Cathie Wood, CEO of ARK Invest, recently shared an encouraging perspective on the convergence of Bitcoin and artificial intelligence (AI) through an X (previously Twitter) post.

She accentuated the revolutionary potential that arises from integrating AI with Bitcoin, underscoring the boundless prospects and positive impacts they can impart on various sectors and the broader economy.

This upbeat sentiment is corroborated by an ARK Invest research report named “Investing In Artificial Intelligence: Where Will Equity Values Surface?”.

This paper reveals that both Wood and ARK Invest are keenly assessing AI’s value in investment frameworks.

Wood’s investment history reflects her confidence in AI. She has consistently channelled funds into AI-centric stocks over the years, showcasing her commitment to this emergent technology.

Moreover, Wood’s fervor for Bitcoin is unmistakable.

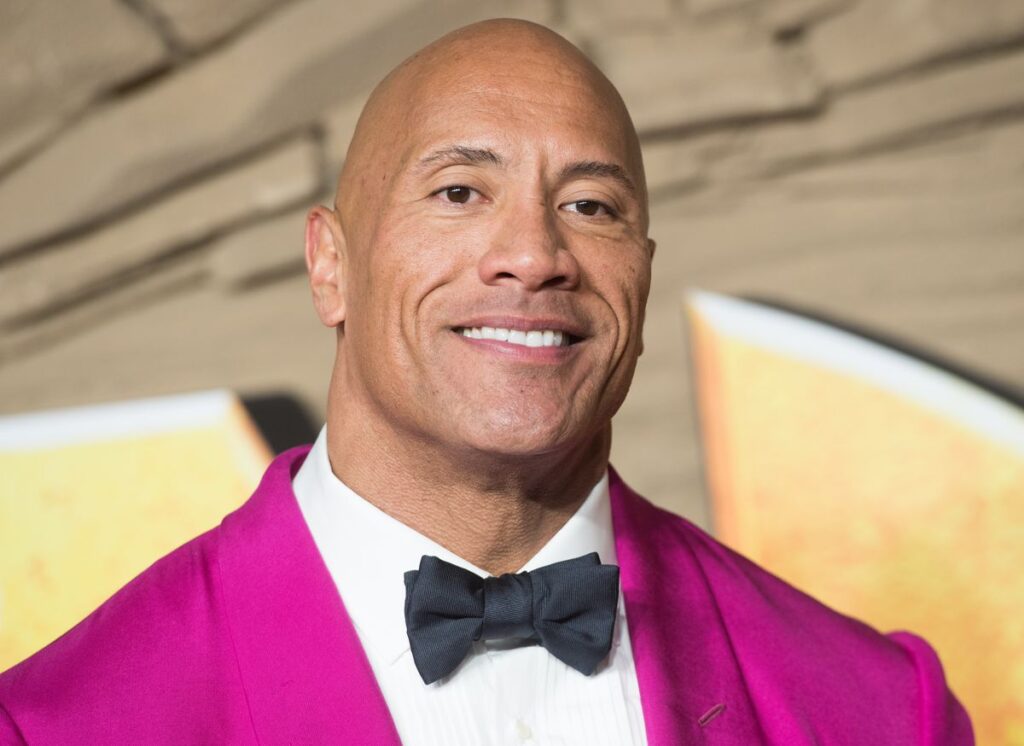

READ MORE: Crypto Community Joins Forces with Oprah and The Rock

This is showcased by ARK’s pursuits related to a Bitcoin exchange-traded fund (ETF). ARK’s acumen in digital assets is further manifested by their considerable investments in platforms like Coinbase and Robinhood.

Highlighting ARK Invest’s successful strategies, their investments in AI tech stocks have borne fruit.

The ARK Disruptive Innovation ETF, which is centered on AI and other groundbreaking technologies, has surpassed the Nasdaq 100 Index, registering an impressive mid-year gain of 41.2%.

Wood’s commentary, complemented by ARK’s insightful research, underscores AI’s escalating prominence in the investment domain.

The amalgamation of Bitcoin and AI is poised to instigate a seismic shift in corporate functionalities, possibly revolutionizing productivity and cost structures.

With investors continually scouting for novel growth trajectories, the interplay of Bitcoin and AI, championed by Wood, could witness heightened investment interest in the coming times.

Other Stories:

Robinhood Acquires Over 55 Million Shares From Former FTX CEO SBF in $606 Million Deal

UK MPs Call for Global Alliance to Safeguard Against AI Misuse and Deepfakes

Bitwise Surprises Market by Withdrawing Bitcoin and Ether ETF Application Amid SEC Delays

Bitcoin (BTC) closed the week below the $26,000 mark on Sep. 3, despite a dismissive stance on overly pessimistic trader sentiment by analysts.

Data derived from Cointelegraph Markets Pro and TradingView revealed that BTC exhibited minimal volatility over the weekend, maintaining a narrow range of $200.

The lack of definitive direction led to a feeling of déjà vu among market participants, reminiscent of the behavior observed during the previous month’s August closing.

The effects of two major volatility-inducing events from the previous week, involving Grayscale, a crypto asset manager, and regulators in the United States, were wiped clean from the charts. Consequently, traders evaluated the potential implications of different levels of weekly closure.

Prominent trader Skew offered insight into the market structure by highlighting the absence of a candle body closure below the Higher Low (HL) established in June, or below the $25.9K mark.

He stressed the significance of this point, suggesting that a 1-week closure below and subsequent price resistance in this range could lead to a downward move towards the prior 1-week resistance at approximately $24.3K.

READ MORE: Robinhood Acquires Over 55 Million Shares From Former FTX CEO SBF in $606 Million Deal

Looking ahead, Skew presented a “bearish scenario” that could bring about levels below $20,000.

Conversely, he expressed skepticism regarding a bullish revival that would involve reclaiming the $26,000 level and maintaining a higher low into the fourth quarter of the year.

Summarizing the events of the previous week, Keith Alan, co-founder of Material Indicators, advised against making definitive judgments on Bitcoin’s bullish or bearish nature.

He acknowledged the recent volatility resulting from Grayscale’s legal victory over the SEC and the SEC’s decision to delay judgment on the first U.S. Bitcoin spot price exchange-traded funds (ETFs).

Alan contended that despite these external events, the fundamental structure of the Bitcoin market remained unaltered.

He emphasized that neither a confirmed breakout nor a breakdown had occurred from a technical perspective, citing $24,750 as the crucial support zone to monitor.

A chart accompanying his analysis depicted the BTC/USD order book on Binance, showing increased buy liquidity just below the spot price at the $24,750 zone of interest.

Other Stories:

Crypto Community Joins Forces with Oprah and The Rock

UK MPs Call for Global Alliance to Safeguard Against AI Misuse and Deepfakes

Bitwise Surprises Market by Withdrawing Bitcoin and Ether ETF Application Amid SEC Delays

Warren Buffett, the celebrated investor and Berkshire Hathaway’s chairman, marked his 93rd birthday on Aug. 30. Over his extensive career, he’s adhered to a value investing strategy akin to the “buy and hold” approach seen with cryptocurrencies.

However, Buffett’s focus lies in assets with robust earnings potential, investing in sectors where he and his team possess in-depth insights into associated risks, competition, and advantages.

The question arises whether such a focused strategy can surpass Bitcoin’s performance in the long term.

Additionally, it’s worth pondering why one of the greatest stock pickers, Buffett, currently holds significant cash and short-term bonds as the second-largest position in his portfolio.

A notable instance of his approach is Berkshire Hathaway’s top holding, Apple (AAPL) shares. Despite acquiring them in 2016 when Apple was valued at over $500 billion, far from being an early investor, Berkshire Hathaway continued adding to its AAPL investment in 2022, despite the stock rallying over 500% since the initial purchase.

This showcases Buffett’s dedication to long-term investment strategies, regardless of recent price fluctuations.

In a February 2012 shareholder letter, Berkshire Hathaway expressed concerns about currency devaluation and the limitations of gold as a store of value.

It argued that gold lacks practical utility, with demand falling short of production for industrial and jewelry purposes.

Gold’s price primarily relies on fear-based sentiment, leading to temporary price spikes. Conversely, investments in productive companies generate substantial returns.

Unfortunately for Buffett, Bitcoin’s price surged by 683% in the year following his skeptical comments on nonproductive commodities’ value storage potential. Over four years, Bitcoin’s gains reached a staggering 9,014%.

READ MORE: Robinhood Acquires Over 55 Million Shares From Former FTX CEO SBF in $606 Million Deal

To compare Berkshire Hathaway’s stock performance with Bitcoin, considering Buffett’s focus on earnings and yield, an analysis simulated Berkshire Hathaway’s stock performance using a factor of three to mimic a leveraged position.

If one invested $1,000 in Bitcoin (spot) and initiated a leveraged long position in Berkshire Hathaway shares in early 2019, they’d have seen a $7,020 return in BTC versus $5,623 in Buffett’s holding company.

Similarly, for investments beginning in 2017, the returns would have been $3,798 in BTC versus $1,998 using the leveraged long strategy in Berkshire Hathaway’s shares.

Buffett’s investment thesis faces a potential loophole: Berkshire Hathaway currently holds a record-high $147 billion in cash equivalents and short-term investments, comprising 18.5% of its market capitalization.

This raises queries about whether it seeks better entry points into stocks or finds the 5.25% returns on fixed-income investments satisfactory.

This scenario underscores that even accomplished investors may hesitate to deploy their cash, prompting questions about whether funds on the sidelines, including $5.6 trillion in money market funds, might seek alternate protection against resurging inflation.

While Bitcoin isn’t a flawless store of value and its volatility is a concern, it’s important to note that it hasn’t yet faced a global economic recession.

Nonetheless, Bitcoin consistently outperforms Berkshire Hathaway shares, implying that investors increasingly see it as a viable alternative store of value.

Considering this, Berkshire Hathaway’s substantial cash position serves as a cautionary note for Bitcoin skeptics.

With Bitcoin’s market capitalization at $500 billion, it signifies untapped potential for it to play a more significant role in finance.

Other Stories:

Bitwise Surprises Market by Withdrawing Bitcoin and Ether ETF Application Amid SEC Delays

UK MPs Call for Global Alliance to Safeguard Against AI Misuse and Deepfakes

Former chair of the United States Securities and Exchange Commission (SEC), Jay Clayton, remains optimistic about the eventual approval of spot Bitcoin exchange-traded funds (ETFs), despite recent delays in decision-making.

In a recent interview with CNBC on September 1st, Clayton noted that the backing of major financial institutions in the realm of spot Bitcoin investments signals a notable shift in providing retail investors with access to cryptocurrency exposure.

The SEC’s recent move to extend the review period for various spot BTC ETF applications from prominent entities such as BlackRock, WisdomTree, VanEck, Invesco Galaxy, Bitwise, Valkyrie, and Fidelity, was observed on August 31st.

This extension grants the commission an additional 45 days, following the notice’s publication in the Federal Register, to either approve, reject, or further delay the ETF applications from these influential firms.

Clayton expressed his belief in the forward momentum of these efforts, indicating that progress can be expected as the process unfolds.

The SEC retains the flexibility to extend the application deadlines until March 2024.

READ MORE: Bitwise Surprises Market by Withdrawing Bitcoin and Ether ETF Application Amid SEC Delays

Clayton emphasized that he envisions an “inevitable” approval for spot Bitcoin ETFs, highlighting the disparity between futures products and cash products, and asserting that this divergence cannot persist indefinitely.

Notably, Clayton’s viewpoint resonates with that of U.S. Court of Appeals Circuit Judge Neomi Rao.

In a recent ruling, Rao and two other judges directed the SEC to reevaluate the application of asset manager Grayscale, seeking to transform its Bitcoin Trust (GBTC) into a spot Bitcoin ETF.

Rao highlighted that the SEC had previously greenlit BTC futures ETFs, implying a similarity between Grayscale’s proposition and the approved futures products.

The sequence of ETF application delays took place in rapid succession on August 31st, just prior to the Labor Day holiday weekend in the United States.

The following key deadline for the assessment of significant spot BTC applications is scheduled for October 7th, at which point the commission is expected to provide updates regarding the proposed offering from fund manager Global X.

Other Stories:

Robinhood Acquires Over 55 Million Shares From Former FTX CEO SBF in $606 Million Deal

UK MPs Call for Global Alliance to Safeguard Against AI Misuse and Deepfakes

Bitcoin extended its decline following the Wall Street opening on September 1, as losses from the monthly close persisted.

Cointelegraph Markets Pro and TradingView data tracked the dwindling BTC price performance, which hit its lowest point since August 22.

The downward momentum was fueled by Bitcoin bears capitalizing on the August monthly close, causing significant volatility in both the Bitcoin and cryptocurrency markets throughout the night.

Overall, BTC/USD saw an 11.2% decline in August, leaving little room for optimism about a potential rebound in September, as noted by market experts.

Prominent trader and analyst Rekt Capital shared insights on Bitcoin’s potential future actions in his recent YouTube update.

He highlighted that BTC price was unable to sustain gains attributed to the “Grayscale hype,” with substantial selling pressure and a drop in the weekly relative strength index (RSI) values toward a crucial upward trendline.

Several exponential moving averages (EMAs), previously acting as support, had now switched roles to become resistance.

The long-standing trendline that had held for over a year was at risk, and a breach of the RSI trendline could result in further downward movement, according to Rekt Capital.

READ MORE: OKX Cryptocurrency Exchange Expands into India, Focusing on Web3 Potential and Local Talent

He identified potential price targets for a new decline, ranging on the path toward $23,000, a favored level among traders.

Referring to historical norms and insights from on-chain monitoring resource CoinGlass, he estimated losses of approximately 7% to 13% for September.

In the event of a relief rally, Rekt Capital suggested that the rally might peak at around $27,200, a level that had previously served as a support zone.

However, Bitcoin’s performance was hindered by the U.S. Dollar Index’s (DXY) second consecutive day of robust strength.

The DXY, which stood above 104 at the time of writing, had recovered from recent losses and was expected to continue its upward trajectory that began in mid-July.

The DXY’s strength had previously acted as resistance during a retest in August, following a local high in June.

Market participants were divided over the current influence of the DXY’s strength in suppressing BTC price, as the inverse correlation between the two had been repeatedly challenged over the past year.

Other Stories:

Ronaldinho Denies Involvement in Alleged $61 Million Crypto Pyramid Scheme

Ethereum Liquid Staking Providers Embrace 22% Cap to Safeguard Decentralization

US Crypto Industry Sees Hope in Court Rulings Restraining SEC

The crypto community has united in solidarity with the Maui community, rallying behind a relief fund endorsed by renowned celebrities Oprah Winfrey and Dwayne “The Rock” Johnson, which now accepts contributions in various cryptocurrencies.

During the initial days of August in 2023, the serene Hawaiian island of Maui was engulfed in destructive wildfires, inflicting considerable damage to both properties and lives as a staggering 2,500 acres were consumed by the blaze.

In response, The Rock and Oprah jointly inaugurated the People’s Fund of Maui, a charitable initiative designed to extend direct financial assistance to those grappling with the aftermath of the disaster.

In a tweet, The Rock unequivocally affirmed that the entirety of the donations would be channeled towards the victims.

He elaborated, “Each adult resident residing within the impacted regions of Lahaina and Kula, displaced by the ferocious wildfires, will be eligible to receive $1200 per month.

This endeavor aims to facilitate their journey towards recovery.”

The People’s Fund of Maui demonstrates its versatility by welcoming donations not only in traditional fiat currencies but also in an array of cryptocurrencies.

Bitcoin, Ether, and Dogecoin are just a few examples of the digital alternatives that can be contributed to the fund.

Beyond merely global fiat donations, the fund’s scope encompasses these digital assets, creating a diverse range of avenues for individuals to provide their support.

Oprah elucidated that the rationale behind placing the donations directly in the hands of the survivors is to empower them to chart their own course towards normalization.

READ MORE: What’s New in Crypto Staking This Year

She expounded, “Empowering individuals to exercise their autonomy, enabling them to determine their requirements and those of their families, constitutes the cornerstone of our objective.”

Running parallel to the commendable efforts initiated by these A-list celebrities, multiple relief initiatives are diligently endeavoring to ameliorate the predicament faced by the wildfire victims.

The All Hands and Hearts disaster relief organization has been at the forefront of collecting both cryptocurrency and fiat donations to assist the local denizens of Maui as they grapple with the aftermath of the devastating fires.

Olga Ruggiero, Chief of Organizational Integration and Events at All Hands and Hearts, emphasized the significance of cryptocurrency contributions, asserting that they are a vital means of offering essential support in the aftermath of such catastrophic events.

She noted, “Cryptocurrency, much like any other form of donation, plays a pivotal role in rendering indispensable aid after the ravages of wildfires.

The crypto industry consistently rallies alongside communities across the globe that find themselves in distress.”

The unity displayed by the crypto community in partnership with influential personalities like Oprah Winfrey and Dwayne “The Rock” Johnson serves as a testament to the potential of leveraging cryptocurrencies to extend a helping hand to communities in dire need.

Other Stories:

BlockFi Advances Fund Recovery Efforts with Court Application

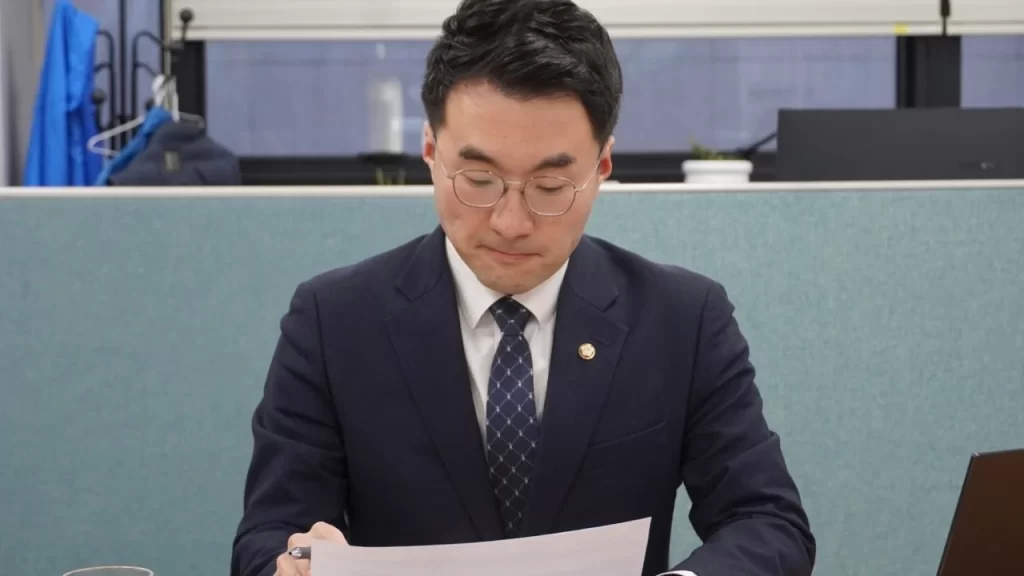

South Korean Parliamentary Subcommittee Rejects Expulsion Motion Over Cryptocurrency Controversy

Bitcoin Holds Strong Above $27,000 as Traders Maintain Bullish Outlook

Bitwise, the asset management firm, has taken an unexpected step by withdrawing its application for a Bitcoin and Ether Market Cap Weight Strategy exchange-traded fund (ETF) from the United States Securities and Exchange Commission (SEC).

Initially filed on August 3, the move came as a surprise given the recent positive market sentiment following Grayscale’s success with the SEC.

The withdrawal statement contained a cautious tone, stating that while the fund aimed to achieve capital appreciation, there were no guarantees of meeting this investment objective.

Matt Hougan, Bitwise’s chief investment officer, had recently voiced support for SEC approval of all ETFs in a Bloomberg interview.

The ETF in question was designed to invest in either Bitcoin or Ether futures contracts, selected based on their respective market capitalizations.

In conjunction with ProShares, Bitwise had also planned to launch another ETF around the same time.

Bitwise clarified in the withdrawal statement that the Trust had abandoned its plans to pursue the effectiveness of the Fund.

The Trust did not sell or intend to sell any Fund securities as part of the process.

This development aligns with the SEC’s continued delay in deciding on various Bitcoin ETF applications, including those from WisdomTree, Invesco Galaxy, Valkyrie, VanEck, BlackRock, Bitwise, and Fidelity.

READ MORE: BlockFi Advances Fund Recovery Efforts with Court Application

The SEC’s recent filing on August 31 disclosed an extended review timeline for several spot Bitcoin ETF applications.

WisdomTree, VanEck, Invesco Galaxy, Bitwise, Valkyrie, Fidelity’s Wise Origin Bitcoin Trust, and BlackRock’s Bitcoin ETF face a longer evaluation period.

Upcoming deadlines for the SEC are set for mid-October, but potential delays could push them to the third batch of deadlines in January or to final decisions in the subsequent months.

Bitwise had previously been at the forefront of asset management firms seeking Bitcoin ETF products.

Its initial application in January 2019 aimed to create a BTC-backed ETF tracking the Bitwise Bitcoin Total Return Index, derived from BTC transaction values across various exchanges.

The firm’s proposal sought to provide a reliable representation of the broader cryptocurrency market, with data sourced from multiple cryptocurrency exchanges.

Additionally, third-party custodians were to be responsible for physically holding Bitcoin.

Notably, this is not Bitwise’s first ETF withdrawal. Earlier this year, the company pulled back an application for an Ethereum Strategy ETF.

The ETF had been designed to invest in both front-time and back-time Ethereum futures, but the withdrawal occurred only a week after the initial application was submitted.

Other Stories:

South Korean Parliamentary Subcommittee Rejects Expulsion Motion Over Cryptocurrency Controversy

Bitcoin Holds Strong Above $27,000 as Traders Maintain Bullish Outlook

BlockFi Advances Fund Recovery Efforts with Court Application

The Cambridge Bitcoin Electricity Consumption Index (CBECI), renowned for assessing Bitcoin’s energy usage, has undergone its inaugural methodology update since its inception in 2019.

Launched in July 2019, CBECI aimed to furnish data-backed insights into Bitcoin mining’s energy intensity and environmental consequences.

In an exclusive conversation with Cointelegraph, lead researcher Alexander Neumueller outlined the index’s role in estimating Bitcoin network electricity consumption.

Neumueller emphasized its role in presenting comprehensible data to the general public.

The revamped methodology accentuates recent trends in Bitcoin mining hardware and hash rates. Researchers scrutinized whether CBECI accurately depicted these dynamics.

They concentrated on unraveling the causes behind significant hash rate growth in recent years, attributed to more powerful contemporary mining equipment superseding older counterparts.

The absence of detailed hardware data posed a challenge, limiting CBECI’s precision in assessing hardware variety and prevalence.

To surmount this, researchers devised a simulation that approximates daily hardware distribution, utilizing performance and power data from actual hardware.

The prior methodology presumed that all profitable hardware models released in the last five years contributed equally to the network hash rate.

This inadvertently led to an overrepresentation of aging hardware during lucrative mining periods.

The team recognized the overrepresentation of older equipment and the underrepresentation of newer models.

READ MORE: Digital Currency Group Reaches Agreement with Genesis Creditors for Potential Recovery

This realization spurred the methodology’s alteration.

Neumueller’s team then cross-referenced hash rate increments with US import data on recent Bitcoin mining hardware.

Public sales data from mining hardware manufacturer Canaan supplemented this analysis.

The CBECI encompassed diverse data points and visualizations, encompassing Bitcoin network power demand, a mining map depicting hash rate distribution, and a greenhouse gas emissions index.

These indexes yield three distinct estimates for each sector, providing a range for these metrics.

The broader discussion encompassed varying viewpoints on Bitcoin’s environmental impact.

Critics alleged Bitcoin undermined ecological progress, while proponents contended that the mining industry could aid environmental efforts.

Neumueller highlighted the intricate nature of the field and the dearth of information, enabling selective data interpretation and biases.

In sum, CBECI’s revamped methodology aligns with evolving Bitcoin mining hardware trends, rectifying previous discrepancies.

The index’s comprehensive insights and visuals offer a multifaceted perspective on Bitcoin’s energy consumption and emissions impact.

Other Stories:

Grayscale Bitcoin Trust’s Negative Price ‘Discount’ Expected to Reverse by 2024

Federal Judge Overturns SEC’s Denial of Grayscale’s Bitcoin ETF

dYdX Unlocks $14.02 Million in DYDK Tokens for Community and Trader Rewards

Bitcoin is maintaining its recent gains, as traders remain optimistic about the bullish trajectory of its price. Despite briefly retreating from the highs above $28,000, the cryptocurrency has not experienced a complete retrace of its recent upward move.

Encouragingly, Bitcoin’s price action on lower timeframes is being supported by a crucial moving average, effectively safeguarding the $27,000 mark.

This trend is highlighted by data from Cointelegraph Markets Pro and TradingView.

Of particular significance is the resilience displayed by BTC/USD in adhering to a long-term trend line that was previously lost as support in August.

This trend line corresponds to the 200-day exponential moving average (EMA), positioned at $27,180.

Although there were instances where hourly candle closures fell below this level toward the end of August, such occurrences failed to initiate a significant breakdown.

Instead, Bitcoin remains closely aligned with the 200-day EMA as the month concludes.

Prominent trader Moustache, known for insights on market trends, noted the positive development, observing that Bitcoin has reclaimed the daily EMA 200-Line.

Expressing confidence in this trend, Moustache dismissed the likelihood of a more favorable entry point occurring in the near future.

This view contrasts with the bearish outlook propagated by various reputable sources, many of whom anticipate a return to levels as low as $25,000.

READ MORE: Digital Currency Group Reaches Agreement with Genesis Creditors for Potential Recovery

However, trader Jelle echoes Moustache’s optimism by underscoring the importance of Bitcoin’s ability to sustain itself above the $27,000 threshold.

Jelle described the current market behavior as conducive to further upward movement, citing a brief spike followed by a shallow retrace and maintenance above a key high-timeframe (HTF) level.

In the midst of the ongoing discussions about Bitcoin’s performance, analyst Rekt Capital advised caution due to prevailing market conditions.

Some previously crucial bull market moving averages are currently acting as resistance, adding an air of uncertainty to the situation.

Further insight from Material Indicators, a monitoring resource, suggests that Bitcoin’s trajectory could complete a full circle.

For a renewed push towards higher local highs, a resurgence of bullish sentiment is deemed essential. The proprietary trading tools of Material Indicators identify $27,760 and $24,750 as pivotal levels to monitor on the upside and downside, respectively.

This assessment underscores the delicate balance between the potential for continued gains and the looming risk of a downward reversal.

Other Stories:

Grayscale Bitcoin Trust’s Negative Price ‘Discount’ Expected to Reverse by 2024

Federal Judge Overturns SEC’s Denial of Grayscale’s Bitcoin ETF

dYdX Unlocks $14.02 Million in DYDK Tokens for Community and Trader Rewards

The parliamentary ethics subcommittee in South Korea has voted against the expulsion of Kim Nam-kuk, a former member of the Democratic Party, the main opposition group.

This decision was reported by the local news agency Yonhap on August 30.

On August 29, the subcommittee dismissed the motion to expel Kim Nam-kuk, with a 3-3 split between the ruling People Power Party (PPP) and the Democratic Party (DP).

The motion required a majority vote to be approved, which did not materialize.

This move comes after Kim faced significant backlash earlier this year due to revelations that he possessed over $4.5 million worth of Wemix (WEMIX) tokens, developed by South Korean blockchain game creator Wemade.

The Wemix tokens had been tradable on major South Korean exchanges until a local court ordered their removal from platforms in late 2022.

Kim’s ownership of Wemix tokens raised serious concerns about potential conflicts of interest, misuse of insider information, and potential involvement in money laundering.

This controversy played a role in expediting the creation of a legal framework mandating that officials disclose their cryptocurrency holdings, including assets like Bitcoin (BTC), in South Korea.

READ MORE: Argo Blockchain Shows Resilience with 50% Reduction in Half-Year Losses

The requirement for cryptocurrency holdings disclosure is not unique to South Korea.

In July, the country’s Financial Services Commission introduced a new bill stipulating that all companies issuing or possessing cryptocurrencies must disclose their holdings starting from 2024.

In another cryptocurrency-related development, the city of Cheongju in South Korea announced in mid-August that it would initiate the seizure of cryptocurrencies from local tax defaulters.

This initiative compels cryptocurrency exchanges such as Upbit and Bithumb to report on these individuals who have failed to meet their tax obligations.

In conclusion, South Korea’s parliamentary ethics subcommittee’s rejection of the motion to expel Kim Nam-kuk, despite concerns surrounding his cryptocurrency holdings, reflects the ongoing debate and regulatory efforts in the country regarding the transparency and accountability of cryptocurrency-related activities.

This decision aligns with broader initiatives to enhance disclosure and monitoring of cryptocurrency assets within South Korea’s regulatory framework.

Other Stories:

Europe Welcomes First-Ever Bitcoin ETF

Shibarium Surpasses 100,000 Wallets in 24 Hours Post-Relaunch

Anticipation Grows as Bitcoin Halving Nears, Experts Predict Surge Beyond $100,000