Bitcoin made a remarkable move, surging to $44,000 following the Wall Street opening on December 8, as the latest United States employment data quashed market speculations of imminent interest rate cuts.

The developments were closely monitored using data from Cointelegraph Markets Pro and TradingView, as the crypto market reacted to fresh signals of inflation in the US economy.

The official release from the US Bureau of Labor Statistics showed that nonfarm payrolls exceeded expectations, with 199,000 jobs added compared to the anticipated 190,000.

Additionally, the unemployment rate was lower than forecast, coming in at 3.7% instead of the predicted 3.9%.

These figures suggested that the full impact of the Federal Reserve’s monetary tightening had yet to materialize, leading to a nervous response from the markets.

Before the release of the November jobs report, there was a 60% likelihood of rate cuts commencing in March 2024.

However, after the latest data, the odds of rate cuts starting in January 2024 plummeted from 16% to just 6%.

READ MORE: VanEck Predicts Bitcoin to Reach New All-Time High in Late 2024

Notably, data from CME Group’s FedWatch Tool indicated that the probability of any changes to the interest rate at the upcoming Federal Reserve meeting was almost zero.

The US Dollar Index (DXY) experienced significant volatility in response to the data, briefly reaching its highest levels since November 20 before retracting gains and trading at 103.8 at the time of reporting.

Interestingly, while gold prices dipped by 0.8%, Bitcoin managed to hold its ground despite reduced expectations of imminent interest rate cuts.

The largest cryptocurrency remained within a multi-day trading range as traders monitored for signs of a continuation in the current trend.

Prominent analyst Matthew Hyland commented on the situation, stating, “Bitcoin still consolidating in an uptrend and holding strong after the recent move,” with clear support seen around the $43,000 level.

Another trader and analyst, Daan Crypto Trades, pointed out significant liquidity zones surrounding the current Bitcoin price, particularly at $42,900 and $43,800.

Furthermore, the crypto market’s attention remained focused on altcoins versus Bitcoin, with Ether (ETH) and Solana (SOL) taking the lead overnight.

There was renewed anticipation of a potential “alt season” making a comeback, with Michaël van de Poppe, the founder and CEO of MN Trading, highlighting that “Bitcoin still consolidating around $43K, while Ethereum is gaining more momentum.”

El Salvador has introduced a new citizenship-by-investment program, known as the “Adopting El Salvador Freedom Visa Program,” which offers residency and a path to citizenship for 1,000 individuals willing to invest $1 million in either Bitcoin or Tether within the country.

While this program represents a unique opportunity, it comes with a steep price tag compared to neighboring Caribbean nations, where citizenship programs can start as low as $100,000.

The initiative, announced on December 7th, is a collaboration between the Salvadoran government and the stablecoin issuer, Tether.

To participate, potential investors are required to make an initial nonrefundable deposit of $999, which is credited toward the total $1 million investment.

If all 1,000 spots are filled, El Salvador stands to generate $1 billion in revenue, a substantial income source reminiscent of countries like Vanuatu, which annually earns millions through its own citizenship-by-investment program.

Critics, including Alistair Milne, the founder of crypto hedge fund Altana Digital Currency, have deemed El Salvador’s offering as “uncompetitive in the global market.”

Join Betfury – The Leading Crypto Casino

Comparatively, other options exist, such as Malta, which offers citizenship by investment for €750,000 ($810,000), providing access to the EU’s visa-free Schengen Area covering 23 countries.

Additionally, neighboring Caribbean nations like Antigua and Barbuda, Dominica, and St. Lucia grant citizenships in exchange for a $100,000 contribution to sovereign development funds.

Grenada and St. Kitts and Nevis offer similar programs with contributions starting at $150,000 and $250,000, respectively.

Despite the higher price point, El Salvador’s unique appeal lies in its pro-Bitcoin policies initiated by President Nayib Bukele.

These policies include recognizing Bitcoin as legal tender and eliminating income and capital gains taxes for tech companies investing in the country for the next 15 years.

These incentives may attract crypto investors to consider relocating to El Salvador.

However, it’s essential to note that President Bukele’s tenure has also faced controversy, with concerns raised about human rights violations and arbitrary detentions during his efforts to reduce the country’s high murder rate.

Bukele stepped down from the presidency on December 1st to focus on his reelection campaign ahead of the general election scheduled for February 2024.

El Salvador’s new citizenship-by-investment program, while notable, comes with mixed reviews due to its relatively high cost compared to other options and ongoing concerns about governance.

Asset manager VanEck has made several predictions for the cryptocurrency market in 2024, foreseeing a new all-time high for Bitcoin later in the year.

These predictions come in the context of a looming U.S. recession and regulatory changes following the 2024 U.S. presidential election.

VanEck, alongside other firms like BlackRock and Fidelity, is seeking approval for spot Bitcoin and Ethereum exchange-traded funds (ETFs).

The firm is confident that the first spot Bitcoin ETFs will receive approval in the first quarter of 2024.

Simultaneously, VanEck paints a gloomy picture for the U.S. economy, anticipating that a recession will finally occur, coinciding with the launch of these ETFs.

They predict that over $2.4 billion could flow into these ETFs during Q1 2024, bolstering Bitcoin’s price.

VanEck also downplays concerns about the Bitcoin halving, expecting minimal market disruption but a subsequent price increase.

The real catalyst for a new all-time high for Bitcoin, according to VanEck, may be political events and regulatory changes triggered by the U.S. presidential election scheduled for November 5, 2024.

VanEck does not anticipate Ether overtaking Bitcoin in 2024, though it expects Ether to outperform major tech stocks.

Join Betfury – The Leading Crypto Casino

They believe that Bitcoin will lead the market rally initially, with smaller tokens benefiting after the halving.

VanEck acknowledges that Ethereum’s market share may face challenges from other smart contract platforms like Solana, which has a more certain scalability roadmap.

Regarding Ethereum, VanEck predicts that Ethereum layer-2 networks will dominate the Ethereum Virtual Machine-compatible total value locked and trading volume after the implementation of the EIP-4844 scaling update.

In a separate report, venture capital firm Andreessen Horowitz (a16z) suggests that crypto could play a crucial role in decentralizing artificial intelligence (AI).

It argues that decentralized networks can counterbalance the centralized AI models currently controlled by tech giants, making it possible for anyone to contribute computing power and data to train large language models.

VanEck also anticipates a shift in the centralized exchange landscape, with Binance potentially losing its top position in trading volume to competitors like Coinbase, OKX, Bybit, and Bitget.

Regulatory pressures have weighed on Binance, culminating in its former CEO stepping down amid a substantial settlement with the U.S. Justice Department.

Additionally, VanEck expects the market capitalization of stablecoins to reach $200 billion, foresees a resurgence of Circle’s USD Coin, and predicts that decentralized exchanges will achieve record spot trading volumes.

They also anticipate Know Your Customer (KYC)-compliant decentralized finance platforms surpassing non-KYC ones in terms of user base and fees, driven by apps like Ethereum Attestation Service and Uniswap Hooks.

JPMorgan CEO Jamie Dimon has found himself under scrutiny from the cryptocurrency community on the social platform X (formerly Twitter) after making controversial remarks about Bitcoin and cryptocurrency.

During a hearing before the United States Senate Committee on Banking, Housing, and Urban Affairs on December 5, Dimon asserted that the “only true use case” for cryptocurrency is to facilitate criminal activities, such as money laundering, drug trafficking, and tax evasion.

He even went as far as to suggest that, if he were in a government position, he would advocate for the shutdown of cryptocurrencies.

Dimon’s comments did not go unnoticed, and crypto enthusiasts were quick to point out what they perceived as hypocrisy in his statements.

They highlighted the fact that JPMorgan, one of the world’s largest banks, has faced numerous legal issues and paid substantial fines under Dimon’s leadership.

According to data from Good Jobs First’s violation tracker, JPMorgan has incurred approximately $39.3 billion in fines across 272 violations since the year 2000, with a significant portion of these fines occurring during Dimon’s tenure as CEO, which began in 2005.

Prominent figures in the cryptocurrency space, such as crypto lawyer John Deaton and VanEck strategy adviser Gabor Gurbacs, criticized Dimon for his comments, emphasizing that banks worldwide have paid a staggering $380 billion in fines in this century alone.

These figures raise questions about Dimon’s credibility in criticizing Bitcoin’s alleged association with illicit activities.

READ MORE: U.S. Senators Seek FTC’s Response on AI Scams Targeting Older Americans

Furthermore, JPMorgan itself has faced legal challenges, including a $75 million settlement with the U.S. Virgin Islands in September, which alleged the bank’s involvement in and financial benefit from Jeffrey Epstein’s sex trafficking operation between 2002 and 2005.

However, it is essential to note that settlements do not necessarily imply an admission of guilt.

In addition to these incidents, JPMorgan has had to settle other significant cases, including a $13 billion settlement in October 2013 for misleading investors regarding “toxic” mortgage deals that significantly contributed to the 2008 financial crisis.

The bank also faced investigations and agreed to pay nearly $1 billion in September 2020 for alleged manipulation of various metals futures markets.

Ironically, despite Dimon’s strong opposition to cryptocurrencies, JPMorgan has launched its own digital asset, JPM Coin, on a private version of the Ethereum blockchain for institutional clients.

The bank has also rolled out a blockchain-based tokenization platform with clients like BlackRock and participated in a $65 million funding round for Ethereum infrastructure firm ConsenSys in April 2021.

Dimon’s comments, which called for a shutdown of cryptocurrency, sparked discussions about the distinction between centralized and decentralized cryptocurrencies.

It is worth noting that he has previously referred to decentralized cryptocurrencies as Ponzi schemes.

Some critics argue that the decentralized nature of cryptocurrencies makes it challenging for the U.S. government to effectively impose a ban.

In response to Dimon’s claims, a Community Notes fact check on X highlighted that less than 1% of cryptocurrency transactions are associated with illicit activities, challenging the notion that cryptocurrency’s primary use case is for criminal purposes.

Short sellers in the crypto industry have faced staggering losses of at least $6 billion this year as they attempted to bet against publicly-traded crypto companies.

The primary culprit behind these substantial losses has been Bitcoin’s remarkable surge since the beginning of the year.

A recent report by research firm S3 Partners, dated December 5, reveals that traders who wagered against publicly traded crypto firms like Coinbase, MicroStrategy, and Marathon Digital are now grappling with cumulative on-paper losses amounting to $6.05 billion.

The majority of these losses have transpired in the past three months.

After Bitcoin dipped to a quarterly low of $25,133 on September 11, short sellers, believing that the sector was overbought, significantly increased their exposure.

However, unbeknownst to these traders, Bitcoin embarked on a remarkable 77% rally, reaching a new yearly high of $44,481 on December 5, as reported by Cointelegraph Markets Pro.

This sudden surge in Bitcoin value inflicted approximately $2.65 billion in losses upon short sellers.

READ MORE: Bitcoin Futures Open Interest Soars to $5.2 Billion, Nearing All-Time High

In response to these developments, S3’s managing director of predictive analysis, Ihor Dusaniwsky, pointed out, “Buying-to-cover in the most shorted crypto stocks such as Coinbase Global, MicroStrategy, Marathon Digital Holdings, and Riot Platforms will help push stock prices higher along with the long buying that has driven up stock prices since the end of October.”

Bitcoin’s year-to-date rally of 161% has exerted a substantial influence on the share prices of crypto firms.

Notably, Coinbase and MicroStrategy witnessed astonishing growth rates of 312% and 285%, respectively, within the same time frame.

As of the current writing, Bitcoin is trading at $43,964, with its recent surge attributed to the growing anticipation of potential approval for a spot Bitcoin exchange-traded fund (ETF) in January.

Among the short sellers, Coinbase stands as the most unfavorable trade, with the firm’s nearly 290% rally resulting in losses exceeding $3.5 billion.

MicroStrategy follows closely behind, with short sellers facing losses exceeding $1.7 billion.

Despite the mounting losses, some short sellers have continued to add to their positions, betting that the current rally will eventually lose momentum.

Since Bitcoin’s mid-September resurgence, an additional $697 million in new short positions have been established.

Bitcoin has defied predictions and gained almost 170% in value since the European Central Bank (ECB) sounded the alarm about its impending “irrelevance.”

On November 30, 2022, when the ECB published a blog post declaring Bitcoin’s demise, the cryptocurrency was trading at just $16,400.

The post argued that even these levels were just a pitstop on the way to further price declines.

According to the ECB’s post, Bitcoin’s value had peaked at $69,000 in November 2021 before plummeting to $17,000 by mid-June 2022.

The post suggested that Bitcoin’s apparent stabilization was merely an artificially induced last gasp before its inevitable descent into irrelevance.

Contrary to the ECB’s predictions, Bitcoin continued to thrive. After briefly revisiting the $16,400 mark in mid-December, it made a swift comeback, surging by 70% in the first quarter of 2023 alone.

A year after the ECB’s premature obituary, Bitcoin was trading at its highest since April 2022, reaching $43,800, marking a 166% increase from the time the ECB issued its warning.

READ MORE: CGMD Miner: Leading Cloud Mining Player in Cryptocurrency

Crypto enthusiasts and experts expressed amusement at the ECB’s erroneous assessment.

Philip Swift, creator of the statistics platform Look Into Bitcoin, found satisfaction in the situation.

Alex Thorn, head of firmwide research at crypto education resource Galaxy, questioned the ECB’s credibility and wondered about other areas where the bank might be wrong.

The ECB has a reputation as a Bitcoin skeptic, with its views on the cryptocurrency market often causing embarrassment. ECB Chief Christine Lagarde, in a recent statement, revealed her low opinion of cryptocurrencies and noted that her own son had disregarded her advice on crypto investments and suffered losses as a result.

Despite its skepticism toward Bitcoin, the ECB is actively exploring the possibility of launching a central bank digital currency (CBDC).

However, this initiative has faced scrutiny, especially after Lagarde admitted that a CBDC could offer enhanced transaction control, sparking concerns about privacy and surveillance within the financial system.

Bitcoin’s remarkable resilience serves as a reminder of the unpredictable nature of the cryptocurrency market and the challenges faced by traditional financial institutions in understanding and adapting to it.

In the ever-changing world of cryptocurrency, every day brings new opportunities and developments. One of the most interesting and promising innovations is cloud mining, a method of mining cryptocurrencies that offers huge benefits to investors and supporters of cryptocurrencies. The leader in this field is the company CGMD miner, which specializes in cloud mining services.

What is cloud mining?

Cloud mining is often referred to as the future of cryptocurrency mining and it is changing the traditional mining process. Instead of investing in and managing their own hardware, miners can rent computing power from specialized providers. This eliminates the need for expensive hardware and reduces electricity costs, allowing users to focus on cryptocurrency mining.

CGMD miner : Uniqueness and Reliability

So, what sets CGMD Miner apart from other companies and makes it a trusted player in the industry?

* Professional Team: CGMD Miner’s success is based on its team of highly skilled experts in the field of cryptocurrency and blockchain technology. These dedicated professionals are responsible for ensuring that the mine is stable and efficient.

*Technological innovation: CGMD Miner continues to be at the forefront of technology and continuously invests in improving hardware and software. This focus on innovation maximizes customer productivity and profitability.

* Transparency and Reliability: CGMD Miner attaches great importance to transparency and reliability. Customers have full access to a wide range of mining statistics and data, allowing them to monitor the progress of their operations with confidence.

* Customized Solutions: CGMD Miner understands that there is no one-size-fits-all solution in the cryptocurrency world. In order to meet the diverse needs of investors, the company offers a wide range of rates and terms, allowing users to choose the most suitable option based on their specific circumstances.

* Adapt to market dynamics: The cryptocurrency market is known for its volatility and constant changes. CGMD miner ‘s risk management strategy enables it to quickly adapt to changing market conditions, ensuring the safety and profitability of customer investments.

Advantages of cloud mining:

1. Cost Effective: Eliminates the need for equipment and energy costs.

2. Diversified cryptocurrency mining: Various cryptocurrencies can be mined, including Bitcoin, Ethereum, etc.

3. User interface: Enjoy a simple and convenient mining process.

4. Regular payment: CGMD mining machine provides regular and transparent profit payment.

5. Flexible Terms: Customize your investment with different interest rates and flexible terms.

6. Quick card opening bonus of 10 yuan!

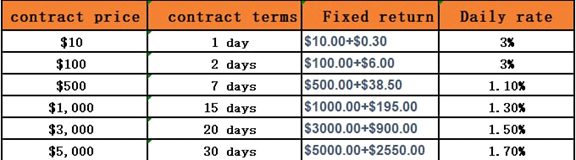

CGMD miner offers contracts that are not only straightforward but also highly diverse, providing you with a range of options to suit your investment needs. They offer stable and no-risk fixed returns.

In the dynamic world of cryptocurrency, CGMD Miner stands out as a leader in cloud mining. With a dedicated team, commitment to innovation, and unwavering transparency, CGMD Miner provides a solid path for investors to explore the world of cryptocurrency. Say goodbye to the complexity of hardware management and embrace the simplicity and profitability of cloud mining with CGMD Miner.

If you are interested in the details of CGMD Miner, please visit its official website www.cgmdminer.com。

You can also find and download the CGMD Miner app by typing “CGMD” in the Google App Store or Apple Store.

Riot Blockchain, a prominent Bitcoin mining company, has announced a significant expansion of its mining operations in preparation for the Bitcoin halving event scheduled for April 2024.

The company is acquiring 66,560 mining rigs from MicroBT, a leading manufacturer, marking one of the most substantial increases in hash rate capacity in Riot’s history.

This substantial purchase amounts to $290.5 million, averaging around $4,360 per machine.

The option to purchase these additional miners was part of Riot’s initial agreement with MicroBT when it initially procured 33,280 machines back in June.

This arrangement has been revised, allowing Riot the option to acquire up to 265,000 more miners under the same terms as the recent order.

Riot’s CEO, Jason Les, referred to this purchase as the “largest order of hash rate” in the company’s history and anticipates that the updated agreement will further enhance Riot’s mining performance.

Of the newly acquired miners, 72% will be MicroBT’s latest model, the M66S, boasting an impressive hash rate of 250 terahashes per second (TH/s).

The remaining machines will include the M66 (14,770) and M56S++ (3,720) models, adding a total of 18 exahashes per second (EH/s) to Riot’s mining operations.

READ MORE: Ben Zhou Addresses Crypto Regulation As Bybit Celebrates 5-Year Anniversary

Riot plans to deploy the first batch of 33,280 miners from the June purchase in the first quarter of 2024, while the newly acquired 66,560 miners will be deployed in the second half of the same year.

The company expects its self-mining hash rate capacity to reach 38 EH/s once all 99,840 rigs are fully operational, which they anticipate happening in the second half of 2025.

Riot’s motivation for this significant expansion is primarily attributed to the upcoming Bitcoin halving event in April 2024, which is expected to impact Bitcoin mining rewards.

This news has driven positive investor sentiment, with Riot’s stock surging nearly 9% on December 4, leading to an impressive year-to-date growth of over 345% in 2023.

In other developments in the Bitcoin mining industry, CleanSpark reported mining 666 BTC in November, showcasing a 5.2% increase from October and a substantial 24% growth from the same period in 2022.

CleanSpark attributes this growth partly to rising transaction fees and the growing interest in Bitcoin’s various use cases.

TeraWulf, listed on Nasdaq, mined 323 BTC in November, a 3% increase from October, primarily driven by higher network transaction fees.

Additionally, Hut 8 completed its merger with Bitcoin Corp to form Hut 8 Corp, commencing trading on Nasdaq and the Toronto Stock Exchange on December 4, albeit with a less-than-ideal debut performance, experiencing a notable decline in its stock price on the same day.

Bitcoin futures open interest on the global derivatives giant, the Chicago Mercantile Exchange (CME), has surged to $5.2 billion, just $200 million shy of its previous all-time high in late October 2021.

Over the last 30 days, open interest in CME’s Bitcoin futures has grown from $3.63 billion to $5.20 billion, mirroring Bitcoin’s 26% gain during the same period, with the cryptocurrency currently trading at slightly above $44,000.

Between October 1 and 21, 2021, CME’s Bitcoin futures open interest saw a substantial increase from $1.46 billion to $5.45 billion.

This rapid growth in open interest coincided with a significant price surge for Bitcoin.

IG Australia analyst Tony Sycamore noted that the surge in open interest indicates renewed interest in Bitcoin, but it does not provide insight into the positioning of CME traders.

Sycamore referred to CME’s November 28 report to the United States Commodities Futures Trading Commission (CFTC), which revealed that “big players” on the platform were net short at the time, with 20,724 short positions compared to 18,979 long positions.

READ MORE: Thirdweb Identifies Critical Security Vulnerability in Web3 Smart Contracts

Sycamore emphasized that it’s crucial to wait for CME’s upcoming report on December 12 to determine the current positioning of these major players.

He stated, “What we can’t see right now is whether the big players have gone from a net short to a net long.

If we saw the market getting extremely long, you’d be very worried about a snapback. The market that we could see last week was short, so I don’t think we’re at that point yet.”

The recent surge in Bitcoin’s price is not solely due to speculation regarding the SEC’s potential approval of spot exchange-traded fund (ETF) products, according to Sycamore.

He believes that other factors, such as the crypto market’s connection to the macroeconomic environment, play a more significant role in driving price action.

This includes the Federal Reserve’s signals to begin cutting interest rates, which can impact Bitcoin’s performance.

In November, CME overtook Binance in Bitcoin futures open interest, signaling increased interest from traditional financial institutions in crypto products.

While many analysts anticipate a spot ETF approval to lead to a significant price increase for Bitcoin, some are cautious, predicting a “sell the news” event in the days and weeks following such an approval.

Hashdex, one of the 13 asset management firms vying for a coveted spot in the Bitcoin exchange-traded fund (ETF) market, is optimistic about the prospects for the first spot Bitcoin ETF in the United States.

According to Hashdex’s U.S. and Europe head of product, Dramane Meite, the anticipated arrival of a spot Bitcoin ETF in the U.S. has shifted from a question of “if” to a matter of “when.”

In a 2024 outlook report released on December 4, Meite expressed the belief that U.S. investors will gain access to a spot Bitcoin ETF by the second quarter of the upcoming year, with a spot Ether ETF likely to follow suit.

Currently, Hashdex is among the 13 asset managers that have submitted applications for a spot Bitcoin ETF to the U.S. Securities and Exchange Commission (SEC).

Additionally, Hashdex has proposed a hybrid Ether ETF, incorporating both futures and spot contracts, to the regulatory authority.

READ MORE: Ben Zhou Addresses Crypto Regulation As Bybit Celebrates 5-Year Anniversary

Although Bloomberg ETF analysts, James Seyffart and Eric Balchunas, have estimated a 90% likelihood of spot Bitcoin ETF approvals in the days leading up to January 10, 2024, it is important to note that the separate Form S-1 application must also receive approval before an ETF can be launched.

Seyffart has emphasized that there could be a period of several weeks or even months between approval and the actual ETF launch.

Companies typically use Form S-1 to inform the SEC about proposed rule changes, requiring endorsement from the agency’s Division of Corporation Finance.

Meite, in Hashdex’s report, highlighted that the introduction of spot Bitcoin and Ether ETFs would mark a significant milestone, as established legacy asset managers with strong brand recognition would be offering cryptocurrency products to their customers for the first time.

He further speculated that this development could unlock a colossal $50 trillion market, surpassing the combined sizes of Europe, Canada, and Brazil—the only three global markets currently featuring spot crypto exchange-traded products.

In all likelihood, the majority of interest in single-asset ETFs would gravitate towards Bitcoin and Ether due to their widespread recognition and minimal differentiation among incumbent offerings.