KPMG, one of the Big Four professional services firms, recently published a report on Bitcoin’s impact on environmental, social, and governance (ESG) issues.

The report highlighted that Bitcoin offers various benefits when analyzed through an ESG framework.

In terms of the environment, the report emphasized that emissions were a more significant environmental concern compared to energy usage.

KPMG contextualized Bitcoin’s emissions in comparison to other sources, such as tobacco and tourism, and found that it ranked as the second smallest contributor, trailing only behind “Video (US).”

Consequently, the report concluded that Bitcoin’s emissions might be lower than commonly discussed.

To improve Bitcoin’s carbon footprint, the report suggested employing renewable energy sources and energy produced from methane for mining.

Regarding social issues, the report pointed out that Bitcoin’s contribution to money laundering was relatively small when compared to the total amount of money laundering globally.

Money laundering constitutes 2-5% of global gross domestic product, according to the United Nations Office on Drugs and Crime statistics cited in the report, while it accounts for merely 0.24% of Bitcoin transactions, as indicated by Elliptic.

Moreover, the report highlighted that laundered money was received in Bitcoin far less frequently than in other cryptocurrencies like Ether, stablecoins, or altcoins.

It suggested that Anti-Money Laundering (AML) and Know Your Customer (KYC) measures could be applied during the off-ramping process of converting Bitcoin back to fiat currency, even though no AML/KYC requirements currently exist for transacting with Bitcoin.

READ MORE: Decentralized Exchange on Coinbase’s Base Network Pauses Trading Amidst Concerns of Exploit

The report also showcased positive use cases for Bitcoin, such as its utilization in fundraising for Ukraine and supporting electrification efforts in rural Africa.

Addressing governance, the report praised Bitcoin’s robust governance system.

It explained that Bitcoin’s rules could not be altered without forking, resulting in a decentralized system that cannot be abused or manipulated by individuals with ulterior motives or those in positions of power.

While the report utilized secondary sources and familiar use cases, it acknowledged that Bitcoin remains widely misunderstood. KPMG, being well-versed in crypto-related matters, offers various crypto-related advisory services.

In summary, KPMG’s report emphasized that Bitcoin presents several advantages from an ESG perspective.

Despite certain environmental concerns, it highlighted the potential for lower emissions, recommended sustainable energy solutions, and acknowledged its relatively minor contribution to money laundering.

Additionally, the report praised Bitcoin’s strong governance structure, ensuring its integrity and decentralization.

Other Stories:

U.S. Judge Denies Motion to Dismiss SEC Lawsuit Against Terraform Labs

IRS Issues New Ruling: U.S. Crypto Investors Must Report Staking Rewards as Gross Income

Binance CEO CZ Unveils Plan to Launch Smaller Algorithmic Stablecoins

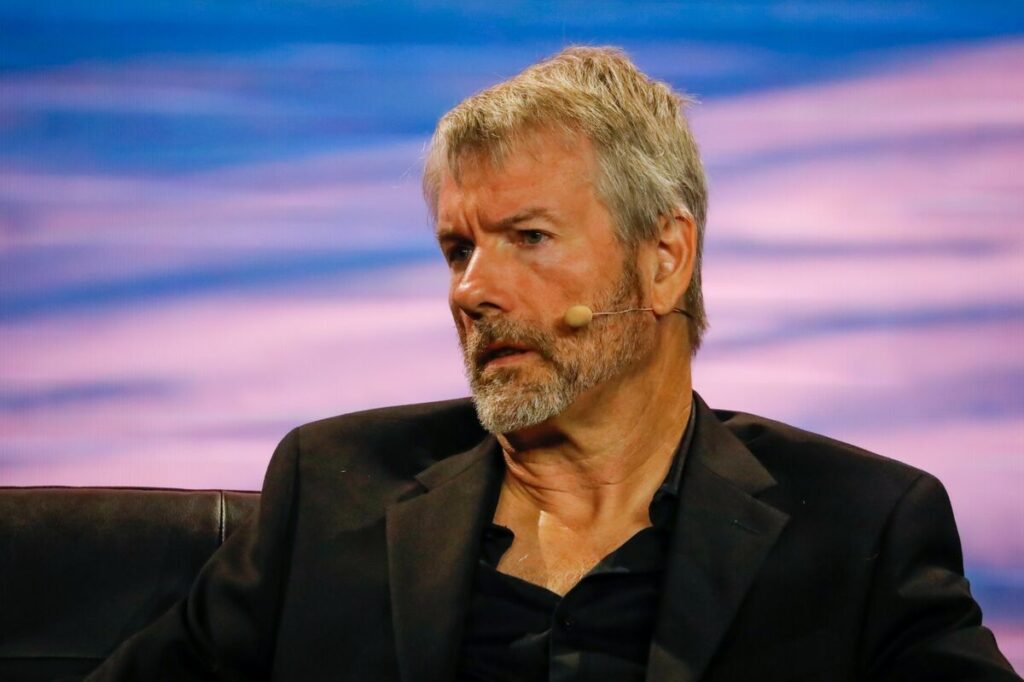

MicroStrategy co-founder, Michael Saylor, is confident that his company will continue to be an attractive option for investors seeking exposure to Bitcoin, irrespective of future exchange-traded fund (ETF) approvals.

As the price of Bitcoin ticks down to $29,223, Saylor reaffirms the firm’s commitment to adding more Bitcoin to its balance sheet, even planning a $750 million share sale to potentially fund further acquisitions.

During an interview with Bloomberg on August 2, Saylor discussed how a spot Bitcoin ETF approval could impact MicroStrategy’s offering.

He expressed assurance that the company would still offer unique advantages that spot Bitcoin ETFs cannot match.

This sentiment echoes his previous remarks during the August 1 earnings call, where he emphasized that MicroStrategy’s Bitcoin operating strategy would set it apart from spot ETFs when they eventually launch.

Since MicroStrategy began its purchasing strategy in August 2020, Bitcoin’s price has surged by 145%. Saylor attributes this success to the company’s use of leveraged investments, generating yields that are shared with shareholders.

Unlike ETFs, MicroStrategy, being an operating company, can access leverage, giving it a distinct advantage in the ecosystem.

Saylor believes that spot Bitcoin ETFs will attract large hedge funds and sovereigns, allowing them to invest billions of dollars in the space.

READ MORE: U.S. Judge Denies Motion to Dismiss SEC Lawsuit Against Terraform Labs

However, he sees MicroStrategy as a unique instrument, akin to a sports car, while spot ETFs would be more like supertankers.

He envisions spot ETFs serving a different set of customers and contributing to the overall growth of the asset class.

Currently, MicroStrategy boasts more than 470 institutional shareholders and holds a market capitalization of $5.3 billion, according to Fintel.

As analysts raise the chances of spot Bitcoin ETF approval in the United States to 65%, Saylor confirms the company’s goal is to accumulate as much Bitcoin as possible.

Their existing holdings of 152,800 BTC are expected to increase in the coming quarters.

To support their Bitcoin accumulation strategy, MicroStrategy plans to sell up to $750 million in class A common stock, as revealed in a recent SEC filing.

Saylor clarifies that the primary use of these proceeds will be to acquire more Bitcoin, further solidifying the company’s belief in the long-term potential of the digital asset.

Other Stories:

IRS Issues New Ruling: U.S. Crypto Investors Must Report Staking Rewards as Gross Income

Decentralized Exchange on Coinbase’s Base Network Pauses Trading Amidst Concerns of Exploit

Binance CEO CZ Unveils Plan to Launch Smaller Algorithmic Stablecoins

Coinbase, the prominent cryptocurrency exchange, was reportedly urged by the United States Securities and Exchange Commission (SEC) to remove all cryptocurrencies from its platform, except for Bitcoin (BTC).

This revelation came to light during a recent interview with Coinbase CEO Brian Armstrong published by the Financial Times on July 31.

According to Armstrong, the SEC demanded the delisting of nearly 250 tokens on Coinbase before initiating legal action against the exchange.

The SEC’s stance was based on its belief that “every asset other than Bitcoin is a security.”

However, Armstrong disagreed with this interpretation, challenging the regulator to explain their reasoning, but they refused, insisting on the complete removal of all tokens besides Bitcoin.

This viewpoint aligns with SEC Chair Gary Gensler’s assertion made in a prior interview that everything apart from Bitcoin falls under the agency’s regulatory purview as a security.

Agreeing to the SEC’s request, Armstrong argued, would have set a dangerous precedent and potentially led to the demise of the entire crypto industry in the United States.

As a result, Coinbase opted to challenge the SEC’s position in court to seek legal clarity.

READ MORE: French Data Protection Agency Investigates Worldcoin

The SEC filed a lawsuit against Coinbase in early June, accusing the exchange of operating without proper registration and identifying 13 cryptocurrencies offered on the platform as unregistered securities.

Coincidentally, the regulator also lodged a similar complaint against Binance.

Responding to the situation, the SEC clarified that while its enforcement division does not formally request companies to delist crypto assets, its staff may share their views on actions that might breach securities laws.

Regulation of the crypto industry in the United States has been somewhat ambiguous, with both the Commodity Futures Trading Commission (CFTC) and the SEC exercising regulatory authority over various aspects of the sector.

To address this regulatory uncertainty, legislation aiming to grant primary jurisdiction over cryptocurrencies to the CFTC and define the SEC’s role concerning crypto was passed by the House Agricultural Committee on July 27, following earlier approval by the House Financial Services Committee.

However, further steps are required for it to become law.

In summary, Coinbase’s confrontation with the SEC regarding the delisting of cryptocurrencies other than Bitcoin reflects the ongoing struggle to establish clear and comprehensive regulations for the crypto industry in the United States.

The outcome of this legal battle could have significant implications for the entire crypto market in the country.

Other Stories:

Pro-XRP Lawyer Alleges SEC’s Actions Driven by Safeguarding Corporate Capitalism

Kyrgyzstan Expands Cryptocurrency Mining with Government Backing at Hydro Power Plant

Worldcoin’s Iris Scanning Project Raises Privacy and Sovereignty Concern

Bitcoin (BTC) experienced reduced volatility as it approached the July 30 weekly close, leaving traders anticipating a significant long-term bullish signal.

Over the weekend, BTC/USD exhibited sideways movement, trading within a narrow $150 range.

Despite several macroeconomic data events throughout the week, the market remained calm, leading to speculations of an imminent breakdown.

Pseudonymous trader Daan Crypto Trades highlighted that the compression in price action had not been seen since the beginning of 2023, suggesting that a substantial move might be on the horizon.

Comparisons were drawn to earlier in the year when Bitcoin’s Bollinger Bands resembled the current conditions before the price surged 70% in the first quarter.

Analysis of the Binance BTC/USD order book by monitoring resource Material Indicators revealed that whales’ buying pressure coincided with increased resistance near $30,000.

However, they expected significant support to remain until the weekly and monthly candle closes on July 29.

READ MORE: Pro-XRP Lawyer Alleges SEC’s Actions Driven by Safeguarding Corporate Capitalism

The potential bullish cross on Bitcoin’s monthly moving average convergence/divergence (MACD) indicator drew significant attention as market observers noted its proximity to confirmation.

Historical patterns indicated that this could lead to upside gains in the future.

Although the cross held positive implications, Trading resource Stockmoney Lizards cautioned that Bitcoin might still be in its summer correction mode.

A chart presented by Stockmoney Lizards displayed a prior monthly MACD cross in late 2015, which preceded Bitcoin’s surge two years later, resulting in the previous cycle’s all-time high of $20,000.

The cross signaled preparations for the significant price movement that followed.

While lower-timeframe MACD crosses can sometimes be false alarms, the significance of a weekly cross in August 2021 was evident as it preceded the move to Bitcoin’s current all-time highs in November of that year.

As the weekly close approached, traders kept a close eye on Bitcoin’s price action, hoping to witness the potential bull signal and foreseeing the implications it might have on the future trajectory of the cryptocurrency.

Other Stories:

Worldcoin’s Iris Scanning Project Raises Privacy and Sovereignty Concern

Kyrgyzstan Expands Cryptocurrency Mining with Government Backing at Hydro Power Plant

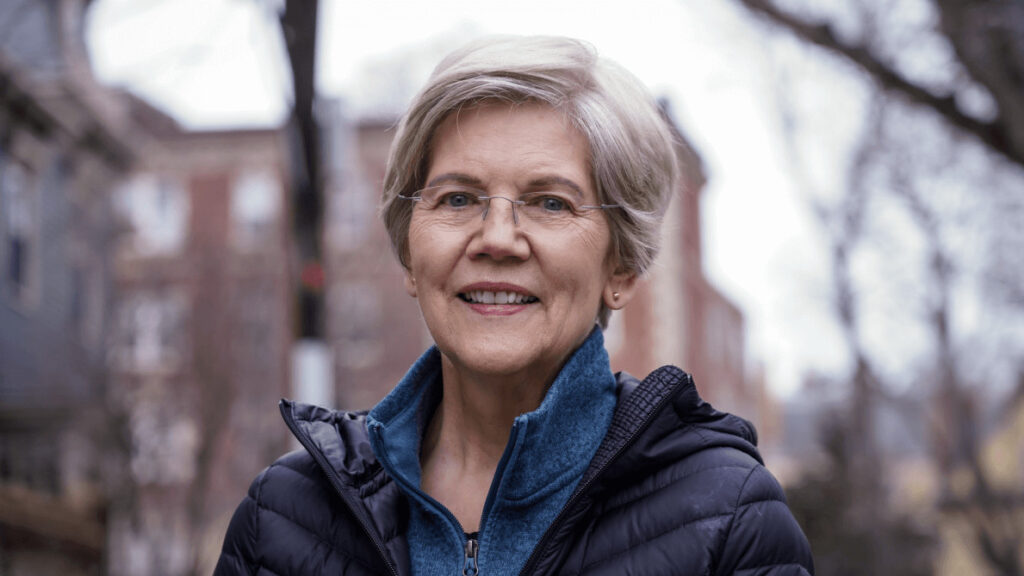

The Bank Policy Institute (BPI), a pro-banking organization in the US, has come out in support of Senator Elizabeth Warren’s efforts to strengthen cryptocurrency regulations.

Senator Warren, along with three other senators, recently reintroduced the Digital Asset Anti-Money Laundering Act, which aims to impose stricter rules to combat money laundering and terrorism financing within the crypto industry.

Despite past criticism from Senator Warren, the BPI expressed its endorsement of the bipartisan legislation.

In a statement, the BPI emphasized the need for the existing anti-money laundering and Bank Secrecy Act framework to encompass digital assets, in order to safeguard the nation’s financial system against illicit finance.

The proposed seven-page bill, if enacted, would require digital asset wallet providers, miners, and blockchain validators to maintain records of customer identities.

Additionally, financial institutions would be prohibited from using digital asset mixers, such as Tornado Cash, which are designed to obscure blockchain data.

Senator Warren and her co-sponsors, Senator Joe Manchin, Senator Roger Marshall, and Senator Lindsey Graham, announced the reintroduction of the bill.

In addition to customer identity tracking, the legislation would prompt relevant government bodies, including the Treasury Department, Securities and Exchange Commission, and Commodity Futures Trading Commission, to establish new examination processes to ensure compliance with anti-money laundering and terrorism financing requirements.

Several organizations, including the Massachusetts Bankers Association, AARP, the National Consumer Law Center, and the National Consumers League, have expressed their support for the bill.

READ MORE: Why Didn’t Bitcoin (BTC) Enter a New Rally?

However, not everyone in the crypto community agrees with the proposed legislation.

Tyler Winklevoss, co-founder of the Gemini crypto exchange, criticized the bill in a tweet, suggesting that those opposing it are making the right decision.

Senator Warren originally introduced the bill in December 2022, arguing that current anti-money laundering laws do not adequately cover the crypto industry.

She has consistently called for cryptocurrencies to be subjected to the same regulations as traditional banking institutions to prevent money laundering and illegal activities.

Gary Gensler, Chairman of the US Securities and Exchange Commission (SEC), has also been vocal about his concerns regarding the crypto market.

He highlighted the prevalence of fraud in the sector and pointed out that many crypto investors do not receive the same level of protection as investors in traditional securities markets.

In conclusion, the Digital Asset Anti-Money Laundering Act seeks to tighten regulations on cryptocurrencies to combat illicit financial activities.

While Senator Warren and the BPI back the bill, some members of the crypto community, including Tyler Winklevoss, have expressed reservations. Gary Gensler, the SEC Chairman, also shares concerns about fraudulent activities in the crypto market and advocates for better investor protection.

Other Stories:

Revealed: The Best Crypto Marketing & PR Agency

3 Best Crypto Projects That Will Boom In 2023 & The Next Bull Run

SEC and Binance Oppose Eeon’s Intervention in Crypto Exchange Lawsuit

Margot Robbie, the well-known Australian actress starring in the lead role of the upcoming Barbie movie, has sparked a lively discussion within the crypto community with her recent statement comparing Bitcoin (BTC) to Barbie’s companion, Ken.

During an interview with Fandango on June 22, Robbie shared that whenever she overheard her husband, Tom Ackerley, and television producer, David Heyman, discussing Bitcoin on set, it reminded her of the traits of Ken, the fictional character played by Ryan Gosling in Barbie.

The crypto community on Twitter, including figures like Michael Saylor from MicroStrategy and social media influencer Layah Heilpern, had a mixed response to Robbie’s analogy.

Saylor even declared Bitcoin to be synonymous with “Big Ken Energy,” while others, like Layah Heilpern, saw it as an insult towards men who talk about Bitcoin.

On July 30, Heilpern further explained her interpretation of Robbie’s remarks, suggesting that the actress implied male Bitcoin enthusiasts are weak and pathetic.

However, Mark Travers, a lead psychologist at Awake Therapy, countered this perspective, stating that having Ken’s energy could indicate someone who is selfless and adaptable, challenging traditional gender stereotypes.

Robbie herself acknowledged that defining Ken energy might be subjective, stating that it’s something one can sense rather than precisely define.

READ MORE:Revealed: The Best Crypto Marketing & PR Agency

Despite differing opinions, Steven Lubka, a managing director at Swan Bitcoin, viewed Robbie’s comment as positive for the crypto community, expressing optimism on July 29.

It is worth noting that Robbie’s comments were brief and neutral, taking place amidst ongoing legal actions against celebrities who have promoted cryptocurrencies.

NBA star Jimmy Butler, for instance, sought to be removed from a class-action lawsuit alleging the promotion of unregistered securities by cryptocurrency exchange Binance.

In a filing on July 24, Butler’s lawyers argued that the tweets he appeared in did not promote the named securities and, therefore, could not have contributed to their promotion.

Binance CEO Changpeng “CZ” Zhao and YouTubers Ben Armstrong (BitBoy Crypto) and Graham Stephan are also contesting similar allegations in the same lawsuit.

In conclusion, Margot Robbie’s comparison of Bitcoin to Ken from Barbie sparked a lively debate within the crypto community.

While some embraced the analogy as a positive representation, others interpreted it as demeaning. As discussions continue, it’s evident that the crypto world remains dynamic and subject to ongoing scrutiny.

Other Stories:

Why Didn’t Bitcoin (BTC) Enter a New Rally?

3 Best Crypto Projects That Will Boom In 2023 & The Next Bull Run

SEC and Binance Oppose Eeon’s Intervention in Crypto Exchange Lawsuit

In this article, we review and rank the best crypto casinos. Most of these casinos are accessible to players in the USA and most other countries, while some don’t accept US-based players.

Read on to discover our ranking of the best crypto and bitcoin casinos, with the highest payouts and best reputation for paying out on time.

1) BitStarz

BitStarz, launched in 2014, has gained global recognition as one of the premier cryptocurrency online casinos. It was among the first wave of casinos that started accepting Bitcoin, ultimately making its mark as a trailblazer in the industry.

BitStarz represents the seamless merger of the thrill of online gambling with the innovation of cryptocurrency.

Operating under the laws of Curacao, BitStarz offers over 3000 games, encompassing a variety of genres like slots, table games, live dealer games, and progressive jackpots. This immense variety ensures that there is something for every player, making BitStarz an appealing platform for gamblers worldwide.

Provably Fair Betting

The cornerstone of BitStarz’s success lies in its commitment to ensuring fair gaming. It was one of the first online casinos to implement the ‘Provably Fair’ system, a revolutionary protocol that enables players to verify the fairness and randomness of each game’s outcome.

This feature provides players with an unprecedented level of transparency and confidence in the integrity of the gaming platform.

Gamble With Bitcoin, Ethereum & Other Coins

One of the defining features of BitStarz is its flexibility with cryptocurrencies. Besides Bitcoin, BitStarz also accepts other popular digital currencies such as Litecoin, Ethereum, Dogecoin, and Bitcoin Cash. For players who are not quite ready to jump into the world of crypto, BitStarz offers the best of both worlds by also accepting fiat currencies.

This makes BitStarz accessible to a wide range of players, regardless of their familiarity or preference for cryptocurrencies.

User-Friendly Design

User experience is at the forefront of BitStarz’s operations. Its website has a sleek and intuitive design, allowing players to navigate easily between different sections and games. Furthermore, BitStarz provides top-notch customer service, with its support team available 24/7 through live chat or email to assist players.

Free Bonuses

One of BitStarz’s key attractions is its promotional offers and bonuses. BitStarz provides a generous welcome package for new players, along with regular promotions for existing players, such as free spins and reload bonuses. Such promotions not only enhance the gaming experience but also offer players a higher potential return on their bets.

Speed & Security

BitStarz has also invested significantly in security measures to protect its users’ information and funds. The website employs SSL encryption, safeguarding the personal and financial data of its users. The casino’s use of cryptocurrencies further augments this security by adding the robust protections inherent in blockchain technology.

The speed of transactions is another significant benefit of BitStarz. Withdrawals in cryptocurrencies are almost instantaneous, a marked advantage over traditional online casinos where processing times can vary. This feature, coupled with the transparency of the blockchain, offers an unrivaled user experience in terms of transaction speed and security.

Despite these numerous advantages, it is worth noting that BitStarz, like any other casino, should be approached with responsible gambling in mind. While cryptocurrencies provide added privacy and security, they also come with their volatility, which could affect the value of players’ winnings.

Moreover, the legality of online gambling and the use of cryptocurrencies varies across jurisdictions, and players must be aware of their local laws before participating.

2) BetFury

Launched in 2019, BetFury is a decentralized iGaming platform that has rapidly made a name for itself in the realm of crypto and Bitcoin casinos.

Building its foundation on the principles of transparency, fairness, and user-centric experiences, BetFury has successfully carved out a niche for itself within the dynamic iGaming industry.

Huge Selection of Casino Games

BetFury’s gaming library is a testament to the platform’s commitment to offering a diverse and comprehensive gaming experience. With over 1000 high-quality games, including slots, table games, and live dealer games, it caters to the tastes and preferences of a wide range of players.

The platform is furnished with the best games from industry-leading developers, offering an unparalleled mix of classic casino favourites and new, innovative titles.

BFG Token

A distinguishing feature of BetFury is the integration of its unique in-house token, BFG, which is used to play games and also forms the basis of the platform’s staking system. Players who wager in games earn BFG tokens, which they can stake to receive a share of the platform’s daily profits.

This unique staking model fosters an active and engaged community, as players are incentivized not only to play but also to contribute to the platform’s overall growth.

Fair Gambling

BetFury is founded on blockchain technology, ensuring utmost transparency and security in its operations. It employs the ‘Provably Fair’ system, allowing players to verify the randomness and fairness of each game outcome. This feature helps build trust among players, ensuring them that the games are not manipulated.

Play With BTC, ETH & BNB

Another prominent feature of BetFury is its hybrid payment system. While it is primarily a Bitcoin casino, BetFury supports multiple cryptocurrencies, including Ethereum, Tron, and Binance Coin, and also offers the option for fiat transactions. This flexibility broadens its appeal, making the platform accessible to both crypto-savvy players and those who prefer traditional currencies.

Sleek Platform

BetFury takes the user experience seriously. Its platform is designed to be intuitive and user-friendly, making it easy for players to navigate through the vast selection of games. Furthermore, BetFury offers a multi-language interface, catering to a global audience. This international focus is complemented by a robust customer support system, which includes 24/7 live chat support in multiple languages.

Welcome Offers

BetFury also stands out in its approach to promotions and bonuses. It offers an array of promotional events, including a lucrative welcome bonus, daily tasks, and jackpot competitions. These bonuses and promotions, coupled with the unique profit-sharing model, provide players with multiple opportunities to increase their winnings.

On the security front, BetFury utilizes advanced SSL encryption technology to safeguard users’ personal and financial information. Additionally, the decentralized nature of its operations and transactions, powered by blockchain technology, adds an extra layer of security, ensuring the safety of users’ funds.

What Are Crypto & Bitcoin Casinos?

Crypto and Bitcoin Casinos are online gambling platforms that allow users to bet with cryptocurrencies. These casinos accept a range of digital currencies, including Bitcoin, Ethereum, Litecoin, and many others. The advent of these casinos has ushered in an entirely new paradigm, redefining the traditional concept of gambling by integrating digital currencies, blockchain technology, and smart contracts.

The fundamental allure of these casinos lies in the inherent characteristics of cryptocurrencies. The decentralized nature of cryptocurrencies eliminates the need for a central authority like a bank or government, providing players with unparalleled financial freedom. This has a tremendous impact on the global reach of these casinos, enabling players to participate irrespective of their geographical location or the absence of a traditional banking system.

Improved Privacy

Additionally, the level of privacy offered by crypto casinos is significantly greater than traditional online casinos. Given that cryptocurrencies operate on the blockchain, a digital ledger where transactions are recorded in a secure and transparent manner, users can gamble anonymously.

Transactions made in Bitcoin or other cryptocurrencies are pseudonymous, meaning the identity of the user is concealed. This can be particularly appealing for players who prefer to keep their gambling activities private.

Security & Fairness

The use of blockchain technology also enhances the security and fairness of the games. With blockchain, each transaction is immutable once recorded. This feature prevents any manipulation of game outcomes or betting results, ensuring a fair gaming experience for all users. Some crypto casinos also employ Provably Fair technology, a system that allows players to verify the randomness and fairness of every game outcome, thereby further enhancing the trustworthiness of the platform.

Lower Fees

In terms of financial advantages, crypto casinos often come with lower transaction fees compared to traditional casinos, mainly because cryptocurrencies cut out the need for intermediaries in financial transactions.

Moreover, the transaction speed is typically faster, as blockchain transactions can be processed 24/7, enabling instant deposits and withdrawals.

Potential Drawbacks of Crypto Casinos

While crypto and Bitcoin casinos offer several benefits, they are not without challenges. The volatility of cryptocurrencies can be a cause of concern for gamblers. A significant drop or rise in the value of the currency could affect the player’s winnings.

Furthermore, legal and regulatory issues surrounding cryptocurrencies differ from one jurisdiction to another, posing potential difficulties.

Summary

Crypto and Bitcoin casinos represent a fusion of two innovative technologies—online gaming and digital currency. They are transforming the gambling industry, offering a novel and exciting experience that combines the thrill of gambling with the advanced features of cryptocurrencies. With their potential to offer a secure, private, and global platform, these casinos are rewriting the rules of the game in the digital age.

Like every innovation, Crypto and Bitcoin casinos have their set of advantages and challenges. They are a vibrant testament to the changing landscape of the gaming industry, heralding a future where technology and entertainment cross paths in unique ways.

As we look forward, it becomes crucial to understand, navigate, and embrace this new world of cryptocurrency-powered entertainment.

Bitcoin (BTC) saw a significant influx of activity on exchanges on July 27, indicating the possibility of heightened volatility ahead.

On-chain analytics firm Glassnode reported that intraday BTC exchange inflows reached multi-month highs, sparking concerns among traders about potential price swings.

BTC’s price has been struggling to break above $30,000, with many traders cautioning against further downside risks.

The uncertainty in the market has left Bitcoin’s largest-volume investor cohort, the whales, in a state of uncertainty as well.

The recent movement of large amounts of coins has drawn attention to the entities sending funds to exchanges, raising the possibility of increased selling pressure.

One market observer, James Straten from CryptoSlate, pointed out that over 10,000 BTC flowing into exchanges in a single day represented the most significant one-day increase in months.

He compared it to the situation during the SVB collapse in March, which caused widespread market uncertainty.

Trader Ali, in agreement with Straten’s observation, warned of a potential spike in volatility.

READ MORE: 3 Best Crypto Projects For The Next Bull Run

Data from research firm Santiment also showed that a substantial number of idle BTC changed hands over the past 24 hours, coinciding with a 10,000 BTC increase in supply on crypto exchanges.

While the combined BTC balance on the monitored exchanges went back above 2.25 million, it is crucial to note that overall balances remain at multi-year lows.

The last time balances were at this level was in March 2018.

Straten highlighted the impact of the cost basis of different hodler cohorts on BTC’s price.

Both short-term and long-term holders’ cost bases have been closely monitored by Glassnode and others as significant support levels. Long-term holders, for instance, have reduced their cost basis to $20,490, the lowest since April 2022.

The realized price is only $70 below this level. In previous bear markets in 2015 and 2019, the short-term holder realized price acted as support, and in 2023, it has been tested three times, currently at $28,241.

In conclusion, the surge in BTC exchange inflows on July 27 has raised concerns about potential volatility in the cryptocurrency’s price.

Market observers and traders are closely monitoring the movement of coins on exchanges, as well as the cost basis of different hodler cohorts, as potential indicators of future price movements.

The situation remains uncertain, and market participants are bracing for possible fluctuations in the coming days.

Other Stories:

Former Twitter Product Director Exposes Peculiarities of Working Under Elon Musk

Crypto.com Receives Approval from Dutch Central Bank

Crypto Mining Firm Explores Initial Public Offering (IPO) in UAE

Bitcoin (BTC) remained relatively stable with a ticker down at $29,311 during the Wall Street open on July 28, despite the release of United States inflation data that surpassed expectations.

However, the data on the Personal Consumption Expenditures (PCE) Index, which is considered the Federal Reserve’s preferred metric for inflation, indicated that U.S. inflation was continuing to decrease.

This development led financial analysts, such as The Kobeissi Letter, to speculate that the Fed might finally have inflation under control, as PCE inflation was at its lowest since April 2021.

Despite the significant economic indicators, Bitcoin’s price action saw only a modest boost and did not display significant volatility. Instead, it remained within a range of $29,000 to $29,500.

Traders’ sentiment suggested that there was still a preference for the downside, as the resistance target of $30,000 had been holding for over a week.

Notably, popular trader Crypto Tony expressed his anticipation for BTC to continue moving down to $28,000, although he acknowledged the possibility of a brief consolidation phase before the drop.

Fellow trader Daan Crypto Trades also emphasized the loss of the local range centered around the $30,000 level and suggested preparing for a potential drop to the low $28Ks.

READ MORE: Former Twitter Product Director Exposes Peculiarities of Working Under Elon Musk

However, he cautioned that if BTC managed to retake the $29.5K level, the bearish scenario could be invalidated.

On the other hand, Michaël van de Poppe, the founder and CEO of trading firm Eight, identified a “deviation” on the daily BTC/USD chart, similar to a previous occurrence in February, which was followed by an upward rebound.

He also questioned whether the weekend’s thinner liquidity and increased potential for volatile movements could trigger a “classic” comeback for Bitcoin.

In conclusion, despite the release of positive U.S. inflation data, Bitcoin’s price remained relatively stable and did not show significant volatility.

Traders’ sentiment suggested a preference for the downside, with the $30,000 resistance level still holding.

However, some analysts remained cautious about the potential for a bullish rebound based on technical indicators and historical patterns.

As the weekend approached, market participants kept a close eye on the potential for increased volatility in the cryptocurrency market.

Other Stories:

Crypto.com Receives Approval from Dutch Central Bank

Crypto Mining Firm Explores Initial Public Offering (IPO) in UAE

While Bitcoin and Ethereum remain the most popular cryptocurrencies – for retail and institutional investors alike – there are many crypto projects that have more upside potential in 2023.

In this article, we rank some of the best crypto projects that are set to boom this year and/or during the next bull run.

Additionally, we have provided an overview of each project and explain why it has a lot of potential, while also outlining how you can buy each project’s native token.

Solana

Solana is an innovative high-performance, permissionless blockchain that has garnered significant attention from the technology and investment communities alike. Built with the goal of scaling blockchain for global adoption, it features a novel design and a unique set of technologies that set it apart from other blockchain platforms. The backbone of Solana’s performance lies in its architectural innovation.

Unlike traditional blockchain networks, which face scalability issues due to increasing transaction volumes, Solana was built with a vision to support thousands of transactions per second without compromising security or decentralization. Its design includes a unique timestamp system, Proof of History (PoH), which enables high-speed processing while maintaining trust across the network.

Proof of History is essentially a cryptographic timestamp that enables the blockchain to track the order and time of transactions, without the need for every node to observe and agree on the state of the network.

By encoding the passage of time within the blockchain itself, PoH helps increase the speed and efficiency of consensus algorithms. In combination with Solana’s unique PoH-based consensus model, called Tower BFT, the platform achieves unparalleled performance and security.

Alongside PoH, Solana utilizes several other groundbreaking technologies that contribute to its superior performance. One such technology is Turbine, a block propagation protocol that breaks data down into smaller packets, reducing the bandwidth requirements for data transmission and making it easier for validators to process transactions.

This approach is analogous to a high-speed internet connection that allows seamless streaming of high-definition videos.

Another key technology employed by Solana is Gulf Stream, which pushes transaction caching and forwarding to the edge of the network. This enables validators to execute transactions ahead of time, reducing confirmation times, and increasing the network’s capacity for processing transactions.

Sea Level, Solana’s parallel smart contracts run-time, allows for simultaneous transaction processing on the same state block, leading to increased throughput. Moreover, Cloudbreak, Solana’s horizontally-scaled accounts database, and Pipelining, a transaction processing unit for validation optimization, contribute further to the overall performance of the Solana network.

This suite of features allows Solana to process up to 65,000 transactions per second, with sub-second finality, making it one of the fastest blockchain networks in existence. Another distinguishing aspect of Solana is its native cryptocurrency, SOL.

SOL is used for transaction fees and for staking, a process by which users can earn additional SOL by helping secure the network. SOL is also used in Solana’s on-chain governance program, where token holders can vote on various proposals to influence the future development of the platform.

Solana’s dedication to scalability and speed has not gone unnoticed, as it has attracted a variety of applications, from decentralized exchanges to stablecoins and prediction markets. It has garnered significant attention as a potential Ethereum competitor due to its scalability and low transaction costs.

Developers are increasingly attracted to Solana because of its ability to handle sophisticated and high-volume applications with ease, enabling them to create more intricate and scalable DApps. Moreover, Solana’s ecosystem has grown rapidly, with numerous developers, projects, and institutions getting involved. This growth has been facilitated by the Solana Foundation’s grants program, which offers financial support to projects that contribute to the Solana ecosystem.

It is also worth noting that Solana has been backed by top-tier investors, including Multicoin Capital, Foundation Capital, and Andreessen Horowitz, underscoring the significant potential seen in the platform. In summary, Solana is an advanced and innovative blockchain platform, offering unmatched speed and scalability.

Its design and technology suite make it ideal for a wide range of applications, particularly those requiring high transaction throughput and low fees. With a rapidly expanding ecosystem and an impressive track record, Solana presents a compelling case for the future of blockchain technology.

Chainlink

Chainlink is a decentralized oracle network that enables smart contracts on the blockchain to securely interact with real-world data and external APIs.

Developed in 2014, Chainlink is a robust blockchain technology that has emerged as a crucial player in the decentralized finance (DeFi) ecosystem and the wider blockchain space, by solving the problem known as the “oracle problem.”

The oracle problem arises due to the inherent nature of blockchain networks: they are closed systems that can’t natively access off-chain data. Therefore, for blockchain applications to interact with the world outside the blockchain, they require external data sources known as oracles.

However, if a decentralized application relies on a centralized oracle, the entire system risks becoming centralized, which defeats the purpose of blockchain technology. Chainlink solves this problem by providing a network of decentralized oracles that feeds reliable and tamper-proof data to the blockchain.

Chainlink’s decentralized network consists of multiple independent oracles that fetch and validate data before it gets added to the blockchain. The network relies on a reputation system to incentivize honesty and accuracy among its nodes (oracles). Nodes with high accuracy are rewarded with LINK tokens, Chainlink’s native cryptocurrency, while those providing inaccurate information are penalized.

The innovative design of Chainlink extends beyond its decentralized oracle network. The protocol uses something called service level agreements (SLAs) to match smart contracts with the appropriate oracles. The SLA defines the terms for the oracle service such as the type of data, the number of oracles required, the speed of data delivery, and the penalties for non-compliance.

This system of SLAs and the reputation system provide a robust mechanism to ensure that the data fed into the smart contracts is accurate and reliable, thereby mitigating the risks associated with incorrect or tampered data.

Furthermore, through Chainlink, smart contracts can be fed with a multitude of data inputs, including but not limited to market prices, temperature, weather conditions, and other IoT data, vastly expanding the potential use-cases for smart contracts.

Chainlink’s native cryptocurrency, LINK, plays a crucial role in the network. It’s used as the payment currency for data requesters who want to access data services. LINK tokens are also used for incentivizing nodes to maintain data accuracy and to participate in the network.

Nodes are required to stake LINK tokens as collateral, and any deviation from accurate reporting can lead to their stake being slashed. This model creates an economic incentive for the nodes to act in the best interest of the network.

Beyond its core function as a decentralized oracle service, Chainlink has shown remarkable versatility by enabling functionalities like Decentralized Finance (DeFi) applications, gaming, insurance, and more. For instance, in DeFi, Chainlink’s Price Feed services allow for reliable, tamper-proof, high-quality price data to be utilized by decentralized exchanges, lending platforms, and other DeFi applications.

Also, Chainlink’s Verifiable Random Function (VRF) provides a secure and provably fair source of randomness that’s invaluable for blockchain gaming, gambling, and other applications requiring random number generation.

By ensuring the source of randomness is verifiable on-chain, Chainlink brings transparency and trustworthiness to the process, a previously complex task for blockchain developers.

Chainlink has also fostered a strong, vibrant community of developers, enthusiasts, and partners. A variety of projects across multiple sectors, from DeFi to insurance and enterprise, have integrated Chainlink, creating a thriving ecosystem. Notable partnerships include Google Cloud, SWIFT, and many other blockchain-based projects.

By solving the oracle problem in a decentralized, secure, and scalable way, Chainlink has made a significant impact on the blockchain ecosystem.

As the bridge between on-chain and off-chain worlds, it extends the capabilities of smart contracts, making them more functional and closer to realizing their full potential. As blockchain technology matures and finds more real-world applications, the demand for reliable oracle services like Chainlink will only continue to grow.

With its robust and secure solution to the oracle problem, it’s paving the way for a new generation of advanced decentralized applications, ensuring they can interact with real-world data in a reliable and trustworthy manner.

Monero

Monero, denoted by its ticker symbol XMR, is a leading cryptocurrency renowned for its exceptional commitment to privacy and security. Unlike many cryptocurrencies that offer some degree of privacy, Monero was specifically designed to make tracking transactions as difficult as possible for outside observers. Its development and acceptance are underpinned by a community that holds privacy and decentralization in the highest regard.

Monero, introduced in 2014, is based on the CryptoNote protocol, a technology that introduces significant privacy improvements over the Bitcoin protocol. In contrast to Bitcoin’s transparent blockchain, where addresses and transactions can be traced directly, Monero uses a range of mechanisms to obfuscate information and ensure transactional privacy.

One such mechanism is ring signatures, a type of digital signature where a group of potential signers are fused together to produce a distinctive signature that authorizes a transaction. This method makes it virtually impossible to determine which member’s keys were used for the signature and, hence, who initiated the transaction.

Monero also uses stealth addresses, which are one-time addresses created for each transaction on behalf of the recipient.

This makes it impossible to link transactions to the recipient’s actual address, adding another layer of privacy. Additionally, Monero employs Ring Confidential Transactions (RingCT), which hide the transaction amount from everyone except the sender and receiver.

With these features, Monero provides an unmatched level of privacy. Each transaction is secure, untraceable, and unlinkable. This makes it a preferred choice for individuals who place a high value on privacy.

Monero’s block reward does not have a hard cap, unlike many other cryptocurrencies. Instead, once the total number of Monero coins reaches 18.4 million (expected in May 2022), the system will switch to a ‘tail emission,’ releasing 0.6 XMR per block indefinitely. This approach ensures continued incentivization for miners, aiding the security of the network in the long run.

Monero also addresses the issue of fair mining. Many cryptocurrencies face centralization concerns due to the advent of Application-Specific Integrated Circuits (ASICs), which can lead to a concentration of mining power. Monero mitigates this problem by employing an ASIC-resistant proof-of-work algorithm called RandomX. This algorithm is designed to be efficient on consumer-grade hardware, making mining more democratic and preserving the decentralized nature of the network.

Monero’s native token, XMR, serves multiple purposes within the network. It is used as a medium of exchange, a store of value, and also as the reward for miners who validate transactions and secure the network. The focus on privacy and security has led to Monero being adopted for a range of applications where these attributes are particularly valued.

However, it’s worth noting that the emphasis on privacy has not been without controversy. Monero has been used in illicit activities due to its untraceability, leading to debates about its regulation. It’s a challenge faced by the entire privacy coin sector, and many believe that a balance must be struck between maintaining privacy and preventing illegal use.

Despite these challenges, the development and adoption of Monero have been robust. A vibrant community of developers, users, and advocates who believe in the need for private, non-censorable transactions has been actively supporting the project. The Monero community also emphasizes grassroots development and contribution, with numerous initiatives like the Community Crowdfunding System, which helps fund new projects and developments.

In conclusion, Monero stands as a powerful testament to the potential for privacy in the blockchain space. By combining innovative technology like ring signatures, stealth addresses, and RingCT, it provides a level of privacy that few other cryptocurrencies can match.

Summary

- Chainlink, Solana, and Monero are some of the best crypto projects to invest in this year.

- As the Chainlink network and community continue to grow, the potential applications for this technology are almost limitless.

- With a rapidly expanding ecosystem and an impressive track record, Solana presents a compelling case for the future of blockchain technology.

- The strength of the Monero network is not just in its technology, but also in its community, which remains committed to the principles of privacy, decentralization, and open development.

- As the discourse around privacy and digital security becomes increasingly vital in our digital age, Monero’s relevance seems set to grow.