A recent CoinGecko report, published on August 17, has shed light on the substantial global disparities in household electricity expenses associated with individual Bitcoin (BTC) mining.

The report highlighted a remarkable contrast between Italy and Lebanon, where the cost of producing a single Bitcoin differs significantly.

According to the findings, mining one Bitcoin in Italy comes at a staggering cost of $208,560.

This is in stark contrast to Lebanon, where the expense is approximately 783 times lower, allowing miners there to generate a Bitcoin for just $266.

The study underscored that only 65 countries present a profitable landscape for solo Bitcoin miners, primarily based on household electricity costs.

Within this group, Asia accounts for 34 countries, while Europe contributes a mere five.

However, miners operating solo face a challenge as the global average for household electricity costs sits at $46,291.24 for mining one Bitcoin.

This figure is notably 35% higher than the average daily price of one Bitcoin in July 2023, which was $30,090.08.

The report identified Italy as the most expensive country for household Bitcoin mining, with a cost per Bitcoin of $208,560.

Austria followed at $184,352, and Belgium at $172,382.

READ MORE: Tether Discontinues Bitcoin Omni Layer Version Due to Waning Interest

Conversely, Lebanon’s affordability shines through in its household electricity rates, allowing for a strikingly low cost of $266 to mine one Bitcoin.

This dramatic variance underlines the immense difference in operational costs between countries.

Iran comes next on the list, with a production cost of $532 per Bitcoin.

Despite legalizing Bitcoin mining in 2019, the country has intermittently prohibited mining due to concerns over energy grid strain during winter.

Binance CEO Changpeng “CZ” Zhao engaged with the report’s data on social media, questioning why individuals in countries with lower electricity costs wouldn’t engage in Bitcoin mining.

However, he acknowledged the potential complexities involved and suggested that feasibility and logistics might not have been fully considered in the report.

CZ also pointed out that some of these low-cost electricity countries experience shortages, often necessitating power reductions in heavy industries during peak hours or the summer months.

This context reveals that while electricity costs are a significant factor, other variables also play into the viability of Bitcoin mining operations across different nations.

Other Stories:

Bitcoin Hovers Near 2-Month Lows Amidst Extensive Liquidations and Market Uncertainty

Shiba Inu’s Shibarium Network Restarts Block Production After Temporary Pause

Former US President Donald Trump’s Ethereum Wallet Surges to $2.8 Million

Stablecoin issuer Tether has revealed its decision to discontinue the Bitcoin Omni Layer version, citing waning user interest.

This particular iteration of Tether holds historical significance as one of the earliest stablecoins to be introduced.

Alongside the Bitcoin version, Tether also plans to halt operations for its Bitcoin Cash and Kusama versions, as communicated through an announcement on August 17.

Tether’s announcement clarified that moving forward, there will be no issuance of new Tether tokens on the Bitcoin Omni Layer, Bitcoin Cash, or Kusama platforms.

However, the redemption process will remain accessible for at least a year, and the company will provide updates before the end of that period regarding the procedure for redemptions beyond it.

The Bitcoin Omni Layer functions as a smart contract system situated atop the Bitcoin blockchain. Initially referred to as “Mastercoin,” this system was launched in July 2013, a full two years ahead of Ethereum.

Tether’s release on the Omni Layer in October 2014 marked a pivotal moment as it became the first stablecoin on this platform.

Over time, it ascended to become the leading stablecoin by market capitalization, surpassing predecessors such as BitUSD and NuBits.

READ MORE: Stellar Development Foundation Invests in MoneyGram International

In recognizing the historical role played by Omni Layer Tether, Tether’s August 17 statement expressed appreciation for the contributions and innovations of the team behind the platform.

This acknowledgment was balanced with the acknowledgement of challenges faced by the Omni Layer due to the lack of popular tokens and the availability of USDT on alternative blockchains.

These challenges prompted exchanges to opt for other transport layers over Omni, ultimately diminishing the usage of USDT Omni and compelling Tether to cease its issuance.

Tether did, however, leave the door open for the potential revival of the Omni Layer version should usage of the platform experience a resurgence.

Additionally, the company revealed that it is in the process of developing a new Bitcoin smart contract system named “RGB.”

Upon its completion, Tether intends to reintroduce the token in an RGB version, thereby re-establishing its presence on the Bitcoin blockchain.

As the stablecoin landscape intensifies in 2023, Tether faces increased competition to maintain its dominance.

The release of PayPal’s PYUSD on August 7 and Binance’s listing of FDUSD on July 26 have added to the mounting pressure on Tether’s standing.

Other Stories:

Silvergate Bank Undergoes Executive Shake-Up Amid Crypto Transition and Legal Challenges

Former US President Donald Trump’s Ethereum Wallet Surges to $2.8 Million

Coinbase’s ‘Stand with Crypto Alliance’ Gains Momentum Amidst Lawmaker Engagement Push

Bitcoin remained close to its lowest levels in two months at the opening of Wall Street on August 18th, as the market grappled with significant liquidations.

Data from Cointelegraph Markets Pro and TradingView indicated that BTC’s price movement was relatively stagnant, following an 8% loss triggered by a single daily candle.

The cryptocurrency market experienced a wave of liquidations across its derivatives sectors, with these dominating the scene while spot selling remained subdued.

Notably, trading firm QCP Capital highlighted a substantial short liquidation event on the Deribit exchange, hinting at a major account being wiped out.

Market observers, including QCP, noted that the reaction to a reported write-down of SpaceX’s $373 million Bitcoin holdings appeared to be overblown.

Recollections of past instances of market influence by Elon Musk, CEO of SpaceX and Tesla, resurfaced, leading some to hope that the market would not revisit such volatility.

The scale of liquidations seen rivaled those following the FTX exchange meltdown, which caused BTC/USD to plunge to $15,600 in November 2022.

The cryptocurrency’s price wavered around $26,000, sparking differing interpretations among market participants about the situation’s true nature and its future ramifications.

Noted trader and analyst Rekt Capital provided a grim outlook, pointing out a potential double-top formation for BTC/USD in 2023 and the lack of support from trend lines and moving averages during the downturn.

READ MORE: Former US President Donald Trump’s Ethereum Wallet Surges to $2.8 Million

Conversely, some market participants remained optimistic.

Trader CryptoCon identified two significant benchmarks that often precede successful price rebounds during bull market retracements: the relative strength index (RSI) bouncing at the 0.382 Fibonacci retracement level.

According to CryptoCon, this pattern repeated across multiple cycles.

Rekt Capital also highlighted the oversold condition of the daily RSI, a level unseen since June 2022, but reminiscent of bear market conditions.

Looking ahead, market focus turned to Jerome Powell’s forthcoming commentary, as the chair of the United States Federal Reserve’s speech at Jackson Hole was anticipated to hold the potential to introduce new volatility.

In summary, Bitcoin struggled near its two-month low on August 18th as the market grappled with significant liquidations across derivatives, despite relatively weak spot selling.

Traders offered differing perspectives on the situation, with some expressing concern over potential negative patterns, while others identified historical indicators of rebounds during bull market retracements.

The anticipation of Jerome Powell’s upcoming speech further added to the market’s uncertainty.

Other Stories:

Coinbase’s ‘Stand with Crypto Alliance’ Gains Momentum Amidst Lawmaker Engagement Push

Silvergate Bank Undergoes Executive Shake-Up Amid Crypto Transition and Legal Challenges

Coinbase’s ‘Stand with Crypto Alliance’ Gains Momentum Amidst Lawmaker Engagement Push

The US Securities and Exchange Commission (SEC), the regulatory body responsible for approving spot cryptocurrency exchange-traded funds (ETFs), appears to be edging closer to granting permission for these investment vehicles after years of deliberation.

A significant development occurred when BlackRock, the world’s largest asset management firm, submitted its application for a Bitcoin ETF in June.

This move has reignited investor interest both within and beyond the cryptocurrency sphere.

Notably, BlackRock also established a “surveillance-sharing agreement” with Coinbase, a leading cryptocurrency exchange, possibly indicating the SEC’s receptiveness to ETF applications under such arrangements.

Numerous companies, including ARK Invest under the leadership of CEO Cathie Wood, have filed for crypto ETFs with the SEC. ARK 21Shares applied to list its spot Bitcoin ETF in May 2023.

However, the SEC recently extended the review period by 21 days until August 11, inviting public comments on the proposal as per its guidelines.

The SEC holds the authority to delay ETF applications for up to 240 days, a period that includes public input.

Nevertheless, the SEC has not yet approved any spot Bitcoin ETF proposal from any US firm. It only began accepting investment products linked to Bitcoin futures in October 2021.

READ MORE: Pro-Bitcoin Politician Surges Ahead in Argentine Presidential Primaries

The challenge lies in the nature of these investment vehicles: Bitcoin futures-linked ETFs allow investment without direct exchange participation, whereas spot Bitcoin ETFs involve holding the cryptocurrency directly within a fund.

Early attempts to gain SEC approval for crypto ETFs date back to 2013 when Gemini co-founders Cameron and Tyler Winklevoss applied for a Bitcoin Trust listing.

However, these attempts were rebuffed, showcasing the evolving regulatory landscape.

Stuart Barton, co-founder and CIO of Volatility Shares, the firm behind a leveraged Bitcoin futures ETF listing, revealed that the SEC application process involves negotiations and suggested that smaller firms might have an advantage in pursuing spot crypto ETFs.

Barton emphasized that significant companies have not substantially advanced the argument for ETF approval.

Prominent asset management firms like BlackRock, ARK Invest, Bitwise Asset Management, VanEck, WisdomTree, Invesco, Galaxy Digital, Fidelity, and Valkyrie currently have spot Bitcoin ETF applications under SEC review.

The SEC’s cautious stance might stem from the complex nature of the US crypto market, which requires further regulatory clarity and oversight.

The SEC’s ongoing enforcement actions against Coinbase, Binance, and Ripple, alongside penalties imposed on other firms, indicate a need for increased regulation.

US legislators are actively considering laws to define the roles of the SEC and Commodity Futures Trading Commission (CFTC) in overseeing digital assets.

Court decisions will likely play a role in shaping regulations, particularly following the SEC vs. Ripple case, where a judge determined that XRP was not a security.

Industry analysts suggest that the probability of a US spot Bitcoin ETF approval is around 65%, partly influenced by BlackRock’s application.

Speculation also abounds regarding potential simultaneous approvals to prevent any single company from gaining an advantage.

Other Stories:

Voyager Digital’s Massive Token Transfers Spark Speculation of Impending Sell-Off

Zunami Protocol Issues Warning Amidst Attack on Stablecoin Pools on Curve Finance

Former FTX CEO Sam Bankman-Fried Detained in Notorious Brooklyn Jail

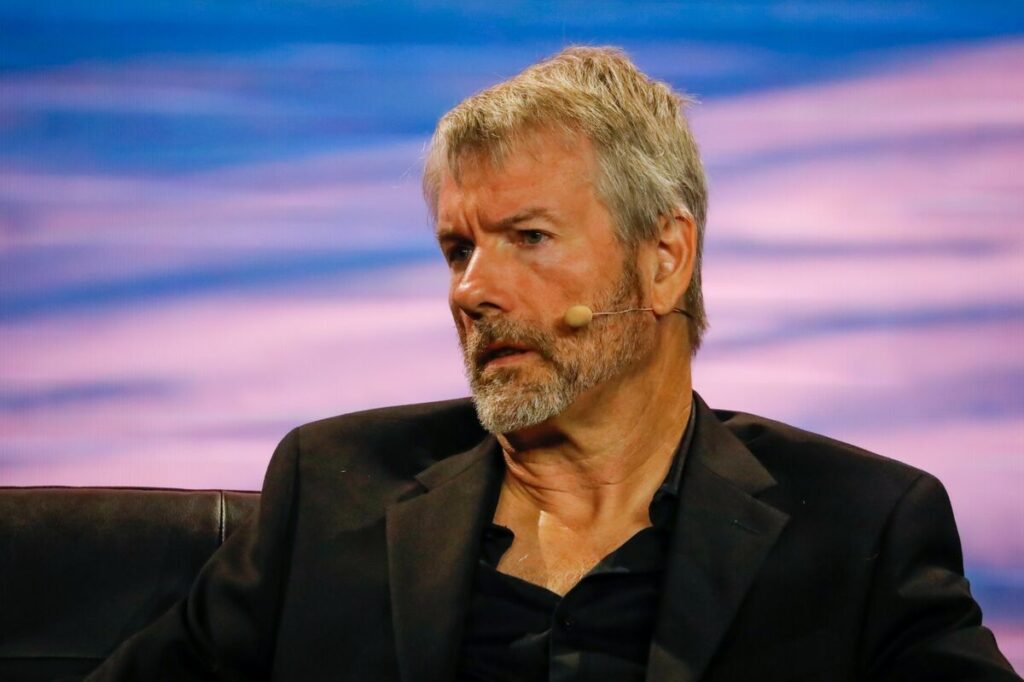

During a recent podcast discussion, Michael Saylor of MicroStrategy conveyed his belief that the involvement of major corporations in purchasing and holding Bitcoin should not be viewed as a worrisome development.

Speaking on the Coin Stories podcast with Natalie Brunell, released on August 7, Saylor highlighted the inevitable expansion of third-party and corporate engagement within the Bitcoin domain.

While acknowledging the aspiration of Bitcoin enthusiasts for complete self-control or sovereignty over their holdings, Saylor proposed that this might not be the exclusive solution, given the diverse applications of Bitcoin.

He expressed the idea that as Bitcoin further intertwines with society, its utility will diversify, negating a one-size-fits-all approach.

Saylor enumerated three primary factors substantiating the need for custodial services: technical, political, and natural considerations.

On a political basis, he argued that certain circumstances necessitate reliance on third-party custodians.

He pointed out that unless fundamental changes occur, political factors tied to regions such as New York City, California, or Iceland will demand custodial solutions.

From a technical perspective, Saylor highlighted the inevitability of trusting layer-3 third parties for transactions, particularly those involving mobile devices.

READ MORE: Former FTX CEO Sam Bankman-Fried’s Bail Revoked Over Witness Intimidation Allegations

He painted a vision of Bitcoin as a foundational layer, accompanied by layer-2 systems like the Lightning Network for speed, and layer-3 services provided by entities like Bank of America and Apple to enhance functionality.

Saylor also introduced the concept of natural reasons for custodial reliance.

He postulated that certain individuals, like an elderly person dealing with Alzheimer’s or someone wanting to secure assets for a future grandchild, might find it safer to entrust their holdings to others.

Drawing an analogy to childhood experiences, he cited that the absence of car keys didn’t necessarily invoke complaints, suggesting a comparable situation with Bitcoin custody.

Emphasizing adaptability, Saylor underlined that the market will ultimately dictate the optimal blend of Bitcoin integration methods.

He asserted that a diverse array of ways to incorporate, wrap, embed, or transact with Bitcoin should not evoke fear, as the right combination of integrations will naturally emerge through market dynamics.

In conclusion, Michael Saylor, during a recent podcast exchange, expressed his viewpoint that the involvement of large corporations in Bitcoin custody shouldn’t raise alarm.

He highlighted the inevitability of Bitcoin’s expansion across various sectors and delineated reasons for custodial arrangements based on technical, political, and natural factors.

Saylor stressed the importance of embracing multiple integration approaches, with the market determining the most suitable amalgamation of Bitcoin functionalities.

Other Stories:

Hacker’s Tether Address Blacklisted with Police and Cyber Support, Stolen Crypto Recovery Progresses

In a significant political development, an Argentine politician advocating for Bitcoin adoption and the dismantling of the central bank has surged ahead in the country’s presidential open primary elections.

With more than 90% of the votes counted, Javier Milei, a prominent libertarian with pro-Bitcoin sentiments, has taken the lead with an impressive nearly 32% of the votes.

This places him ahead of the conservative Together for Change party, which has secured just under 30% of the votes, according to data from Bloomberg.

The Union for the Homeland coalition, representing the incumbent government, stands at the third position with slightly over 28.5% of the total votes.

Milei, a central figure in the Liberty Advances coalition (La Libertad Avanza), has been associated with views that span from libertarian to far-right ideologies.

Milei, who identifies as an anarcho-capitalist, has been a vocal proponent of abolishing Argentina’s central bank, labeling it a fraudulent institution.

He has also controversially stated that the trading of human organs should be treated as a regular market transaction.

He attributes the rise of Bitcoin to a response against what he terms “central bank scammers.”

READ MORE: Hacker’s Tether Address Blacklisted with Police and Cyber Support, Stolen Crypto Recovery Progresses

Furthermore, he argues that fiat currency enables politicians to exploit Argentinians through inflation, a message that has struck a chord with the country’s populace.

The resonance of Milei’s rhetoric among voters is driven by Argentina’s staggering annual inflation rate of 116%, the highest in over 30 years.

This dire economic situation has exacerbated the country’s ongoing cost of living crisis, making the call for alternative financial mechanisms like Bitcoin more appealing to a frustrated electorate.

The culmination of this political landscape will be Argentina’s general presidential election scheduled for October 22nd.

In the event that no candidate secures a minimum of 45% of the votes, a runoff election is slated for November.

As the nation grapples with economic challenges and increasing public support for unconventional approaches, the upcoming election holds the potential for a significant shift in Argentina’s political trajectory.

Other Stories:

Former FTX CEO Sam Bankman-Fried’s Bail Revoked Over Witness Intimidation Allegations

The potential approval of a spot Bitcoin exchange-traded fund (ETF) in the United States has been shrouded in suspense due to the Securities and Exchange Commission’s (SEC) ongoing delay in reaching a decision.

This delay is now raising speculations that the verdict might encompass influential players in the financial sector, including giants like BlackRock and Fidelity.

Dave Weisberger, co-founder of CoinRoutes and an experienced figure in the markets, emphasized the mounting pressure on the SEC to grant approval for several ETFs.

The performance of approved futures-backed products has fallen significantly behind the actual spot performance, adversely affecting investors.

He believes that the culmination of this decision will likely encompass all pending applications.

The SEC is currently evaluating eight applications for a spot Bitcoin ETF, reflecting a series of past rejections and postponements for such cryptocurrency-related products.

The contenders awaiting a decision comprise prominent entities like ARK Invest, Bitwise, BlackRock, VanEck, WisdomTree, Invesco, Galaxy Digital, Fidelity, and Valkyrie. Together, these firms oversee a staggering $15 trillion in global assets.

Recently, the SEC initiated a 21-day commentary period for the ARK 21Shares Bitcoin ETF.

The regulator’s inquiries revolve around the proposal’s potential to counter fraudulent and manipulative actions and its assessment of the susceptibility of the Bitcoin market to manipulation.

A particular focus was directed towards Coinbase’s surveillance-sharing agreement, with the SEC requesting input on whether this involvement could effectively identify, investigate, and discourage manipulation and fraud in Bitcoin’s valuation.

Ruslan Lienkha, Chief of Markets at YouHodler, offered insight into the SEC’s concerns about market manipulation by major entities.

He elaborated that if the SEC were to greenlight multiple ETFs, the risk of manipulation would substantially diminish, as these firms could engage in frequent trading against each other.

Despite the SEC’s extended contemplation, Bitcoin’s valuation experienced a modest impact, hovering around $30,000.

Market players, including Mauricio Di Bartolomeo, co-founder of Ledn, a crypto lending platform, seemed prepared for the SEC’s prolonged deliberation, asserting that today’s decision bears minimal influence on market expectations.

Notably, the SEC has a couple of deadlines to meet before reaching a final conclusion. The next deadline for the ARK 21Shares application is scheduled for January 2024.

Valkyrie’s application, the most recent addition to the lineup, faces deadlines in January and March of the following year.

The outcome of the BTC ETF ruling has the potential to reshape the landscape of cryptocurrency investments.

If approved, this could infuse the Bitcoin market with a substantial $70 billion in liquidity.

Lienkha highlighted the enhanced confidence regular investors would gain through ETFs, as professional guidance would alleviate the need for them to delve into intricate technicalities and risk assessments independently.

Other Stories:

Hacker’s Tether Address Blacklisted with Police and Cyber Support, Stolen Crypto Recovery Progresses

Former FTX CEO Sam Bankman-Fried’s Bail Revoked Over Witness Intimidation Allegations

SoFi Bank, headquartered in San Francisco, has reported an impressive surge in its cryptocurrency holdings, disclosing nearly $170 million in its Q2 earnings report.

This marks a substantial escalation compared to the previous quarter and underscores the bank’s growing involvement in the crypto market.

With an extensive customer base of over six million individuals, SoFi has established itself as a prominent player in the United States banking landscape.

Of the total crypto investments amounting to $166 million, SoFi Bank’s portfolio encompasses $82 million in Bitcoin (BTC) and $55 million in Ethereum (ETH).

Additionally, Dogecoin (DOGE) claims the third spot with an allocation nearing $5 million, while Cardano (ADA) holdings total $4.5 million.

Notably, the bank’s investor presentation highlighted its impressive feat of onboarding more than 500,000 new customers, expanding its support to facilitate trading for over 22 different cryptocurrencies.

Beyond mere crypto holdings, SoFi offers its clientele the ability to buy and sell a diverse array of cryptocurrencies, leveraging its strategic partnership with the Coinbase crypto exchange.

This move is aligned with the bank’s earlier initiative, commencing crypto services in September 2019.

Interestingly, SoFi evolved into a full-fledged bank in February 2022 when it obtained a banking license, distinguishing itself as one of the limited traditional banks delving into the crypto realm.

Despite its strides in the crypto domain, SoFi’s crypto venture has encountered resistance from regulatory quarters.

READ MORE: XRP Price Fails to Reach Anticipated Levels Despite Favorable Court Ruling

In November 2022, a U.S. Senate committee raised concerns about the bank’s adherence to banking laws, spotlighting a looming deadline in January 2024.

SoFi Bank’s response to these concerns remains pending, as Cointelegraph’s outreach for clarity regarding its compliance deadline and potential implications for crypto holdings did not yield a response at the time of publication.

The integration of the cryptocurrency sector with conventional banking has long been deemed a pivotal milestone for mainstream adoption.

However, the crypto industry weathered a tumultuous 2022, which was further exacerbated by the collapse of several banks focused on crypto affairs in 2023.

In response, U.S. legislators hurriedly intervened to safeguard customers’ assets, albeit at the cost of disrupting the synergistic relationships between crypto and traditional finance.

As the regulatory landscape grapples with assigning accountability, the future trajectory of this evolving partnership remains uncertain.

Other Stories:

Governments Remain Wary About Worldcoin Amid Privacy Concerns

Binance’s Proof-of-Reserves Discloses Strong Financial Position

PayPal’s Ethereum-Based Stablecoin PYUSD Divides Crypto Community

The futuristic animated series, Futurama, known for its comedic take on science fiction, took a humorous jab at cryptocurrency mining in its latest installment, demonstrating the show’s knack for predicting trends well before they materialize.

The show’s third episode of its recent version, titled “How the West Was 1010001,” was released on Hulu on August 6, where the characters found themselves indebted to the Robot Mafia.

In a clever parody, they embarked on a journey to “Crypto Country,” a fictional representation of the Wild West, reminiscent of Bitcoin mining’s resource-intensive nature.

Set in the year 3023, Futurama’s portrayal of the cryptocurrency landscape remained true to its comedic nature.

The price of BTC remained volatile, and people scoured the land for sources of “cheap, filthy electricity” to facilitate their mining operations.

The episode’s humor manifested through absurd scenarios, like collecting thallium for crypto mining chips, relocating to the comically named “Doge City,” and BTC miners consuming such massive energy that it started ionizing the atmosphere.

Not solely focused on Bitcoin, the show humorously touched upon “danged Ethereum” and depicted robots’ heads repurposed for mining crypto.

READ MORE: Binance’s Proof-of-Reserves Discloses Strong Financial Position

Remarkably, Futurama had been on air since March 1999, a decade before the inception of Bitcoin.

While the show had rarely delved into cryptocurrency discussions, its recent episode underscores the growing presence of digital assets in mainstream media, spanning from animated series like South Park to blockbuster films like Mission: Impossible – Dead Reckoning Part One.

Curiously, the episode left unaddressed the rationale behind the characters’ persistence in Bitcoin mining in 3023, despite the widely-known BTC halving process.

This process indicates that the final Bitcoin block would likely be mined around the year 2140, making the episode’s comedic depiction divergent from the actual cryptocurrency timeline.

In its characteristic style, Futurama’s latest episode has managed to weave an amusing tale around cryptocurrency mining, showcasing the series’ enduring relevance and its ability to lampoon emerging trends with a comedic touch.

Other Stories:

PayPal’s Ethereum-Based Stablecoin PYUSD Divides Crypto Community

Governments Remain Wary About Worldcoin Amid Privacy Concerns

XRP Price Fails to Reach Anticipated Levels Despite Favorable Court Ruling

In the week ending on August 4, cryptocurrency asset flows recorded a total of $107 million in outflows, continuing a three-week negative trend that amounted to $134.8 million.

Once again, the primary factor behind this movement was Bitcoin (BTC), which experienced $111 million in outflows. These outflows offset the majority of inflows seen in the market during the week.

According to CoinShares’ “Digital Asset Fund Flows” weekly report, this trend indicates further “profit taking” following the gains from the previous market cycle.

In the month leading up to the recent outflows, crypto funds had seen inflows of $742 million, with a significant 99% of those inflows directed towards Bitcoin.

Weekly trading volumes in investment products experienced a decline below the year-to-date average, with broader on-exchange market volumes down by 62% compared to the relative average.

Regionally, only Australia and the United States demonstrated inflows of $0.3 million and $0.2 million, respectively.

Conversely, Canada and Germany witnessed the largest outflows, with $70.8 million and $28.5 million, respectively.

READ MORE: Chamber of Digital Commerce Releases Report on SEC vs Ripple Ruling

Despite the outflows from Bitcoin, the total weekly outflows were partially offset by inflows into Solana (SOL), amounting to $9.5 million, a significant increase from the previous week’s $0.6 million inflows.

Additionally, investment products related to XRP (XRP) also experienced inflows of $0.5 million.

However, Ether (ETH) funds continued their negative trend, with an additional $5.9 million in outflows following the previous week’s $1.9 million.

These outflows offset the prior inflows of $6.6 million, further distinguishing Ether from the current bullish trend of Solana.

Bitcoin has maintained its overall value since the beginning of the year compared to its January opening, but market experts believe that the sideways movement observed since April, mostly below $30,000, is a result of market uncertainty.

Data from Switzerland-based investment adviser 21e6 Capital AG revealed that “hodlers” of Bitcoin, those who held funds in BTC, outperformed crypto funds by 69% in the first half of 2023.

The 2022 implosion of FTX and regulatory and legal uncertainties surrounding several other exchanges may have prompted crypto fund investors to increase their cash reserves rather than investing further, contributing to the current decline.

The report from 21e6 Capital AG also noted a slight increase in investor sentiment compared to the first half of 2023.

Other Stories:

Digital Currency Group Faces Regulatory Scrutiny Over Transactions with Genesis Global Capital