstrong argued that crafting sensible rules is not “rocket science,” and he expects the U.S. to arrive at the correct regulatory framework over time. He believes the SEC lawsuit against Coinbase is significant for the entire U.S. crypto industry, as he hopes it will bring more clarity and prevent the U.S. from lagging behind other countries in this arena.

Armstrong is optimistic that once clear and stable regulations are established in the U.S., it would encourage crypto businesses to return to the country. He stated, “We expect entrepreneurs who had left the U.S. to return, as they won’t be randomly targeted or face high legal bills unexpectedly.”

A previous report by Cointelegraph noted a 26% decline in the share of global crypto developers in the U.S. between 2018 and 2022, attributing this decrease to regulatory ambiguity.

Armstrong emphasized that clarity is needed, especially in defining the roles and boundaries of the two major U.S. financial regulators, the SEC and the Commodity Futures Trading Commission (CFTC).

READ: Changpeng Zhao claims SEC chairman wanted to become Binance adviser

Amidst the lawsuits by US regulators against leading competitors Binance and Coinbase, cryptocurrency exchange Bitget has observed a significant upsurge in new account registrations from Latin America. The platform reported a 43% increase in new users from the region between June 6 and 9 compared to the daily averages, with Brazil and Argentina driving the growth, as per a Bitget spokesperson.

In Brazil, the number of new Bitget clients soared by 54%, with total deposits experiencing a 208% spike. In Argentina, the customer base and total deposits grew by 33% and 87% respectively. The crypto exchange, which also operates in Venezuela, Colombia, and Mexico, reported a 134% rise in total regional deposits during this period.

With over 8 million customers in 100 countries, Bitget didn’t disclose the total user count in Latin America. The uptick in figures is attributed to the recent regulatory developments in the US, where the SEC sued Binance on June 5 on 13 charges, leading to Binance net outflows of $3.128 billion over the past week, while Bitget’s deposits increased by $14.8 million.

Gracy Chen, Bitget’s Managing Director, expressed her confidence in the industry’s resilience despite recent upheavals, stating that “favorable policies are being implemented in places like Hong Kong, Dubai, Singapore and new opportunities are emerging.”

On June 6, Coinbase, another major crypto exchange, was sued by the US SEC for allegedly dealing in unregistered securities. The SEC Chair accused Coinbase of failing to provide adequate protection against fraud, manipulation, and conflicts of interest, leading to an overnight change of 113.06% in Coinbase’s trade volume, which reached $1.5 billion.

Interestingly, both Binance and Coinbase have been actively expanding their local operations in Brazil, a market of significant importance to these exchanges.

READ: Hackers steal almost $1 million after hijacking crypto influencers’ accounts

The cryptocurrency market has been hit hard with Bitcoin dropping to a three-month low of $25,483 on June 10, a significant decrease of over $1,200 from the previous day, according to data from Cointelegraph Markets Pro and TradingView. Despite this, Bitcoin has fared better than major altcoins, which have suffered severely from US regulatory scrutiny.

The recent legal action by the U.S. Securities and Exchange Commission (SEC) against leading exchanges, Coinbase and Binance, has resulted in certain altcoins being delisted. In response, Robinhood, a popular trading app, revealed it would cease support for several cryptocurrencies implicated in the lawsuit. These include Cardano, Polygon, and Solana, which are expected to be dropped on June 27th, 2023 at 6:59 PM ET.

The announcement sparked a notable decrease in the value of the affected cryptocurrencies, with Cardano and Solana recording a 25% loss in 24 hours. Robinhood justified this move stating it regularly reviews its crypto offerings, and the decision was based on the latest assessment.

Crypto.com CEO, Kris Marszalek, expressed that such delistings and regulatory pressures are part of the growth and maturation process of the crypto industry. He anticipates the sector will emerge stronger, despite the current challenges. The platform also revealed that it would stop its U.S. institutional trading service from June 21.

Michaël van de Poppe, CEO of trading firm Eight, highlighted the significant impact of these developments on the overall cryptocurrency market capitalization. If the total market cap drops below its 200-week moving average (MA), currently standing at nearly $26,400 for Bitcoin, it will indicate a clear bearish trend. Van de Poppe conveyed his concern to his Twitter followers, suggesting that the worst might be yet to come.

The Commonwealth Bank of Australia (CBA), the country’s largest financial institution, has announced plans to restrict specific payments to cryptocurrency exchanges due to concerns about potential scams. This decision aligns with similar actions from other major banks and follows a series of legal challenges faced by global exchanges from US regulatory bodies.

Earlier this month, CBA disclosed its intention to either decline or impose a 24-hour hold on “certain payments to cryptocurrency exchanges”. The bank cited the need to shield its customers from the scam risks linked to such transactions. Specific details about the types of payments to be affected have not been revealed publicly, due to concerns over scammers potentially bypassing the restrictions.

In a bid to further safeguard its customers, CBA also stated plans to cap the amount individuals can send to cryptocurrency exchanges at AUD $10,000 (approximately $6,650) per month, to be rolled out in the near future.

CBA’s general manager of fraud management services, James Roberts, highlighted that scammers worldwide are exploiting the growing interest in cryptocurrencies, presenting themselves as genuine investment opportunities or funneling funds into crypto exchanges. The bank assured that these protective measures would be subject to continuous review and assessment of their impacts.

This new stance marks a significant shift for CBA, which had previously shown a more crypto-friendly approach. In November 2021, the bank was preparing to roll out cryptocurrency trading services for its CommBank app users, signifying its intent to actively participate in the burgeoning sector. CBA’s CEO, Matt Comyn, acknowledged risks in the sector but highlighted that the potential perils of non-participation were far greater. He maintained that both the technology and the sector were here to stay.

Interested in writing for Crypto Intelligence News? Submit a crypto guest post

Poloniex is one of the most well-known names in the world of cryptocurrency, launched in 2014. Since its inception, it has established a reputation for being a leading digital asset exchange offering a wide range of cryptocurrency trading options, including spot trading, margin trading, and lending.

Aesthetics and User Interface

On first landing on Poloniex’s platform, it’s evident that they’ve put effort into developing an appealing and easy-to-navigate interface. The overall look is clean and modern, with a dark theme that is friendly to the eyes, especially for those who tend to spend long hours trading. The layout is intuitive and self-explanatory, with tabs and dropdown menus providing easy access to different functions and markets.

The trading interface, complete with charts, order books, and trading history, offers all the critical information on one screen. Advanced traders will appreciate the extensive range of technical analysis tools integrated into the charting feature. On the flip side, beginners may initially find the interface slightly overwhelming due to the wealth of information displayed.

Security

Security is always a key consideration when assessing any cryptocurrency exchange. Poloniex has learned from past experiences, like the Bitcoin hack back in 2014, and made substantial strides in this area. All deposits are now stored in air-gapped cold storage. Additionally, they offer two-factor authentication (2FA) for accounts, email confirmations for withdrawals, and have stringent AML and KYC checks to prevent illicit activity.

However, it’s worth noting that, like all centralized exchanges, it’s not fully immune to risks. Users must exercise individual security measures, such as enabling 2FA, regularly updating passwords, and not clicking suspicious links.

Trading Options and Liquidity

Poloniex stands out due to its extensive variety of trading options. Its margin trading feature allows users to borrow funds to leverage their trades. Their lending feature allows users to earn interest by lending their assets.

In terms of cryptocurrency pairs, Poloniex offers a wide selection, making it an attractive option for those looking to trade less popular or more niche cryptocurrencies. The platform’s liquidity is generally strong, ensuring quick trade execution and lower slippage. However, the liquidity can vary across different pairs, with lesser-known pairs potentially having lower liquidity.

Fees

Poloniex operates a maker-taker fee schedule, which is dependent on the user’s 30-day trading volume. The fees are competitive, particularly for more active traders who benefit from lower fees as their volume increases.

However, the fee structure can be complex for new users or those not trading regularly. While the fees are generally lower compared to other exchanges, it’s always important to understand the costs associated with trading on the platform.

Customer Support

Customer support is an area where Poloniex has faced criticism in the past. The platform offers 24/7 support and a comprehensive knowledge base, but the response times can vary significantly, leading to some frustration among users. However, the company appears to be addressing this, with noticeable improvements in response times and resolution efficiency.

Regulation

Poloniex is a US-based exchange, and it adheres to the regulatory environment. It was acquired by Circle in 2018, a company with a strong focus on compliance and regulation. Since October 2020, it’s been operated by Polo Digital Assets, Ltd., who have pledged to continue focusing on compliance with all relevant laws and regulations.

Mobile App

The Poloniex mobile app offers a seamless experience, mirroring the desktop platform’s functionality. The design remains consistent, ensuring that users can easily navigate and execute trades on the go. The app is responsive, user-friendly, and offers real-time updates, making it a reliable tool for traders.

Conclusion

Overall, Poloniex remains a prominent player in the cryptocurrency exchange arena. With its wide selection of cryptocurrencies, array of trading options, and focus on security, it’s an appealing option for both novice and experienced traders.

However, it’s essential for potential users to understand the platform’s intricacies, particularly in terms of fees and the sometimes complex trading interface.

Improvements in customer support and a continued focus on security will be vital for Poloniex moving forward, given the intense competition within the industry. That said, Poloniex’s solid track record, established reputation, and commitment to staying at the forefront of cryptocurrency innovation make it a compelling choice for anyone seeking a versatile and secure trading platform.

Other Stories:

Sam Bankman-Fried fires key evidence allegation at US prosecutors

Is crypto mining legal in the UK?

Jack Dorsey branded a ‘clown’ after admitting he considers Ethereum to be a security

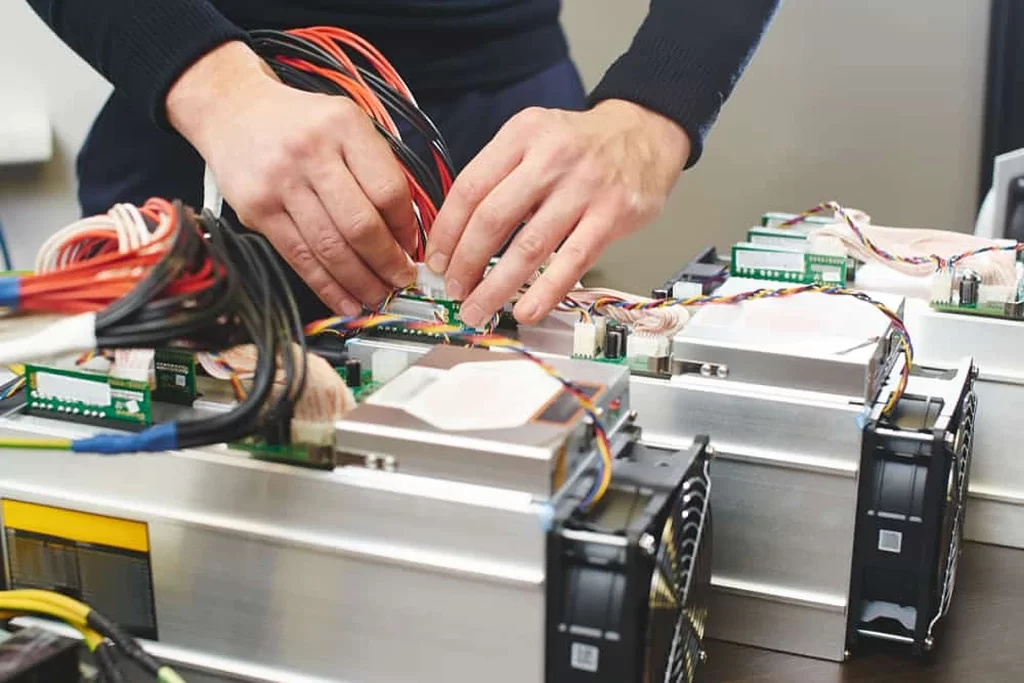

Cryptocurrency, with Bitcoin leading the way, has revolutionized the financial landscape worldwide. Given the potential for profits, the practice of cryptocurrency mining has become widespread. One of the countries witnessing significant cryptocurrency activities, including mining, is the United Kingdom (UK). This article provides an in-depth examination of the legal status of cryptocurrency mining in the UK.

Cryptocurrency mining is legal in the UK. The government neither restricts nor encourages the activity; instead, it treats cryptocurrency operations much like any other form of business. Cryptocurrency miners in the UK, like all businesses, must comply with the applicable tax laws, specifically the Her Majesty’s Revenue and Customs (HMRC) tax regulations.

The primary guidance for cryptocurrency miners comes from the HMRC’s policy paper on “Cryptoassets for Individuals”, updated in December 2019. According to this paper, when the mining activity amounts to a trade, the miner must pay income tax and National Insurance contributions on the mining profits. Conversely, if the mining does not amount to a trade, the miner may be liable to pay Capital Gains Tax when they sell the coins.

An essential aspect to note is the criteria HMRC uses to determine whether the mining activity amounts to a trade. Factors such as the degree of activity, organization, risk, and commerciality are considered. Given the complexity of these regulations, miners are often advised to seek legal counsel to ensure compliance.

Legal Risks of Crypto Mining in the UK

While mining itself is not illegal, certain activities associated with mining can fall foul of the law. In the case of cryptojacking (using someone else’s computer to mine cryptocurrency without their consent), the Computer Misuse Act 1990 comes into play. Cryptojacking is illegal in the UK as it involves unauthorized access to another person’s computer and electricity.

The UK, like many jurisdictions worldwide, has been focusing on the regulation of cryptocurrencies, primarily to prevent money laundering and terrorism financing. The 5th Anti-Money Laundering Directive (5AMLD), which came into effect in January 2020, was implemented into UK law. The law mandates that all cryptocurrency platforms, including those involved in exchanging between cryptocurrencies and fiat currencies, must register with the Financial Conduct Authority (FCA) and comply with stringent anti-money laundering (AML) and counter-terrorist financing (CTF) regulations.

While these regulations do not directly impact cryptocurrency miners, the law’s broad interpretation could potentially classify certain mining activities, particularly those involving pooling resources, as financial services. Therefore, miners should be aware of these regulations and their implications.

Despite the legality of cryptocurrency mining, the UK government and regulatory bodies have continuously issued warnings about the risks associated with cryptocurrencies. These warnings primarily highlight the volatility of cryptocurrencies, lack of consumer protection, potential for facilitating illicit activities, and environmental concerns.

On the environmental front, cryptocurrency mining, notably Bitcoin mining, is often criticized for its high energy consumption and carbon footprint. In response to global climate change concerns and the UK’s commitment to achieving net-zero carbon emissions by 2050, it’s plausible that stricter regulations could be implemented in the future to govern energy-intensive industries, including cryptocurrency mining.

In Summary

Cryptocurrency mining is legal in the UK, but it comes with responsibilities, primarily related to tax obligations. However, given the fast-paced evolution of the cryptocurrency landscape and increasing regulatory focus on cryptocurrencies, miners are advised to keep abreast with the latest laws and regulations.

Moreover, they should be aware of the associated risks, including the potential for criminal liability in cases of cryptojacking or non-compliance with AML and CTF regulations. The future of cryptocurrency mining in the UK, like in many other countries, could be shaped by an array of factors ranging from regulatory changes, technological advancements, to environmental concerns.

Other Stories:

Is crypto haram or halal? Everything Muslims need to know

Is Big Eyes Coin a scam? Why investors should be wary of this crypto presale

ArbitrageScanner – the best scanner for cryptocurrency arbitrage between exchanges

US Securities and Exchange Commission (SEC) chair Gary Gensler has drawn attention to potential similarities between cryptocurrency exchange Binance and the now-defunct FTX, focusing on their suspected use of affiliated companies for fund transfers.

In an interview with Bloomberg on June 6, Gensler alluded to allegations of fraud and manipulation at FTX, involving its sister company Alameda Research, and its founder Sam Bankman-Fried. Gensler underscored a questionable business model where specific financial activities are bundled and merged, a practice not commonly seen or permitted in traditional finance.

A day earlier, the SEC lodged 13 charges against Binance. The charges included allegations that Binance and Binance.US co-mingled funds into an account managed by Merit Peak Limited, a company linked with Binance’s CEO, Changpeng Zhao. Another claim asserted that Binance.US engaged in wash trading through its primary, undisclosed ‘market-making’ trading firm Sigma Chain, also owned by Zhao.

Gensler criticized such models where entrepreneurs seek to increase wealth for themselves and their investors by using affiliated entities to trade against their customers. This controversial business model has been deployed across multiple platforms.

Gensler’s comments have fueled an ongoing debate about why the SEC hasn’t taken legal action against FTX. Ripple CEO Brad Garlinghouse, in a June 6 tweet, suggested the SEC’s recent flurry of lawsuits is a diversion from its issues with FTX. Others have speculated that FTX’s significant political contributions and Bankman-Fried’s frequent lobbying in Washington D.C. could potentially be influencing factors.

Interested in writing for Crypto Intelligence News? Submit a crypto guest post

New York, United State, June 7th, 2023, Chainwire

WOW EARN has announced a major upgrade to its crypto app and the release of a dedicated mobile wallet. The WOW EARN Wallet was launched on May 29 and is available for download on both the Google Play Store and App Store.

The WOW EARN platform supports the buying, exchanging, and trading of cryptocurrency. With a strong commitment to security and a diverse range of offerings, WOW EARN provides a seamless and safe environment for crypto enthusiasts.

Through an intuitive interface and comprehensive asset management tools, users can effortlessly trade digital assets. Driving this ecosystem are WOW tokens, acting as catalysts for the growth of WOW EARN’s products and services while strengthening community governance.

The new WOW EARN Wallet includes an airdrop facility. By simply using the wallet, users receive WOW coins as a reward, eliminating the need for additional equipment or extensive crypto knowledge.

“We are extremely excited to announce the release of the WOW EARN Wallet,” said WOW EARN spokesperson Yara G. “With its cutting-edge features and focus on user safety and security, the WOW EARN Wallet will redefine the way crypto assets are managed. We believe it will enable individuals to take full control of their digital assets and herald a new era for crypto asset security.”

WOW EARN has also introduced a sleek and user-friendly UI with the latest update to its platform. The redesigned interface enhances the overall user experience, making it easier than ever to navigate the platform.

By referring friends and acquaintances, users can earn additional rewards. This incentivized referral program allows users to boost their earnings while expanding their network within the crypto community.

About WOW EARN

WOW EARN is on a mission to reshape the crypto landscape by offering users an accessible, secure, and user-friendly platform for buying, exchanging, and trading digital assets. WOW EARN strives to empower individuals worldwide and foster a thriving community united by a shared interest in crypto.

For more information, visit: https://WowEarn.com

Contact

Marketing Director

Yara Georgina

WOW EARN

yara.georgina@wowearn.com

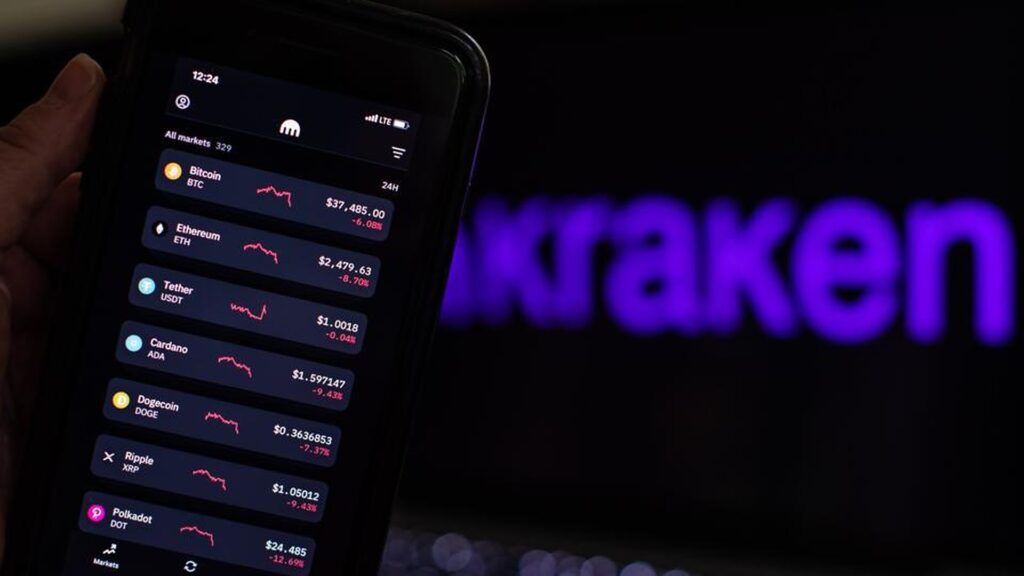

On June 6, Kraken, a leading cryptocurrency exchange, reported issues with several cryptocurrency funding gateways, including Bitcoin, Ethereum, and ERC-20, leading to operational delays. A message posted on Kraken’s status page revealed that deposits and withdrawals were delayed, without specifying the cause. By 8:35 am UTC, the situation seemed to have normalized with all updates regarding the issue removed from the status page.

Meanwhile, Kraken’s futures platform was scheduled for a 10-minute downtime at 10:30 am UTC due to site maintenance. In other news, Kraken, currently under pressure from the US Internal Revenue Service (IRS) to surrender customer data, has objected to the IRS’s demands, describing them as an “unjustified treasure hunt.” The exchange has requested the San Francisco courts to intervene, arguing that the IRS’s claims are unwarranted.

In April, Kraken became the third cryptocurrency exchange in Ireland to receive authorization to operate as a virtual asset service provider, joining Gemini and Coinbase.

In a recent initiative against malicious actors, Nick Percoco, Kraken’s chief security officer, worked with a popular streamer to set up a counterfeit crypto account on the exchange, aiming to lure and catch fraudsters in its ecosystem. Cointelegraph has contacted Kraken for additional details regarding the aforementioned funding gateways issue.

The US House Financial Services Committee and House Agriculture Committee have proposed a draft discussion that may pave the way for certain crypto assets to be classified as digital commodities. This draft bill seeks to bring regulatory clarity to cryptocurrency firms in the US and presents an alternative to the current regulatory approach by the SEC.

It prohibits the SEC from blocking digital asset platforms from registering as regulated alternative trading systems, while encouraging these platforms to offer digital commodities and payment stablecoins.

The proposed bill offers a framework allowing specific digital assets to be classified as digital commodities if they are functional, decentralized, and obliges the SEC to supply an analysis of any counter-arguments against a firm being considered decentralized. The bill also pushes the SEC to update its rules to let broker-dealers custody digital assets given certain requirements, and to modernize regulations related to digital assets.

Paul Grewal, chief legal officer at Coinbase, praised the bill as it lays a strong foundation for regulatory jurisdiction and definitions. However, he emphasized the need for a thorough review before formal introduction. Meanwhile, the bill, presented by Republicans Patrick McHenry and Glenn Thompson, hasn’t included inputs from Democrats. Despite occasional bipartisan support for crypto regulation, it’s uncertain how far this proposed legislation can progress in a divided Congress.

At the time of this report, both houses of Congress had approved legislation to prevent the US government from defaulting by raising the debt ceiling, with President Biden expected to sign the bill into law on June 2.