Galaxy Digital founder Mike Novogratz has delivered a promising outlook for the year 2024, forecasting a pivotal moment marked by the institutional adoption of cryptocurrencies.

He shared this vision during Galaxy Digital’s third-quarter earnings call on November 9, emphasizing that the approval of several cryptocurrency exchange-traded funds (ETFs) is no longer a matter of “if” but “when.”

In collaboration with Invesco, the fund manager filed applications for spot Bitcoin and Ether ETFs with the United States Securities and Exchange Commission (SEC) in the third quarter of 2023.

In November 2023, investor sentiment took a bullish turn, with prominent ETF research analysts predicting that the SEC would approve 12 significant Bitcoin spot ETF applications by January 2024.

Novogratz stated that 2024 would witness a surge in institutional adoption, primarily starting with the Bitcoin ETF, followed by an Ethereum ETF.

As institutions gain confidence and the government potentially endorses Bitcoin, Novogratz anticipates a broader shift toward other cryptocurrencies.

He predicts that capital will flow into the crypto space, leading to increased investments in tokenization and wallets, potentially reaching a climax in 2025.

He also stressed the importance of maintaining dollar-backed stablecoins as a central component of the broader cryptocurrency ecosystem, ensuring their alignment with American values.

READ MORE: Bitwise Asset Management Disassociates Itself from Troubled Firm Amidst SEC Charges

Novogratz believes that a Bitcoin ETF will instill institutional confidence and inject a significant amount of capital into the crypto space, breathing life into the ecosystem.

However, he emphasizes that the long-term plan for crypto remains on track.

The possibility of an Ether spot ETF was also discussed during the investor call. Novogratz acknowledged that its approval might not receive the same level of enthusiasm as a Bitcoin ETF due to the unique staking model of Ethereum.

He pointed out that unless an ETF can incorporate staking rewards effectively, it may not be as attractive as owning Ethereum directly and staking it through platforms like Galaxy Digital.

This technical distinction becomes significant when considering staking yields ranging from 4% to 7%. Novogratz emphasized that blockchain projects must have a clear purpose and offer practical applications to maintain long-term value.

In conclusion, Mike Novogratz’s optimistic outlook for 2024 centers on the institutional adoption of cryptocurrencies, with the approval of Bitcoin ETFs as a pivotal catalyst.

He anticipates a ripple effect, with capital flowing into the crypto space and an eventual focus on tokenization, wallets, and stablecoins, setting the stage for a transformative period in the world of digital assets.

Bitcoin’s future price trajectory is coming under scrutiny as it continues its bullish cycle, with a classic on-chain indicator suggesting that it might be a good time to sell when the cryptocurrency reaches at least $110,000.

According to data from the on-chain analytics platform Look Into Bitcoin, the “Terminal Price” of Bitcoin is hinting at a potential six-figure peak.

This Terminal Price is seen as a straightforward method for estimating the long-term peak price of Bitcoin.

To calculate the Terminal Price, one looks at Bitcoin’s “Transferred Price,” which is determined by dividing “Coin Days Destroyed” (CDD) by the existing supply of Bitcoin.

CDD is a popular metric used to measure the number of dormant days reset each time a certain amount of BTC is moved on-chain. It provides insights into hodler intent and activity in the market.

The Terminal Price, created by Checkmate, the lead on-chain analyst at data firm Glassnode, becomes relevant at the peak of each Bitcoin price cycle.

While not every all-time high reaches the Terminal Price, Bitcoin did touch the trendline during its 2017 all-time high and again during its initial peak in April 2021.

The most recent all-time high of $69,000 in November of that year fell short of the Terminal Price.

Philip Swift, the creator of Look Into Bitcoin, suggests that selling “near” the Terminal Price could be a prudent strategy.

READ MORE: SafeMoon CEO’s Bail Release on Hold Amid Flight Risk Concerns

Additionally, there’s a bear market counterpart known as the “Balanced Price,” which signals useful market bottoms.

As time passes, the Terminal Price tends to increase, suggesting that $110,000 might actually be a conservative target if the next all-time high occurs later in the upcoming cycle.

Swift also brings attention to the “Pi Cycle Top” indicator in his analysis. This indicator uses two moving averages for forecasting and has a track record of reliably predicting long-term price highs, albeit with just a few days’ notice.

It managed to accurately identify the top of the previous Bitcoin cycle, leaving many, including Swift himself, surprised. The question remains whether it will once again pinpoint the top of the current cycle.

With Bitcoin’s price action reaching new heights and these on-chain indicators in play, the cryptocurrency market is abuzz with predictions and strategies for the future.

The potential for Bitcoin to reach six figures in the next cycle is certainly on the radar of many forecasters and investors.

The recent surge in transaction fees on both the Ethereum and Bitcoin networks has reignited discussions surrounding scalability solutions and the role of layer 2 solutions.

Over the past 24 hours, cryptocurrency enthusiasts have shared screenshots depicting skyrocketing transaction fees on Ethereum and Bitcoin.

Some screenshots displayed gas fees as high as $220 for high-priority Ethereum transactions, while others hovered around the $100 mark.

On the Bitcoin side, users reported fees of approximately $10 for high-priority transactions.

This, though relatively low, represents a significant increase compared to the average Bitcoin transaction cost of around $1 over the past three months, as reported by BitInfoCharts.

These fees on Bitcoin haven’t been this high since May.

At the time of writing, conducting a $300 transfer on the decentralized exchange Uniswap using an Ethereum hot wallet incurs a network cost of $45.65, according to a test transaction by Cointelegraph.

The surge in gas fees has led proponents of blockchains like Solana to highlight the cost-effectiveness of transactions on their networks.

Solana, for instance, charges only $55-60 per minute for all users, contrasting starkly with Ethereum’s high fees.

In response to this fee surge, some have questioned how these high fees benefit lower-income individuals and the unbanked population.

READ MORE: Robinhood Announces European Expansion Amid Cryptocurrency Challenges

The impact on such users during times of network congestion and high fees can be detrimental.

Before the recent fee surge, Ethereum transaction costs averaged $11.35 on November 8, according to BitInfoCharts.

Just a few weeks earlier, on October 14, fees had dropped to as low as $1.40, marking the lowest point in 2023.

Notably, gas fees on Ethereum had previously peaked at $196 on May 1, 2022, with fees consistently above $20 between August 2021 and February 2022.

Bitcoin and Ethereum developers have chosen to prioritize decentralization and security at the base layer, opting to offload much of the execution environment to layer 2 solutions to reduce transaction costs.

Bitcoin utilizes the Lightning Network for scaling, while Ethereum has various layer 2 solutions like Arbitrum, Optimism, and Polygon to enhance speed and affordability.

However, opinions diverge on whether layer 2 solutions are the ideal approach to tackle scalability.

Justin Bons, founder of cryptocurrency investment firm Cyber Capital, advocates for monolithic blockchain architectures in which consensus, data availability, and transaction execution all occur on the base layer, citing Solana as an example.

Bitcoin and Ethereum, in contrast, employ modular blockchain designs by offloading certain transactions to a second layer.

Critics of Solana have highlighted network congestion-related outages, arguing that a modular blockchain design offers a more effective scalability solution.

The debate continues as blockchain ecosystems explore ways to address the pressing issue of high transaction fees.

Bitcoin has surged to a significant milestone, reaching $37,000 for the first time in 18 months. However, this impressive price action has raised suspicions among traders and market observers.

Bitcoin’s recent price surge, which saw it break through the $37,000 mark, is now targeting the elusive $40,000 level.

This upward movement in November has surprised many in the market, especially after the cryptocurrency gained nearly 30% in October.

One area of concern highlighted by on-chain monitoring resource Material Indicators is the lack of strong trading volume to support this rally.

While the price has been climbing rapidly, the volume of trading activity hasn’t followed suit. The support level is currently holding at $33,000, while resistance has shifted to the $42,000 range.

Material Indicators emphasized the unusual nature of this price move, stating, “There is no denying the fact that price has been challenging a number of different local top signals, but there is also no denying that something doesn’t seem right about this move.”

They pointed out the red flag of price appreciation on declining volume, a pattern that often leads to unfavorable outcomes.

READ MORE: Cardano’s ‘Boring’ Approach Proves to be a Pillar of Strength in Blockchain Evolution

Meanwhile, prominent trader Skew has noted ongoing whale selling pressure as Bitcoin approaches the $40,000 mark, which has become a psychologically significant level.

In addition to price action, open interest (OI) in Bitcoin futures has been on the rise. According to data from CoinGlass, total Bitcoin futures OI has surpassed $17 billion, reaching its highest level since mid-April.

Financial commentator Tedtalksmacro has highlighted the importance of OI in recent rapid upward movements in the market.

He noted that during bearish periods, the market tends to fade these OI impulses, leading to a ranging and unpredictable environment.

Bitcoin’s recent price surge may be exciting for many, but the concerns surrounding trading volume and the potential impact of large whale selling have made traders cautious.

Additionally, the role of open interest in recent market dynamics adds another layer of complexity to the ongoing Bitcoin rally.

Market participants will be closely monitoring these factors to determine the sustainability of the current price levels.

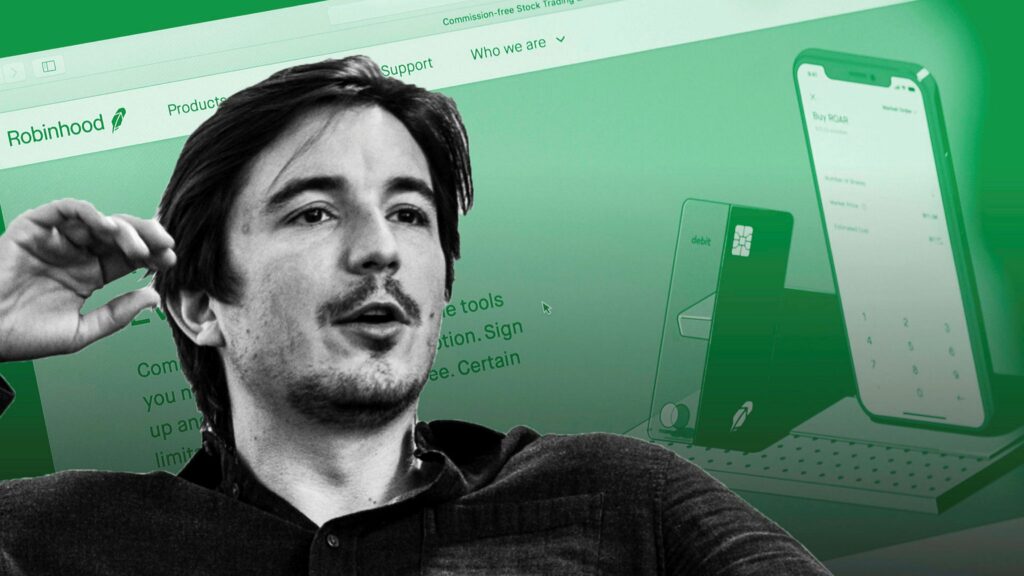

Robinhood, the popular commission-free trading platform, has unveiled its plans to expand into Europe in the near future, with a focus on establishing brokerage operations in the United Kingdom.

This announcement was made on November 7th, coinciding with the release of the company’s third-quarter financial results, which revealed a revenue miss.

The decline in transaction-based revenue was attributed to reduced cryptocurrency trading volumes on the platform.

In the third quarter, Robinhood reported a net revenue of $467 million, slightly below the average analyst estimate of $478.9 million.

Despite this, the company still achieved a substantial 29% year-on-year growth compared to the same period last year.

Transaction-based revenues saw an 11% decrease, amounting to $185 million, primarily due to a significant 55% drop in cryptocurrency notional volumes over the past year, as stated in Robinhood’s Tuesday announcement.

Interestingly, despite the decline in cryptocurrency trading activity, Robinhood has ambitious plans for its crypto services.

READ MORE: US Lawmaker Proposes Cutting SEC Chair’s Salary to $1

The company recently revealed its intentions to expand its services to the state of Nevada and added support for the meme cryptocurrency Shiba Inu just last month.

When questioned about the expansion into the European Union, Cointelegraph attempted to reach out to Robinhood for more details but has yet to receive a response.

This expansion move comes at a time when some cryptocurrency firms have suspended serving U.K. customers due to new regulations that require crypto firms to provide clear risk labels and implement system changes, which took effect on October 8th.

It’s worth noting that back in June, Robinhood ceased support for cryptocurrencies that were involved in lawsuits with the United States Securities and Exchange Commission, including those related to Binance and Coinbase.

These included assets like Cardano, Polygon, and Solana. Presently, Robinhood offers trading support for 15 different cryptocurrencies, including popular ones like Bitcoin, Ether, Dogecoin, and Avalanche.

Robinhood’s decision to expand into Europe demonstrates its commitment to further globalize its platform and services, despite challenges in the cryptocurrency market and regulatory changes in different regions.

By venturing into the U.K. and potentially other European markets, Robinhood aims to continue its growth and offer its user-friendly trading platform to a broader international audience while adhering to regulatory standards.

Athena Bitcoin, the company overseeing a network of crypto ATMs in El Salvador, has unveiled ambitious plans to incorporate the Lightning Network technology into 100 of these machines over the next few months.

This development comes as Athena Bitcoin Global and Genesis Coin, in a joint effort, have successfully integrated Lightning Network technology into their infrastructure.

Initially, this integration will take place in El Salvador, followed by a broader expansion across Latin America.

The Lightning Network stands as a layer-2 payment protocol designed to enhance transaction efficiency by facilitating faster withdrawals and reducing associated fees.

Moreover, it circumvents the necessity of recording transaction data on the primary network. Remarkably, only a mere 3.7% of the world’s crypto ATMs currently support this cutting-edge technology, as per data from Coin ATM Radar.

Although Athena Bitcoin has yet to provide an official statement in response to inquiries from Cointelegraph, their strategic timeline for Lightning Network adoption is clear.

READ MORE: VARA’s Innovative Crypto Regulations Catapult Dubai into the Global Spotlight

By December 2023, Athena aims to transition 100 of the state-owned Chivo ATMs in El Salvador to Lightning support.

Subsequently, the remaining kiosks, including those bearing the Athena brand, will follow suit in the first quarter of 2024. As it stands, there are presently 215 crypto teller machines situated throughout El Salvador.

Notably, El Salvador’s leader, Nayib Bukele, who played a pivotal role in establishing Bitcoin as legal tender in the country in 2021, has announced his intention to seek re-election as president in 2024. In a recent speech delivered to thousands of Salvadorans,

Bukele declared, “Five more [years], five more and not one step back.” In April 2023, Bukele initiated a bold move to abolish all taxes on technology innovations, a policy shift poised to attract more entrepreneurs and foreign capital to invest in the nation.

Experts such as Gabor Gurbacs, a strategy adviser at investment management firm VanEck, envision the possibility of El Salvador following in Singapore’s footsteps to become a prominent financial center within the Americas.

This integration of the Lightning Network into a significant portion of the country’s crypto ATMs is poised to further enhance El Salvador’s position in the rapidly evolving cryptocurrency landscape, potentially attracting further attention from both investors and innovators alike.

Over the past two weeks, Bitcoin has maintained a relatively tight trading range, fluctuating within a 4.5% margin around the $34,700 mark. Despite this apparent consolidation, the cryptocurrency has experienced notable gains of 24.2% since October 7.

These gains have ignited optimism among investors, driven by the anticipation of the 2024 Bitcoin halving and the possible approval of a spot Bitcoin exchange-traded fund (ETF) in the United States.

However, concerns about a bearish global economic outlook have cast a shadow over the financial markets.

Some experts are apprehensive about macroeconomic data indicating a global economic slowdown, as the U.S. Federal Reserve keeps its interest rate above 5.25% to combat inflation.

Recent data, such as the 6.4% contraction in Chinese exports in October and a 1.4% drop in Germany’s October industrial production, have fueled these concerns.

The global economic uncertainty has also affected other markets, causing WTI oil prices to dip below $78 for the first time since July, despite the potential for supply cuts from major oil producers.

Neel Kashkari, President of the U.S. Federal Reserve Bank of Minneapolis, expressed bearish sentiments about inflation, prompting investors to seek refuge in U.S. Treasurys and driving the 10-year note yield down to 4.55%, its lowest level in six weeks.

Interestingly, the S&P 500 stock market index has defied expectations by reaching 4,383 points, its highest level in nearly seven weeks, amid the global economic slowdown.

READ MORE: Monero Community Crowdfunding Wallet Hacked, Loses Nearly $460,000 in Devastating Attack

This phenomenon can be attributed to the significant cash reserves held by firms within the S&P 500, offering protection in a high-interest rate environment and aligning with investor preferences during uncertain times.

In the cryptocurrency market, Bitcoin’s futures open interest has surged to $16.3 billion, the highest level since April 2022, highlighting growing demand for Bitcoin options and futures.

This increased interest is fueled by the potential approval of a spot Bitcoin ETF and the upcoming Bitcoin halving in 2024.

To gauge market health, analysts are closely monitoring the Bitcoin futures premium, which has reached its highest level in over a year at 11%.

This indicates strong demand for Bitcoin futures, particularly from leveraged long positions. Additionally, the demand for Bitcoin call (buy) options has outweighed put (sell) options, reflecting a 40% bias towards bullish sentiment.

Bitcoin options open interest has also surged by 51% in the past month, reaching $15.6 billion, with growth predominantly driven by bullish instruments.

Despite some skepticism and hedging, Bitcoin’s derivatives market remains robust, with no signs of excessive optimism. This aligns with the prevailing bullish outlook, which targets Bitcoin prices exceeding $40,000 by year-end.

Bitcoin (BTC) experienced its trademark price volatility as a “short squeeze” pushed the market close to the $36,000 mark on November 7th.

Market data from Cointelegraph Markets Pro and TradingView closely tracked BTC/USD as it reacted to significantly elevated open interest (OI) on various cryptocurrency exchanges.

Earlier reports had indicated that the more than $15 billion in OI could trigger a fresh round of market volatility. There was uncertainty regarding whether Bitcoin’s price would decline or rise in response.

Ultimately, short sellers found themselves in a tough spot as Bitcoin rapidly gained ground, reaching just below $35,900.

Prior to this move, popular trader Skew and others had predicted the event. Skew had suggested that momentum would increase rapidly if Bitcoin’s price returned to $34,800—a prediction that came true.

Skew explained, “Open interest is still building up, and it appears that shorts have a larger position in the OI. $34,800 is a key price level for a squeeze.”

READ MORE:Monero Community Crowdfunding Wallet Hacked, Loses Nearly $460,000 in Devastating Attack

On-chain monitoring resource Material Indicators also suggested that $36,000 would likely remain out of reach for the week based on their proprietary trading indicators.

Another trader, Daan Crypto Trades, observed an interesting shift in derivatives composition.

He noted that traders on the largest crypto exchange, Binance, were positioning themselves in a bearish manner compared to those on the exchange Bybit.

However, it was uncertain whether a “long squeeze” would occur.

By comparing the BTC/USDT perpetual swap pairs on both exchanges, he highlighted that Binance was trading at a lower level after the short squeeze.

He concluded, “It will be very interesting to see how this resolves. One thing is clear—Bybit traders are more bullish than Binance traders.”

Financial commentator Tedtalksmacro illustrated the impact of the squeeze on Binance, where short open interest had disappeared.

At the time of writing on November 8th, BTC/USD was trading at $35,300, with open interest still exceeding $15 billion, according to data from on-chain monitoring resource CoinGlass.

The cryptocurrency market remained dynamic and full of surprises, with traders closely monitoring various indicators to make informed decisions.

On November 7th, Bitcoin experienced a dip, falling toward the $34,500 mark, catching the attention of analysts who were closely monitoring the growing open interest (OI) in the cryptocurrency markets.

Data from Cointelegraph Markets Pro and TradingView revealed that Bitcoin was struggling to regain the $35,000 support level.

Amidst the uncertainty in the market, there was a consensus among market participants that volatility was poised to make a return.

The main driver behind this anticipation was the significant surge in open interest within the derivatives markets.

On November 7th, financial commentator Tedtalksmacro noted that almost 10,000 BTC, equivalent to approximately $350 million USD, had been added to the open interest that day, suggesting that fireworks could be on the horizon.

This increase in open interest has historically coincided with periods of heightened volatility in recent months.

At the time of writing, the total open interest had reached nearly $15.5 billion, as reported by CoinGlass. James Van Straten, a research and data analyst at CryptoSlate, highlighted that both the CME exchange, favored by institutional investors, and Binance had recorded substantial open interest figures, with CME setting a new record of 105,380 BTC contracts open, valued at $3.68 billion.

READ MORE: Bitcoin Mining Firm Luxor Technology to Launch Innovative Hash Rate-Backed Investment Product

Van Straten indicated that this trend might signify growing participation in Bitcoin futures, implying either a positive shift in market sentiment or a move by investors towards protective strategies.

J. A. Maartunn, a contributor to the on-chain analytics platform CryptoQuant, voiced concerns over the uncertainty surrounding the impact of increasing open interest.

He pointed out that historically, when this metric surpassed $12.2 billion, it often led to a minimum 20% decline in Bitcoin’s price, warranting significant attention.

Popular trader Skew highlighted the significance of current price levels on shorter timeframes, emphasizing that being on the wrong side of the market direction could lead to challenges and potentially trigger a volatile price reaction.

Looking ahead, the monitoring resource Material Indicators concluded that $36,000 would likely remain a formidable resistance level in the near term.

While it didn’t rule out the possibility of Bitcoin surpassing $36,000 later in the year, the analysis suggested that, at least for the current week, breaching that threshold might be challenging.

It also noted that failure to validate a bullish breakout in the near future could make the previous range low of $25,000 to $28,500 a critical level to watch.

Luxor Technology, a Bitcoin mining firm, is gearing up to launch a unique hash rate-backed product, promising investors returns ranging from 10% to 13%.

This offering distinguishes itself from previous cryptocurrency lending and borrowing platforms like BlockFi and Celsius, which have faced controversy and skepticism.

In a recent episode of the What Bitcoin Did podcast, Luxor’s product was scrutinized for its potential risks.

However, Luxor’s Head of Derivatives, Matt Williams, clarified that their product stands apart due to its foundation in actual proof-of-work and tangible economic activity.

He emphasized that the returns come from miners willingly sharing a portion of their mining margins with investors who finance their operations, not from dubious schemes or rehypothecation.

The process revolves around investors providing Bitcoin as collateral to Luxor, which, in turn, lends it to other miners for their operations.

Profits are generated by acquiring hash rate from Bitcoin miners at a discounted rate and subsequently selling it at a higher price.

Luxor estimates that investors can expect returns between 10% and 13% through this mechanism, facilitated by Luxor’s upcoming hash rate marketplace.

READ MORE: FTX Advisers Share Customer Data with FBI Amid Bankruptcy Proceedings

Importantly, Luxor operates as an intermediary between investors and mining firms, avoiding direct involvement in mining activities.

This structure allows miners to access capital without selling their mined Bitcoin holdings, offering them a more sustainable financial option.

Joe Kelly, the CEO of Bitcoin lending firm Unchained, advised caution for those considering investing or borrowing with Bitcoin.

He emphasized the need for diligent scrutiny and vigilance due to the nascent nature of Bitcoin lending and borrowing markets, referencing previous failures with platforms like BlockFi and Celsius.

Williams emphasized that Luxor’s hash rate-backed product will be available exclusively to individuals who pass the firm’s rigorous due diligence checks.

Luxor acknowledges the inherent apprehension stemming from past failures in the cryptocurrency lending space and plans to mitigate risks by collaborating only with reputable miners and possibly mandating insurance coverage.

While Luxor did not specify a release date for its product, it aims to provide a novel and more secure way for investors to leverage their Bitcoin holdings while supporting the mining industry’s growth.