Britain’s Financial Services Minister, Andrew Griffith, has rejected the idea of treating cryptoassets as a form of gambling.

He argues that such a classification would not only put Britain at odds with global and EU regulators but also fail to address the risks posed by the crypto sector.

In a report released in May, Parliament’s Treasury Select Committee suggested that cryptocurrencies like bitcoin and ether should be regulated as gambling due to the significant risks they pose to consumers.

However, Griffith firmly disagrees with this recommendation, asserting that it could lead consumers to mistakenly believe that investing in crypto is safer than it actually is.

UK regulators have been warning investors about the potential to lose all their money in the volatile crypto market.

The UK government has ambitious plans to establish itself as a global hub for cryptocurrencies and blockchain technology.

Nevertheless, Griffith maintains that regulating cryptoassets as gambling would not be an appropriate solution to ensure the safety and stability of the sector.

Moreover, such an approach would contradict internationally agreed-upon recommendations from standard-setting bodies like the International Organization of Securities Commissions (IOSCO) and the G20 Financial Stability Board (FSB).

READ MORE: Nigerian Social Payments App Bundle Ceases Crypto Exchange Services

Both organizations have been actively working on establishing standards for the crypto sector, with IOSCO having proposed the world’s first set of rules for cryptocurrencies in May.

Griffith emphasizes that adopting a gambling regulation model would also risk creating confusion and overlapping mandates between financial regulators and the Gambling Commission.

This misalignment could hinder the growth and development of the crypto industry in the UK.

The European Union has already approved a comprehensive set of rules for trading cryptoassets, scheduled to take effect in mid-2024.

However, buying or selling cryptocurrencies is not currently classified as gambling under the UK’s Gambling Act.

The UK’s gambling watchdog previously investigated a fantasy sports company called Sorare, which uses cryptocurrency for buying and selling non-fungible tokens (NFTs) representing sports stars.

The investigation aimed to determine whether the game amounted to gambling.

Looking ahead, Britain is working on regulations for stablecoins, a type of cryptocurrency backed by underlying assets to maintain a stable value.

These regulations will differentiate stablecoins from the more volatile “unbacked” cryptocurrencies like bitcoin and ether.

In conclusion, the debate over how to regulate cryptoassets continues in the UK, with the government aiming to strike a balance between fostering innovation in the sector and protecting consumers from potential risks.

Other Stories:

OpenAI Unveils Android Version of ChatGPT

Bitcoin Laundering Couple Reach Plea Agreement with U.S. Authorities

On July 20, a British court granted an appeal to Craig Wright, allowing him the opportunity to argue that the Bitcoin file format deserves copyright protection. Since 2016, Wright has asserted that he is the original creator of Bitcoin, using the pseudonym Satoshi Nakamoto.

In his legal action, Wright filed a lawsuit against 13 Bitcoin Core developers and several companies, including Blockstream, Coinbase, and Block, alleging that they infringed on his copyright to the Bitcoin white paper, the file format, and database rights associated with the Bitcoin blockchain.

This recent court decision comes as a reversal of a previous ruling from February, which deemed Wright’s arguments insufficient to demonstrate the initial recording, or fixation, of the Bitcoin file format, a crucial concept in copyright law.

Wright’s tweet on July 20 emphasized the importance of protecting intellectual property to support creators and innovators, encouraging the generation of new ideas and creative works, although he didn’t explicitly mention the court’s decision.

The legal representation for the developers, the Bitcoin Legal Defense Fund (BLDF), countered Wright’s claims by arguing that he has failed to provide any evidence supporting his assertion of being Satoshi Nakamoto.

READ MORE: Vermont Department of Financial Regulation Issues Stark Crypto Warning

BLDF stated that Wright must first prove his identity as Nakamoto before the court can proceed with the primary claims of the lawsuit. The trial is anticipated to take place in early 2024.

One significant point of contention in the case is that the Bitcoin code is open-source and distributed freely under the Massachusetts Institute of Technology license.

This means that users have the right to reuse the code for any purpose, including in proprietary software.

However, Wright argues that the Bitcoin Core developers act as a centralized entity, referred to as the “Bitcoin Partnership,” which allegedly controls the Bitcoin network.

BLDF expressed concern over the court’s decision to hear Wright’s arguments, as they believe it sets a dangerous precedent not only for the crypto community but for the entire world.

Allowing developers to be sued for purportedly violating the file format of open-source software claimed by someone else could have far-reaching implications for the software development industry.

As the legal battle continues, the outcome of this case could have significant ramifications for the protection of intellectual property rights in the realm of open-source software and the broader cryptocurrency community.

Other Stories:

2023 Ranking: 4 Best Crypto Projects To Invest In

China’s Digital Yuan Soars: Business Travelers Can Now Pay for Flights with CBDC

Nigerian social payments app Bundle has recently announced the discontinuation of its crypto exchange services.

The decision, communicated through a statement on July 20 on the company’s blog, comes as part of a strategic restructuring effort to shift focus towards their payment solution called Cashlink.

According to the statement, the move was prompted by the observed growth of the Web3 and blockchain community.

Bundle’s shareholders deemed it necessary to pivot the business to meet the evolving needs of the ecosystem, concentrating on payment solutions that align better with the current trends.

With this change, users will no longer be able to register on Bundle’s platform, deposit assets into their Bundle wallet, or execute asset swaps within the wallet (except for Tether (USDT)).

Furthermore, users won’t be able to withdraw their assets with Cashlink unless they have Nigerian naira or other fiat currencies stored within their Bundle wallet.

The company has set a deadline for users to withdraw their assets from the app. Users are advised to complete this process on or before September 12, 2023.

To facilitate a smooth withdrawal, Bundle has outlined specific steps for users in Nigeria, Ghana, Kenya, and other francophone-speaking countries.

READ MORE: Vermont Department of Financial Regulation Issues Stark Crypto Warning

For users in these locations, the withdrawal process involves transferring their funds from Bundle to any preferred exchange.

Nigerian users, in particular, have the option to withdraw their naira using Cashlink or conduct bank transfers through P2P express. If their balance is less than $10, an easily accessible link is provided to initiate the withdrawal process.

The closure of Bundle’s crypto exchange arm follows the footsteps of another Nigerian crypto payment startup, LazerPay, which ceased its operations in April and made its intellectual property available for sale.

In conclusion, Bundle’s decision to shut down its crypto exchange services is driven by the desire to adapt to the rapidly evolving crypto and blockchain landscape.

By focusing on their payment solution, Cashlink, the company aims to cater better to the needs of the Web3 community.

Users are urged to withdraw their assets before the designated deadline, and specific guidelines have been provided for a seamless withdrawal process in various countries.

Other Stories:

2023 Ranking: 4 Best Crypto Projects To Invest In

China’s Digital Yuan Soars: Business Travelers Can Now Pay for Flights with CBDC

A plea agreement has been reached between the husband and wife implicated in the laundering of billions of dollars worth of Bitcoin linked to the 2016 Bitfinex hack and U.S. authorities.

Ilya Lichtenstein and Heather Morgan are set to appear for an arraignment and hearing on August 3, following records filed with the U.S. District Court for the District of Columbia on July 21.

This agreement comes as they faced charges of money laundering conspiracy and conspiracy to defraud the U.S., and as part of the deal, they will be forfeiting digital assets associated with the case.

The criminal activities stem from the notorious hack of the cryptocurrency exchange Bitfinex in August 2016, during which approximately 119,754 Bitcoin (BTC), valued at $29,841 at that time, were stolen.

Subsequently, Lichtenstein and Morgan allegedly engaged in a series of intricate transactions across multiple accounts and platforms, laundering over 94,643 BTC of the stolen funds.

In February 2022, the authorities arrested the couple in New York and seized the BTC.

At the time of the hack, the confiscated Bitcoin was worth roughly $54 million, but by the time of the current publication, the value had surged to $3.6 billion.

The arrests and the subsequent seizure of laundered Bitcoin marked the most significant financial seizure ever carried out by the U.S. Department of Justice.

Though some small amounts of BTC connected to the hack have been occasionally traced and moved, only a limited portion has been returned to Bitfinex by the authorities to aid in the restoration of victims’ funds.

READ MORE: Vermont Department of Financial Regulation Issues Stark Crypto Warning

This plea agreement may bring some semblance of closure to the complex case, allowing the legal process to move forward while addressing the consequences of the vast cryptocurrency theft and its impact on the victims.

However, it also highlights the need for continued vigilance and security measures within the cryptocurrency space to safeguard against such high-profile hacks and money laundering schemes.

Other Stories:

2023 Ranking: 4 Best Crypto Projects To Invest In

China’s Digital Yuan Soars: Business Travelers Can Now Pay for Flights with CBDC

In 2023, Bitcoin miners have been facing an uphill battle as the cryptocurrency market experiences volatility and uncertainty.

The past year has seen a surge in BTC being sent to centralized exchanges by miners to cover their operational costs.

The Bitcoin mining industry had a momentous year, earning a staggering $184 million from transaction fees in the second quarter of 2023.

This increase was attributed to the rebound in BTC’s price and the growing excitement surrounding BRC-20 tokens.

However, despite this revenue boost, prominent mining firms’ stocks outperformed Bitcoin’s market value by a significant margin, with their market capitalization rising by 257% since the start of the year.

To cope with the prolonged bear market, miners have been forced to sell mined BTC to cover expenses. June 2023 witnessed a record $128 million worth of Bitcoin sent to exchanges, leading experts to highlight miners’ tendency to cash out, cover costs, and secure profits.

Reports from Bitfinex indicate that mining companies are engaging in derisking strategies by offloading BTC to exchanges.

These strategies involve hedging activities in the derivatives market, conducting over-the-counter orders, or transferring funds through exchanges for various purposes.

READ MORE: Vermont Department of Financial Regulation Issues Stark Crypto Warning

Cointelegraph reached out to prominent mining companies for insights into the current mining climate. Hut8’s CEO, Jaime Leverton, revealed that the company had been pursuing a merger with USBTC, which hindered its capital-raising efforts through at-the-market offerings.

To meet its operating costs, Hut8 sold a portion of its Bitcoin holdings and newly produced BTC.

Nevertheless, Leverton assured that the company still held more than 9,100 BTC (equivalent to $271 million) and remained bullish on Bitcoin, maintaining one of the largest self-mined Bitcoin reserves among publicly traded companies.

Foundry’s senior manager, Charles Chong, pointed out that current market conditions differed from previous bull markets, where miners could hold onto their BTC due to abundant external capital and higher production margins.

Now, with scarce external funding and reduced margins of 15-30%, miners are compelled to liquidate their Bitcoin to sustain operations.

Chong also noted that comparing the current market to the bear markets following the 2017 and 2021 peaks was challenging.

Bitcoin mining operates in cycles, with miners overinvesting in ASIC mining equipment during favorable times.

The recent all-time high in Bitcoin mining difficulty indicated a robust network, with new, more efficient mining equipment entering the market, requiring miners to update their fleets to remain profitable.

Despite market challenges, industry participants’ continuous deployment of machines and increasing hashrates signals their optimism regarding Bitcoin’s future price appreciation.

Difficulty increases, driven by rising hashrates, reflect miners’ confidence in potential upside for BTC’s price.

Unfortunately, the tough market conditions led to the closure of some major mining firms, including Core Scientific, which filed for chapter 11 bankruptcy in June 2023.

However, the company managed to raise substantial capital to initiate a reorganization plan slated for September 2023.

Other Stories:

China’s Digital Yuan Soars: Business Travelers Can Now Pay for Flights with CBDC

Bitcoin (BTC) is showing signs of an impending burst of volatility, comparable to the significant 40% gains it experienced in January.

On-chain data, as reported in analytics firm Glassnode’s weekly newsletter, The Week On-Chain, points to the tightest Bollinger Bands for BTC since the beginning of 2023.

BTC’s price has remained in a narrow range for a whole month, with $30,000 acting as a pivotal point for sideways movement.

This situation is testing both bullish and bearish traders, leaving them uncertain about the future direction of the market.

Analyst Aksel Kibar observed on July 21 that the prolonged sideways action is often a precursor to strong price movements, although he remains unsure of the direction.

To prepare for the upcoming surge in volatility, he sticks to his well-defined boundaries and awaits the directional move.

Bollinger Bands, a classic volatility indicator, are currently signaling that the days of rangebound BTC price action are limited. These bands use standard deviation around a simple moving average to determine when a shift in trend is likely.

READ MORE: Bitcoin Mining Companies Employ Derisking Strategies, Offload BTC to Exchanges

At present, the upper and lower bands are closer together than at any point during BTC’s upside in 2023, indicating a potentially significant move soon.

The market is experiencing a period of extremely low volatility, with the 20-day Bollinger Bands indicating an extreme squeeze, marking the “quietest BTC market since the lull in early January.”

Such a scenario previously led to a breakout in January, resulting in substantial gains throughout the month.

Glassnode also observed that, despite BTC’s price gains since January, there is little active selling for profit or loss at current levels.

This lack of “realized” activity is a common occurrence after price cycle lows.

Investors seem reluctant to spend their coins on-chain, as evidenced by the relatively small sum of profits and losses locked in by the market, amounting to approximately $290 million per day.

This figure, although significant on a nominal basis, is comparable to the situation in 2019 and October 2020, even though the Bitcoin market cap has approximately doubled since then.

In summary, Bitcoin’s tight Bollinger Bands and the lack of active selling indicate an imminent surge in volatility.

Traders and investors are eagerly anticipating the directional move, as it has the potential to rival the significant gains witnessed in January.

Other Stories:

Bitcoin Mining Companies Employ Derisking Strategies, Offload BTC to Exchanges

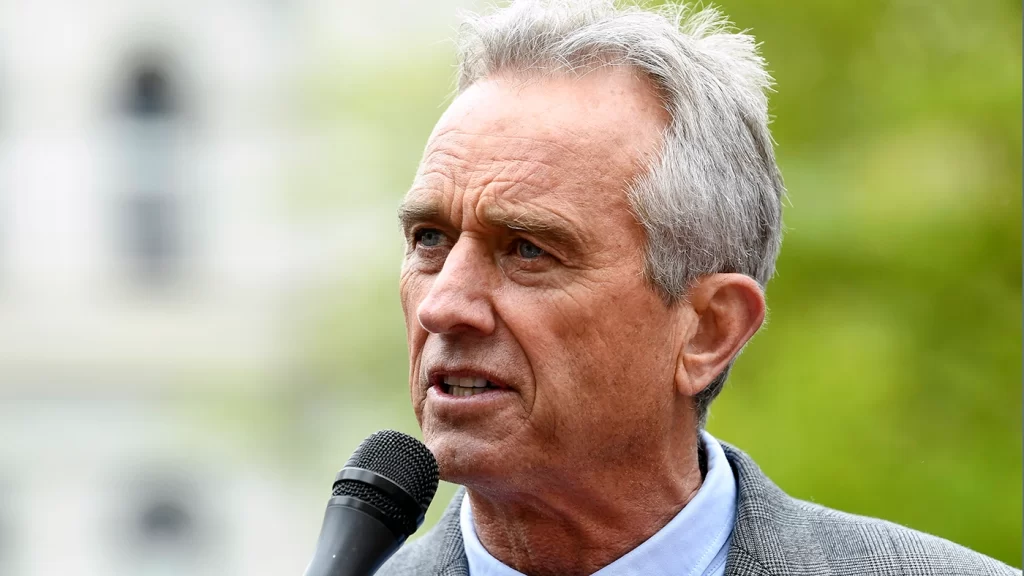

Robert F. Kennedy Jr. Pledges to Back US Dollar with Bitcoin if Elected President

Democratic presidential candidate Robert F. Kennedy Jr. has unveiled his plan to back the United States dollar with Bitcoin (BTC) if he wins the presidency.

Kennedy made this announcement during a Heal-the-Divide PAC event on July 19, where he emphasized the potential of using “hard currency” like gold, silver, platinum, or Bitcoin to stabilize the American economy.

Kennedy believes that backing the U.S. dollar with tangible assets could strengthen the currency, combat inflation, and foster financial stability, peace, and prosperity in the nation.

He clarified that this process would be implemented gradually, and the level of backing for the dollar would be adjusted based on the success of the plan.

To initiate the strategy, Kennedy proposed a conservative approach, suggesting that initially, only a small portion of issued T-bills, perhaps around 1%, would be backed by hard currency such as gold, silver, platinum, or Bitcoin.

In addition to his backing of Bitcoin, Kennedy also declared his intention to exempt Bitcoin to U.S. dollar conversions from capital gains taxes.

READ MORE: Celo Blockchain Plans Transition to Ethereum Layer-2 Solution

He believes that this exemption would encourage investment and incentivize businesses to choose the United States as their primary location, rather than crypto-friendly jurisdictions like Singapore or Switzerland.

Kennedy’s recent statements in support of Bitcoin follow his participation in the Bitcoin 2023 conference in Miami on May 19, where he announced that he would accept political campaign donations in Bitcoin.

Surprisingly, investment disclosures on July 9 revealed that Kennedy himself owned up to $250,000 worth of Bitcoin, contradicting his earlier claims of having no exposure to the asset.

Kennedy is not the only presidential candidate making promises related to cryptocurrencies.

On July 14, Republican presidential candidate and Florida Governor Ron DeSantis vowed to ban central bank digital currencies if elected as president, asserting that such currencies would have no place in the United States under his leadership.

As the race for the presidency continues, it remains to be seen how these crypto-based promises and proposals will shape the future of the American economy and financial landscape.

Other Stories:

PEPE Coin in Trouble? Financial Regulator Clamps Down On Crypto Memes

SEC Chair Gary Gensler Advocates Greater Use of Artificial Intelligence for Market Surveillance

FSB Proposes Global Regulatory Framework for Cryptocurrencies

Bitcoin (BTC) experienced a drop below the $30,000 mark on July 18, surprising retail investors who had witnessed positive developments in the past month.

However, this downward movement does not indicate a shift in the long-term trend.

Despite the recent decline, there are positive signs to consider. Bitcoin is still making efforts to establish $30,000 as a support level, with numerous attempts since April.

Moreover, buyers consistently emerge within the $28,000 to $25,000 range, which seems to be viewed as an accumulation zone.

Glassnode’s Bitcoin Accumulation Trend Score aligns with this sentiment, revealing that larger entities are accumulating BTC rather than distributing it.

The Accumulation Trend Score indicates that buyers were accumulating from November to December and continued to do so from March to April when Bitcoin surpassed $30,000.

The score suggests that the same accumulation behavior is occurring in July, possibly due to Bitcoin’s attempt to conquer the $30,000 resistance or the positive news surrounding ETFs and XRP SEC.

The current price action and derivatives market data indicate that Bitcoin is in a crab market, characterized by a range-bound price that consolidates for an extended period.

Breaking through the $32,000 level could trigger a CME gap fill from the Luna Terra-crash era.

On a weekly market structure basis, $30,000 serves as a crucial pivot point, previously functioning as support in the last bull market cycle and now as resistance.

READ MORE: Celo Blockchain Plans Transition to Ethereum Layer-2 Solution

Surpassing this level would signify a higher high and confirm a trend reversal, with the next resistance point at approximately $37,000.

In the derivatives market, trading activity remains relatively muted, with funding down and open interest not displaying significant surges.

This suggests that a substantial breakout is yet to occur. While the recent dip in the DXY (U.S. Dollar Currency Index) may have influenced investor sentiment, it is unlikely to trigger an immediate massive reaction in Bitcoin.

Although short-term price fluctuations may concern new investors and day-traders, the on-chain perspective presents a compelling outlook.

The Total Balance in Accumulation Addresses metric has been on an uptrend since March 16, indicating that investors continue to increase their allocation to Bitcoin, even throughout the crypto market collapse and price sell-off.

It is worth noting that the metric also reveals a continuous increase in the total balance in accumulation addresses since January 2022, when Bitcoin was trading at $47,800 per coin.

This data highlights investors’ long-term confidence in Bitcoin and their ongoing accumulation of the cryptocurrency.

Other Stories:

PEPE Coin in Trouble? Financial Regulator Clamps Down On Crypto Memes

SEC Chair Gary Gensler Advocates Greater Use of Artificial Intelligence for Market Surveillance

FSB Proposes Global Regulatory Framework for Cryptocurrencies

Data suggests that the price of Bitcoin is likely to drop below $29,000 in the near future.

The inability to break above $31,800 on July 13 led to a 6.3% correction, bringing the price down to $29,700 on July 17.

Investors are concerned that ongoing regulatory developments and macroeconomic challenges could push Bitcoin below the $29,000 level, last seen on June 21.

Bitcoin futures indicate increased demand, but Asian markets are slowing down. Typically, Bitcoin futures trade at a slight premium compared to spot markets, indicating sellers’ willingness to delay settlement for more money.

Healthy markets usually exhibit BTC futures contracts trading at a 5% to 10% annualized premium.

Between July 14 and July 17, BTC futures maintained a 7% premium, surpassing the 5% threshold, suggesting moderate conviction among bulls after the unsuccessful attempt to break above $31,800.

However, the premium of Tether (USDT) in Asia has been decreasing. The stablecoin premium serves as an indicator of demand from China-based retail crypto traders, measuring the difference between peer-to-peer trades and the U.S. dollar.

The recent Tether premium in Asia reached a discount of 1.8%, its lowest point in over six months.

This widening discount trend, starting on July 12, indicates moderate sell pressure.

Regulatory concerns continue to affect the crypto sector.

READ MORE: Ex-Federal Prosecutor Surprised by Potential SEC Appeal in Ripple Case

While the July 13 ruling that the sale of XRP via exchanges and over-the-counter desks did not violate securities regulations boosted markets, it did not definitively determine whether XRP’s initial coin offering was classified as a security offering.

This lack of clarity unsettles some investors, raising the possibility of other cryptocurrencies facing similar designations.

Additionally, Binance’s layoff of 1,000 employees and the departure of key executives, along with ongoing court actions from the Securities and Exchange Commission, have raised concerns about the future of the exchange.

Macroeconomic trends also pose challenges for Bitcoin and risk-on assets. China’s second-quarter gross domestic product growth fell short of expectations due to factors like the trade war with the United States and the government’s efforts to address debt.

These external factors, along with impending court decisions that could negatively impact major exchanges, increase the likelihood of Bitcoin dropping below $29,000.

In terms of trading, BTC futures indicate higher confidence among professional traders using leverage. However, sell pressure from retail investors in Asia limits the overall upside potential for cryptocurrencies.

Without a specific catalyst to drive it higher, Bitcoin’s price is susceptible to worsening macroeconomic conditions and indications of interest rate increases by the Federal Reserve in 2023.

Other Stories:

Best crypto marketing agencies to promote your project in 2023

3 Best Crypto PR Agencies – Fees, Results and Full Review

Web3 Needs Asset Protection, and This Startup Wants to Make it Widely Available

Bitcoin’s performance in the second quarter of 2023 has been strong, with its market dominance increasing against altcoins that experienced losses during the period, as reported by CoinGecko.

The crypto data aggregator released its Q2 industry report on July 18, revealing that Bitcoin (BTC) and Ether (ETH) continued to build on their gains from the previous quarter.

While Bitcoin and Ether made progress, other cryptocurrencies suffered double-digit losses.

Binance Coin (BNB), XRP, and Cardano (ADA) were among the hardest hit. BNB and ADA were particularly affected due to their classification as securities in lawsuits against Binance and Coinbase filed by the Securities and Exchange Commission.

The decentralized finance (DeFi) sector also took a hit, with tokens like Uniswap (UNI), Chainlink (LINK), and Lido (LDO) experiencing significant losses.

Metaverse and play-to-earn tokens, including Axie Infinity (AXS), Sandbox (SAND), and Decentraland (MANA), also faced losses of up to 40%.

Bitcoin’s dominance reached a two-year high of over 52% in late June but subsequently dropped below 50% due to an altcoin rally fueled by Ripple’s partial court victory.

READ MORE: PEPE Coin in Trouble? Financial Regulator Clamps Down On Crypto Memes

However, most altcoins that had gained following the XRP pump lost their gains, returning the market to its pre-ruling state.

CoinGecko’s report highlighted that the total market capitalization remained relatively stable throughout the quarter, starting and ending at $1.2 trillion.

As the third quarter began, the market cap remained unchanged at $1.2 trillion.

Bitcoin emerged as the winner of the period, outperforming the rest of the market with a gain of nearly 7%.

However, the average daily trading volume for BTC declined by 58.7% compared to the previous quarter.

Despite this decline, the report stated that Bitcoin still outperformed most major asset classes in Q2, trailing only behind the NASDAQ and S&P 500.

With most altcoins, except for XRP, currently experiencing a retreat, the prospects for an early “altseason” are diminishing. Bitcoin continues to maintain its position as the dominant cryptocurrency in the market.

Other Stories:

Celo Blockchain Plans Transition to Ethereum Layer-2 Solution

SEC Chair Gary Gensler Advocates Greater Use of Artificial Intelligence for Market Surveillance

FSB Proposes Global Regulatory Framework for Cryptocurrencies