Bitcoin faced a notable resurgence, surging by 5% after a critical test of the $25,000 support level on September 11th.

Nonetheless, this upward swing should not be hailed as an unequivocal triumph for bullish investors.

To provide context for this recent price action, it’s crucial to acknowledge that Bitcoin has weathered a harsh 15% decline since July, a performance contrasted by the stability observed in the S&P 500 index and gold during the same period.

This underperformance exposes Bitcoin’s struggle to gain momentum, despite substantial catalysts like MicroStrategy’s intent to acquire an additional $750 million worth of BTC and the persistent requests for Bitcoin spot exchange-traded funds (ETFs) from trillion-dollar asset management firms.

Yet, in the realm of Bitcoin derivatives, the bullish camp appears confident, viewing the $25,000 level as a significant bottom and a gateway to further price hikes.

Some proponents argue that Bitcoin’s primary drivers for 2024 remain in force, particularly the anticipation of a spot ETF and the reduction in new supply after the April 2024 halving.

Furthermore, immediate risks in the cryptocurrency markets have diminished, partly due to the United States Securities and Exchange Commission experiencing partial losses in cases involving Grayscale, Ripple, and decentralized exchange Uniswap.

Conversely, bears have their own advantages, including ongoing legal disputes involving prominent exchanges like Binance and Coinbase.

Additionally, Digital Currency Group’s precarious financial position after a subsidiary’s January 2023 bankruptcy declaration, bearing debts exceeding $3.5 billion, could potentially lead to the sale of Grayscale-managed funds, including the Grayscale Bitcoin Trust.

A closer examination of derivatives metrics sheds light on the stance of professional traders in the current market conditions.

Bitcoin monthly futures typically maintain a slight premium over spot markets, signaling that sellers demand more money to postpone settlement.

READ MORE: CFTC Commissioner Calls for Tech-Driven Investor Protection Reforms

Consequently, BTC futures contracts usually exhibit a 5 to 10% annualized premium, known as contango, a phenomenon not unique to crypto markets.

While the demand for leveraged BTC long and short positions through futures contracts had minimal impact on the drop below $25,000 on September 11th, the BTC futures premium remains below the 5% neutral threshold, signaling a lack of enthusiasm for leveraged long positions.

To delve further into market sentiment, observing the options markets, particularly the 25% delta skew, provides insight into investor optimism.

Previously, a 9% premium on protective put options implied an anticipation of correction.

However, this metric has now stabilized at zero, indicating balanced pricing between call and put options, suggesting equal odds for both bullish and bearish price movements.

In light of macroeconomic uncertainty, including the impending release of the Consumer Price Index report on September 13th and retail sales data on September 14th, crypto traders are likely to proceed cautiously, aiming for a “return to the mean” within the trading range of $25,500 to $26,200 observed over the past weeks.

Ultimately, both bullish and bearish forces possess influential triggers that could sway Bitcoin’s price.

However, the timing of events such as court decisions and ETF rulings remains elusive.

This dual uncertainty likely explains the resilience of derivatives metrics, with both sides exercising caution to mitigate excessive exposure.

Other Stories:

SEC Pursues Appeal in Ripple Labs Lawsuit Over XRP’s Security Classification

Bitcoin Rebounds from Three-Month Lows Amid Traders’ Doubts

Federal Reserve Vice Chairman Highlights CBDC Research and Stablecoin Oversight in Fintech Speech

Former PayPal president, David Marcus, has raised concerns about the outdated nature of global payments despite the ease of transferring information online.

He argues that while we can send emails or texts instantaneously, international money transfers remain stuck in the “fax era.”

According to Marcus, the lack of a universal protocol for online money transfers poses a significant challenge.

If you want to communicate with someone, you can simply ask for their email address and connect with them within minutes.

However, when it comes to sending money, the process is far from seamless. Marcus illustrated this by highlighting the difficulty of sending money to someone outside the U.S. who doesn’t use the same fintech apps.

In such cases, one would need the recipient’s bank account number and often resort to expensive international wire transfers costing as much as $50.

To address this issue, Marcus is leading the charge with his Bitcoin Lightning-focused payment service, Lightspark, which he co-founded in May 2022.

He believes that the Bitcoin Lightning Network has the potential to revolutionize the cumbersome process of sending money across borders.

READ MORE: Vitalik Buterin’s X Account Breached: Over $691K Lost to Malicious NFT Link

While Marcus acknowledges that Bitcoin’s Lightning Network may not become the go-to currency for everyday purchases, he sees its primary utility in facilitating international transfers.

Rather than being used for buying goods and services directly, Bitcoin could serve as a bridge currency, allowing users to send U.S. dollars that are seamlessly converted into other currencies, such as Japanese yen or euros, on the recipient’s end.

The key advantage of this approach is the speed and cost-effectiveness of Bitcoin Lightning’s settlement layer.

It enables near-instantaneous and low-cost cash finality, making it a promising solution for cross-border transactions.

In essence, Marcus envisions Bitcoin’s Lightning Network as the remedy to the outdated and expensive global payment systems that continue to prevail in today’s interconnected world.

In conclusion, David Marcus, the former PayPal executive and co-founder of Lightspark, believes that Bitcoin’s Lightning Network holds the key to modernizing international money transfers and bringing them out of the “fax era.”

With its potential to revolutionize cross-border payments, Bitcoin Lightning could pave the way for a more efficient and cost-effective global financial system.

Other Stories:

Coinbase CEO Foresees Crypto’s Major Role in 2024 Elections, Urges Clearer Regulations

Terra Classic Community Proposes Minimum Deposit Hike to Combat Spam

Rise of Senior Executives Leading Digital Asset Strategies Signals Investment Firm Transformation

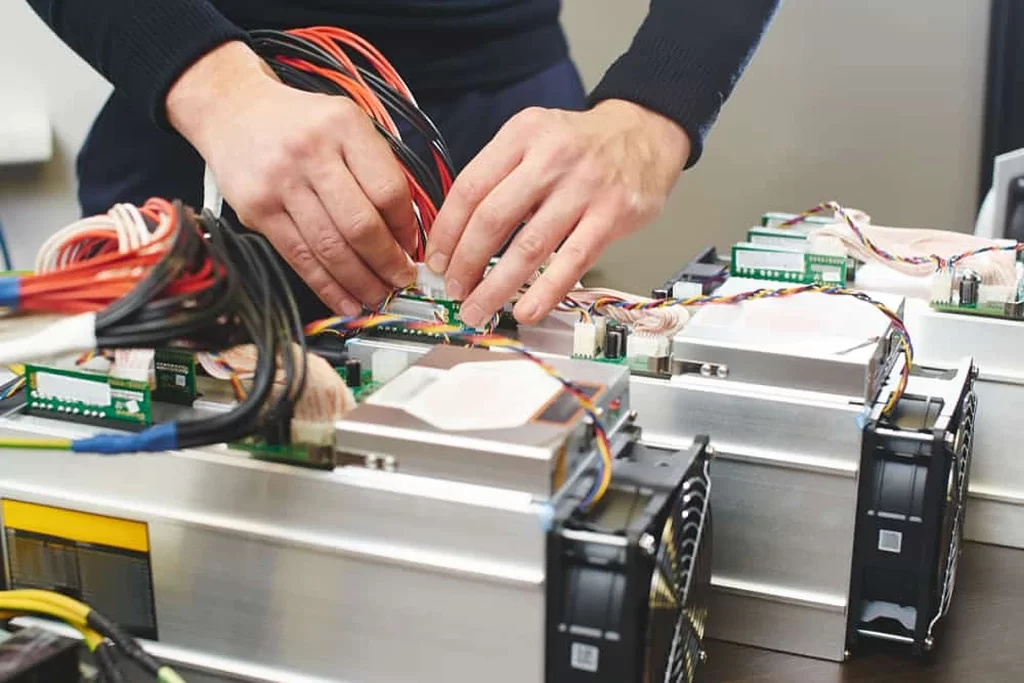

Key figures from leading mining and manufacturing firms are anticipating that the fourth Bitcoin halving, scheduled for 2024, could propel the price of Bitcoin (BTC) beyond the $100,000 mark.

This intriguing insight was shared by Canaan’s Vice President, Davis Hui, during a panel discussion at Canaan’s Avalon Bitcoin and Crypto Day (ABCD) in Singapore.

This panel included prominent Bitcoin mining executives from Singapore, Kazakhstan, and the United Arab Emirates, all of whom offered similar BTC price predictions for 2024, citing the profound impact of the upcoming Bitcoin mining reward halving.

Hui emphasized the impending reduction in Bitcoin’s supply, which will drop to 6.25 BTC per block after the reward halving.

Simultaneously, traditional financial institutions are displaying an increasingly keen interest in investing in the cryptocurrency sector.

Hui pointed out that industry giants like BlackRock, managing a staggering $10 trillion in assets, hold five times more value than the entire cryptocurrency market capitalization, currently standing at $2 trillion.

This surge in institutional interest, coupled with the halving’s supply reduction, is expected to drive BTC’s price upward.

Furthermore, Hui underscored the significance of several Bitcoin exchange-traded fund (ETF) applications pending with the United States Securities and Exchange Commission (SEC), submitted by some of the world’s largest asset managers.

READ MORE: Vitalik Buterin’s X Account Breached: Over $691K Lost to Malicious NFT Link

These applications, once approved, are anticipated to inject substantial capital into the cryptocurrency market, further fueling the demand for BTC and contributing to its price surge.

Hui also shed light on the challenging environment faced by most miners in the fiercely competitive market, where all-time high hash rates and network difficulties are eroding miner profitability.

In response, miners who cannot cover their electricity costs with their mining rewards are shutting down their operations.

However, those continuing to mine are doing so with an eye on the potential gains following the 2024 halving.

He also noted that miners capable of upgrading to more efficient and powerful machines are likely to maintain better profitability.

Hui speculated that mining companies in the United States might face particular challenges due to high electricity and administrative costs.

In a candid admission, Hui revealed that Canaan, like other industry players, reported a financial loss in the first quarter of 2023, underscoring the prolonged impact of the cryptocurrency bear market.

Despite these challenges, the industry remains optimistic about the future, driven by the potential market dynamics set to unfold as a result of the fourth Bitcoin halving.

Other Stories:

Coinbase CEO Foresees Crypto’s Major Role in 2024 Elections, Urges Clearer Regulations

Terra Classic Community Proposes Minimum Deposit Hike to Combat Spam

Rise of Senior Executives Leading Digital Asset Strategies Signals Investment Firm Transformation

Bitcoin experienced a notable recovery from its recent three-month lows on September 12, sparking skepticism among traders regarding the cryptocurrency’s price behavior.

Market data from Cointelegraph Markets Pro and TradingView reflected a rapid return to levels seen immediately after the weekly close of BTC/USD.

The preceding day had witnessed a sudden decline in Bitcoin’s value upon Wall Street’s opening, briefly pushing it below the $25,000 mark.

This performance marked its most significant decline since mid-June.

However, Bitcoin embarked on a subsequent comeback, surging by $1,000. Nevertheless, as of the time of writing, it was encountering resistance at the $26,000 level.

In anticipation of future price movements, on-chain monitoring resource Material Indicators had already issued a warning about an imminent “support test.” This was due to a decrease in bid liquidity in the order book’s lower levels.

Further analysis, both from Material Indicators and others, pointed out that previous occurrences of “rug pulls” in support levels had paradoxically led to positive outcomes in the Bitcoin market.

Large-volume traders were effectively clearing liquidity from the immediate vicinity of the spot price.

Co-founder Keith Alan even predicted that $24,750 would hold as support during a potential downturn, a prediction that remained accurate at the time of writing.

In a separate development, the DeFi Education Fund (DEF), an advocacy group for decentralized finance (DeFi), submitted a petition to the United States Patent and Trademark Office (USPTO) on September 7.

READ MORE: Coinbase CEO Foresees Crypto’s Major Role in 2024 Elections, Urges Clearer Regulations

This petition aimed to prompt a review of a patent owned by True Return Systems, a company accused by DEF of being a “patent troll.” Such entities seek to profit from patent-related lawsuits.

The patent, granted in 2018, claimed ownership of a process for “linking off-chain data to a blockchain.” DEF’s legal chief, Amanda Tuminelli, revealed that True Return had attempted to sell the patent as a nonfungible token (NFT) before subsequently filing lawsuits against DeFi protocols MakerDAO and Compound Finance in October.

Tuminelli asserted that True Return’s intention was to name defendants who couldn’t respond to the complaint, obtaining a default judgment.

The company would then seek to enforce the court’s ruling against token holders and repeat the process with other protocols that lacked the resources or means to challenge them in court.

DEF argued that the technology described in the patent was not innovative at the time of its granting and cited existing tech such as the InterPlanetary File System (IPFS) and decentralized storage platforms like Sia, Storj, and Swarm.

True Return Systems acknowledged a request for comment from Cointelegraph but had not provided an immediate response.

DEF’s petition to the USPTO aimed to protect the use and development of open-source software, prevent potential legal actions by True Return against crypto projects, and aid in the legal defense of MakerDAO and Compound.

True Return has a three-month window to optionally respond to the petition, after which the USPTO must decide whether to review the patent within six months and, ultimately, whether to cancel it within 12 months.

Other Stories:

Vitalik Buterin’s X Account Breached: Over $691K Lost to Malicious NFT Link

Rise of Senior Executives Leading Digital Asset Strategies Signals Investment Firm Transformation

Terra Classic Community Proposes Minimum Deposit Hike to Combat Spam

Bitcoin is in the midst of a recovery journey after enduring a “black swan” event reminiscent of the turbulent days of the March 2020 COVID-19 crash, according to recent data.

On September 7, CryptoQuant, an on-chain analytics platform, brought attention to a significant surge in loss-making unspent transaction outputs (UTXOs), revealing a curious tale of Bitcoin activity “under the hood.”

UTXOs signify the remaining BTC following an on-chain transaction, and CryptoQuant’s “UTXOs in Loss” metric tracks instances where these UTXOs are currently worth less than their original acquisition price.

The data shows that more UTXOs are currently in a loss position compared to their initial purchase price than at any point since March 2020.

Back then, the BTC/USD price plummeted by a staggering 60%, reaching its lowest levels since March 2019, which it never revisited.

Drawing parallels with March 2020, CryptoQuant contributor Woominkyu suggested that Bitcoin may be experiencing, or even recovering from, a surprise selling event, akin to a “black swan.”

He stated that those anticipating another “black swan” event should contemplate whether it is already unfolding.

In terms of percentages, 38% of UTXOs were in a loss position at the close of August, a level not witnessed since April 2020.

READ MORE: Ripple Bolsters U.S. Regulatory Presence with Fortress Trust Acquisition

Woominkyu explained that when numerous UTXOs are in a loss position, it can indicate heightened market anxiety, potentially prompting more investors to sell.

Conversely, when most UTXOs are profitable, it suggests optimism and stronger investor sentiment.

Bitcoin, however, remains ensnared in a narrow trading range, with no clear trend emerging in its price.

The cost basis data reveals that the current spot price is hovering between the acquisition prices of different investor cohorts.

The “Realized Price,” which is calculated as the price at which the supply was last moved divided by age group, shows that short-term holders face losses when BTC/USD dips below approximately $27,000.

Nevertheless, a complete capitulation event has yet to manifest on-chain.

In conclusion, despite the recent turbulence in Bitcoin’s UTXOs and price activity, the crypto market is witnessing intriguing dynamics reminiscent of the “black swan” event of March 2020, leaving market participants pondering the future trajectory of the leading cryptocurrency.

Other Stories:

Congressman Takes Aim at SEC’s Digital Asset Enforcement Spending

Ripple’s Chief Legal Officer Lambasts SEC’s ‘Contradictory Shift’ in Latest Submission

Ant Group Unveils ZAN Sub-Brand for Web3 Blockchain Development Services

In August, Riot Platforms, a prominent Bitcoin miner, recorded a slightly reduced Bitcoin mining output compared to July.

However, the month proved exceptionally lucrative for the company, as it received an impressive $31 million in power credits.

To put this into perspective, Riot’s CEO, Jason Les, emphasized that this sum equates to approximately 1,136 Bitcoin.

A significant portion of these credits, estimated at $24.2 million, stemmed from Riot’s contract with the Electric Reliability Council of Texas (ERCOT), the state’s grid operator.

Additionally, another $7.4 million was accrued through participation in ERCOT’s demand response program.

Remarkably, these monthly credits surpassed the total credits received by Riot throughout the entire year of 2022.

Riot’s power strategy, as outlined in a presentation released on September 6th, hinges on its long-term ERCOT contract.

It operates through three core mechanisms, all intricately linked to this contract.

The first involves receiving power credits when the company temporarily curtails its operations, returning excess electricity to ERCOT during periods of unprofitable mining due to high electricity prices.

The second mechanism revolves around demand and response credits, earned by competitively offering ERCOT the option to control Riot’s electrical load, irrespective of whether the grid operator exercises this option.

READ MORE: Self-Custody Platform Enhances User Privacy with New ETH Pay Wallet Relay Feature

Jason Les emphasized that these credits play a pivotal role in significantly reducing Riot’s Bitcoin mining costs, positioning the company as one of the most cost-effective producers in the industry.

This strategic approach to power management stands as a key competitive advantage for Riot Platforms.

The backdrop for Riot’s financial success in August was Texas’ extreme weather conditions, marked by unusually high temperatures.

Riot’s presentation noted the unique ability of Bitcoin mining to lower energy consumption and provide support to the grid during periods of high demand stress.

While Riot Platforms incurred a loss of $27.7 million in the second quarter of the current year, it represents a substantial improvement over the same period last year when the company faced a staggering loss of $353.6 million during the crypto winter of Q2 2022.

In light of these developments, Riot has ambitious plans to install thousands of new miners in anticipation of the upcoming Bitcoin halving, further solidifying its position in the cryptocurrency mining industry.

Other Stories:

Former OpenSea Manager Chooses Prison as Insider Trading Appeal Looms

Race for First U.S. Ethereum ETF Heats Up as CBOE Files 19b-4 Applications

Sam Bankman-Fried’s Bail Revocation Upheld Amid Witness Tampering Concerns

Bitcoin’s recent bullish momentum appears to be losing steam, as shifts in liquidity on the Binance exchange signal potential volatility ahead, according to a recent analysis by Keith Alan, co-founder of Material Indicators, a monitoring resource.

While Bitcoin’s price has remained relatively stable over the weekend, data from Binance’s BTC/USD order book reveals concerning changes in liquidity.

The bid support has shifted downward, concentrating around the $24,600 mark—a level not observed in spot markets since March.

What’s particularly worrisome is that the largest concentrations of BTC bid liquidity have moved below the previously established Lower Low at the bottom of the range.

BTC/USD experienced its lowest post-March dip in mid-June, reaching $24,750 before bouncing back, as confirmed by data from Cointelegraph Markets Pro and TradingView.

Keith Alan anticipates a similar bounce from the current spot levels before any downside pressure resumes.

However, he also expects a breakdown in price from a macro perspective, indicating that bullish momentum and sentiment are waning.

Although bears have not yet gained complete control, there is no clear dominance on either side of the market.

READ MORE: MetaMask Users Targeted in Cryptocurrency Scam Using Government Website URLs

This shift does not necessarily signify a surge in bearish momentum but rather hints at fading bullish sentiment. Keith Alan expressed skepticism about buy walls persisting without being filled.

Previously, Keith Alan had identified $24,750 as a crucial level for bulls to maintain to protect Bitcoin’s broader price uptrend.

Other traders in the cryptocurrency space also expect increased volatility in the near future.

Skew, a popular trader, pointed to activity in derivatives markets as a sign of impending turbulence.

Meanwhile, Credible Crypto, known for his optimistic BTC price outlook, hoped that any potential downside would be limited to the high $24,000 range.

He emphasized the importance of maintaining the higher timeframe low at $24.8k, suggesting that a reversal to fill the inefficiency above that level could follow.

In summary, Bitcoin’s bullish momentum appears to be fading as liquidity shifts on Binance signal potential volatility ahead.

While some traders anticipate a short-term bounce, the overall market sentiment remains uncertain, with both bullish and bearish forces at play.

The coming days will likely reveal whether Bitcoin can maintain its price uptrend or experience a more significant correction.

Other Stories:

Bitcoin’s Price Correction to $22,000 Grows Likely as Bearish Signals Emerge in Derivatives

Ethereum’s Price Stability Under Threat as Bearish Sentiment and Network Metrics Weigh In

Coinbase Launches Institutional Crypto Lending Service Amid Market Turbulence

In an exclusive interview with Cointelegraph, Senator Andrew Bragg has issued a stark warning, stating that Australian investors could face exposure to unregulated markets and risk driving investments away from the country if the Digital Assets (Market Regulation) Bill is rejected by parliament.

This caution comes in the wake of the Senate Committee on Economics Legislation’s recommendation on September 4th to reject Bragg’s bill and continue industry consultations regarding cryptocurrency regulation.

Labor Party Senator Jess Walsh, who chairs the Committee, explained the rejection in a report, citing concerns that the bill “fails to interoperate with the established regulatory landscape, creating a genuine concern for regulatory arbitrage and adverse outcomes to the industry.”

Senator Bragg expressed his disappointment with the Committee’s recommendation, emphasizing that it would “expose consumers to an unregulated market and drive investment offshore.”

He underscored the dual purpose of digital asset regulations, asserting that they safeguard consumers while also fostering market investment and activity, which is why the former Liberal government placed them on the legislative agenda in October 2021.

Bragg believes that the rejection of his bill is largely rooted in partisan politics, as several Labor Party members sit on the Senate Committee.

He criticized their decision for stalling the implementation of digital asset regulations in Australia, lamenting that Australia is now approaching the end of 2023 with no plan to enact these regulations.

However, Liam Hennessey, a partner at international law firm Clyde & Co., offered a different perspective.

He suggested that the rejection may be more related to a separate regulatory process, specifically the Treasury’s consultation paper on the government’s “token mapping” exercise.

Hennessey emphasized that the rejection of Bragg’s draft bill may not necessarily be detrimental to crypto regulation in Australia.

Hennessey explained that Senator Bragg’s bill and the feedback it received from the industry would still be considered.

READ MORE:Coinbase Launches Institutional Crypto Lending Service Amid Market Turbulence

The Senate is currently dealing with a multitude of legislation, and the delay should not be overanalyzed.

He concluded that Bragg’s bill and the effort put into it would inform the government’s approach to crypto regulation.

The Australian government initiated a token mapping exercise in August, aiming to identify how crypto assets and related services should be regulated.

In February, the Treasury released a public consultation paper as a foundational step in regulating the digital asset market.

However, there has been little mention of digital assets or the broader regulatory approach since then.

Bragg introduced the Digital Assets (Market Regulation) Bill 2023 in March, intending to protect consumers and promote investors.

The bill contains recommendations for regulating stablecoins, licensing exchanges, and establishing custody requirements.

It is currently before the Senate and is expected to be voted on during the next sitting session.

Other Stories:

Ethereum’s Price Stability Under Threat as Bearish Sentiment and Network Metrics Weigh In

MetaMask Users Targeted in Cryptocurrency Scam Using Government Website URLs

Bitcoin’s Price Correction to $22,000 Grows Likely as Bearish Signals Emerge in Derivatives

The likelihood of a Bitcoin price correction descending to $22,000 is growing, driven by emerging bearish signals within BTC derivatives.

Examining the Bitcoin price chart underscores a decline in investor sentiment, attributed to Grayscale’s legal triumph against the SEC on August 29 and subsequent delays in spot BTC exchange-traded fund (ETF) applications.

Crucially, the question at hand is whether the potential for an ETF can outweigh escalating risks.

By August 18, the entire 19% post-BlackRock ETF filing rally had reversed, with Bitcoin regressing to $26,000.

Efforts to reclaim the $28,000 support faltered as optimism for an ETF approval rose following Grayscale’s favorable Bitcoin trust request.

Cryptocurrency investor morale waned as the S&P 500 closed at 4,515 on September 1, only 6.3% below its January 2022 peak.

Similarly, gold, unable to surpass $2,000 since mid-May, sits 6.5% from its all-time high, dampening Bitcoin investor sentiment months ahead of the 2024 halving.

Analysts attribute Bitcoin’s lackluster performance to regulatory actions against Binance and Coinbase, alongside speculation of a potential U.S. Department of Justice indictment against Binance for money laundering and sanctions breaches.

According to Pentoshi, potential gains from a spot ETF approval eclipse the price impact of regulatory actions against exchanges.

Yet, this analysis disregards decreased U.S. inflation (3.2% in July 2023 from 9.1% in June 2022) and the Federal Reserve’s liquidity reduction, unfavorable to Bitcoin’s inflation protection thesis.

Though Bitcoin clings to $25,000 since mid-March, derivatives data suggests testing bulls’ conviction.

Typically, Bitcoin monthly futures trade slightly above spot markets, indicating sellers demand more to delay settlement.

Presently, a 3.5% futures premium is the lowest since mid-June, pre-BlackRock’s ETF filing, revealing reduced demand for leverage buyers via derivatives.

Options markets also offer insights into investor optimism post-correction.

A bearish tone emerges, with protective put options trading at a 9% premium on September 4, contrasting similar call options.

The increasing bearish momentum in Bitcoin derivatives data, coupled with potential spot ETF approval delays until 2024 due to SEC concerns, tips the regulatory landscape in favor of bears.

The looming uncertainty surrounding potential DOJ actions and ongoing SEC lawsuits against exchanges exacerbates the situation.

In conclusion, considering the inability to sustain a positive price momentum despite elevated odds of a spot Bitcoin ETF approval, a retracement to $22,000 appears probable.

This echoes the price level observed when Bitcoin’s futures premium was 3.5%.

Other Stories:

Pro-XRP Lawyer Outlines Potential Settlement Scenarios Amid Ripple-SEC Speculation

Cathie Wood Envisions Transformational Potential in the Convergence of Bitcoin and AI

Binance CEO Makes Massive Claim About Upcoming Crypto Bull Run

Micro Bitcoin mining devices, despite their limited performance, are being positioned by their creators as a countermeasure against what they perceive as the predominant flaw in the Bitcoin ecosystem.

These compact devices, often open-source and conveniently sized to fit in a pocket, have carved out a niche within the market by providing users with options to either purchase fully assembled units or acquire do-it-yourself kits for individual Bitcoin mining endeavors.

While the developers behind these micro mining kits acknowledge that substantial profits are unlikely, they emphasize the significance of challenging the perceived “secrecy and exclusivity” that characterizes the Bitcoin mining industry.

BitMaker, a notable company in this realm, recently asserted that manufacturing a micro mining device could cost as little as $3, delivering a throughput of 50 kilohashes per second.

BitMaker’s spokesperson, reflecting on their involvement in micro mining since June 2022, drew attention to a key distinction between mainstream Bitcoin ASIC mining rigs and the open-source nature of Bitcoin’s underlying code.

This difference, they argued, has led to a situation where commercialized entities control the production and distribution of Bitcoin mining hardware, fostering a lack of transparency.

Data reveals that a significant portion of the Bitcoin hash rate originates from the United States (35.4%), followed by Kazakhstan (18.1%), Russia (11.2%), and Canada (9.6%).

Leading mining companies such as Marathon Digital and Riot Blockchain, based in the U.S., along with Bitdeer Technologies Group from Singapore, dominate the global mining landscape.

Skot, an individual involved in crafting Bitaxe miners, echoed similar sentiments regarding the importance of open-sourcing designs to introduce much-needed transparency into the mining industry.

READ MORE: Cathie Wood Envisions Transformational Potential in the Convergence of Bitcoin and AI

The traditional aura of secrecy surrounding mining is being dismantled by these open-source initiatives, allowing greater visibility and accessibility for the general public.

Bitaxe representatives emphasized that by sharing documents detailing the construction of hashboards and mining equipment, they enable interested parties to independently build their miners.

This contributes, albeit in a limited manner, to the decentralization of the system.

It’s understood, however, that immediate substantial Bitcoin gains are not the primary focus for buyers.

Skot indicated that while efforts are being directed towards enhancing the efficiency of these miners, the primary purpose is educational, communal, and centered on understanding the technology.

Importantly, Skot highlighted that these portable miners are not aimed at competing with established players in the commercial sphere.

Instead, they offer an avenue for individuals to engage in home-based mining without investing in cumbersome, costly, and heat-intensive setups.

Additional miniature Bitcoin miners in the market include the Bitmain AntRouter and Mars Lander. Meanwhile, innovators are also exploring unconventional methods such as mobile phone-based Bitcoin mining.

Other Stories:

Binance CEO Makes Massive Claim About Upcoming Crypto Bull Run

Pro-XRP Lawyer Outlines Potential Settlement Scenarios Amid Ripple-SEC Speculation