The Financial Conduct Authority (FCA), the financial regulator of the United Kingdom, has taken action against cryptocurrency ATMs, disrupting 26 out of the 34 machines it visited and inspected since the beginning of 2023.

On February 14th, the FCA issued an ultimatum to all crypto ATM operators in the country, stating that they must comply with regulations or cease their illegal operations.

In response to this warning, the FCA, along with other law enforcement agencies, conducted investigations into 36 crypto ATM locations using their authority under money laundering regulations.

Steve Smart, the joint executive director of enforcement and market oversight at the FCA, spoke out against the use of all crypto ATMs, highlighting the risks involved.

READ MORE: Crypto Firms Struggle to Attract Local Talent in Hong Kong Despite Regulatory Changes

He emphasized that using a crypto ATM in the UK means utilizing a machine that is operating illegally, and users may unknowingly be handing their money over to criminals.

Smart further clarified that victims of scams involving these ATMs, specifically those related to cryptocurrencies like Bitcoin (BTC), will not receive government protection or assistance from the ATM operators.

Between May and June, the FCA inspected 18 of these locations, coinciding with their public announcement about the initiation of their inspection campaign.

It is worth noting that all crypto exchanges and ATMs in the UK are required to register with the FCA and comply with the country’s money laundering regulations.

On July 8th, the Clive Police Department released a report detailing a crypto scam in which a fraudster posed as a law enforcement representative and managed to steal $6,000 from an unsuspecting victim while threatening them with an arrest warrant.

Scammers often employ fear tactics and impersonate law enforcement officials to deceive individuals into transferring funds through crypto ATMs.

However, it is important to remember that legitimate law enforcement agencies never demand payments over the phone or through cryptocurrency.

The FCA’s efforts to disrupt illegal crypto ATM operations and raise awareness about the risks associated with them are aimed at safeguarding the public and preventing financial crimes.

Individuals are urged to exercise caution and verify the legitimacy of any communication or transaction involving cryptocurrency to protect themselves from falling victim to scams.

Cboe Global Markets, a prominent exchange operator, has made significant changes to five spot Bitcoin Exchange-Traded Fund (ETF) applications by including a surveillance-sharing agreement (SSA) with Coinbase.

Invesco, VanEck, WisdomTree, Fidelity, and the joint fund by ARK Invest and 21Shares are among the ETFs that had their filings amended with the United States Securities and Exchange Commission (SEC) on July 11.

Cboe confirmed that it had recently reached an agreement with Coinbase regarding the terms of the SSA, which was finalized on June 21.

The initial filings for the ETFs had indicated that the parties were anticipating entering into an SSA prior to potentially offering the ETFs.

READ MORE: Bitcoin Attempts Fresh Breakout as Battle for Yearly Highs Intensifies

The inclusion of SSAs in the filings is an attempt to meet the SEC’s requirements, which aim to prevent fraudulent conduct and safeguard investors.

The regulator outlined these standards on March 10, emphasizing the need for a comprehensive surveillance-sharing agreement with a regulated market that deals with significant amounts of the underlying or reference bitcoin assets.

Spot Bitcoin ETF applications have been a significant focal point for the industry in recent times.

Fidelity, Invesco, WisdomTree, and Valkyrie have all submitted filings, following the footsteps of BlackRock, a $10 trillion asset management firm, which also filed an ETF for SEC approval.

Additionally, on June 29, the U.S. stock exchange Nasdaq resubmitted its application to list BlackRock’s ETF, also incorporating an SSA with Coinbase.

The amended filings made by Cboe had a positive impact on the share price of Coinbase (COIN), with a nearly 10% increase observed on June 11.

This surge took Coinbase’s shares to their highest value since August 16, as reported by Google Finance.

However, despite its involvement in Bitcoin ETF applications, Coinbase is currently engaged in a legal dispute with the SEC.

The regulatory body has accused Coinbase of offering cryptocurrencies that it deems to be unregistered securities, leading to a lawsuit between the two parties.

In conclusion, Cboe Global Markets’ decision to amend the spot Bitcoin ETF applications to include a surveillance-sharing agreement with Coinbase reflects the industry’s efforts to comply with SEC standards.

This development has generated positive market sentiment, as demonstrated by the increase in Coinbase’s share price.

Nonetheless, Coinbase faces legal challenges from the SEC regarding the alleged offering of unregistered securities.

Bitcoin (BTC) made a fresh breakout attempt on July 11, as the battle for yearly highs intensified.

The cryptocurrency briefly surpassed $31,000 before the daily close on July 10, signaling a potential leverage crunch.

BTC/USD approached resistance but lost momentum and retraced over $800. However, some continuation was observed, and at the time of writing, Bitcoin was trading around $30,500.

READ MORE: Hacker Exploits Code Vulnerability, Drains $455,000 from Arcadia Finance

According to Michaël van de Poppe, the founder and CEO of trading firm Eight, the recent overnight move resembled a leverage crunch.

He cautioned traders about the choppy market and highlighted that while Bitcoin revisited previous highs, it did not make new lows, with $30,200 acting as a strong support level.

Crypto Daan, a popular trader, compared the recent price behavior with the Bart Simpson pattern, where Bitcoin’s price would spike and then retrace. However, the current market structure resembled the Burj Khalifa, indicating a different pattern.

Meanwhile, Rekt Capital, a trader and analyst, identified $30,600 as a crucial level for Bitcoin. He stated that BTC needed to turn this level into support in the coming days to confirm its breakout.

The market’s ability to hold above this level would be a significant indicator of Bitcoin’s upward momentum.

Glassnode, an analytics firm, noted that Bitcoin’s price cycles often exhibit repetitive patterns.

The $30,000 price level in the current cycle resembled a mid-point, similar to levels observed in previous cycles.

Glassnode referred to the current price action as “re-accumulation,” indicating a consolidation phase before potential further upward movement.

In conclusion, Bitcoin made a fresh breakout attempt, reaching above $31,000 before retracing. The market exhibited characteristics of a leverage crunch, with BTC finding support at $30,200.

Traders analyzed various price patterns and identified crucial levels, such as $30,600, to determine Bitcoin’s future direction. Glassnode suggested that the current price action resembled a phase of re-accumulation, similar to previous Bitcoin price cycles.

The digital asset industry experienced significant growth, reaching a peak of over $3 trillion in November 2021. However, the custodial sector of the market remained more modest, totaling $447.9 billion in 2022.

These figures are derived from a joint report on digital asset custody by consulting firm PricewaterhouseCoopers (PwC) and wealth tech platform Aspen Digital. The 39-page report was published on July 11.

The report identifies 120 custody service providers as of April 2023, categorized into two main groups: third-party service providers and self-custody solutions.

It highlights key institutional developments such as increased interest in crypto staking, driven by the Ethereum Merge, as well as the emergence of nonfungible tokens (NFTs) and the metaverse, attracting institutional investors.

READ MORE: Crypto Firms Struggle to Attract Local Talent in Hong Kong Despite Regulatory Changes

Security is cited as the primary challenge faced by the custody industry, as demonstrated by FTX’s failure in 2022, attributed to inadequate governance, risk management, and internal controls.

Consequently, institutions are increasingly seeking to safeguard their assets through reputable digital asset custodians or self-custody solutions rather than solely relying on exchange platforms for holding their assets.

Insurance policies present another challenge for custodians.

Self-custody solutions lack insurance coverage, leaving users uncompensated for any loss of digital assets resulting from negligence.

The report emphasizes that sound insurance policies are a critical factor when selecting digital asset custodians, as recognized by sources within family offices.

To assist investors, the report suggests a five-step approach to selecting a custody service provider.

These steps include mapping the market, creating a grading system, conducting performance reviews, and other necessary preliminary procedures.

In recent developments, Canada’s financial authority released guidance to aid fund managers in complying with legal requirements for investment funds holding crypto assets.

Additionally, it expressed confidence in the regulated futures market for cryptocurrencies, which it believes promotes greater price discovery.

The joint report by PwC and Aspen Digital sheds light on the state of digital asset custody, highlighting the challenges faced by the industry and offering recommendations for investors.

As the digital asset market continues to evolve, addressing security concerns and ensuring robust insurance policies will be crucial for the custodial sector to thrive.

Switzerland, renowned for its banking secrecy laws and favored by the wealthy, has quickly embraced the principles of self-sovereignty embodied by Bitcoin (BTC).

The head of Lugano’s Plan ₿ initiative, Giw Zanganeh, spoke with Cointelegraph journalist Joe Hall at the Plan ₿ Bitcoin Summer School, shedding light on the growing use of Bitcoin for everyday transactions in the Swiss city.

Lugano has emerged as a hub for Bitcoin adoption, as well as for Tether and its LVGA stablecoin, which can be used for various utility bills, goods, and services throughout the city.

Zanganeh, who leads Tether’s Plan ₿, expressed his enthusiasm for Switzerland’s remarkable cryptocurrency adoption, despite its well-established financial and banking infrastructure.

READ MORE: South Korean Regulator Takes Action After ‘Coin Gate’ Scandal

He noted that many Swiss citizens are not only interested in Bitcoin from a philosophical perspective but also find alignment with Swiss values.

Swiss society places high value on individual sovereignty and financial privacy, which creates a natural overlap between Swiss culture and the ideals of the Bitcoin movement.

Zanganeh stated that Switzerland likely has one of the highest densities of Bitcoin-only companies per capita in the world, and even politicians, diplomats, and members of parliament are embracing Bitcoin, reinforcing a positive outlook for adoption in the country.

The increased usage of Bitcoin in Switzerland can be attributed to concerted efforts to educate and inform the populace about the advantages of BTC.

Regular articles in newspapers discuss various aspects of Bitcoin and its relevance to financial freedom and freedom of speech, targeting individuals interested in these concepts.

Zanganeh acknowledged that Bitcoin adoption is a gradual process, but the onboarding of merchants in Lugano has played a crucial role in establishing a new payment paradigm in the region.

Zanganeh likened the process of Bitcoin adoption to the initial proliferation of bank cards decades ago, emphasizing that practical experience with novel transactional methods will continue to attract more users to the Bitcoin ecosystem.

Switzerland’s potential as a center for institutional cryptocurrency adoption has also been highlighted by Bitcoin Suisse CEO Dr. Dirk Klee, with the Canton of Zug attracting numerous cryptocurrency and blockchain companies due to its progressive and crypto-friendly initiatives supported by the government.

The interview with Giw Zanganeh is part of an upcoming Cointelegraph documentary that delves into the experience of attending a Bitcoin School.

For those interested, subscribing to Cointelegraph’s YouTube channel will provide access to the documentary.

Readers are also encouraged to collect this article as an NFT, preserving this historical moment and demonstrating support for independent journalism in the crypto space.

Gerardo Moran, an 18-year-old teenager from El Salvador, recently took to social media to share his remarkable story following the completion of the country’s Bitcoin diploma program, Mi Primer Bitcoin (my first Bitcoin).

This program, supported by El Salvador’s Ministry of Education, provided Moran with an opportunity to leave behind his challenging life in construction, where he earned a mere $6 a day.

In a series of heartfelt tweets on July 8, Moran opened up about his experiences, highlighting the stark realities faced by many Salvadoran citizens who toil tirelessly for minimal compensation.

Having worked since the tender age of 11, mostly in construction and tourism, Moran struggled to comprehend why his fellow countrymen put in so much effort for such meager rewards.

READ MORE: Galaxy Digital CEO Mike Novogratz Considering Relocating Business Away From the US

“I’ve pondered why people in my country work so diligently for so little money,” Moran expressed on Twitter, acknowledging that he, too, had been trapped in a cycle of arduous labor for paltry compensation. He reached a breaking point, realizing that earning $6 a day in construction was simply not sustainable for him. Unbeknownst to him at the time, a life-changing opportunity lay just ahead.

It was when Moran’s school announced its search for students interested in enrolling in the Bitcoin diploma course that he decided to seize the opportunity. With determination and dedication, he excelled in the program, acquiring a profound understanding of Bitcoin and its implications.

Now, Moran has returned to his former high school, Antonio J. Alfaro, to educate the teachers about Bitcoin. As a leader in Bitcoin education in his hometown, he is currently training and instructing a group of eight senior professors, sharing his knowledge and experiences through the Bitcoin diploma program.

Mi Primer Bitcoin has garnered immense support from global advocates of Bitcoin education, amassing over 1 BTC in donations.

Generous individuals from countries like Poland and Canada have contributed satoshis over the Lightning Network, showcasing their commitment to fostering the growth of El Salvador’s Bitcoin diploma program.

El Salvador’s director of education, Gilberto Motto, previously emphasized the government’s focus on educating citizens about Bitcoin, particularly targeting teenagers.

Motto explained that by reaching every 16- and 17-year-old in the country, they aim to effectively educate the entire nation within a year.

This strategic demographic is expected to disseminate their knowledge to their families, creating a ripple effect of understanding and adoption.

Gerardo Moran’s inspiring journey serves as a testament to the transformative power of education and the positive impact that Bitcoin can have on individuals and communities.

As El Salvador continues its efforts to embrace digital currencies, Moran’s dedication to sharing his newfound knowledge is playing a vital role in shaping a more informed and empowered society.

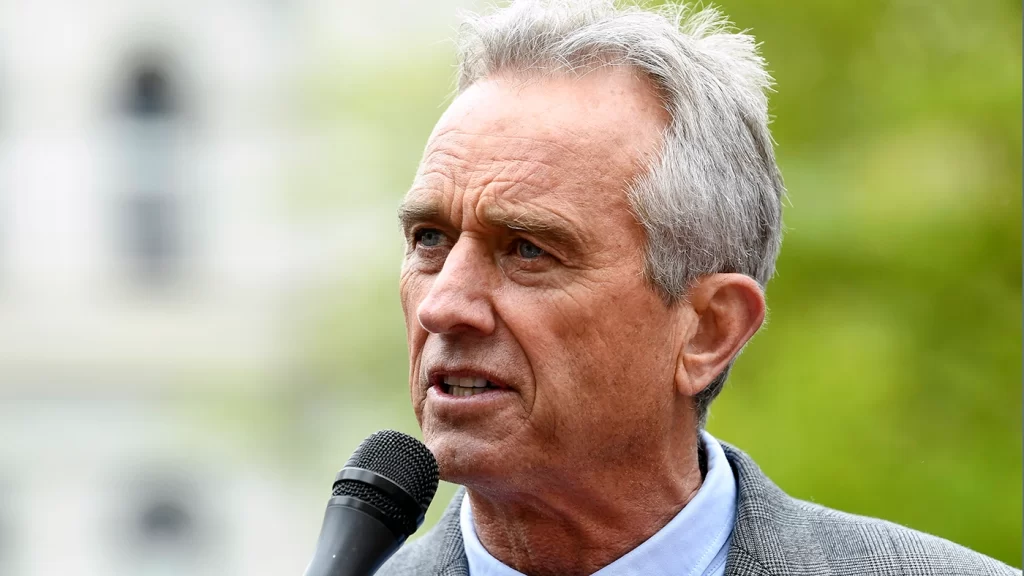

Presidential candidate Robert F. Kennedy Jr. of the United States has admitted to owning a substantial amount of Bitcoin (BTC), contrary to his previous denial of being an investor in the leading cryptocurrency.

According to records obtained by CNBC, Kennedy Jr. held between $100,001 and $250,000 worth of Bitcoin by the end of June.

The investment was made following his speech at the Bitcoin 2023 conference in May, during which he announced that his campaign would be the first in the United States to accept Bitcoin donations.

READ MORE: Digital Currency Group Dismisses Gemini Lawsuit as “Publicity Stunt” by Winklevoss Twins

Interestingly, during the conference, Kennedy Jr. explicitly denied investing in Bitcoin, stating, “I am not an investor, and I am not here to give investment advice.”

The financial disclosure filed on June 30 did not specify the exact timing of the cryptocurrency purchase but revealed that the investment had yielded a return of less than $201 thus far.

Although the filing did not identify the purchaser, Kennedy Jr.’s campaign acknowledged that it was him.

Kennedy Jr., who is challenging President Joe Biden, has been actively targeting the crypto community as part of his campaign.

In a tweet on May 3, he expressed his belief that cryptocurrencies, particularly Bitcoin, are a significant source of innovation.

He also criticized the U.S. government for impeding the industry and potentially driving innovation away.

Notably, Kennedy Jr. has gained support from prominent figures within the crypto industry, including Jack Dorsey, the founder of Twitter and CEO of The Block.

Dorsey took to Twitter to express his confidence in Kennedy Jr.’s strategy to defeat his opponents in the upcoming race.

As the son of former Attorney General and Senator Robert F. Kennedy, as well as the nephew of the 35th President of the U.S., John F. Kennedy, Kennedy Jr.’s candidacy has attracted attention and backing from influential figures.

His support comes at a critical juncture for the American crypto industry, which is currently grappling with regulatory uncertainties as the Securities and Exchange Commission tightens its scrutiny of crypto businesses in the absence of a comprehensive regulatory framework for digital assets in the United States.

In a recent Twitter thread, investor Luke Broyles predicts Bitcoin (BTC) could engulf future prosperity gains, leaving non-investors behind.

He foresees BTC becoming society’s base money due to its key attribute— a fixed, immutable supply, a feature that makes it a future-proof asset.

Broyles argues that while technological innovations, including artificial intelligence (AI), will drive prices down, and nations will continue to print currency to maintain credit markets and raise prices, BTC’s emission will remain unchanging.

READ MORE: Galaxy Digital CEO Mike Novogratz Considering Relocating Business Away From the US

Consequently, even minimal exposure to Bitcoin would be vastly different from having none.

“We have less in common with the future than the past… Bitcoin is already trading for hundreds of millions of political currency units in several nations.

But the actual big deal is that all future innovations’ prosperity gains will pour into society’s base money – BTC,” Broyles explained.

He insists it is vital for individuals to invest, or “get off zero”. Comparing Bitcoin to “digital gold”, he said, is like calling a locomotive an “iron horse”.

This view echoes the opinion of Arthur Hayes, ex-CEO of BitMEX, a crypto derivatives exchange.

Hayes suggested AI will naturally select BTC as its financial backbone because of its distinctive characteristics, leading to a potential price surge past $750,000 per BTC.

The competition for the remaining Bitcoin supply has likely already begun.

According to Broyles, Bitcoin’s liquidity reached its apex during the 2020 cross-market crash and won’t ever revert.

The announcement of a Bitcoin spot-based exchange-traded fund (ETF) filing by BlackRock, the world’s biggest asset manager, boosted US Bitcoin activity. Glassnode, an on-chain analytics firm, observed that the US appears to be reconsidering its own Bitcoin exposure.

“Following the Blackrock Bitcoin ETF request announcement on June 15th, the share of Bitcoin supply held/traded by US entities has seen a significant increase, indicating a potential inflection point in supply dominance if the trend continues,” Glassnode stated on July 8.

Bitcoin (BTC) is currently experiencing a significant price discrepancy on Binance.US, offering a tempting opportunity for arbitrage. The cryptocurrency is being sold at a nearly $3,000 discount compared to global spot prices.

This phenomenon has been referred to as a “depeg” of cryptocurrencies, as the prices listed on the United States crypto exchange deviate from the global average.

At present, Bitcoin is trading at $27,536 against the U.S. dollar on Binance.US, representing an 8.5% markdown from the global spot price of $30,106.

Other digital assets, including Ethereum, are also being traded at discounted rates.

READ MORE: South Korean Regulator Takes Action After ‘Coin Gate’ Scandal

Ethereum is priced approximately $200 lower on Binance.US, with a current trading value of $1,695.

Even stablecoins like Tether (USDT) are affected, trading below their intended peg with Tether being valued at $0.915 on the exchange.

However, it is important to note that these discounts are only applicable when trading cryptocurrencies against fiat USD on Binance.US.

Unfortunately, most investors will not be able to take advantage of this opportunity due to the suspension of new USD deposits on the platform since June 9.

As a result, only those who already possess USD funds in their Binance.US accounts can purchase the discounted cryptocurrencies.

Moreover, concerns have arisen that Binance.US may soon halt USD withdrawals, prompting some users to sell their cryptocurrencies below market value in order to exit their positions in USD.

An email from Binance.US to customers, which has circulated on Twitter, states that the last day for USD withdrawals will be July 20.

This situation mirrors a similar incident that took place in late May at the Australian branch of Binance, where the company’s third-party payments provider ceased offering fiat on- and off-ramps.

Consequently, the price of BTC on Binance dropped by 20% when traded against the Australian dollar.

As a testament to the significance of these events, readers are encouraged to collect this article as a non-fungible token (NFT).

This unique digital asset will preserve this moment in history and demonstrate support for independent journalism in the cryptocurrency space.

Bitcoin (BTC) has the potential to become the currency of choice for artificial intelligence (AI), according to Arthur Hayes, the former CEO of BitMEX.

In his recent essay titled “Massa,” Hayes argues that as fiat currencies become increasingly dysfunctional, the AI revolution will flourish, leading to a surge in BTC adoption.

Hayes predicts that the price per coin could reach $760,000 as a result.

Hayes believes that the future will witness a significant expansion of AI-related applications, making AI an integral part of everyday life.

READ MORE: Top Executives Depart Binance Amidst Legal Scrutiny and Compliance Concerns

The rapid advancements in computing power have brought us to the verge of an AI explosion that will revolutionize humanity.

Hayes cites the example of ChatGPT, which acquired 100 million monthly active users in just two months, highlighting the unprecedented pace of technological adoption.

When it comes to financial solutions for AI integration, Hayes suggests that Bitcoin, rather than a tailor-made altcoin, will be the preferred choice.

This is because AI systems are likely to perceive Bitcoin’s qualities, such as its fixed supply, digital scarcity, and status as “energy money,” as the most logical option.

AI systems are unlikely to rely on anything operated by human governments, thus making Bitcoin and gold the most suitable choices.

Hayes also outlines a potential path for Bitcoin’s price to reach $1 million.

He anticipates that the real impact of AI will be felt in approximately three years, and it could take another decade for the network value boost driven by AI alone to push BTC/USD to nearly $1 million.

Hayes emphasizes that his predictions aim to create a narrative that gains traction before the peak of what he calls “deranged growth investing” in 2025 to 2026.

Depending on the extent of investment, Bitcoin’s price could surge to $760,000 per coin.

Hayes concludes by stating that the market is most lucrative when it shifts from believing something is impossible to considering it as a possibility.

His optimistic outlook on Bitcoin’s future price is based on the expectation that the market will overvalue Bitcoin’s network growth if it sees a chance of his assumptions coming true.

Arthur Hayes is renowned for his bullish long-term perspective on Bitcoin and has previously advocated for a million-dollar price target, attributing it to the disintegration of fiat currencies.